Government Employees Insurance

In the complex world of insurance, there exists a specialized branch known as Government Employees Insurance. This unique insurance program is designed to cater specifically to government employees, offering a range of coverage options and benefits tailored to their unique needs. As we delve into the intricacies of Government Employees Insurance, we'll explore its history, the types of coverage it provides, and its impact on the lives of those it serves.

A Legacy of Protection: The History of Government Employees Insurance

The roots of Government Employees Insurance can be traced back to the early 20th century, when governments across the globe began to recognize the importance of safeguarding their employees’ financial well-being. The first iterations of this insurance program emerged as a response to the growing need for comprehensive protection for those serving in the public sector.

One of the earliest recorded instances of Government Employees Insurance can be found in the United States, where the Federal Employees' Compensation Act (FECA) was enacted in 1916. This landmark legislation established a compensation program for federal employees who suffered work-related injuries or illnesses, marking a significant step towards ensuring the welfare of public servants.

Over the years, Government Employees Insurance has evolved to meet the changing needs of government workers. In the post-World War II era, for instance, many countries expanded their insurance programs to include benefits such as life insurance, disability coverage, and retirement plans, acknowledging the invaluable contributions of their public sector employees.

Comprehensive Coverage: What Does Government Employees Insurance Offer?

Government Employees Insurance is far more than a simple insurance policy; it’s a comprehensive package of protections designed to address the diverse risks faced by government workers.

Health Insurance

Health insurance is a cornerstone of Government Employees Insurance, offering government employees and their families access to essential medical services. This coverage typically includes a range of benefits, such as doctor visits, hospital stays, prescription medication, and preventive care. Many programs also provide options for dental and vision coverage, ensuring holistic health protection.

Life Insurance

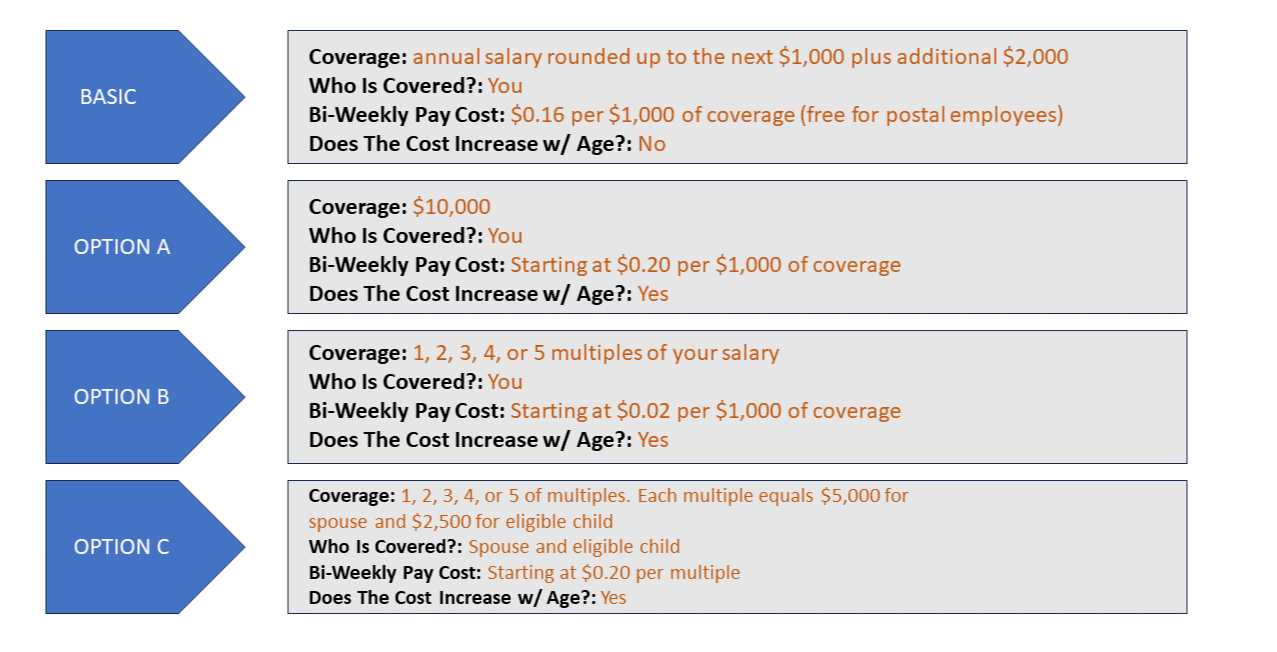

Life insurance is another critical component of Government Employees Insurance. This coverage provides financial support to the beneficiaries of government employees in the event of their untimely demise. The benefits can help cover funeral expenses, outstanding debts, and ongoing living costs, offering a vital safety net for families.

