Health Insurance Premium Deduction

In the realm of healthcare, understanding the intricacies of insurance plans and their associated costs is crucial. One key aspect that often generates questions and curiosity is the health insurance premium deduction. This article aims to demystify this concept, shedding light on its mechanisms, implications, and the factors that influence it.

Unraveling Health Insurance Premium Deductions

Health insurance premium deductions represent a fundamental component of the insurance landscape, influencing both individuals and employers alike. These deductions serve as a means to offset the cost of healthcare services, ensuring that policyholders can access necessary medical care without bearing the full financial burden.

At its core, a health insurance premium deduction refers to the amount deducted from an individual's salary or an employer's payroll to contribute towards their health insurance plan. This deduction is a regular, recurring payment, typically made on a monthly or biweekly basis, depending on the payroll schedule.

Key Factors Influencing Premium Deductions

Several critical factors come into play when determining the magnitude of health insurance premium deductions. These include:

- Plan Type and Coverage: The type of insurance plan chosen significantly impacts the premium. Plans with extensive coverage, such as comprehensive medical, dental, and vision benefits, often carry higher premiums.

- Employee Contribution: In employer-sponsored plans, employees usually contribute a portion of the premium. The employee's share is often a fixed amount or a percentage of the total premium, and it can vary based on the plan selected.

- Family Coverage: Insuring additional family members usually increases the premium. The number of dependents and their age can affect the final deduction amount.

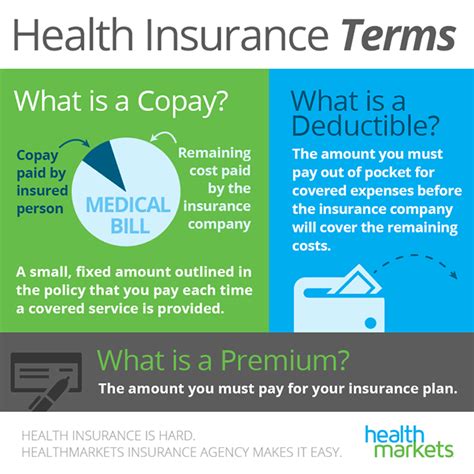

- Deductibles and Copays: Plans with higher deductibles and copayments generally have lower premiums. Individuals can choose a plan with a higher deductible to reduce their premium deduction, but this means they will pay more out of pocket for healthcare services.

- Provider Network: Insurance plans that offer a broad network of healthcare providers tend to have higher premiums. Narrower networks, while potentially restricting choice, can lead to lower premiums.

- Location: The geographic area where an individual resides or works can influence premium costs. Healthcare expenses vary by region, and this disparity is often reflected in insurance premiums.

- Age and Health Status: Younger, healthier individuals typically pay lower premiums. As people age or develop health conditions, their premiums may increase to reflect the higher risk and potential healthcare needs.

Understanding these factors is essential for individuals and employers to make informed decisions about health insurance coverage and its associated costs.

The Impact of Premium Deductions

Health insurance premium deductions have a significant impact on both individuals and businesses. For individuals, these deductions directly affect their take-home pay, making it crucial to choose a plan that aligns with their healthcare needs and financial capabilities.

Employers, on the other hand, face the task of balancing the need to provide comprehensive health coverage for their workforce with the desire to minimize the financial burden on both the company and its employees. This often involves careful consideration of plan options, contribution strategies, and communication with employees to ensure they understand the implications of their insurance choices.

Comparative Analysis: Premium Deductions vs. Out-of-Pocket Costs

When assessing the overall cost of healthcare, it’s essential to consider not only premium deductions but also the potential out-of-pocket expenses. Out-of-pocket costs include deductibles, copayments, and coinsurance, which are paid directly by the policyholder when receiving healthcare services.

While premium deductions are a consistent, predictable expense, out-of-pocket costs can vary significantly based on an individual's healthcare utilization. Those with frequent medical needs or major health events may face substantial out-of-pocket expenses, even with a seemingly affordable insurance plan.

To illustrate this, let's consider two individuals, Jane and Michael, both enrolled in health insurance plans with different premium deduction and out-of-pocket cost structures.

| Plan Type | Premium Deduction | Out-of-Pocket Costs |

|---|---|---|

| Jane's Plan | $200/month | High Deductible: $3,000 annually |

| Michael's Plan | $350/month | Lower Deductible: $1,500 annually |

In this scenario, Jane's plan has a lower premium deduction, making it more affordable on a monthly basis. However, if she requires extensive medical care or undergoes a major procedure, she could face significant out-of-pocket costs due to the high deductible. On the other hand, Michael's plan, with its higher premium, offers a lower deductible, potentially saving him money if he requires frequent healthcare services.

