Health Insurance In New Jersey

New Jersey, known for its vibrant communities and diverse population, presents a unique landscape when it comes to health insurance. Understanding the specific dynamics of health coverage in this state is essential for residents and policymakers alike. This article aims to delve deep into the world of health insurance in New Jersey, exploring its intricacies, key players, and the impact it has on the lives of its residents.

The Importance of Health Insurance in New Jersey

Health insurance plays a vital role in ensuring the well-being and financial security of individuals and families across New Jersey. With a diverse population and a range of healthcare needs, the state's residents rely on comprehensive and accessible insurance plans to navigate the complexities of the healthcare system.

The cost of healthcare can be a significant burden, especially for those without insurance. Health insurance provides a safety net, covering a wide range of medical services and reducing the financial strain associated with unexpected illnesses or injuries. In New Jersey, where the cost of living is relatively high, affordable and comprehensive health insurance is a necessity for many.

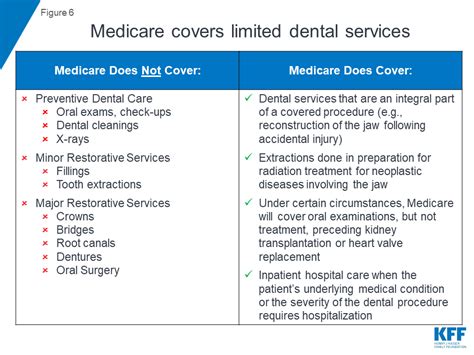

Furthermore, health insurance in New Jersey is not just about covering medical expenses. It also plays a crucial role in promoting preventive care and early detection of health issues. Many insurance plans offer incentives and coverage for regular check-ups, screenings, and vaccinations, which are essential for maintaining good health and preventing more serious and costly health problems down the line.

The State's Role in Health Insurance

The New Jersey Department of Banking and Insurance (DOBI) is a key player in regulating and overseeing the health insurance market within the state. DOBI works to ensure that insurance companies comply with state and federal regulations, protect consumer rights, and promote accessibility and affordability of health coverage.

One of the department's key initiatives is the New Jersey Standard Health Benefit Plan (NJSHBP), which is a standardized set of health insurance benefits designed to provide comprehensive coverage to residents. The NJSHBP ensures that essential health services, such as hospital care, physician services, prescription drugs, and mental health treatment, are included in most insurance plans.

In addition to regulating insurance companies, DOBI also provides resources and assistance to consumers. They offer a Health Insurance Consumer Assistance Program that helps residents understand their rights, navigate the insurance process, and resolve disputes with insurance providers. This program is crucial for ensuring that New Jersey residents have the support they need to access and understand their health coverage options.

Health Insurance Options in New Jersey

New Jersey residents have a variety of health insurance options to choose from, each with its own set of benefits and considerations. The type of insurance plan one chooses depends on individual needs, preferences, and eligibility criteria.

Employer-Sponsored Plans

Many New Jersey residents receive health insurance through their employers. These plans are often more affordable and comprehensive, as the employer typically covers a portion of the premium costs. Additionally, employer-sponsored plans may offer additional benefits tailored to the specific needs of the company's workforce.

For example, a large technology company in New Jersey might offer its employees access to specialized mental health services, recognizing the unique stress levels associated with the industry. On the other hand, a healthcare provider might provide enhanced coverage for preventive care, given the nature of their work and the importance of maintaining good health.

Employer-sponsored plans can vary widely, and it's essential for employees to carefully review the benefits and understand their coverage limits and exclusions.

Individual and Family Plans

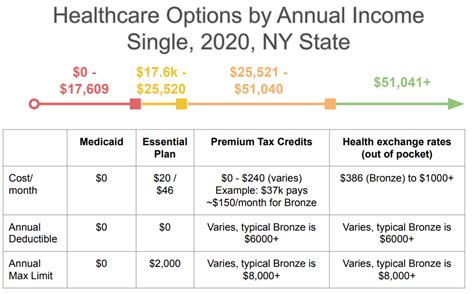

For those who are self-employed, unemployed, or do not have access to employer-sponsored insurance, individual and family plans are an option. These plans can be purchased directly from insurance companies or through the New Jersey Health Insurance Marketplace, also known as the HealthCare.gov exchange.

The Marketplace offers a range of insurance plans from various providers, allowing individuals and families to compare options based on cost, coverage, and network of providers. It's important to note that plans offered through the Marketplace may qualify for premium subsidies, making health insurance more affordable for low- and middle-income households.

When choosing an individual or family plan, factors such as the annual deductible, co-pays, and out-of-pocket maximums should be carefully considered. Additionally, the network of providers available under each plan should align with the healthcare needs of the individual or family.

Medicaid and NJ FamilyCare

New Jersey's Medicaid program, known as NJ FamilyCare, provides health coverage to eligible low-income residents, including children, parents, pregnant women, individuals with disabilities, and the elderly. NJ FamilyCare is a crucial safety net for those who may not be able to afford private insurance.

