Homeowners Insurance Liberty

Homeownership is an exciting journey, and one of the essential steps is securing adequate insurance coverage. In the vast landscape of insurance providers, Liberty stands out as a prominent name. This article aims to delve into the world of homeowners insurance offered by Liberty, exploring its features, benefits, and how it can protect one of your most valuable assets.

Understanding Liberty Homeowners Insurance

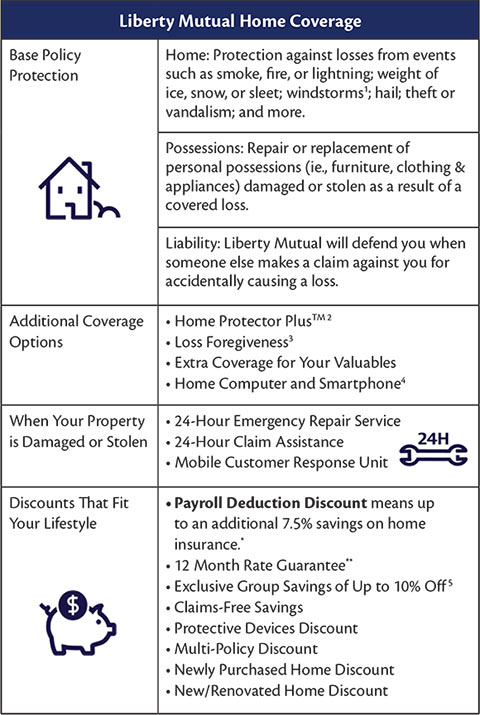

Liberty Mutual, one of the largest property and casualty insurance companies in the United States, offers a comprehensive suite of insurance products, including homeowners insurance. Their approach to homeowners insurance is tailored to provide financial protection and peace of mind to policyholders.

Liberty's homeowners insurance policies are designed to cover a wide range of potential risks and liabilities associated with homeownership. These policies aim to safeguard your home, its contents, and your personal liability, ensuring that you are protected in the event of unforeseen circumstances.

Coverage Options

Liberty offers several coverage options to cater to the diverse needs of homeowners. Here’s an overview of the key coverage types:

- Dwelling Coverage: This provides protection for the physical structure of your home, including walls, roofs, and foundations. It covers damages caused by perils such as fire, wind, and vandalism.

- Personal Property Coverage: Liberty’s policies typically cover the contents of your home, including furniture, electronics, and clothing. This coverage ensures that if your belongings are damaged or stolen, you can replace them.

- Liability Coverage: An essential aspect of homeowners insurance, liability coverage protects you from financial loss in case someone gets injured on your property or you are held responsible for causing property damage to others.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage helps cover the cost of temporary housing and other additional living expenses until you can return home.

- Medical Payments Coverage: This coverage pays for medical expenses if someone is injured on your property, regardless of liability.

It's important to note that the specific coverage options and limits may vary depending on your state and the type of policy you choose. Liberty offers customizable policies to ensure you receive the coverage that best suits your needs.

Policy Enhancements and Endorsements

Liberty understands that every homeowner has unique requirements. To address these needs, they offer various policy enhancements and endorsements. These additions can provide additional protection and peace of mind.

- Water Backup Coverage: This endorsement covers damage caused by water backing up through sewers or drains.

- Identity Theft Coverage: In today’s digital age, identity theft is a growing concern. Liberty’s identity theft coverage can help protect you and your family from the financial and emotional burdens of identity theft.

- Home Systems Protection: This enhancement provides coverage for the failure or breakdown of home systems like plumbing, electrical, and HVAC.

- Personal Property Replacement Cost: With this option, you can ensure that your belongings are replaced at their current market value, rather than their depreciated value.

Benefits of Choosing Liberty for Homeowners Insurance

Liberty Mutual has built a reputation for its comprehensive coverage, competitive pricing, and exceptional customer service. Here are some key benefits of choosing Liberty for your homeowners insurance needs:

- Financial Strength: Liberty Mutual is rated highly by leading insurance rating agencies, ensuring that they have the financial stability to honor their commitments and pay claims promptly.

- Personalized Service: Liberty offers a dedicated team of professionals who are committed to providing personalized service. They understand that each homeowner’s situation is unique and strive to tailor their policies accordingly.

- Digital Convenience: In today’s fast-paced world, convenience is essential. Liberty offers a user-friendly digital platform where policyholders can manage their policies, file claims, and access important documents anytime, anywhere.

- Claims Handling: Liberty is known for its efficient and fair claims handling process. They work diligently to ensure that policyholders receive the coverage they deserve when they need it most.