This comparison highlights the importance of evaluating both premium deductions and out-of-pocket costs when choosing a health insurance plan. It underscores the need for individuals to carefully assess their healthcare needs and financial situation to make an informed decision.

Navigating the Health Insurance Landscape

The world of health insurance is complex, and making informed decisions can be challenging. However, with the right knowledge and resources, individuals and employers can navigate this landscape effectively.

For individuals, it's essential to review and compare various insurance plans, considering not just the premium deductions but also the coverage, deductibles, and copayments. Understanding one's healthcare needs and financial situation is key to selecting an appropriate plan.

Employers, too, face the responsibility of offering comprehensive yet affordable insurance options. This often involves a delicate balance between providing generous benefits and managing the financial impact on both the company and its employees. Regular reviews of insurance plans and open communication with employees about their options are crucial.

The Future of Health Insurance Premium Deductions

The landscape of health insurance is constantly evolving, influenced by advancements in medical technology, changes in healthcare policies, and shifting societal needs. As we look ahead, several trends and considerations come to the forefront:

- Telehealth and Virtual Care: The rise of telehealth services has been a game-changer, especially in the wake of the COVID-19 pandemic. This trend is likely to continue, offering convenient and cost-effective healthcare options that could influence premium structures.

- Value-Based Care: There is a growing shift towards value-based healthcare models, where providers are incentivized to deliver high-quality care while controlling costs. This approach could potentially lead to more affordable insurance plans and reduced premium deductions.

- Prevention and Wellness: Emphasizing preventative care and wellness initiatives is gaining traction. By encouraging healthy lifestyles and early detection of health issues, insurers can potentially reduce the overall cost of healthcare, impacting premium structures positively.

- Digital Health Solutions: The integration of digital health technologies, such as wearables and health apps, offers opportunities for personalized healthcare and improved patient engagement. These innovations could lead to more efficient healthcare delivery and potentially lower insurance costs.

- Regulatory Changes: Government policies and regulations play a significant role in shaping the insurance landscape. Any changes in healthcare laws or subsidies can directly impact premium costs and the affordability of insurance plans.

As we navigate these evolving trends, it becomes increasingly important for individuals and employers to stay informed and adapt their insurance strategies accordingly. Staying abreast of the latest developments in healthcare and insurance can empower decision-makers to make choices that align with their needs and the changing landscape.

Conclusion

Health insurance premium deductions are a critical aspect of healthcare financing, impacting both individuals and employers. Understanding the factors that influence these deductions and their implications is essential for making informed decisions about insurance coverage. As the healthcare landscape continues to evolve, staying informed and adapting to new trends and policies will be vital for ensuring accessible and affordable healthcare for all.

How are health insurance premium deductions calculated?

+Premium deductions are calculated based on various factors, including the type of plan, coverage, and the policyholder’s age, health status, and location. Employers often contribute a portion of the premium, and employees pay the remaining amount through payroll deductions.

Can I change my health insurance plan to reduce premium deductions?

+Yes, individuals can choose from a range of insurance plans, each with different premium deductions and coverage. It’s essential to carefully evaluate one’s healthcare needs and financial situation before making a decision.

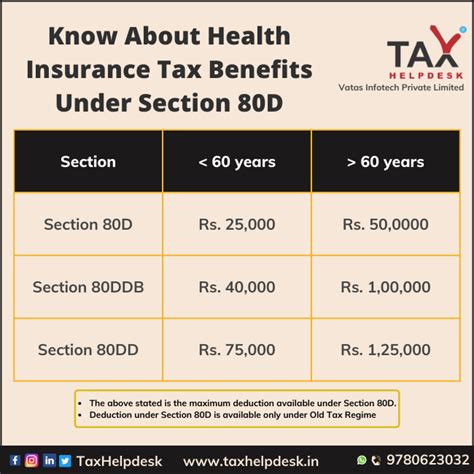

What are the potential tax benefits associated with health insurance premium deductions?

+In many cases, health insurance premium deductions can offer tax advantages. These deductions may be tax-exempt or eligible for tax credits, reducing the overall tax burden for individuals and employers. It’s advisable to consult with a tax professional for specific guidance.