Disability Insurance

Disability insurance is designed to replace a portion of an employee’s income if they become unable to work due to injury or illness. This coverage is particularly important for government employees, as it ensures they can maintain their standard of living even when facing unexpected health challenges.

Retirement Plans

Government Employees Insurance often includes retirement plans, such as pension schemes or 401(k) programs, to help employees save for their golden years. These plans typically offer tax advantages and the potential for employer contributions, making retirement planning more accessible and secure.

Workers’ Compensation

Workers’ compensation is a crucial aspect of Government Employees Insurance, providing benefits to employees who suffer work-related injuries or illnesses. This coverage can include medical expenses, a portion of lost wages, and rehabilitation costs, ensuring that employees receive the support they need to recover and return to work.

| Coverage Type | Benefits |

|---|---|

| Health Insurance | Medical services, prescription coverage, preventive care |

| Life Insurance | Financial support for beneficiaries in the event of death |

| Disability Insurance | Income replacement for employees unable to work due to injury or illness |

| Retirement Plans | Pension schemes, tax-advantaged savings plans |

| Workers' Compensation | Medical expenses, lost wages, rehabilitation costs for work-related injuries |

Real-World Impact: Stories of Government Employees Insurance in Action

Government Employees Insurance isn’t just a collection of policies and benefits; it’s a lifeline for those who dedicate their lives to public service. Let’s explore a few real-life scenarios where Government Employees Insurance has made a tangible difference.

Protecting Public Health Workers

Consider the case of Emily, a dedicated public health officer who contracted a serious illness while responding to a disease outbreak. Thanks to her Government Employees Insurance coverage, Emily received the necessary medical treatment without financial strain. Her life insurance policy also provided peace of mind, ensuring her family’s financial security should the worst occur.

Supporting Law Enforcement

Law enforcement officers face unique risks in their line of duty. John, a police officer, sustained a career-ending injury during a high-speed pursuit. His disability insurance coverage replaced a significant portion of his income, allowing him to focus on his recovery without the added stress of financial worry.

Ensuring Retirement Security

For many government employees, retirement planning is a top priority. Sarah, a long-serving government administrator, utilized her Government Employees Insurance-provided pension plan to secure her retirement. With consistent contributions and the power of compound interest, she was able to achieve her retirement goals and maintain her desired standard of living.

The Future of Government Employees Insurance

As we look ahead, the future of Government Employees Insurance is poised for innovation and expansion. With advancements in technology and changing societal needs, the program is likely to evolve to meet the diverse demands of government workers.

Digital Transformation

The digital age has brought about a revolution in insurance, and Government Employees Insurance is no exception. The program is increasingly moving towards digital platforms, offering online enrollment, claims management, and policy updates. This shift not only enhances convenience but also allows for more efficient and accessible services.

Enhanced Benefits

To keep pace with modern challenges, Government Employees Insurance is likely to expand its coverage options. This could include enhanced mental health services, increased focus on preventative care, and more comprehensive disability benefits to address the evolving needs of government workers.

Collaborative Partnerships

The future of Government Employees Insurance may also involve collaborative partnerships with private insurers and healthcare providers. Such collaborations could lead to improved access to specialized services, enhanced negotiation power for better rates, and innovative solutions to meet the unique needs of government employees.

Personalized Coverage

As technology advances, Government Employees Insurance may leverage data analytics and artificial intelligence to offer more personalized coverage. This could involve tailoring policies to individual employee needs, ensuring that each person receives the specific protections they require.

Who is eligible for Government Employees Insurance?

+Eligibility for Government Employees Insurance typically extends to full-time, part-time, and temporary government employees, including federal, state, and local workers. The specific eligibility criteria may vary based on the jurisdiction and the type of insurance program.

How do I enroll in Government Employees Insurance?

+Enrollment processes can vary, but generally, you’ll need to complete an application form provided by your employer or the relevant government agency. This form will detail the coverage options and allow you to select the benefits that best suit your needs.

What are the costs associated with Government Employees Insurance?

+The costs of Government Employees Insurance can vary depending on the type of coverage and the employee’s salary. Typically, employees contribute a portion of their salary towards the insurance premiums, while the government covers the remaining costs. The exact contribution amounts are often determined by the specific insurance program and the employee’s classification.