Health Insurance For Workers

In today's rapidly evolving business landscape, ensuring the well-being of employees has become an integral part of any successful organization's strategy. Health insurance, as a vital component of employee benefits, plays a crucial role in fostering a healthy and productive workforce. This comprehensive guide aims to delve into the world of health insurance for workers, shedding light on its significance, the various types available, and how it can be effectively implemented to create a robust and supportive work environment.

Understanding the Importance of Health Insurance for Workers

The health and well-being of employees are of utmost importance for any organization. With rising healthcare costs and the increasing complexity of medical treatments, providing comprehensive health insurance has become a necessity rather than a mere perk. It is an essential tool to attract and retain top talent, boost morale, and enhance overall productivity.

Health insurance offers employees peace of mind, knowing that their medical needs are covered. It ensures access to quality healthcare services, promotes early disease detection and management, and encourages a culture of preventive care. By investing in health insurance, businesses demonstrate their commitment to employee welfare, fostering a sense of loyalty and trust within the workforce.

Types of Health Insurance Plans for Workers

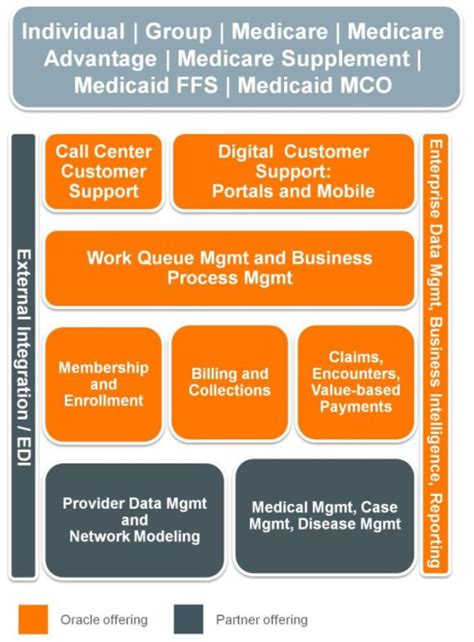

When it comes to health insurance for workers, a plethora of options are available, each designed to cater to specific needs and preferences. Understanding these plans is crucial for both employers and employees to make informed decisions.

Traditional Fee-for-Service Plans

Traditional fee-for-service plans are one of the oldest forms of health insurance. Under this model, healthcare providers charge a fee for each service rendered, which is then reimbursed by the insurance company. While these plans offer flexibility and a wide range of healthcare options, they often come with higher out-of-pocket costs for employees.

One notable example is the Indemnity Plan, which allows employees to choose any healthcare provider without restrictions. This plan provides extensive coverage but can result in higher premiums and deductibles.

Managed Care Plans

Managed care plans are designed to control healthcare costs while ensuring quality services. These plans typically involve a network of preferred healthcare providers, offering cost-effective solutions.

- Health Maintenance Organizations (HMOs): HMOs require employees to select a primary care physician (PCP) who coordinates their healthcare needs. Services from out-of-network providers may not be covered. This plan is known for its affordability and comprehensive preventive care.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing employees to choose from a network of preferred providers. While out-of-network services are covered, they come with higher costs. PPOs strike a balance between cost and choice.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs. Employees can choose a PCP but also have the option to see out-of-network providers with increased costs. POS plans provide a customized approach to healthcare.

High-Deductible Health Plans (HDHPs)

High-deductible health plans are gaining popularity, especially among younger employees. These plans have higher deductibles, meaning employees pay more out-of-pocket before the insurance coverage kicks in. However, they often come with Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs), allowing employees to save pre-tax dollars for medical expenses.

Exclusive Provider Organizations (EPOs)

EPOs are a relatively new type of health insurance plan. Similar to HMOs, EPOs require employees to choose a primary care physician and use a network of preferred providers. However, unlike HMOs, EPOs do not require a referral for specialists. While EPOs offer cost savings, they may have limited provider choices.

Implementing Health Insurance: A Strategic Approach

Implementing health insurance for workers requires a well-thought-out strategy. Employers must consider various factors, including the company’s size, budget, and the diverse needs of their workforce.

Assessing Company Needs

Before selecting a health insurance plan, employers should conduct a thorough assessment of their company’s needs. This includes understanding the demographic composition of the workforce, common health concerns, and the desired level of coverage. Analyzing historical healthcare data can provide valuable insights into the most suitable plan.

