Homeowner Insurance Policies

In the realm of homeownership, understanding the intricacies of insurance policies is paramount. This article delves deep into the world of homeowner insurance policies, offering an in-depth analysis of their coverage, benefits, and implications. With the ever-changing landscape of homeownership and the potential risks associated with it, having a comprehensive insurance policy is essential. Let's explore the critical aspects of these policies and how they can provide security and peace of mind to homeowners.

Unraveling the Complexity of Homeowner Insurance Policies

Homeowner insurance policies are complex contracts designed to protect one of the most significant investments an individual can make: their home. These policies offer a safety net against various perils, from natural disasters to unforeseen accidents, providing financial coverage and support during challenging times. Understanding the ins and outs of these policies is crucial for homeowners to ensure they have adequate protection and make informed decisions.

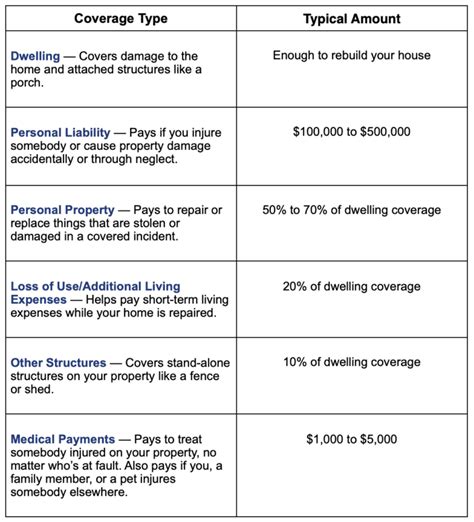

The coverage provided by homeowner insurance policies can vary greatly, depending on the specific policy and the insurance provider. However, there are some standard components that are typically included:

- Dwelling Coverage: This is the foundation of most homeowner insurance policies, covering the physical structure of the home itself. It provides protection against damage caused by events like fire, storms, vandalism, and more.

- Personal Property Coverage: This aspect of the policy safeguards the contents of the home, including furniture, electronics, and personal belongings. It ensures that, in the event of a loss, these items are covered, offering financial relief to replace or repair them.

- Liability Coverage: A crucial element, liability coverage protects homeowners from legal and financial responsibilities if someone is injured on their property or if their actions cause damage to others. This provides a vital layer of protection against potential lawsuits.

- Additional Living Expenses: In the event that a home becomes uninhabitable due to a covered loss, this coverage steps in to provide financial assistance for temporary housing and other necessary expenses until the home is restored.

The Importance of Customization

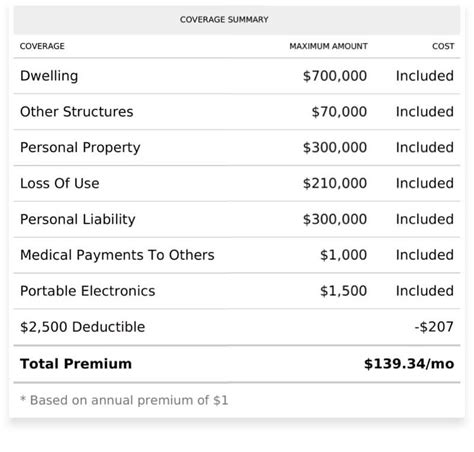

While these are some of the core components of homeowner insurance policies, it’s essential to understand that each policy can be tailored to the unique needs of the homeowner. Different levels of coverage and optional add-ons can be selected to ensure that the policy aligns perfectly with the homeowner’s circumstances and requirements.

For instance, homeowners living in areas prone to natural disasters like hurricanes or earthquakes may opt for enhanced coverage to protect against these specific risks. Similarly, those with valuable art collections or expensive electronics may choose to add additional personal property coverage to ensure these items are adequately insured.

| Coverage Type | Description |

|---|---|

| Basic Form | Covers only the most common perils, including fire, windstorms, and theft. |

| Broad Form | Offers more extensive coverage, including damage from fallen trees and broken water pipes. |

| Special Form (HO-3) | The most common policy type, covering all risks except those specifically excluded. |

The Claims Process: A Step-by-Step Guide

Understanding the claims process is an essential part of homeowner insurance policies. In the event of a loss, the following steps typically outline the process:

- Reporting the Claim: As soon as a loss occurs, it's vital to report it to your insurance provider. Most insurers have a 24/7 claims hotline, and prompt reporting can expedite the process.

- Assessing the Damage: An insurance adjuster will visit your home to assess the extent of the damage and determine what is covered under your policy.

- Providing Documentation: You'll need to provide documentation supporting your claim, including photographs, receipts, and any other relevant evidence.

- Settlement and Payment: Once the claim is approved, the insurance company will provide a settlement, which can be in the form of a cash payment or repairs to your home.

