Go For Insurance

Welcome to a comprehensive guide on the world of insurance, specifically tailored for those seeking expert insights and practical knowledge. In today's complex and ever-evolving financial landscape, understanding insurance is crucial, yet it often remains a mysterious concept for many. This article aims to demystify insurance, providing you with the tools to make informed decisions and navigate the insurance market with confidence.

Understanding the Essence of Insurance

Insurance is a financial safety net, a contract that offers protection against potential future losses. It’s a mechanism designed to provide peace of mind and financial security in the face of uncertainty. From the everyday to the extraordinary, insurance policies cover a vast array of risks, ensuring individuals and businesses are prepared for the unexpected.

At its core, insurance operates on the principle of risk sharing. By pooling resources from a large group of policyholders, insurance companies can provide coverage for those who experience losses. This collective approach ensures that the financial burden of unforeseen events is distributed fairly, allowing individuals to manage risks effectively.

The world of insurance is vast, encompassing various types of coverage tailored to specific needs. Let's explore some of the key categories:

1. Health Insurance

Health insurance is a vital aspect of personal financial planning, providing coverage for medical expenses. With rising healthcare costs, having adequate health insurance is essential to protect against the financial impact of illness or injury. Health insurance plans vary widely, offering different levels of coverage, deductibles, and co-payments. Understanding your health insurance policy is crucial to ensure you receive the care you need without facing unexpected financial burdens.

| Health Insurance Type | Coverage |

|---|---|

| Individual Plans | Covers personal medical expenses, often tailored to individual needs. |

| Family Plans | Provides coverage for multiple family members, offering comprehensive protection. |

| Group Health Plans | Offered by employers, these plans provide coverage for employees and their families. |

2. Life Insurance

Life insurance is a critical financial tool, offering protection for your loved ones in the event of your untimely demise. It provides a lump-sum payment to your beneficiaries, ensuring they have the financial means to maintain their standard of living and cover expenses such as funeral costs, mortgage payments, and education fees. Life insurance policies come in various forms, including term life and whole life insurance, each with its own unique features and benefits.

| Life Insurance Type | Key Features |

|---|---|

| Term Life Insurance | Offers coverage for a specific term, typically 10-30 years, with a fixed premium. Ideal for short-term financial protection. |

| Whole Life Insurance | Provides lifelong coverage with a guaranteed death benefit. Offers cash value accumulation, which can be borrowed against or withdrawn. |

3. Auto Insurance

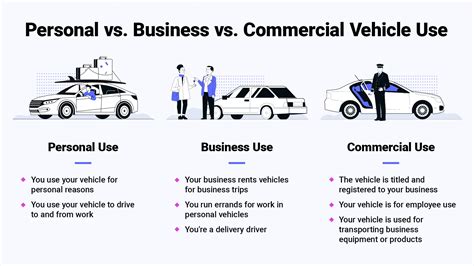

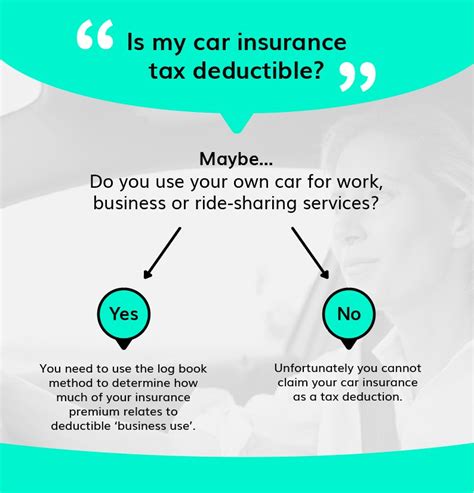

Auto insurance is mandatory in most regions and provides coverage for a wide range of risks associated with vehicle ownership. From accidents and theft to natural disasters and vandalism, auto insurance offers financial protection. It’s essential to understand the different types of auto insurance coverage and choose a policy that suits your specific needs, whether you’re a daily commuter or a weekend driver.

