Health Insurance Health Insurance

Health insurance is a vital aspect of modern healthcare systems, providing individuals and families with financial protection and access to essential medical services. With rising healthcare costs and an increasing focus on preventative care, understanding health insurance plans and their benefits is more important than ever. In this comprehensive guide, we will delve into the world of health insurance, exploring its intricacies, key features, and how it impacts our well-being.

Understanding Health Insurance

Health insurance is a contract between an individual or a group (such as an employer) and an insurance company. It aims to cover the cost of medical expenses, including doctor visits, hospital stays, prescription medications, and various healthcare services. The insurance company agrees to pay a portion of these costs, while the policyholder pays a premium and often shares some of the expenses through deductibles, copayments, or coinsurance.

Types of Health Insurance Plans

There are several types of health insurance plans, each with its own set of features and coverage options. Some common types include:

- Fee-for-Service Plans (Indemnity Insurance): These plans offer flexibility, allowing policyholders to choose their healthcare providers. Payment is made based on the services rendered, and the insurance company reimburses a portion of the cost.

- Health Maintenance Organizations (HMOs): HMOs provide comprehensive care through a network of healthcare providers. Members typically choose a primary care physician who coordinates their healthcare and refers them to specialists within the HMO network. HMOs often have lower out-of-pocket costs but may restrict choice of providers.

- Preferred Provider Organizations (PPOs): PPOs offer a balance between HMOs and fee-for-service plans. Members can choose providers inside or outside the PPO network, but costs may be lower when using in-network providers. PPOs typically provide more flexibility than HMOs.

- Exclusive Provider Organizations (EPOs): EPOs are similar to PPOs but have a more restricted provider network. Members must use in-network providers, and there is no coverage for out-of-network care, except in emergencies.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. Members can choose between an HMO-like model with a primary care physician or a PPO-like model with more provider options. Costs and coverage vary depending on the chosen model.

Key Terms and Concepts

To fully understand health insurance, it’s essential to grasp some key terms:

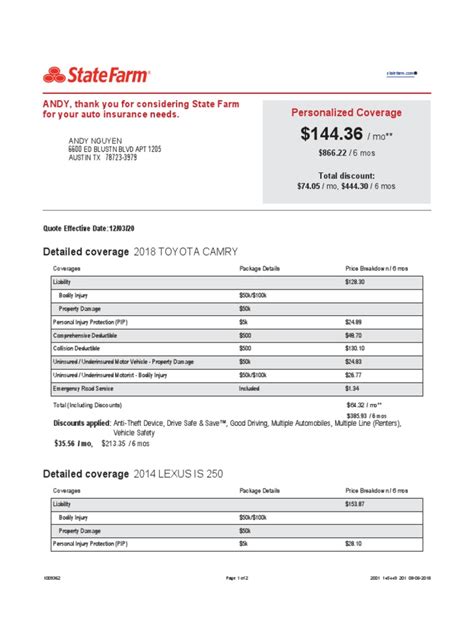

- Premium: The amount paid by the policyholder to the insurance company, typically on a monthly basis, to maintain the insurance coverage.

- Deductible: The amount an individual must pay out of pocket before the insurance coverage begins. Higher deductibles often result in lower premiums.

- Copayment (Copay): A fixed amount paid by the policyholder for a specific service, such as a doctor’s visit or prescription medication. Copays are typically paid at the time of service.

- Coinsurance: The percentage of the cost of a service that the policyholder must pay after the deductible has been met. For example, a 20% coinsurance means the policyholder pays 20% of the service cost, while the insurance company pays the remaining 80%.

- Out-of-Pocket Maximum: The maximum amount an individual is responsible for paying out of pocket in a year. Once this limit is reached, the insurance company covers 100% of eligible expenses.

- Network: A group of healthcare providers, such as doctors, hospitals, and specialists, that have contracted with the insurance company to provide services at negotiated rates. Using in-network providers often results in lower costs.

Benefits and Coverage

Health insurance offers a range of benefits and coverage options, ensuring individuals can access necessary medical care without facing financial hardship.

Preventative Care

Many health insurance plans prioritize preventative care, offering coverage for services such as annual physical exams, immunizations, cancer screenings, and wellness programs. By focusing on prevention, insurance companies aim to reduce the occurrence of costly chronic diseases and promote overall health and well-being.

Hospitalization and Surgery

Health insurance provides crucial financial protection for hospital stays and surgical procedures. It covers a wide range of services, including emergency room visits, inpatient care, intensive care unit (ICU) stays, and various surgical procedures. The level of coverage depends on the specific plan and the individual’s chosen healthcare providers.

