Health Insurance Subsidy

Health insurance subsidies are a crucial component of healthcare affordability and accessibility for many individuals and families worldwide. These financial aids play a pivotal role in ensuring that people can obtain the medical coverage they need without facing insurmountable financial burdens. As the cost of healthcare continues to rise, understanding the intricacies of health insurance subsidies becomes increasingly important.

In this comprehensive guide, we delve deep into the world of health insurance subsidies, exploring their mechanisms, eligibility criteria, and the profound impact they have on the lives of those they support. By the end of this article, you'll have a thorough understanding of how these subsidies work, who they benefit, and why they are a critical aspect of modern healthcare systems.

Understanding Health Insurance Subsidies

Health insurance subsidies are financial assistance provided by governments or private entities to reduce the cost of health insurance premiums for eligible individuals and families. These subsidies are designed to make health coverage more affordable, especially for those with low to moderate incomes, ensuring that financial constraints do not become a barrier to accessing essential healthcare services.

The concept of health insurance subsidies has gained prominence in recent years, driven by the understanding that healthcare is a fundamental right and should be accessible to all. These subsidies have been implemented in various forms across different countries, each with its unique approach to addressing the challenges of healthcare affordability.

Types of Health Insurance Subsidies

Health insurance subsidies come in several forms, each catering to specific needs and circumstances. Understanding these types is essential to grasp the breadth of support available to individuals seeking affordable healthcare.

- Premium Subsidies: These are the most common form of subsidy, where the government or an entity contributes a portion of the health insurance premium on behalf of the insured individual. This reduces the amount the individual needs to pay out of pocket, making insurance more affordable.

- Cost-Sharing Reductions: In this type of subsidy, the government or insurer covers a portion of the costs associated with healthcare services, such as deductibles, copayments, and coinsurance. This reduces the financial burden on individuals when they need to utilize their insurance coverage.

- Tax Credits: Tax credits are another form of subsidy, where individuals receive a credit on their taxes based on their health insurance expenses. This can provide a significant financial relief, especially for those with high insurance costs.

- Government-Sponsored Programs: Some governments offer comprehensive health insurance programs, often with reduced or no premiums, targeting specific vulnerable populations like the elderly, children, or those with low incomes. These programs ensure that these groups have access to essential healthcare services.

Eligibility and Criteria

Eligibility for health insurance subsidies is typically based on a combination of factors, including income level, family size, and in some cases, age or health status. The specific criteria can vary widely depending on the country or region, as well as the specific subsidy program.

Income is often a primary determinant of subsidy eligibility. Individuals and families with lower incomes are generally given priority, as they are more likely to struggle with affording healthcare. The exact income thresholds can vary, with some programs offering subsidies on a sliding scale, where the amount of subsidy increases as income decreases.

Family size is another critical factor, as larger families often face higher healthcare costs. Many subsidy programs take into account the number of dependents in a household when determining eligibility and the level of support provided.

| Program | Income Eligibility | Family Size Consideration |

|---|---|---|

| Medicaid | Varies by state, typically for low-income families | Yes, larger families may have higher income thresholds |

| CHIP (Children's Health Insurance Program) | Up to 200% of the Federal Poverty Level | Yes, tailored to families with children |

| ACA Marketplace Subsidies | Between 100% and 400% of the Federal Poverty Level | Yes, with family size influencing the level of subsidy |

The Impact of Health Insurance Subsidies

Health insurance subsidies have a profound and wide-reaching impact on individuals, families, and the healthcare system as a whole. By making insurance more affordable, these subsidies enable a broader segment of the population to access essential healthcare services, improving overall health outcomes and reducing financial strain.

Improved Access to Healthcare

One of the most significant impacts of health insurance subsidies is the increased accessibility of healthcare services. With subsidies reducing the financial barrier to insurance coverage, more individuals can afford to enroll in health plans, leading to a higher uptake of preventative care, routine check-ups, and timely treatment for illnesses or injuries.

This improved access to healthcare can have a cascading effect, reducing the incidence of severe and costly health conditions that might have gone untreated due to financial constraints. Early detection and treatment, made possible by insurance coverage, can lead to better health outcomes and potentially lower long-term healthcare costs.

Financial Protection for Individuals and Families

Health insurance subsidies provide a critical layer of financial protection for individuals and families. Without subsidies, many people would face the difficult choice between paying for healthcare or meeting other basic needs. Subsidies alleviate this burden, ensuring that healthcare remains a feasible and affordable option, even for those with limited financial means.

By reducing the financial risk associated with healthcare, subsidies can improve overall financial stability and security for individuals and families. This can lead to better mental health, reduced stress levels, and increased productivity, as people are not constantly worried about how to pay for unexpected medical expenses.

Positive Effects on the Healthcare System

The implementation of health insurance subsidies can have positive effects on the broader healthcare system. With more people covered by insurance, there is a potential reduction in the number of uninsured patients seeking treatment at emergency rooms, which can be a costly and inefficient use of healthcare resources.

Furthermore, insurance coverage encourages the utilization of primary care services, which can lead to better disease management and a reduction in costly complications. This shift towards preventative care and early intervention can result in more efficient use of healthcare resources and potentially lower overall healthcare spending.