Evaluating Plan Options

Employers should carefully evaluate the available plan options, considering factors such as cost, coverage, and employee preferences. It is essential to strike a balance between affordability and comprehensive coverage. Providing a range of plan choices allows employees to select the one that best fits their needs.

Communication and Education

Effective communication is key to the successful implementation of health insurance. Employers should provide clear and concise information about the selected plan, including its benefits, costs, and any potential changes. Educating employees about their healthcare options empowers them to make informed decisions and fully utilize their benefits.

Monitoring and Adjusting

Health insurance plans should not be seen as a one-time decision. Employers must regularly monitor the plan’s performance, employee satisfaction, and market trends. Based on this analysis, adjustments can be made to ensure the plan remains competitive and aligned with the company’s goals.

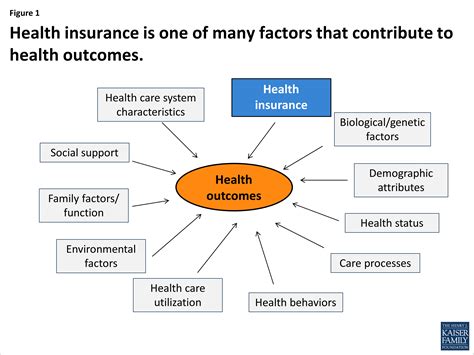

The Impact of Health Insurance on Employee Well-being

Health insurance has a profound impact on the overall well-being of employees. It goes beyond physical health, extending to mental and emotional wellness. When employees have access to quality healthcare, they are more likely to take proactive steps towards maintaining their health, leading to improved productivity and job satisfaction.

Studies have shown that employees with health insurance are more likely to seek preventive care, such as regular check-ups and screenings. This early detection can help identify potential health issues before they become severe, resulting in better health outcomes and reduced healthcare costs in the long run.

Furthermore, health insurance provides employees with financial security, especially in times of unexpected medical emergencies. Knowing that their healthcare needs are covered can alleviate stress and anxiety, allowing employees to focus on their work and personal lives with peace of mind.

The Future of Health Insurance for Workers

As the healthcare industry continues to evolve, so too will the landscape of health insurance for workers. The rise of telemedicine and digital health solutions has already begun to transform the way healthcare is delivered and accessed. These advancements offer new opportunities for cost-effective and convenient healthcare services.

Additionally, the concept of personalized medicine is gaining traction, where healthcare is tailored to an individual's unique genetic makeup and health history. This approach has the potential to revolutionize disease prevention and treatment, further emphasizing the importance of health insurance in providing access to cutting-edge medical care.

As we move forward, it is crucial for employers and employees alike to stay informed about the latest developments in health insurance. Staying ahead of the curve ensures that workers receive the best possible care, fostering a healthy and thriving workforce.

How can employers encourage employees to utilize their health insurance benefits effectively?

+Employers can organize educational workshops or seminars to raise awareness about the importance of preventive care and the specific benefits offered by the chosen health insurance plan. Additionally, providing easy access to healthcare information and resources, such as online portals or mobile apps, can empower employees to make informed decisions about their health.

What are some common challenges faced when implementing health insurance for workers, and how can they be addressed?

+One common challenge is the complexity of health insurance plans, which can be overwhelming for employees. To address this, employers can provide simplified summaries or infographics outlining the key features and benefits of the plan. Additionally, offering one-on-one consultations or group sessions with insurance representatives can help clarify any doubts or concerns.

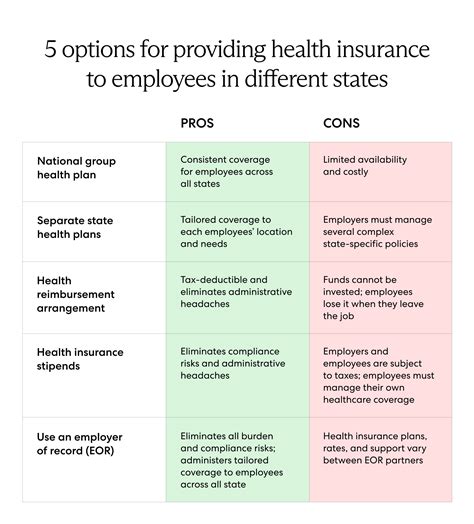

How can health insurance plans be tailored to meet the diverse needs of a multinational workforce?

+Multinational companies can consider offering a combination of global and local health insurance plans. Global plans can provide coverage for employees traveling or living abroad, while local plans can be customized to meet the specific healthcare needs and regulations of each country. This approach ensures comprehensive coverage and addresses cultural and linguistic differences.