House Insurance Prices

In the dynamic landscape of the insurance industry, understanding the intricacies of house insurance prices is essential for homeowners seeking comprehensive protection. The cost of insuring one's home can vary significantly, influenced by a multitude of factors that range from the geographical location to the specific features of the property. This article aims to delve into these factors, providing a detailed analysis to help readers navigate the complex world of house insurance pricing.

The Key Factors Influencing House Insurance Prices

The price of house insurance is not a static figure but rather a reflection of numerous variables, each contributing to the overall cost. These factors can be broadly categorized into three main groups: location-based, property-specific, and personal circumstances.

Location-Based Factors

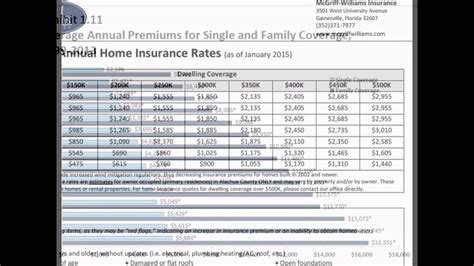

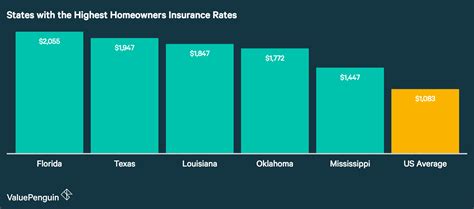

The geographical location of a property is a critical determinant of insurance prices. Insurance companies consider the risk associated with various regions, taking into account natural disasters, crime rates, and even proximity to fire stations. For instance, homes located in areas prone to hurricanes, floods, or earthquakes will likely face higher insurance premiums due to the increased risk of damage.

| Location | Average Annual Premium |

|---|---|

| Hurricane-prone Coastal Region | $2,500 |

| Flood-prone Inland Area | $1,800 |

| Urban Center with High Crime Rate | $2,000 |

Furthermore, the availability of emergency services can also impact insurance costs. Properties situated closer to fire stations or in areas with a robust emergency response system may benefit from lower premiums as the risk of extensive damage is mitigated.

Property-Specific Factors

The characteristics of the house itself play a significant role in determining insurance prices. Older homes, for example, may require more expensive coverage due to the increased likelihood of structural issues or outdated wiring and plumbing. Similarly, the size of the home matters; larger homes generally have higher insurance costs as there is more to insure.

| Property Feature | Impact on Premium |

|---|---|

| Age of the Home | Older homes may require higher premiums due to potential structural issues and outdated systems. |

| Home Size | Larger homes typically have higher insurance costs as there is more to insure. |

| Construction Materials | Homes built with certain materials, like brick or stone, may be more resistant to damage and thus may result in lower premiums. |

The construction materials used can also influence insurance costs. For instance, homes built with brick or stone may be more resistant to certain types of damage, leading to lower premiums. On the other hand, homes with wood-frame construction might be more susceptible to fire or pest damage, impacting insurance costs.

Personal Circumstances and Lifestyle Choices

Individual circumstances and lifestyle choices also affect insurance prices. For example, homeowners with a history of insurance claims may face higher premiums, as past claims are often seen as an indicator of future risks. Similarly, personal credit scores can impact insurance costs, with higher scores often leading to lower premiums.

| Personal Factor | Impact on Premium |

|---|---|

| Claim History | Homeowners with a history of claims may pay higher premiums. |

| Credit Score | A higher credit score can lead to lower insurance costs. |

| Occupation | Certain occupations, like firefighters or police officers, may qualify for insurance discounts. |

Additionally, lifestyle choices can affect insurance prices. For instance, homeowners who install security systems, smoke detectors, or fire sprinklers may qualify for insurance discounts. These safety measures can reduce the risk of theft or fire-related damage, leading to potential savings on insurance premiums.

Strategies to Lower House Insurance Costs

While many factors influencing house insurance prices are beyond a homeowner’s control, there are strategies that can be employed to potentially lower costs. These strategies involve a combination of proactive measures and informed decisions.

Improving Home Security

Investing in home security systems, such as alarm systems, surveillance cameras, or even simple measures like reinforced doors and windows, can make your home less attractive to thieves. This reduction in risk may lead to lower insurance premiums. Additionally, insurance companies often offer discounts for homes equipped with certain security features.

Disaster-Proofing Your Home

Taking steps to minimize the impact of natural disasters can also reduce insurance costs. For instance, reinforcing your roof or installing hurricane shutters can help protect your home from storm damage. In regions prone to earthquakes, measures like seismic retrofitting can make your home more resilient, potentially lowering your insurance premiums.