Real-World Examples and Case Studies

To illustrate the impact of health insurance subsidies, let’s explore a few real-world examples and case studies.

Case Study: Medicaid Expansion in the United States

The expansion of Medicaid, a government-funded health insurance program for low-income individuals and families, has had a significant impact on healthcare access in the United States. With the expansion, millions of previously uninsured individuals gained access to healthcare services, leading to improved health outcomes and a reduction in financial strain for low-income families.

A study by the Commonwealth Fund found that states that expanded Medicaid saw substantial increases in insurance coverage, with uninsured rates dropping by nearly half in some states. This led to increased utilization of preventative services, such as cancer screenings and routine check-ups, which are crucial for early detection and management of health conditions.

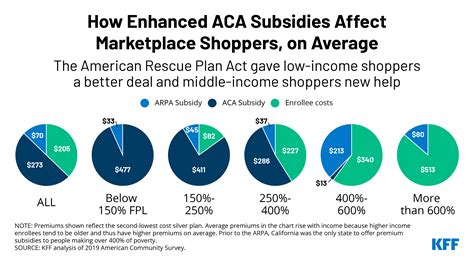

Example: Premium Subsidies in the Affordable Care Act

The Affordable Care Act (ACA) in the United States introduced premium subsidies for individuals purchasing insurance through the Health Insurance Marketplace. These subsidies are based on income and family size, with the aim of making insurance more affordable for middle- and low-income households.

A report by the Kaiser Family Foundation revealed that premium subsidies have been effective in reducing the cost of insurance for many Americans. For instance, a family of four earning $50,000 annually could receive a premium subsidy of up to $1,490 per month, making insurance significantly more affordable and accessible.

Future Implications and Challenges

While health insurance subsidies have proven to be a powerful tool for improving healthcare access and financial protection, there are ongoing challenges and considerations for the future.

Sustainability and Funding

One of the primary challenges facing health insurance subsidies is sustainability and funding. Subsidy programs often require significant financial resources, and ensuring their long-term viability can be a complex task, especially in the face of changing political landscapes and economic conditions.

To address this, many countries are exploring innovative funding mechanisms, such as dedicated healthcare taxes or leveraging private sector partnerships. Finding a balance between providing necessary financial support and maintaining fiscal responsibility is a delicate task for policymakers.

Equitable Access and Targeted Support

Ensuring equitable access to healthcare through subsidies requires careful consideration of eligibility criteria and targeted support for vulnerable populations. While subsidies have been effective in increasing overall insurance coverage, certain groups, such as the extremely poor or those with complex health needs, may still face barriers to accessing care.

Policymakers and healthcare advocates are working towards refining eligibility criteria and exploring additional support mechanisms to ensure that subsidies reach those who need them the most. This includes exploring ways to simplify the enrollment process and providing additional resources for navigating the healthcare system.

The Role of Technology and Data

Advancements in technology and data analytics are poised to play a significant role in the future of health insurance subsidies. These tools can enhance the efficiency and effectiveness of subsidy programs by improving eligibility determination, streamlining enrollment processes, and identifying areas where support is most needed.

For instance, data analytics can be used to identify geographic areas or demographic groups with low insurance uptake, allowing for targeted outreach and support. Additionally, technology can facilitate the integration of subsidy programs with healthcare providers, ensuring that patients receive the full benefits of their insurance coverage.

Conclusion

Health insurance subsidies are a critical component of modern healthcare systems, providing a safety net for individuals and families facing financial challenges in accessing healthcare. Through a combination of premium subsidies, cost-sharing reductions, tax credits, and government-sponsored programs, these initiatives have proven effective in improving healthcare access, reducing financial strain, and enhancing overall health outcomes.

As we move forward, continued efforts to refine and expand subsidy programs, coupled with a commitment to equitable access and financial protection, will be essential in building a healthcare system that serves the needs of all. By staying informed and advocating for accessible and affordable healthcare, we can work towards a future where no one is denied the care they need due to financial constraints.

Frequently Asked Questions

How do I know if I’m eligible for health insurance subsidies?

+Eligibility for health insurance subsidies typically depends on your income level, family size, and sometimes age or health status. You can check your eligibility by visiting the official government website or contacting a healthcare navigator or enrollment counselor. They can guide you through the process and help you understand the specific criteria for your region or country.

Can I receive subsidies if I have a pre-existing condition?

+Yes, health insurance subsidies are designed to make coverage more affordable for everyone, including those with pre-existing conditions. In many countries, insurers are prohibited from discriminating against individuals with pre-existing conditions, ensuring that they can access the same level of support as others.

How are subsidy amounts determined?

+The amount of subsidy you receive is typically based on a combination of your income and family size. Some programs use a sliding scale, where the subsidy amount increases as your income decreases. Others may have set income thresholds, with those below a certain income level receiving the full subsidy, and those above receiving a reduced amount.

Do I have to repay health insurance subsidies?

+In most cases, health insurance subsidies do not need to be repaid. These are typically considered grants or benefits to help make insurance more affordable. However, it’s important to note that some programs may have specific rules or requirements that could impact your eligibility or the amount of subsidy you receive. Always review the terms and conditions of your subsidy program to understand any potential obligations.