Homeowners Insurance Policies

Homeowners insurance is an essential aspect of protecting one's most valuable asset, their home. It provides financial security and peace of mind, covering various risks and liabilities associated with homeownership. With a wide range of policies available, understanding the intricacies of homeowners insurance is crucial for making informed decisions. In this comprehensive article, we delve into the world of homeowners insurance policies, exploring their coverage, benefits, and key considerations.

Understanding Homeowners Insurance Policies

Homeowners insurance policies are contracts between property owners and insurance companies, offering protection against various perils and potential liabilities. These policies are tailored to meet the specific needs of homeowners, providing coverage for their dwellings, personal belongings, and additional living expenses in the event of a covered loss.

The primary purpose of homeowners insurance is to safeguard homeowners from financial losses arising from unexpected events such as natural disasters, theft, or accidents. By purchasing an appropriate policy, homeowners can ensure they have the necessary coverage to rebuild, repair, or replace their homes and belongings if the unexpected occurs.

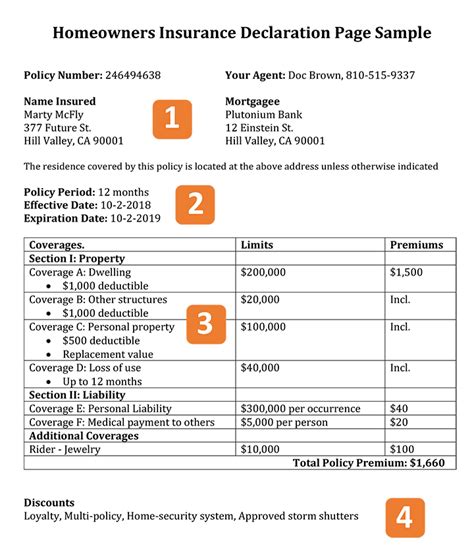

Key Components of Homeowners Insurance Policies

Homeowners insurance policies consist of several key components, each covering different aspects of homeownership. Understanding these components is essential for choosing the right policy and ensuring adequate protection.

Dwelling Coverage

Dwelling coverage is the cornerstone of homeowners insurance policies. It provides protection for the physical structure of the home, including the main dwelling, attached structures like garages or sheds, and even permanent fixtures such as built-in appliances and cabinets.

This coverage ensures that homeowners can repair or rebuild their homes if they suffer damage from covered perils. Common perils covered under dwelling coverage include fire, lightning, windstorms, hail, vandalism, and theft. However, it's important to note that flooding and earthquakes are typically excluded and require separate policies.

| Perils Covered | Examples |

|---|---|

| Fire | Damage caused by fire, including fires originating from cooking accidents or electrical malfunctions. |

| Lightning | Damage resulting from lightning strikes, including fires or structural damage. |

| Windstorms | Coverage for damage caused by strong winds, including hurricanes, tornadoes, or severe storms. |

| Hail | Protection against damage from hailstones, which can dent roofs, gutters, or exterior surfaces. |

| Vandalism | Vandalism coverage for intentional damage to the home, such as graffiti or broken windows. |

| Theft | Theft coverage for stolen belongings or damage caused during a break-in. |

Personal Property Coverage

Personal property coverage is an essential aspect of homeowners insurance, providing protection for the belongings inside the home. This coverage typically includes furniture, clothing, electronics, appliances, and other personal items.

The amount of personal property coverage varies depending on the policy and the value of the homeowner's belongings. It's important to ensure that the coverage limits are adequate to replace the contents of the home in the event of a loss. Some policies offer actual cash value coverage, while others provide replacement cost coverage, which replaces items with new ones of similar quality.

Liability Coverage

Liability coverage is a vital component of homeowners insurance, providing protection against claims and lawsuits resulting from accidents or injuries that occur on the insured property. This coverage protects homeowners from financial losses arising from their legal responsibility for causing harm to others.

Liability coverage typically includes medical payments to others, which cover reasonable and necessary medical expenses for injuries sustained by guests or visitors on the insured premises. It also provides protection for personal liability, which covers damages awarded in a lawsuit if the homeowner is found legally responsible for someone else's injuries or property damage.

Additional Living Expenses

In the event that a home becomes uninhabitable due to a covered loss, additional living expenses coverage comes into play. This coverage provides financial assistance to homeowners for temporary housing, meals, and other necessary expenses while their home is being repaired or rebuilt.