| Auto Insurance Coverage | Description |

|---|---|

| Liability Coverage | Covers damages you cause to others or their property. |

| Collision Coverage | Pays for repairs or replacement of your vehicle after an accident. |

| Comprehensive Coverage | Protects against theft, vandalism, and natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers. |

4. Homeowners Insurance

Homeowners insurance is a must-have for anyone who owns a home. It provides financial protection against a variety of risks, including damage to your home, theft of personal belongings, and liability for accidents that occur on your property. Homeowners insurance policies can be customized to fit your specific needs, covering everything from your main residence to vacation homes and rental properties.

| Homeowners Insurance Coverage | Key Features |

|---|---|

| Dwelling Coverage | Protects the structure of your home against damage or destruction. |

| Personal Property Coverage | Covers your belongings, including furniture, electronics, and clothing. |

| Liability Coverage | Provides protection if someone is injured on your property. |

| Additional Living Expenses | Covers temporary living expenses if your home becomes uninhabitable due to a covered event. |

5. Business Insurance

For business owners, insurance is not just a necessity but a strategic tool. Business insurance provides protection against a wide range of risks, from property damage and liability claims to data breaches and employee injuries. With the right business insurance coverage, you can protect your assets, maintain business continuity, and safeguard your reputation.

| Business Insurance Coverage | Description |

|---|---|

| General Liability Insurance | Covers third-party claims for bodily injury, property damage, and advertising injuries. |

| Property Insurance | Protects your business property, including buildings, equipment, and inventory. |

| Professional Liability Insurance | Provides coverage for negligence claims, errors, and omissions. |

| Workers' Compensation Insurance | Covers medical expenses and lost wages for employees injured on the job. |

6. Travel Insurance

Travel insurance is a valuable companion for any trip, offering protection against unforeseen events while you’re away from home. From trip cancellations and delays to medical emergencies and lost luggage, travel insurance provides peace of mind and financial support. It’s especially crucial for international travel, where unexpected medical expenses can be costly.

| Travel Insurance Coverage | Key Features |

|---|---|

| Trip Cancellation and Interruption | Reimburses non-refundable expenses if your trip is canceled or interrupted due to covered reasons. |

| Medical and Dental Coverage | Provides coverage for medical emergencies and dental treatments while traveling. |

| Baggage and Personal Effects | Covers lost, stolen, or damaged luggage and personal items. |

| Emergency Evacuation and Repatriation | Arranges and covers the cost of medical evacuation or repatriation to your home country. |

The Process of Selecting the Right Insurance

Choosing the right insurance policy is a critical decision that requires careful consideration. Here’s a step-by-step guide to help you navigate the process:

1. Assess Your Needs

Start by evaluating your specific needs and circumstances. Consider your financial situation, assets, and potential risks. Are you a homeowner, a renter, or a business owner? Do you have dependents who rely on your income? Understanding your unique situation will help you determine the type and level of insurance coverage you require.

2. Research Insurance Providers

Once you’ve identified your needs, it’s time to research insurance providers. Look for reputable companies with a strong track record of financial stability and customer satisfaction. Read reviews, compare policies, and consider the range of services and support they offer. Don’t hesitate to reach out to insurance brokers or agents who can provide personalized guidance based on your needs.

3. Understand Policy Terms

Insurance policies can be complex, so it’s essential to thoroughly understand the terms and conditions. Pay close attention to coverage limits, deductibles, and exclusions. Make sure you grasp the differences between various types of coverage within a policy, such as comprehensive vs. collision in auto insurance or dwelling vs. personal property coverage in homeowners insurance.

4. Compare Quotes and Prices

Obtain quotes from multiple insurance providers to compare prices and coverage. Remember that the cheapest policy might not always be the best option. Consider the overall value, including the level of coverage, customer service, and the insurer’s financial strength. Look for discounts and consider bundling multiple policies with the same provider to potentially save on premiums.

