Cheap Car Insurance For Teenagers

As a parent, guardian, or even a young adult yourself, finding affordable car insurance for teenagers can be a daunting task. With their limited driving experience, young drivers often face higher insurance premiums. However, there are strategies and considerations that can help you secure more affordable coverage for your teenage driver. This comprehensive guide will explore the factors influencing insurance costs, provide tips on how to find cheap car insurance for teenagers, and offer insights into making informed decisions to protect your wallet and ensure your teen's safety on the road.

Understanding the Factors That Affect Teen Car Insurance Rates

Several key factors influence the cost of car insurance for teenagers. Understanding these elements is crucial to developing an effective strategy for securing more affordable coverage. Here’s a breakdown of the primary factors that impact insurance rates for young drivers:

Driving Experience

One of the most significant factors is the limited driving experience of teenagers. Insurance companies view this as a higher risk, as new drivers are more likely to be involved in accidents. This lack of experience often leads to higher premiums.

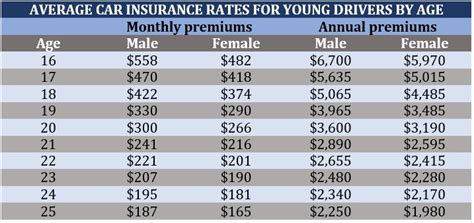

Age and Gender

Insurance rates can also be influenced by the age and gender of the teenage driver. Generally, younger drivers (aged 16-19) are considered higher-risk, and males in this age group often face higher premiums due to statistical trends showing higher accident rates.

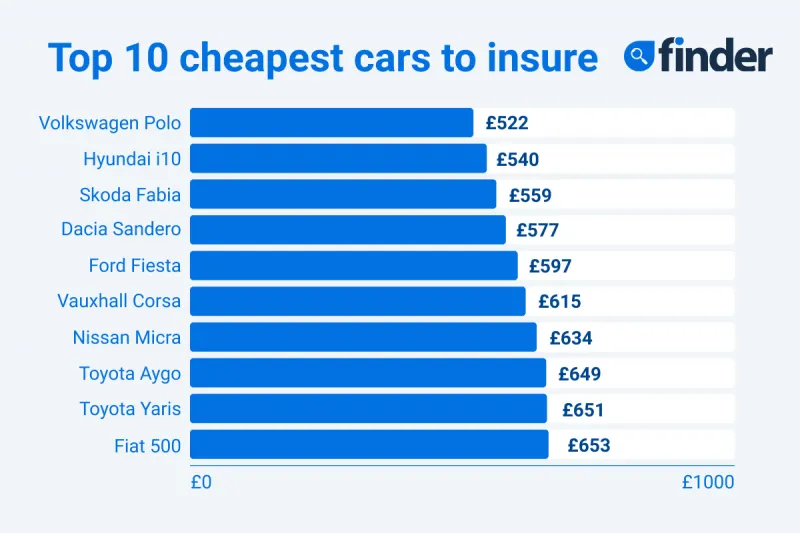

Vehicle Choice

The type of vehicle your teenager drives can impact insurance costs. Sports cars and high-performance vehicles typically have higher premiums due to their association with higher speeds and potential for accidents. Opting for a safe, reliable, and less powerful vehicle can help reduce insurance expenses.

Location and Driving Conditions

The geographical location and driving conditions in your area can affect insurance rates. Teenagers living in urban areas with higher traffic density and accident rates may face higher premiums. Similarly, weather conditions and the potential for severe weather events can also influence insurance costs.

Academic Performance and Driving Courses

Some insurance companies offer discounts to teenagers with good academic performance or those who have completed driver education courses. These courses can provide valuable skills and knowledge, making teenagers safer drivers and potentially qualifying them for reduced insurance rates.

Strategies for Finding Cheap Car Insurance for Teenagers

While the factors mentioned above influence insurance rates, there are strategies you can employ to find more affordable car insurance for your teenage driver. Here are some effective approaches to consider:

Shop Around and Compare Quotes

One of the most crucial steps in securing cheap car insurance for teenagers is shopping around and comparing quotes from multiple insurance providers. Each insurer has its own criteria for assessing risk and setting premiums, so getting quotes from several companies can help you identify the most affordable option. Online comparison tools can be particularly useful for this purpose.

Explore Bundle Discounts

If you have multiple vehicles or other insurance policies with the same provider, you may be eligible for bundle discounts. By consolidating your insurance needs with one company, you can often save money on your overall insurance costs, including your teenager’s car insurance.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. While this means you’ll have to pay more out of pocket if an accident occurs, it can be a cost-effective strategy if your teenager is a safe driver. Just ensure that the chosen deductible amount is manageable and doesn’t strain your finances.

Promote Safe Driving Habits

Encourage your teenager to adopt safe driving practices. This includes obeying traffic laws, avoiding distracted driving, and practicing defensive driving techniques. A clean driving record can lead to reduced insurance premiums over time. Consider installing monitoring devices or using telematics insurance, which rewards safe driving habits with discounts.

Inquire About Discounts

Many insurance companies offer a range of discounts for teenage drivers. These may include good student discounts, driver training course discounts, and even discounts for maintaining a good GPA. Be sure to inquire about all available discounts when discussing insurance options with providers.

Choose a Suitable Coverage Level

It’s essential to balance affordability with adequate coverage. While you want to keep costs down, ensure that the insurance policy you choose provides sufficient protection for your teenager and your assets. Assess your specific needs and choose a coverage level that offers the right balance of protection and affordability.

Maintain a Clean Driving Record

A clean driving record is crucial for keeping insurance premiums low. Encourage your teenager to drive safely and avoid violations or accidents. Even a single traffic violation or accident can lead to significantly higher insurance rates. Regularly review your teenager’s driving record and address any issues promptly.

Explore Insurance Options for Teenagers

Different insurance companies offer specialized policies for teenage drivers. These policies may include additional features or benefits tailored to the needs of young drivers. Research and compare these options to find the best fit for your teenager’s situation and budget.

Conclusion: Protecting Your Teen and Your Wallet

Finding cheap car insurance for teenagers requires a thoughtful approach that considers both affordability and adequate coverage. By understanding the factors that influence insurance rates and implementing the strategies outlined in this guide, you can make informed decisions to protect your wallet and ensure your teenager’s safety on the road. Remember that a combination of safe driving habits, careful insurance selection, and ongoing vigilance can lead to more affordable insurance premiums over time.

How can I get the best car insurance rates for my teenage driver?

+To get the best rates, shop around for quotes from multiple insurers, explore bundle discounts, and consider higher deductibles. Promoting safe driving habits and maintaining a clean driving record are also crucial.

Are there any discounts available for teenage drivers?

+Yes, many insurance companies offer discounts for teenage drivers, including good student discounts, driver training course discounts, and discounts for maintaining a good GPA.

What is the impact of my teenager’s driving record on insurance rates?

+A clean driving record is essential for keeping insurance rates low. Even a single violation or accident can lead to significantly higher premiums, so it’s crucial to encourage safe driving habits and regularly review your teenager’s driving record.