Good House Insurance

Protecting your home and belongings is a crucial aspect of responsible homeownership. With the right house insurance, you can safeguard your investment and ensure peace of mind. In this comprehensive guide, we will delve into the world of home insurance, exploring the factors that make a good policy, the benefits it offers, and how to make an informed decision tailored to your specific needs.

Understanding House Insurance: A Comprehensive Approach

House insurance, often referred to as homeowners insurance, is a contract between you and an insurance company. It provides financial protection against various risks and perils that could affect your home and personal property. This comprehensive coverage is designed to offer you security and peace of mind, ensuring that you can rebuild and recover in the event of unexpected losses.

A good house insurance policy goes beyond the basic coverage, offering a range of benefits and optional add-ons to cater to your unique circumstances. Let's explore the key components that make up a comprehensive house insurance policy.

Coverage for Your Home Structure

The foundation of any house insurance policy is coverage for the physical structure of your home. This includes protection against damages caused by fires, storms, hail, and other natural disasters. It’s important to note that floods and earthquakes are typically excluded from standard policies and may require additional coverage.

When evaluating policies, look for ones that offer replacement cost coverage. This ensures that you receive the full cost to rebuild your home, even if it exceeds the initial purchase price. Some policies may only provide actual cash value, which factors in depreciation, leaving you with less coverage in the event of a total loss.

| Coverage Type | Description |

|---|---|

| Replacement Cost | Pays the full cost to rebuild your home, regardless of initial purchase price. |

| Actual Cash Value | Covers the current value of your home, factoring in depreciation. |

Protection for Your Personal Belongings

Your house insurance policy should also extend coverage to your personal belongings, including furniture, electronics, clothing, and other valuable items. This coverage typically provides compensation for damages or losses due to theft, vandalism, or natural disasters.

It's essential to understand the limits and sublimits within your policy. Some policies may have caps on certain types of items, such as jewelry or electronics, requiring you to purchase additional coverage to fully protect your valuables.

Liability Coverage

Liability coverage is a crucial aspect of house insurance, protecting you from financial losses in the event that someone is injured on your property or if you are found legally responsible for causing damage to others’ property.

This coverage can help cover legal fees, medical expenses, and any compensation you may be required to pay. It's recommended to choose a policy with higher liability limits to ensure adequate protection in case of a severe incident.

Additional Living Expenses

In the event that your home becomes uninhabitable due to a covered loss, additional living expenses coverage can provide reimbursement for temporary housing, meals, and other necessary expenses until you can return to your home.

This coverage is especially valuable as it ensures that you don't have to bear the financial burden of unexpected living costs during a difficult time.

Optional Add-Ons and Endorsements

Good house insurance policies offer a range of optional add-ons and endorsements to cater to specific needs. These can include coverage for:

- Flood or earthquake insurance (if not covered by your standard policy)

- Identity theft protection

- Water backup and sump pump failure

- Personal injury liability (covering libel, slander, and invasion of privacy)

- Scheduled personal property coverage (for high-value items)

Benefits of Choosing a Good House Insurance Policy

Selecting a comprehensive house insurance policy offers numerous benefits that extend beyond financial protection. Here’s a closer look at some of the advantages:

Peace of Mind

Knowing that your home and belongings are protected against a wide range of risks can provide immense peace of mind. You can rest assured that you’re prepared for unexpected events and that you have the resources to rebuild and recover.

Financial Security

A good house insurance policy ensures that you have the financial means to repair or replace your home and belongings without incurring significant debt. This security is especially valuable in the event of a major loss, such as a fire or natural disaster.

Legal Protection

Liability coverage within your house insurance policy provides legal protection in case you’re sued for bodily injury or property damage. This coverage can be a lifeline, covering legal fees and any compensation you may be required to pay.

Assistance in Times of Need

In the aftermath of a covered loss, your insurance provider can offer valuable assistance. They can guide you through the claims process, provide resources for temporary housing, and help you navigate the complexities of rebuilding or replacing your home.

Making an Informed Decision: Key Considerations

When selecting a house insurance policy, it’s essential to consider your unique circumstances and needs. Here are some key factors to keep in mind:

Your Home’s Value and Replacement Cost

Accurately assessing the value of your home and its replacement cost is crucial. This ensures that you have adequate coverage to rebuild your home in the event of a total loss. Consider working with a professional appraiser to get an accurate estimate.

Your Personal Belongings

Take inventory of your personal belongings and assess their value. This will help you understand the level of coverage you need to protect your valuables. Don’t forget to consider items like jewelry, electronics, and art, which may require additional coverage.