- Discounts and Savings: Liberty offers a range of discounts to help policyholders save on their premiums. These discounts include multi-policy discounts, loyalty rewards, and safety features discounts.

Protecting Your Home and Assets

Homeownership comes with numerous responsibilities, and safeguarding your home and assets is paramount. Liberty’s homeowners insurance policies are designed to provide the necessary protection against a wide range of risks.

| Coverage Type | Coverage Details |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home from perils such as fire, wind, and vandalism. |

| Personal Property Coverage | Covers the contents of your home, ensuring you can replace damaged or stolen belongings. |

| Liability Coverage | Protects you from financial loss due to injuries or property damage caused to others. |

| Additional Living Expenses | Covers temporary housing and additional living expenses if your home becomes uninhabitable. |

| Medical Payments Coverage | Pays for medical expenses for injuries sustained on your property, regardless of liability. |

The Liberty Advantage: Comprehensive Coverage and Customer Satisfaction

Liberty Mutual’s homeowners insurance policies offer a comprehensive suite of coverage options to protect your home and assets. Their commitment to customer satisfaction and financial stability makes them a trusted choice for homeowners across the United States.

Customizable Policies

One of the standout features of Liberty’s homeowners insurance is its customization options. Whether you’re a first-time homeowner or have a unique property with specific needs, Liberty can tailor a policy to fit your circumstances.

For instance, if you have valuable artwork or jewelry, Liberty's scheduled personal property endorsement allows you to increase coverage limits for these high-value items. This ensures that you receive adequate compensation if they are lost, stolen, or damaged.

Enhanced Coverage for Peace of Mind

Liberty understands that certain risks are more prevalent in specific regions. For homeowners living in areas prone to natural disasters like hurricanes or earthquakes, Liberty offers additional coverage options to address these concerns.

Their hurricane deductible feature allows you to choose a separate deductible for hurricane-related claims, providing more financial flexibility during challenging times. Similarly, their earthquake coverage endorsement ensures that your home and its contents are protected against seismic activity.

The Importance of Adequate Coverage

Securing adequate homeowners insurance is crucial to protect your financial well-being. Natural disasters, accidents, and other unforeseen events can lead to costly repairs and replacement expenses. Without proper coverage, these financial burdens can be overwhelming.

Consider the following real-life scenario: A homeowner in a coastal region experiences significant property damage due to a hurricane. Without adequate insurance coverage, they may face substantial out-of-pocket expenses for repairs, potentially impacting their financial stability.

By investing in homeowners insurance from a reputable provider like Liberty, you can mitigate these risks and ensure that you are financially prepared for the unexpected.

Understanding Policy Limits and Deductibles

When choosing a homeowners insurance policy, it’s essential to understand policy limits and deductibles. Policy limits define the maximum amount your insurance provider will pay for covered losses, while deductibles are the portion of the claim that you, as the policyholder, are responsible for paying.

Liberty's policies offer flexibility in choosing deductibles, allowing you to select the option that best fits your budget and risk tolerance. Lower deductibles mean you pay less out of pocket when filing a claim, but they also result in higher premiums.

On the other hand, higher deductibles can lead to lower premiums but require you to pay a larger portion of the claim out of pocket. It's crucial to strike a balance that aligns with your financial situation and risk appetite.

Conclusion: Liberty’s Commitment to Homeowners

Liberty Mutual’s homeowners insurance policies are a testament to their commitment to providing comprehensive protection and peace of mind to policyholders. With their customizable coverage options, financial stability, and dedicated customer service, Liberty stands as a reliable partner in safeguarding your home and assets.

As you navigate the world of homeowners insurance, consider the benefits and advantages that Liberty has to offer. Remember, your home is one of your most valuable possessions, and having the right insurance coverage is essential to protect it.

How much does Liberty homeowners insurance cost?

+The cost of Liberty homeowners insurance can vary based on factors such as your location, the value of your home, and the coverage limits you choose. On average, policyholders can expect to pay between 1,000 and 2,000 annually. However, it’s best to obtain a personalized quote to get an accurate estimate for your specific circumstances.

Does Liberty offer discounts on homeowners insurance?

+Yes, Liberty provides a range of discounts to help policyholders save on their premiums. These discounts include multi-policy discounts (if you bundle your homeowners and auto insurance with Liberty), loyalty rewards for long-term customers, and safety features discounts for homes equipped with certain safety measures like smoke detectors and burglar alarms.

What should I do in case of a homeowners insurance claim with Liberty?

+In the event of a covered loss, it’s important to take immediate steps to protect your home and your belongings. Contact Liberty’s claims department as soon as possible to report the incident and begin the claims process. They will guide you through the necessary steps and ensure a timely resolution.