Health Insurance Marketplace Tax Form

The Health Insurance Marketplace, a crucial component of the Affordable Care Act (ACA), has revolutionized healthcare access and coverage in the United States. As we delve into the intricacies of this system, we uncover the essential role played by tax forms in facilitating access to quality healthcare for millions of Americans. This article aims to provide a comprehensive guide to understanding the Health Insurance Marketplace tax forms, their purpose, and their impact on individuals and businesses alike.

Understanding the Health Insurance Marketplace

The Health Insurance Marketplace, also known as the Health Insurance Exchange, is an online platform designed to simplify the process of purchasing health insurance for individuals, families, and small businesses. Established under the Affordable Care Act, it offers a centralized hub where users can compare and purchase insurance plans from various providers, ensuring transparency and affordability.

One of the key features of the Marketplace is the provision of financial assistance in the form of premium tax credits and cost-sharing reductions for eligible individuals and families. These tax benefits, tied to the submission of specific tax forms, play a pivotal role in making healthcare more accessible and affordable.

The Role of Tax Forms in the Marketplace

Tax forms are integral to the Health Insurance Marketplace as they serve as the primary mechanism for determining eligibility for premium tax credits and cost-sharing reductions. These forms collect essential information about an individual’s or family’s income, household size, and other relevant factors that influence their eligibility for financial assistance.

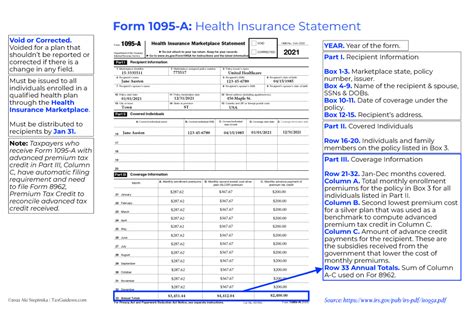

The most common tax form associated with the Marketplace is the 1095-A form, also known as the Health Insurance Marketplace Statement. This form is sent to individuals who enroll in a qualified health plan through the Marketplace and receive advance payments of the premium tax credit. It provides crucial information to taxpayers when filing their federal income tax returns, allowing them to reconcile their premium tax credit and ensure compliance with ACA requirements.

Key Components of the 1095-A Form

- Taxpayer Information: This section includes personal details such as name, address, and social security number, ensuring accurate identification.

- Coverage Information: Details about the health plan coverage, including the plan type, effective dates, and any changes made during the coverage period.

- Premium Tax Credit: This section outlines the advance payments of the premium tax credit received by the taxpayer, along with any adjustments or reconciliations made.

- Covered Individuals: Information about all individuals covered under the health plan, including their relationship to the taxpayer and their respective ages.

| Form Section | Description |

|---|---|

| Part I | Provides personal information and coverage details. |

| Part II | Details the advance payments of the premium tax credit and any applicable adjustments. |

| Part III | Lists the covered individuals, their relationships, and ages. |

Filing Requirements and Deadlines

Individuals who receive a 1095-A form must file it with their federal income tax return to claim the premium tax credit. The deadline for filing tax returns, and by extension, the 1095-A form, typically falls in mid-April each year. However, it’s important to note that the exact deadline may vary based on the taxpayer’s specific circumstances and the state in which they reside.

Failure to file the 1095-A form with the tax return or providing inaccurate information can result in penalties and complications with the IRS. It's crucial for taxpayers to carefully review and understand the information on their 1095-A form before filing.