The program offers comprehensive benefits, including coverage for doctor visits, hospital stays, prescription drugs, and mental health services. It also provides access to specialized care for chronic conditions and long-term care needs. NJ FamilyCare aims to ensure that all residents, regardless of income, have access to the healthcare services they require.

To be eligible for NJ FamilyCare, individuals and families must meet certain income and asset requirements. The program has different eligibility categories, and the specific income limits vary depending on factors such as household size and age.

Understanding Health Insurance Plans

Health insurance plans in New Jersey, as in many other states, can be categorized into different types based on their structure and how they share costs between the insurer and the insured.

Health Maintenance Organizations (HMOs)

HMOs are a popular choice for many New Jersey residents. These plans typically require members to select a primary care physician (PCP) who coordinates all their healthcare needs. Referrals from the PCP are often necessary to see specialists or receive certain services.

One of the key advantages of HMOs is their focus on preventive care. Many HMO plans offer incentives and discounted rates for regular check-ups and screenings, encouraging members to stay on top of their health. Additionally, HMOs often have negotiated rates with a network of providers, which can result in lower out-of-pocket costs for members.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility compared to HMOs. Members of PPO plans have the freedom to choose any healthcare provider, whether in-network or out-of-network. However, using in-network providers typically results in lower costs, as PPOs negotiate discounted rates with a network of preferred providers.

PPOs are often preferred by individuals who value the ability to choose their own doctors and specialists without the need for referrals. While PPO plans may have higher premiums, they can provide peace of mind for those who require specialized or ongoing medical care.

Point of Service (POS) Plans

POS plans combine elements of both HMOs and PPOs. Members typically start with a primary care physician (PCP) and referrals are required to see specialists. However, POS plans offer the option to see out-of-network providers without a referral, although at a higher cost.

POS plans can be a good middle ground for individuals who want some flexibility in choosing providers but also appreciate the cost savings and coordinated care that come with having a PCP.

High Deductible Health Plans (HDHPs)

HDHPs are designed to offer lower premiums in exchange for higher deductibles. These plans are often paired with Health Savings Accounts (HSAs), allowing individuals to save money tax-free for future medical expenses.

HDHPs are a popular choice for those who are generally healthy and do not anticipate frequent medical visits. The lower premiums can be a significant advantage, but individuals should be prepared to pay the full cost of medical services until the deductible is met.

Performance Analysis and Future Implications

Analyzing the performance of health insurance in New Jersey provides valuable insights into the effectiveness of the state's healthcare system and the overall well-being of its residents.

One key metric to consider is the percentage of insured residents. According to recent data, New Jersey has a relatively high rate of insured individuals, with over [X]% of the population having some form of health coverage. This is a positive indicator, suggesting that the state's efforts to promote accessibility and affordability of insurance are making an impact.

Another important aspect is the quality of care provided under different insurance plans. While it can be challenging to measure, indicators such as patient satisfaction surveys, healthcare provider ratings, and clinical outcomes can offer insights into the effectiveness of various insurance models. For instance, HMOs that emphasize preventive care may see improved health outcomes and reduced hospital admissions over time.

Looking ahead, there are several key trends and developments that could shape the future of health insurance in New Jersey.

| Trend | Impact |

|---|---|

| Telehealth Services | The increasing adoption of telehealth services could revolutionize access to healthcare, especially in rural areas. It may also lead to more efficient and cost-effective care delivery, benefiting both insurers and patients. |

| Value-Based Care Models | Shifting towards value-based care, where providers are reimbursed based on patient outcomes rather than the volume of services, could incentivize better coordination and quality of care. This could lead to improved health outcomes and reduced healthcare costs over time. |

| Expansion of Medicaid | Expanding Medicaid eligibility or implementing new programs like NJ FamilyCare Plus could significantly increase access to healthcare for low-income residents, reducing the number of uninsured individuals and improving overall health outcomes. |

Frequently Asked Questions

How do I know if I’m eligible for NJ FamilyCare?

+

Eligibility for NJ FamilyCare depends on various factors, including income, household size, and citizenship status. To determine your eligibility, you can visit the official NJ FamilyCare website or contact the program’s hotline. They will guide you through the application process and help you understand your coverage options.

What happens if I can’t afford my health insurance premiums?

+

If you’re struggling to afford your health insurance premiums, there are several options to consider. First, check if you’re eligible for premium subsidies through the New Jersey Health Insurance Marketplace. Additionally, review your plan’s benefits and consider switching to a more affordable option, such as a High Deductible Health Plan (HDHP) if you’re generally healthy.

If you’re still facing financial challenges, reach out to your insurance provider to discuss potential payment plans or other assistance programs they may offer.

Are there any discounts or incentives for enrolling in certain health insurance plans in New Jersey?

+

Yes, New Jersey offers various incentives and discounts to encourage residents to enroll in health insurance plans. For example, the state provides premium subsidies for eligible individuals and families purchasing insurance through the Health Insurance Marketplace. Additionally, certain plans may offer discounted rates for specific services or provide incentives for participating in wellness programs.

It’s important to review the benefits and incentives of each plan carefully to determine which option best aligns with your healthcare needs and financial situation.