Additional living expenses coverage typically covers the difference between the insured's normal living expenses and the increased costs incurred during the temporary displacement. It ensures that homeowners can maintain their standard of living while their home is being restored.

Types of Homeowners Insurance Policies

Homeowners insurance policies are categorized into different types, each offering varying levels of coverage and protection. The choice of policy type depends on the specific needs and circumstances of the homeowner.

HO-1: Basic Form

The HO-1 policy is the most basic form of homeowners insurance, providing limited coverage for specific perils. It covers the dwelling and personal property against a defined list of perils, which typically includes fire, lightning, windstorm, hail, explosion, riot, vandalism, theft, and more.

However, HO-1 policies often have narrow coverage and may not provide adequate protection for modern homes. They are suitable for older homes with lower replacement costs or for those on a tight budget who want basic protection.

HO-2: Broad Form

The HO-2 policy, also known as the broad form, offers more comprehensive coverage than the HO-1 policy. It provides protection for the dwelling and personal property against a wider range of perils, including those covered in the HO-1 policy, as well as additional perils such as falling objects, weight of ice, snow, or sleet, accidental discharge or overflow of water or steam, and more.

HO-2 policies provide a better level of protection for homeowners, as they cover a broader range of potential risks. They are suitable for homeowners who want more comprehensive coverage without the extensive coverage of the HO-3 policy.

HO-3: Special Form

The HO-3 policy, also referred to as the special form, is the most common and popular type of homeowners insurance policy. It provides the broadest coverage, offering protection for the dwelling and personal property against all risks except those specifically excluded in the policy.

HO-3 policies typically exclude perils such as flooding, earthquakes, and certain types of water damage. These exclusions can be added back through endorsements or separate policies. The HO-3 policy provides excellent protection for homeowners, as it covers a wide range of perils, including fire, theft, vandalism, and accidental damage.

HO-4: Renter’s Insurance

HO-4 policies are specifically designed for renters or tenants who do not own the property they reside in. These policies provide coverage for personal belongings and liability protection, similar to the HO-3 policy. However, since renters do not own the dwelling, there is no coverage for the structure itself.

Renter's insurance policies typically cover personal property, providing protection against theft, fire, and other perils. They also include liability coverage to protect the renter if someone is injured in their rented space.

HO-5: Premier or Deluxe Homeowners Insurance

The HO-5 policy is the most comprehensive form of homeowners insurance, offering the highest level of coverage. It provides open perils coverage, meaning it covers all risks unless specifically excluded in the policy. This includes coverage for personal belongings, structural damage, and liability.

HO-5 policies are ideal for homeowners who want the maximum protection for their valuable assets. They provide broader coverage than the HO-3 policy and are particularly beneficial for high-value homes or those with expensive personal belongings.

Choosing the Right Homeowners Insurance Policy

Selecting the appropriate homeowners insurance policy is a crucial decision that requires careful consideration of several factors. Here are some key aspects to keep in mind when choosing the right policy for your needs:

Assess Your Needs and Risks

Start by evaluating your specific needs and the risks associated with your home and location. Consider factors such as the age and condition of your home, the value of your belongings, and the potential for natural disasters or other hazards in your area.

If you live in an area prone to floods or earthquakes, you may need to purchase separate policies to cover these risks. Additionally, consider your personal belongings and their value, as this will impact the amount of personal property coverage you require.

Understand Your Policy’s Coverage

Read and understand the policy’s coverage limits and exclusions. Ensure that the policy provides adequate coverage for your dwelling, personal property, and liability needs. Pay close attention to any exclusions or limitations, as these can significantly impact your coverage in the event of a claim.

Review the policy's deductible, which is the amount you must pay out of pocket before the insurance coverage kicks in. Choose a deductible that aligns with your financial capabilities and comfort level.

Compare Different Policy Options

Shop around and compare different homeowners insurance policies from multiple providers. Obtain quotes and review the coverage, deductibles, and additional benefits offered by each policy. Consider factors such as the insurer’s reputation, financial stability, and customer service ratings.

Look for policies that offer flexible coverage options, additional endorsements or riders to customize your coverage, and discounts for multiple policies or safety features.

Consider Additional Coverages

Evaluate the need for additional coverages or endorsements to enhance your homeowners insurance policy. Some common additional coverages include:

- Flood insurance: As standard homeowners insurance policies typically exclude flood damage, consider purchasing a separate flood insurance policy if you live in a high-risk flood zone.