The Impact of Location and Risk Factors

Homeowner insurance policies are not one-size-fits-all. The cost and coverage can vary significantly based on a homeowner’s location and the associated risk factors. Here’s a closer look at these influences:

Location-Based Considerations

The geographical location of a home plays a pivotal role in determining the cost and coverage of a homeowner insurance policy. Areas prone to natural disasters like hurricanes, tornadoes, or earthquakes often come with higher premiums due to the increased risk of damage.

For instance, homeowners in coastal areas may face higher premiums due to the risk of hurricanes and flooding. Similarly, those in regions with high crime rates might pay more for their policies to cover potential theft or vandalism.

Risk Factors and Mitigation Strategies

Beyond geographical location, there are various risk factors that can influence homeowner insurance policies. These include:

- Age of the Home: Older homes may have outdated wiring, plumbing, or roofing, which can increase the risk of damage and subsequently the insurance premium.

- Home Construction Materials: Homes built with certain materials, like wood, may be more susceptible to fire damage, affecting the cost of insurance.

- Homeowner's Credit Score: Believe it or not, a homeowner's credit score can impact their insurance premium. A lower credit score may result in a higher premium, as it is seen as a potential indicator of increased risk.

Mitigating Risks for Better Premiums

Homeowners can take proactive steps to mitigate these risks and potentially reduce their insurance premiums. Here are some strategies:

- Home Improvements: Upgrading outdated systems and making home improvements can reduce the risk of damage, which may lead to lower premiums.

- Safety Features: Installing smoke detectors, fire sprinklers, and security systems can enhance the safety of your home, potentially resulting in lower insurance costs.

- Regular Maintenance: Keeping up with regular maintenance, such as roof inspections and gutter cleaning, can prevent potential issues and keep your home in good condition.

Understanding Policy Exclusions and Limitations

While homeowner insurance policies provide extensive coverage, it’s important to understand that they do not cover every possible risk. Here are some common exclusions and limitations to be aware of:

- Flood Damage: Standard homeowner insurance policies do not cover flood damage. Homeowners in flood-prone areas must purchase separate flood insurance.

- Earthquake Damage: Similarly, earthquake damage is typically not covered by standard policies. Separate earthquake insurance is available for homeowners in high-risk areas.

- Wear and Tear: Insurance policies do not cover damage caused by normal wear and tear over time. This includes things like aging roofs, deteriorating foundations, or slowly developing mold issues.

The Fine Print: Understanding Your Policy

It’s crucial to carefully review your homeowner insurance policy to understand what is and isn’t covered. Many policies have specific language outlining exclusions and limitations, and it’s essential to be aware of these to avoid any surprises in the event of a claim.

Making Informed Choices

By understanding these exclusions and limitations, homeowners can make informed decisions about their insurance coverage. For instance, if you live in an area prone to earthquakes or floods, you may want to consider purchasing additional coverage to protect your home from these specific risks.

Navigating the Future: Trends and Advancements in Homeowner Insurance

The world of homeowner insurance is continually evolving, with new trends and advancements shaping the industry. Here’s a glimpse into the future of homeowner insurance:

The Rise of Digital Insurance

With the increasing digitalization of various industries, homeowner insurance is no exception. Digital insurance platforms are gaining traction, offering homeowners the convenience of managing their policies online, from purchasing to filing claims.

These digital platforms often provide real-time quotes, allow for easy policy comparisons, and offer a streamlined claims process, making it more efficient for homeowners to handle their insurance needs.

Innovative Coverage Options

Insurance providers are constantly innovating to offer new and specialized coverage options. These can include:

- Green Home Coverage: Policies that offer additional benefits for homeowners who have eco-friendly features or use renewable energy sources.

- Cyber Insurance: With the increasing reliance on technology, cyber insurance is becoming more prevalent, offering protection against cyber attacks and data breaches.

- Shared Economy Coverage: As the shared economy grows, insurance policies are adapting to cover homeowners who rent out their properties through platforms like Airbnb.

Data-Driven Risk Assessment

Advancements in data analytics are transforming the way insurance providers assess risk. By utilizing data-driven models, insurers can more accurately predict potential risks, leading to more precise premiums and coverage recommendations.

What is the average cost of homeowner insurance?

+The average cost of homeowner insurance can vary widely depending on factors such as location, the value of the home, and the level of coverage. As of 2023, the national average for homeowner insurance premiums is around $1,300 per year. However, this can range from as low as $700 to over $3,000 annually depending on individual circumstances.

How often should I review my homeowner insurance policy?

+It's recommended to review your homeowner insurance policy annually, or whenever there are significant changes to your home or personal circumstances. This ensures that your coverage remains up-to-date and aligned with your needs.

What should I do if I need to file a claim?

+If you need to file a claim, contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves documenting the damage, providing evidence, and waiting for an adjuster to assess the loss. It's important to follow the instructions provided by your insurer to ensure a smooth claims process.

In conclusion, homeowner insurance policies are intricate tools designed to provide financial protection and peace of mind to homeowners. By understanding the coverage, exclusions, and trends in the industry, homeowners can make informed decisions to safeguard their most valuable asset.