High Deductible Insurance Plans

High Deductible Insurance Plans (HDHPs) have become an increasingly popular option for individuals and families seeking affordable healthcare coverage. These plans offer a unique approach to insurance, often providing lower premiums in exchange for higher deductibles. As healthcare costs continue to rise, understanding the ins and outs of HDHPs is crucial for making informed decisions about your health insurance coverage.

Understanding High Deductible Health Plans

A High Deductible Health Plan is a type of health insurance policy that requires individuals to pay a higher amount out-of-pocket before the insurance coverage kicks in. This plan design aims to encourage individuals to become more conscious of their healthcare choices and to actively manage their healthcare expenses.

HDHPs are often coupled with Health Savings Accounts (HSAs), tax-advantaged accounts that allow individuals to save money for medical expenses. The combination of an HDHP and an HSA can provide significant financial benefits, as the money contributed to the HSA grows tax-free and can be used to cover qualified medical expenses.

Key Features of High Deductible Plans

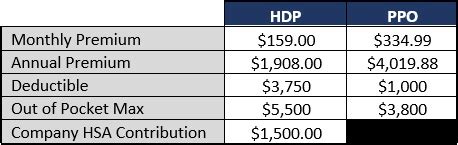

- Lower Premiums: One of the primary advantages of HDHPs is the reduced monthly premiums compared to traditional health insurance plans. This can make healthcare coverage more accessible, especially for those on a tight budget.

- Higher Deductibles: As the name suggests, HDHPs come with higher annual deductibles. This means that individuals will need to pay a larger portion of their medical expenses upfront before the insurance coverage starts to contribute.

- Preventive Care Coverage: Despite the higher deductibles, HDHPs are required by law to cover certain preventive services at no cost to the policyholder. This includes services like annual check-ups, screenings, and immunizations, ensuring that individuals can access basic healthcare services without incurring additional costs.

- Tax Benefits: The pairing of an HDHP with an HSA offers significant tax advantages. Contributions to an HSA are tax-deductible, and the funds can grow tax-free. Additionally, any money withdrawn from the HSA to cover qualified medical expenses is tax-free, providing a double tax benefit.

How High Deductible Plans Work

When enrolled in an HDHP, individuals are responsible for paying for their medical expenses until they reach their annual deductible. This deductible amount varies based on the specific plan but typically ranges from a few thousand dollars to over $10,000. Once the deductible is met, the insurance plan starts to cover a portion of the costs, often up to a certain limit or until the out-of-pocket maximum is reached.

For example, let's consider an HDHP with a $5,000 deductible and an 80/20 coinsurance rate. If an individual incurs a medical expense of $10,000 after meeting their deductible, the insurance plan would cover 80% of the remaining costs, leaving the individual responsible for the remaining 20% or $2,000. This coinsurance rate continues until the out-of-pocket maximum is reached, at which point the insurance plan covers 100% of the costs.

| HDHP Scenario | Individual's Expenses | Insurance Coverage |

|---|---|---|

| Before Deductible | $5,000 (Deductible) | $0 |

| After Deductible | $5,000 (80% coinsurance) | $4,000 (80% coverage) |

| Total Out-of-Pocket | $9,000 | $4,000 |

HDHPs and Preventive Care

A significant advantage of HDHPs is their coverage of preventive care services. These services are designed to catch potential health issues early on, when they are often more treatable and less expensive. By encouraging individuals to utilize preventive care, HDHPs can help reduce overall healthcare costs and improve long-term health outcomes.

Some common preventive care services covered by HDHPs include:

- Annual physical exams and check-ups

- Immunizations and vaccinations

- Cancer screenings (e.g., mammograms, colonoscopies)

- Cholesterol and blood pressure screenings

- Prenatal and postpartum care

The Benefits of High Deductible Plans

HDHPs offer several advantages that make them an attractive option for many individuals and families.

Affordable Premiums

One of the most significant benefits of HDHPs is their potential to reduce monthly premiums. With lower premiums, individuals can save money on their healthcare coverage, especially if they have relatively low medical expenses throughout the year.

Tax Advantages with HSAs

The pairing of an HDHP with an HSA provides substantial tax benefits. Contributions to an HSA are tax-deductible, and the funds can grow tax-free, similar to a retirement account. This means that individuals can save money on their taxes while building a savings account for future medical expenses.