5. Read the Fine Print

Before finalizing your insurance purchase, carefully review the policy’s fine print. This includes understanding the renewal process, cancellation rights, and any changes that may occur during the policy period. Ensure that you’re comfortable with the terms and conditions and that they align with your expectations.

6. Seek Professional Advice

If you’re unsure about any aspect of insurance or need personalized guidance, consider consulting with an insurance professional. They can provide expert advice tailored to your specific needs and help you navigate the complex world of insurance with confidence.

The Future of Insurance: Innovation and Trends

The insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of insurance and some key trends to watch:

1. Digital Transformation

Insurance companies are embracing digital technologies to enhance customer experiences and streamline operations. From online policy management and mobile apps to AI-powered chatbots, the digital transformation is making insurance more accessible and convenient. Customers can now easily compare policies, manage claims, and access personalized insurance solutions with just a few clicks.

2. Data Analytics and Personalization

With the advent of big data and advanced analytics, insurance providers are leveraging data-driven insights to offer personalized coverage. By analyzing customer behavior, demographics, and risk factors, insurers can tailor policies to individual needs, providing more accurate pricing and targeted solutions. This level of personalization enhances customer satisfaction and loyalty.

3. Telematics and Usage-Based Insurance

In the auto insurance industry, telematics and usage-based insurance are gaining traction. These innovative approaches use real-time data from vehicle sensors to monitor driving behavior and calculate premiums based on actual usage. This shift towards pay-as-you-drive insurance models rewards safe drivers with lower premiums, encouraging safer road practices.

4. Blockchain and Smart Contracts

Blockchain technology is revolutionizing the insurance industry by enhancing security, transparency, and efficiency. Smart contracts, self-executing agreements stored on a blockchain, are being used to automate insurance processes, including policy issuance, claim management, and payment processing. This technology reduces administrative burdens and minimizes the risk of fraud.

5. Insurtech Startups

Insurtech startups are disrupting the traditional insurance landscape with innovative business models and technologies. These startups are leveraging digital platforms, machine learning, and data analytics to offer innovative insurance solutions, often targeting niche markets or specific consumer needs. Their agility and focus on customer experience are driving competition and pushing established insurers to adapt.

Frequently Asked Questions (FAQ)

How do I choose the right health insurance plan for my family’s needs?

+

When selecting a health insurance plan, consider your family’s medical needs, including any pre-existing conditions. Look for a plan with a network of healthcare providers that includes your preferred doctors and hospitals. Compare deductibles, co-pays, and out-of-pocket maximums to find a balance between affordability and comprehensive coverage. Don’t forget to review the plan’s coverage for prescription drugs and specialty services.

What are the benefits of whole life insurance compared to term life insurance?

+

Whole life insurance offers permanent coverage with a guaranteed death benefit, making it a long-term investment. It also accumulates cash value over time, which can be borrowed against or withdrawn. Term life insurance, on the other hand, provides coverage for a specific term, typically offering higher coverage amounts for a lower premium. It’s ideal for short-term financial protection, such as covering mortgage payments or children’s education expenses.

How can I save money on my auto insurance premiums?

+

To reduce your auto insurance premiums, consider increasing your deductible, as a higher deductible typically leads to lower premiums. Maintain a clean driving record, as insurance companies reward safe drivers with discounts. Explore bundling discounts by insuring multiple vehicles or combining auto insurance with other policies, such as homeowners or renters insurance. Additionally, consider enrolling in usage-based insurance programs, which offer discounts based on your driving behavior.

Insurance is a powerful tool for managing risk and protecting your financial well-being. By understanding the various types of insurance, assessing your needs, and staying informed about industry trends, you can make informed decisions and navigate the insurance market with confidence. Remember, insurance is an investment in your future, providing peace of mind and security in an uncertain world.