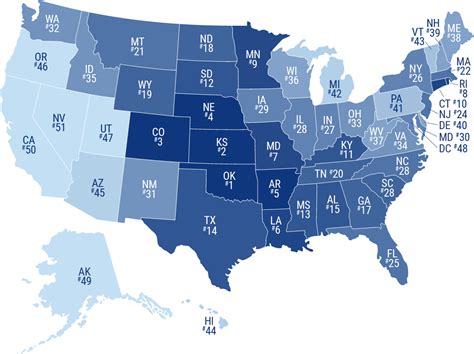

Your Location and Risk Factors

Consider the specific risks associated with your location. If you live in an area prone to natural disasters like hurricanes, floods, or wildfires, ensure that your policy provides adequate coverage for these risks. Additionally, assess other potential risks, such as crime rates or proximity to water sources.

Your Financial Situation

Evaluate your financial capacity to handle unexpected expenses. Consider choosing a higher deductible to reduce your monthly premiums, but ensure that you can afford the deductible in case of a claim. Balancing your budget with adequate coverage is key.

Comparing Quotes and Coverage

Obtain quotes from multiple insurance providers to compare coverage and prices. Ensure that you’re comparing policies with similar coverage limits and deductibles. Don’t hesitate to ask questions and seek clarification on any policy details.

The Reputation and Reliability of the Insurance Provider

Research the insurance company’s reputation and financial stability. Look for reviews and ratings from reputable sources to ensure that the provider is reliable and able to fulfill their obligations in the event of a claim.

The Future of House Insurance: Technological Advancements

The house insurance industry is evolving, with technological advancements playing a significant role in shaping the future of coverage. Here’s a glimpse into some of the trends and innovations that are revolutionizing the industry:

Data-Driven Underwriting

Insurance companies are increasingly using data analytics to assess risk and determine premiums. This data-driven approach allows for more accurate underwriting, taking into account factors like the age and condition of your home, your claims history, and even your neighborhood’s crime rates.

Smart Home Integration

The rise of smart home technology is impacting house insurance. Some insurance providers offer discounts for homes equipped with smart devices that can detect and prevent losses, such as water leaks or fires. Additionally, smart home systems can provide valuable data for insurance companies, improving their understanding of risks.

Usage-Based Insurance

Similar to the concept in auto insurance, usage-based house insurance policies are being explored. These policies could use sensors or other technologies to monitor your home’s usage patterns, potentially offering discounts for safe practices or providing real-time alerts to prevent losses.

Artificial Intelligence and Machine Learning

AI and machine learning are being leveraged to improve claim processing and fraud detection. These technologies can analyze large amounts of data quickly, helping insurance companies identify patterns and anomalies that may indicate fraudulent activity.

Digital Claim Management

The process of filing and managing claims is becoming more streamlined and digital. Insurance companies are investing in user-friendly platforms and mobile apps, allowing policyholders to initiate and track claims from the comfort of their homes.

Frequently Asked Questions

What is the difference between replacement cost and actual cash value coverage?

+

Replacement cost coverage provides the full amount needed to rebuild your home, regardless of its original purchase price. Actual cash value, on the other hand, factors in depreciation, offering a lower payout that reflects the current value of your home.

How often should I review and update my house insurance policy?

+

It’s recommended to review your policy annually or whenever there are significant changes to your home or personal belongings. This ensures that your coverage remains adequate and up-to-date.

Can I customize my house insurance policy to fit my specific needs?

+

Yes, most insurance providers offer a range of optional add-ons and endorsements that allow you to tailor your policy to your unique circumstances. From flood insurance to identity theft protection, you can choose the coverage that matters most to you.

What should I do if I need to file a claim under my house insurance policy?

+

Contact your insurance provider as soon as possible to initiate the claims process. They will guide you through the steps, which typically involve providing documentation and evidence of the loss. It’s important to cooperate fully with the insurance company to ensure a smooth claims process.

How can I lower my house insurance premiums without compromising coverage?

+

You can explore options like increasing your deductible, bundling your house insurance with other policies (like auto insurance), or taking advantage of discounts for safety features or loyalty programs. However, be cautious not to reduce your coverage to a level that leaves you vulnerable in the event of a loss.

In conclusion, selecting a good house insurance policy is a crucial step in protecting your home and belongings. By understanding the components of a comprehensive policy, considering your unique needs, and staying informed about industry advancements, you can make an informed decision that provides the coverage and peace of mind you deserve.