Getting Insurance Quotes

Insurance is an essential aspect of financial planning, providing individuals and businesses with the security and peace of mind they need in an uncertain world. Whether you're looking for car insurance, health insurance, or coverage for your home, obtaining insurance quotes is the first step toward making informed decisions about your protection.

In today's digital age, the process of getting insurance quotes has become more accessible and efficient. However, navigating the vast landscape of insurance providers and understanding the complexities of insurance policies can be daunting. This guide aims to demystify the process, offering expert insights and practical tips to help you secure the best insurance coverage at the right price.

Understanding Insurance Quotes: A Comprehensive Guide

Insurance quotes are an insurer's estimate of the cost of a specific insurance policy for a particular individual or business. These quotes are tailored to the risks and needs of the applicant and are influenced by various factors, including the type of coverage, the applicant's personal or business circumstances, and the insurance company's underwriting guidelines.

Key Factors Influencing Insurance Quotes

- Coverage Type: Different types of insurance, such as auto, health, or property insurance, have distinct risk profiles and coverage options, which impact the quote.

- Applicant's Profile: Your personal or business characteristics, including age, location, driving record, health status, or the nature of your business, play a significant role in determining the quote.

- Insurance Company's Risk Assessment: Insurance companies use complex algorithms and data to assess risk and set premiums. Their underwriting guidelines and risk appetite influence the quotes they provide.

Understanding these factors is crucial as they form the basis for insurance quotes. By being aware of how these elements interact, you can better navigate the quote process and make informed choices about your insurance coverage.

The Insurance Quote Process: Step-by-Step

The process of obtaining insurance quotes typically involves a series of steps, each designed to provide you with accurate and personalized estimates. Here's a breakdown of the typical quote process:

Step 1: Research and Compare Insurance Providers

Before requesting quotes, it's essential to research and compare different insurance providers. Each insurer has its own unique offerings, pricing structures, and reputation. Consider factors such as financial stability, customer satisfaction, and the range of coverage options they provide.

- Use online resources, consumer reviews, and industry ratings to evaluate insurance companies.

- Look for insurers who specialize in the type of coverage you need, as they may offer more tailored and competitive quotes.

- Consider the insurer's claims process and customer service reputation, as these can significantly impact your experience if you need to make a claim.

Step 2: Gather Relevant Information

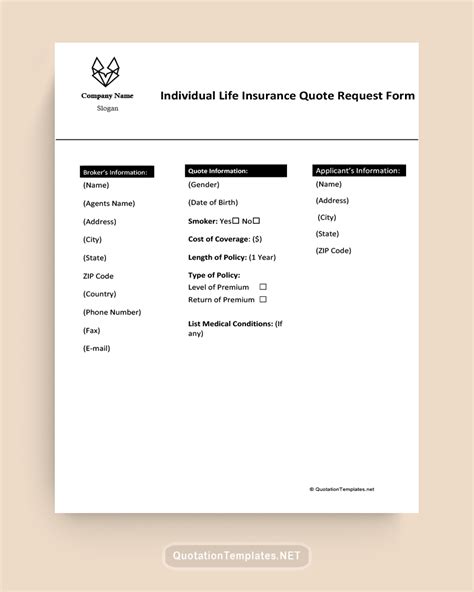

To obtain accurate quotes, you'll need to provide detailed information about your needs and circumstances. This may include:

- Personal or Business Details: Your name, address, date of birth, and other relevant information.

- Coverage Requirements: Specify the type and extent of coverage you need. For example, if you're seeking auto insurance, provide details about the vehicles you want to insure, your driving history, and any additional coverage options you're interested in.

- Existing Policies: If you have existing insurance policies, provide their details, as this can impact the new quotes you receive.

- Financial Information: In some cases, especially for business insurance, you may need to provide financial statements or other documentation to obtain an accurate quote.

Step 3: Request Quotes

Once you've gathered the necessary information, you can request quotes from the insurance providers you've shortlisted. There are several ways to do this:

- Online Quote Tools: Many insurance companies offer online quote tools on their websites. These tools allow you to input your information and receive instant quotes, often providing a range of coverage options and pricing.

- Broker or Agent: Working with an insurance broker or agent can be beneficial, as they can provide quotes from multiple insurers, helping you compare options and find the best fit.

- Direct Contact: You can also contact insurance companies directly by phone or email to request quotes. This may be more time-consuming, but it allows for a more personalized discussion of your needs.

Step 4: Analyze and Compare Quotes

Once you have a set of quotes, it's essential to analyze and compare them carefully. Consider the following factors:

- Premium Cost: The premium is the amount you'll pay for the policy. Compare premiums across quotes, but remember that the lowest premium isn't always the best option. Consider the coverage provided and the insurer's reputation.

- Coverage Details: Ensure that the quotes provide the coverage you need. Compare the limits, deductibles, and any exclusions or limitations to ensure you're getting the protection you require.