- Earthquake insurance: Similarly, if earthquakes are a concern in your area, a separate earthquake insurance policy can provide additional protection.

- Personal articles floater: This endorsement provides coverage for high-value items such as jewelry, artwork, or collectibles, which may exceed the standard personal property coverage limits.

- Water backup coverage: This coverage protects against damage caused by water backup from sewers or drains, which is often excluded from standard policies.

Review and Update Your Policy Regularly

Homeowners insurance policies should be reviewed and updated periodically to ensure they remain adequate and up-to-date. As your circumstances change, such as home improvements, acquiring new possessions, or experiencing life events, your insurance needs may also change.

Regularly review your policy to ensure it aligns with your current needs and circumstances. Consider conducting an annual review or whenever significant changes occur in your life or home.

Filing a Claim: What to Expect

In the unfortunate event of a covered loss, knowing the process for filing a claim is essential. Here’s a step-by-step guide to help you navigate the claims process:

Contact Your Insurance Provider

As soon as a loss occurs, contact your insurance provider to report the claim. Provide them with the necessary details, including the date and time of the incident, a description of the damage, and any relevant photographs or documentation.

Prepare and Gather Documentation

Collect and organize all relevant documentation related to the loss. This may include photographs or videos of the damage, estimates or receipts for repairs or replacements, and any supporting documents such as police reports or medical records.

Cooperate with the Claims Adjuster

A claims adjuster will be assigned to your case to assess the damage and determine the extent of coverage. Cooperate fully with the adjuster, providing them with all the necessary information and documentation. Be prepared to answer questions and provide additional details if requested.

Understand the Claims Process

Familiarize yourself with the claims process outlined in your policy. Understand the timeline for processing claims, the procedures for obtaining repairs or replacements, and any specific requirements or limitations imposed by your insurer.

Stay Informed and Communicate

Maintain open communication with your insurance provider throughout the claims process. Stay updated on the progress of your claim and address any concerns or questions promptly. If there are delays or issues, reach out to your insurer to discuss the matter and seek resolution.

Consider Alternative Dispute Resolution

In the event of a disagreement or dispute regarding your claim, consider alternative dispute resolution methods such as mediation or arbitration. These processes can help resolve conflicts outside of the traditional legal system, often resulting in a faster and more cost-effective resolution.

Common Misconceptions and FAQs

Homeowners insurance policies can be complex, and misconceptions often arise. Here are some common misconceptions and frequently asked questions addressed:

Is homeowners insurance mandatory?

+Homeowners insurance is not legally mandatory in all states, but it is highly recommended. Many mortgage lenders require homeowners to maintain insurance coverage as a condition of their loan. Even if it's not legally required, homeowners insurance provides valuable protection against financial losses.

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between replacement cost and actual cash value coverage for personal property?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Replacement cost coverage reimburses the insured for the cost of replacing damaged or lost personal property with new items of similar quality. Actual cash value coverage, on the other hand, considers depreciation and pays the insured the current market value of the item at the time of the loss.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Do homeowners insurance policies cover water damage from leaks or burst pipes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>It depends on the specific policy and the cause of the water damage. Some policies cover water damage resulting from sudden and accidental causes, such as burst pipes or sudden water leaks. However, gradual water damage or damage caused by maintenance issues may be excluded.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I add coverage for specific high-value items, such as jewelry or artwork, to my homeowners insurance policy?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, you can often add coverage for high-value items through endorsements or personal articles floaters. These endorsements provide additional protection for specific items that may exceed the standard personal property coverage limits. It's important to discuss these options with your insurance provider to ensure adequate coverage.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What is the role of an insurance adjuster in the claims process?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>An insurance adjuster is responsible for evaluating and assessing the extent of damage or loss in a claim. They inspect the property, review the policy, and determine the coverage and reimbursement amount. It's important to cooperate with the adjuster and provide all necessary information to facilitate a smooth claims process.</p>

</div>

</div>

</div>

Conclusion

Homeowners insurance policies are an essential tool for protecting one’s home and belongings. By understanding the different types of policies, their coverage, and key considerations, homeowners can make informed decisions to secure the right protection for their valuable assets. Remember to regularly review and update your policy to ensure it remains adequate and aligned with your evolving needs.

With the right homeowners insurance policy in place, homeowners can have peace of mind knowing they are financially prepared for unexpected events and potential liabilities. Take the time to research, compare, and choose a policy that provides comprehensive coverage and meets your specific requirements.