Additionally, any funds remaining in the HSA at the end of the year can be rolled over and used in subsequent years. This feature allows individuals to build a substantial medical savings fund over time, providing financial security for unexpected medical emergencies.

Encouraging Cost-Conscious Decisions

HDHPs encourage individuals to become more engaged in their healthcare choices. With a higher deductible, individuals are incentivized to research and compare healthcare providers and services, leading to more cost-effective decisions. This can result in lower overall healthcare costs and a better understanding of the healthcare system.

Potential Drawbacks and Considerations

While HDHPs offer numerous benefits, there are also some potential drawbacks and considerations to keep in mind.

Higher Out-of-Pocket Costs

The most obvious downside of HDHPs is the higher out-of-pocket costs associated with meeting the deductible. Individuals with significant medical needs or unexpected health issues may find themselves paying a substantial portion of their medical expenses upfront. This can be a significant financial burden, especially for those with limited financial resources.

Limited Coverage for Certain Services

HDHPs may have more restrictive coverage for certain medical services or treatments. While preventive care is typically covered, other specialized or experimental treatments may not be included in the plan’s coverage. It’s essential to carefully review the plan’s benefits and exclusions to understand what is and isn’t covered.

Network Restrictions

HDHPs often have narrower provider networks compared to traditional health insurance plans. This means that individuals may have a more limited choice of healthcare providers, which can be inconvenient or restrictive, especially in rural areas or for those with specific healthcare needs.

Is a High Deductible Plan Right for You?

Choosing an HDHP is a personal decision that depends on various factors, including your healthcare needs, financial situation, and risk tolerance. Here are some considerations to help you decide if an HDHP is the right choice for you:

- Healthcare Needs: If you anticipate having high medical expenses or require specialized treatments, an HDHP may not be the best option. Traditional health insurance plans with lower deductibles and broader coverage may be more suitable.

- Financial Situation: Consider your ability to handle the higher out-of-pocket costs associated with an HDHP. If you have a stable financial situation and can afford the higher deductible, an HDHP can provide significant savings on premiums.

- Risk Tolerance: HDHPs involve a higher level of financial risk. If you are comfortable with the idea of paying more upfront for medical expenses, an HDHP can be a viable choice. However, if you prefer more predictable and consistent healthcare costs, a traditional plan may be more suitable.

Seeking Professional Advice

If you are unsure about which type of health insurance plan is best for you, it’s recommended to seek advice from a qualified insurance agent or financial advisor. They can help assess your specific needs and provide guidance on choosing the most suitable plan based on your circumstances.

The Future of High Deductible Plans

HDHPs have gained popularity in recent years, and their role in the healthcare industry is expected to continue evolving. As healthcare costs rise, these plans offer a potential solution for making healthcare coverage more affordable for individuals and families.

Additionally, the integration of technology and digital health solutions is expected to play a significant role in the future of HDHPs. Telehealth services, remote monitoring, and digital health platforms can provide more accessible and cost-effective healthcare options, further enhancing the benefits of HDHPs.

As the healthcare landscape continues to transform, HDHPs are likely to adapt and evolve to meet the changing needs of individuals and the healthcare system as a whole.

Can I use my HSA funds for any medical expense?

+HSAs are designed to cover qualified medical expenses. This includes a wide range of healthcare-related costs, such as doctor visits, prescriptions, dental care, and vision expenses. However, it’s important to note that certain expenses, like cosmetic procedures or over-the-counter medications without a prescription, may not be eligible for HSA funding.

Are HDHPs suitable for families with children?

+HDHPs can be a viable option for families, especially if the children are generally healthy and have limited medical needs. The tax benefits of HSAs can provide substantial savings over time. However, it’s crucial to carefully assess the family’s healthcare needs and financial situation to determine if an HDHP is the best choice.

What happens if I don’t use all the funds in my HSA in a given year?

+Any funds remaining in your HSA at the end of the year are rolled over and can be used in subsequent years. This means that you can continue to grow your HSA balance over time, providing a substantial savings account for future medical expenses. HSAs offer long-term tax advantages, making them an attractive option for long-term healthcare planning.