Special Considerations for Business Owners

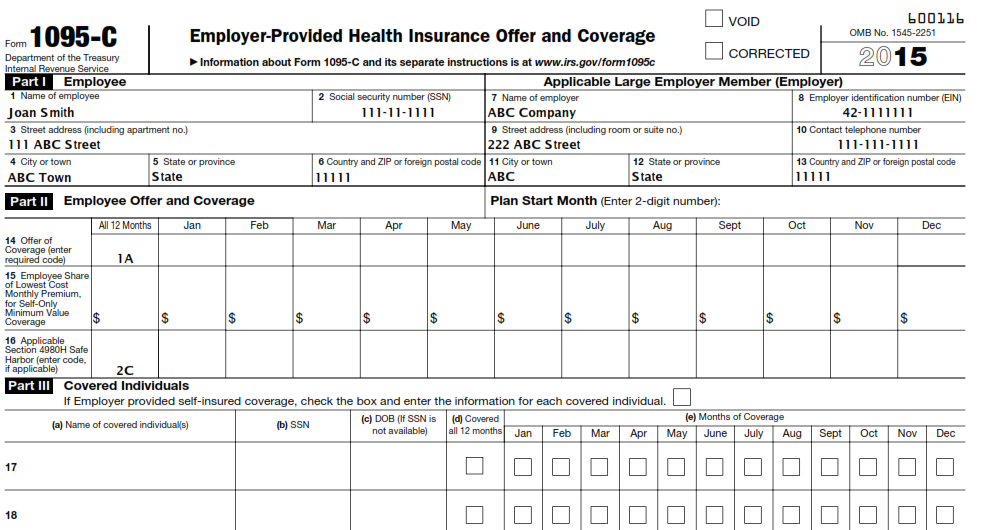

For business owners offering health insurance coverage to their employees through the Marketplace, the tax form requirements are slightly different. They must provide a 1094-C and 1095-C form to each employee and file these forms with the IRS.

- The 1094-C form is a transmittal form that provides summary information about the employer's health insurance coverage.

- The 1095-C form is provided to each employee and includes details about their coverage, including the months of coverage, the employee's share of the premium, and any applicable cost-sharing reductions.

Business owners must ensure that these forms are distributed to employees by the required deadline, typically in early February, and filed with the IRS by the end of February.

Impact and Benefits of the Marketplace Tax Forms

The Health Insurance Marketplace tax forms have had a significant impact on individuals and businesses, facilitating access to affordable healthcare and promoting compliance with the Affordable Care Act.

Advantages for Individuals

- Financial Assistance: The 1095-A form allows individuals to claim premium tax credits, reducing the cost of their health insurance premiums and making healthcare more affordable.

- Transparency: The Marketplace and the associated tax forms provide a transparent process for individuals to understand their eligibility for financial assistance and their coverage options.

- Compliance: By filing the 1095-A form, individuals demonstrate compliance with the ACA’s individual mandate, avoiding potential penalties.

Benefits for Businesses

- Employee Benefits: The 1095-C form ensures that employees receive detailed information about their health insurance coverage, promoting transparency and understanding.

- Compliance with ACA: Business owners can demonstrate compliance with the ACA’s employer mandate by providing the necessary tax forms to their employees and filing them with the IRS.

- Cost-Sharing Reductions: The Marketplace tax forms facilitate the implementation of cost-sharing reductions, making healthcare more affordable for employees and potentially reducing employer costs.

Future Implications and Evolving Landscape

As the healthcare landscape continues to evolve, the role of tax forms in the Health Insurance Marketplace is likely to adapt and expand. Here are some potential future implications:

- Digital Integration: With the increasing adoption of digital technologies, the Marketplace may further integrate with tax filing systems, simplifying the process of claiming tax credits and reducing administrative burdens.

- Expanded Eligibility: Ongoing policy discussions and legislative changes may lead to an expansion of eligibility criteria for premium tax credits, making healthcare more accessible to a broader range of individuals.

- Enhanced Data Analytics: The data collected through Marketplace tax forms can be leveraged for advanced analytics, providing valuable insights into healthcare trends, cost drivers, and population health.

Frequently Asked Questions

What happens if I don’t receive a 1095-A form, but I enrolled in a health plan through the Marketplace and received advance payments of the premium tax credit?

+

If you don’t receive a 1095-A form, you should contact the Marketplace or your health insurance provider to request a copy. It’s important to have this form to accurately file your taxes and claim the premium tax credit.

Are there any penalties for not filing the 1095-A form with my tax return?

+

Yes, failing to file the 1095-A form with your tax return can result in penalties. It’s important to include this form to reconcile your premium tax credit and demonstrate compliance with the Affordable Care Act.

As a business owner, can I provide the 1095-C form electronically to my employees?

+

Yes, you can provide the 1095-C form electronically to your employees as long as it meets the IRS requirements for electronic delivery. This can streamline the process and reduce administrative costs.