Choosing the Right Insurance Provider

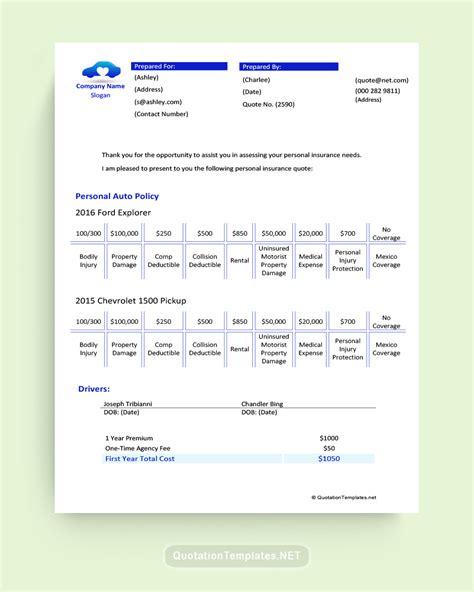

Different insurance companies offer a range of policies with varying coverage and price points. It’s important to compare multiple providers to find the best fit for your needs. Online comparison tools can be a great starting point, but it’s also beneficial to seek recommendations from trusted sources or consult with an insurance broker who can provide personalized advice.

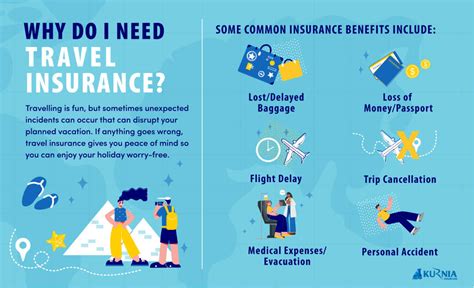

Understanding Coverage Options

Home insurance policies come with various coverage options, and understanding these can help you make informed decisions. For example, choosing a higher deductible can lower your premium, but it also means you’ll pay more out of pocket if you need to make a claim. Similarly, adding optional coverages like flood or earthquake insurance can increase your premium but provide essential protection in high-risk areas.

Maintaining a Good Credit Score

Your credit score is often used by insurance companies to assess your financial responsibility. Maintaining a good credit score can not only help you secure lower insurance rates but also improve your overall financial health.

The Future of House Insurance Pricing

The insurance industry is continually evolving, and technological advancements are set to play a significant role in shaping the future of house insurance pricing. The emergence of technologies like artificial intelligence and machine learning is already impacting the industry, offering more accurate risk assessments and personalized insurance products.

The Rise of Telematics

Telematics, the use of technology for data transmission and reception, is becoming increasingly common in the insurance industry. This technology allows insurance companies to gather real-time data about a property, such as its energy efficiency or the state of its security systems. By analyzing this data, insurance providers can offer more precise premiums based on an individual property’s unique characteristics and risks.

The Impact of Climate Change

Climate change is expected to have a significant influence on house insurance pricing in the future. As extreme weather events become more frequent and severe, insurance companies will need to adjust their risk assessments and pricing models accordingly. This could lead to higher premiums for homes in areas vulnerable to climate-related disasters.

The Role of Smart Home Technology

The integration of smart home technology, such as smart locks, thermostats, and leak detectors, is gaining traction in the insurance industry. These devices can provide real-time data about a home’s condition and alert homeowners and insurance providers to potential issues. This data can be used to offer more accurate insurance premiums and even provide discounts for homes equipped with certain smart technologies.

The Importance of Consumer Education

In an evolving insurance landscape, consumer education will play a vital role. Homeowners need to be aware of the factors that influence their insurance premiums and the steps they can take to potentially lower their costs. This includes understanding the coverage they need, comparing insurance providers, and staying informed about emerging technologies and their impact on insurance pricing.

Conclusion

House insurance prices are a complex interplay of various factors, from geographical location and property features to personal circumstances. While some of these factors are beyond a homeowner’s control, there are strategies that can be employed to potentially lower insurance costs. By understanding these factors and implementing proactive measures, homeowners can navigate the world of house insurance pricing with confidence and ensure they are adequately protected.

How often should I review my house insurance policy?

+It’s recommended to review your house insurance policy annually to ensure your coverage remains adequate and up-to-date. This review should consider any changes to your home, your personal circumstances, or the insurance market to ensure you’re getting the best value and protection.

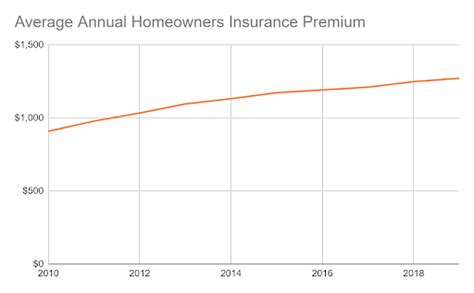

What is the average cost of house insurance in the US?

+The average cost of house insurance in the US varies widely depending on the state and the specific coverage needed. As of [latest available data], the national average for home insurance premiums is approximately 1,300 per year, but this can range from around 700 to over $2,500 based on various factors.

Can I negotiate my house insurance premium?

+While insurance premiums are typically non-negotiable, you can take steps to potentially lower your costs. This includes shopping around for different providers, considering higher deductibles, and taking advantage of any discounts you may qualify for based on your personal circumstances or home improvements.