- Additional Benefits: Some insurers offer additional benefits or perks with their policies, such as roadside assistance or travel insurance. Consider if these benefits are valuable to you and factor them into your decision.

- Reputation and Financial Stability: Research the insurer's reputation and financial stability. A reputable insurer with a strong financial standing is more likely to be reliable and able to pay claims.

Step 5: Choose and Purchase Your Insurance

After analyzing and comparing quotes, choose the insurance policy that best meets your needs and budget. Contact the insurer or your broker/agent to proceed with the purchase. They will guide you through the application process, which may involve additional paperwork and verification of your information.

Remember, insurance is a long-term commitment, so take your time and choose wisely. If you have any questions or concerns during the quote or purchase process, don't hesitate to reach out to the insurer or your trusted advisor for clarification.

Maximizing Your Insurance Quote: Tips and Strategies

Obtaining insurance quotes is just the first step. To ensure you get the best value and coverage, consider the following tips and strategies:

Negotiate and Ask for Discounts

Insurance quotes are often negotiable, especially if you're a loyal customer or have multiple policies with the same insurer. Don't be afraid to negotiate and ask for discounts. Insurers may offer reduced rates for safe driving records, loyalty programs, or bundle discounts if you insure multiple vehicles or policies with them.

Bundle Your Policies

If you're in the market for multiple types of insurance (e.g., auto and home insurance), consider bundling your policies with the same insurer. Many insurers offer significant discounts for bundling, as it simplifies their administration and reduces their risk exposure.

Review Your Coverage Regularly

Insurance needs can change over time. Regularly review your policies to ensure they still meet your needs. Life events such as marriage, having children, buying a new home, or starting a business can all impact your insurance requirements. Stay informed and adjust your coverage accordingly.

Explore Alternative Insurance Options

Traditional insurance isn't the only option. Explore alternative insurance models, such as peer-to-peer insurance or parametric insurance, which can offer innovative coverage options and potentially more affordable premiums.

Utilize Insurance Comparison Websites

Insurance comparison websites can be a valuable tool when shopping for insurance. These platforms aggregate quotes from multiple insurers, allowing you to compare options and prices in one place. However, be cautious and ensure the website is reputable and provides accurate information.

The Future of Insurance Quotes: Technology and Innovation

The insurance industry is evolving rapidly, with technology playing a pivotal role in shaping the future of insurance quotes. Here's a glimpse into the innovations that are transforming the quote process:

Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing the way insurance quotes are generated. These technologies enable insurers to analyze vast amounts of data quickly and accurately, improving risk assessment and quote precision. AI-powered chatbots and virtual assistants are also becoming more common, providing instant quotes and personalized recommendations to customers.

Telematics and Usage-Based Insurance

Telematics technology allows insurers to track and analyze real-time data about a vehicle's usage, driving behavior, and location. This data is then used to generate more accurate insurance quotes, especially for auto insurance. Usage-based insurance policies, which adjust premiums based on actual driving behavior, are becoming increasingly popular and offer drivers the opportunity to save on insurance costs.

Blockchain Technology

Blockchain, the technology behind cryptocurrencies like Bitcoin, has the potential to revolutionize the insurance industry. By providing a secure, decentralized ledger, blockchain can enhance data security, streamline claims processes, and improve overall transparency in insurance transactions. This technology may also enable more efficient and secure peer-to-peer insurance models.

Insurtech Startups

Insurtech startups are disrupting the traditional insurance landscape with innovative solutions. These companies leverage technology to offer more efficient and customer-centric insurance products and services. From digital-first insurance providers to companies focusing on specific niche markets, Insurtech startups are driving competition and innovation in the insurance space.

Conclusion: Empowering Your Insurance Journey

Obtaining insurance quotes is a critical step in securing the right protection for your needs. By understanding the quote process, leveraging technology, and exploring innovative options, you can make informed decisions and find insurance coverage that offers both value and peace of mind. Remember, insurance is an investment in your financial security, and with the right approach, you can navigate the insurance market confidently and effectively.

How often should I review my insurance policies and quotes?

+It’s recommended to review your insurance policies and quotes at least once a year, or whenever there’s a significant life change. Regular reviews ensure your coverage remains adequate and that you’re not overpaying for unnecessary coverage.

Can I get an insurance quote without providing personal information?

+While some insurers offer anonymous quote tools, these are typically just estimates and may not be accurate. To get a precise quote, insurers will need detailed information about your circumstances.

What should I do if I receive a quote that seems too good to be true?

+Be cautious of extremely low quotes, as they may indicate inadequate coverage or hidden costs. Always compare quotes from multiple insurers and carefully review the coverage details before making a decision.

Are there any resources to help me understand complex insurance terms and concepts?

+Yes, there are numerous online resources, including government websites, insurance industry guides, and consumer advocacy groups, that provide clear explanations of insurance terms and concepts. These resources can help you better understand your insurance needs and make more informed choices.