Prescription Drugs

Prescription medications are often an essential part of managing health conditions. Health insurance plans typically include coverage for prescription drugs, although the level of coverage can vary. Some plans have preferred drug lists (PDLs) or require prior authorization for certain medications. Understanding the prescription drug coverage is vital for managing costs effectively.

Specialized Services

Health insurance plans also cover a variety of specialized services, including mental health treatment, substance abuse programs, maternity care, and pediatric services. These services are often covered at different levels, with some plans offering more comprehensive coverage than others.

Dental and Vision Care

While not all health insurance plans include dental and vision coverage, many offer optional add-ons or separate plans for these services. Dental insurance covers procedures such as cleanings, fillings, and more complex treatments, while vision insurance covers eye exams, glasses, and contact lenses.

Choosing the Right Health Insurance Plan

Selecting the appropriate health insurance plan involves careful consideration of individual needs and preferences. Here are some factors to keep in mind:

Premium and Deductible Balance

Health insurance plans come with a range of premium and deductible options. Lower premiums often come with higher deductibles, while higher premiums may offer lower deductibles. It’s essential to find a balance that aligns with your budget and expected healthcare needs.

Network Providers

Review the network of providers associated with each plan. Ensure that your preferred doctors, specialists, and hospitals are in-network to avoid higher out-of-pocket costs. Consider the convenience of accessing these providers and the overall quality of care they provide.

Coverage Limits and Exclusions

Read the fine print to understand the coverage limits and exclusions of each plan. Some plans may have specific restrictions or limitations on certain procedures or services. Ensure that the plan covers the healthcare services you anticipate needing, especially if you have existing health conditions.

Cost-Sharing and Out-of-Pocket Maximums

Understand the cost-sharing arrangements, such as copays and coinsurance, for various services. Additionally, be aware of the out-of-pocket maximum, which caps your financial responsibility for covered services in a year. Plans with lower out-of-pocket maximums can provide greater financial protection.

Additional Benefits

Look for plans that offer additional benefits tailored to your needs. This may include coverage for alternative therapies, wellness programs, or specialized services like fertility treatments or genetic counseling.

Future of Health Insurance

The healthcare industry is constantly evolving, and so is health insurance. Here are some key trends and developments to watch out for:

Telehealth and Digital Health

The rise of telehealth services has revolutionized healthcare access. Many insurance companies now cover virtual doctor visits, remote monitoring, and digital health apps. This trend is expected to continue, offering convenient and cost-effective healthcare options.

Value-Based Care

Value-based care models are gaining traction, focusing on the quality and outcomes of healthcare rather than the quantity of services provided. These models aim to improve patient outcomes, reduce costs, and enhance the overall healthcare experience. Insurance companies are increasingly embracing value-based care, which could lead to more efficient and effective healthcare systems.

Health Insurance Reform

The healthcare landscape is subject to ongoing policy changes and reforms. Keep an eye on legislative developments and proposed reforms that could impact health insurance coverage, affordability, and accessibility. Understanding these changes will help individuals make informed decisions about their healthcare and insurance choices.

Table: Comparison of Health Insurance Plans

| Plan Type | Flexibility | Provider Choice | Cost Sharing | Coverage Limits |

|---|---|---|---|---|

| Fee-for-Service | High | Wide range of options | Varies, often higher copays | None specified |

| HMO | Moderate | Limited to network providers | Lower copays and coinsurance | May have restrictions on certain services |

| PPO | High | Wide range of options, including out-of-network | Moderate copays and coinsurance | May have coverage limits for specific services |

| EPO | Moderate | Limited to network providers | Lower copays and coinsurance | No coverage for out-of-network care except emergencies |

| POS | Moderate to High | Varies based on chosen model (HMO-like or PPO-like) | Varies based on model | May have coverage limits for specific services |

How do I choose the right health insurance plan for my family?

+Consider your family’s healthcare needs, including any existing conditions or anticipated medical services. Evaluate plans based on premium and deductible balance, network providers, coverage limits, and additional benefits. Seek advice from insurance brokers or financial advisors if needed.

What is the difference between an HMO and a PPO plan?

+HMOs typically offer more limited provider choice but lower out-of-pocket costs. PPOs provide more flexibility in choosing providers, both in and out of network, but may have higher costs. The right choice depends on your personal preferences and healthcare needs.

Can I change my health insurance plan during the year?

+In most cases, you can only change your health insurance plan during designated open enrollment periods or if you experience a qualifying life event, such as marriage, divorce, or loss of other coverage. Check with your insurance provider or local healthcare marketplace for specific guidelines.

What happens if I can’t afford my health insurance premiums?

+If you’re facing financial hardship, explore options such as applying for Medicaid or seeking assistance through government programs like the Health Insurance Marketplace. These programs offer financial aid to eligible individuals and families.