Get Homeowners Insurance Quotes

As a homeowner, safeguarding your property and possessions is of utmost importance. Homeowners insurance provides financial protection against various risks, offering peace of mind and security. Obtaining quotes for homeowners insurance is a crucial step in ensuring you find the right coverage at an affordable rate. In this comprehensive guide, we will delve into the process of getting homeowners insurance quotes, exploring the key factors that influence premiums and the steps to secure the best coverage for your needs.

Understanding Homeowners Insurance and Its Importance

Homeowners insurance is a vital investment for every homeowner. It provides comprehensive protection against a range of perils, including fire, theft, natural disasters, and liability claims. This insurance policy serves as a financial safety net, covering the cost of repairs or replacements if your home or personal belongings are damaged or destroyed. Additionally, it offers liability protection, safeguarding you from potential lawsuits if someone is injured on your property.

The significance of homeowners insurance extends beyond mere financial protection. It provides a sense of security and peace of mind, knowing that you and your loved ones are protected in the event of an unexpected disaster or accident. Moreover, it is often a requirement for obtaining a mortgage, as lenders want to ensure their investment is protected.

Understanding the coverage options and limits is essential when evaluating homeowners insurance quotes. Different policies offer varying levels of protection, and it's crucial to tailor your coverage to your specific needs. Common coverage types include:

- Dwelling Coverage: This covers the physical structure of your home, including repairs or rebuilding costs in the event of damage or destruction.

- Personal Property Coverage: It protects your belongings, such as furniture, electronics, and clothing, against theft, damage, or loss.

- Liability Coverage: This provides protection if someone is injured on your property or if your actions result in property damage to others.

- Additional Living Expenses: In the event you need to vacate your home due to covered damages, this coverage helps cover temporary living expenses.

Factors Influencing Homeowners Insurance Quotes

Several key factors play a role in determining the cost of homeowners insurance quotes. Understanding these factors can help you make informed decisions and potentially negotiate better rates.

Location and Risk Factors

The location of your home is a significant factor in insurance quotes. Areas prone to natural disasters, such as hurricanes, floods, or wildfires, typically have higher insurance premiums. Insurance companies assess the risk associated with your location and adjust premiums accordingly.

Other location-specific factors include crime rates and proximity to fire stations. Homes in high-crime areas or those located far from emergency services may face higher insurance costs.

| Location Risk Factor | Impact on Premiums |

|---|---|

| Natural Disaster Prone Areas | Higher Premiums |

| High Crime Rates | Increased Costs |

| Distance from Emergency Services | Potential Premium Hike |

Home Characteristics and Construction

The physical attributes of your home also influence insurance quotes. Older homes may have higher premiums due to potential maintenance issues and outdated construction methods. Similarly, homes with unique architectural features or those built with specific materials may require specialized coverage, impacting the cost.

The size of your home, the number of stories, and the type of roofing material are additional factors considered. Larger homes generally have higher premiums, as they are more expensive to rebuild.

Personal Factors and Credit History

Your personal circumstances and credit history can affect homeowners insurance quotes. Insurance companies often review your credit score, as it is considered an indicator of financial responsibility. A good credit score may result in lower premiums, while a poor credit history could lead to higher costs.

Other personal factors include your age, occupation, and claims history. Younger individuals or those with high-risk occupations may face higher premiums, as they are statistically more likely to file claims. A history of frequent claims can also impact your insurance rates.

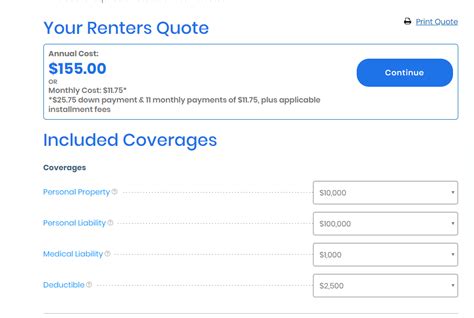

Coverage Limits and Deductibles

The coverage limits and deductibles you choose significantly impact your insurance quotes. Higher coverage limits, providing more extensive protection, typically result in higher premiums. Conversely, opting for a higher deductible, which is the amount you pay out of pocket before insurance coverage kicks in, can lower your premiums.

It's important to strike a balance between coverage limits and deductibles to ensure you have adequate protection without paying excessive premiums. Consider your financial situation and the potential risks you may face to make an informed decision.

Steps to Get Accurate Homeowners Insurance Quotes

To ensure you receive accurate and competitive homeowners insurance quotes, follow these steps:

Research Multiple Insurance Providers

Don't settle for the first insurance company you come across. Research and compare quotes from multiple providers to find the best rates and coverage options. Online comparison tools can be a valuable resource for this step.

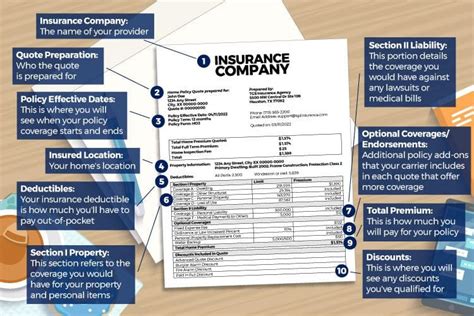

Provide Accurate and Detailed Information

When requesting quotes, provide accurate and detailed information about your home, its location, and your personal circumstances. Inaccurate information can lead to unexpected surprises when it comes time to file a claim.

Consider Bundle Discounts

If you already have other insurance policies, such as auto insurance, consider bundling your homeowners insurance with the same provider. Many insurance companies offer significant discounts for customers who bundle multiple policies.

Explore Discount Opportunities

Insurance companies often provide discounts for various reasons. Some common discounts include:

- Safety Features: Installing security systems, smoke detectors, or fire sprinkler systems can result in lower premiums.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may qualify you for loyalty discounts.

- Multi-Policy Discounts: As mentioned, bundling multiple insurance policies with the same provider can lead to substantial savings.

- Homeowner Association (HOA) Discounts: Some insurance companies offer discounts if your home is part of a well-maintained HOA.

Understand the Fine Print

When reviewing insurance quotes, carefully read the policy details and exclusions. Some policies may have limitations or exclusions that could impact your coverage in specific situations. Ensure you understand the fine print to make an informed decision.

Customizing Your Homeowners Insurance Coverage

Every homeowner has unique needs and circumstances. Customizing your homeowners insurance coverage ensures you have the right protection for your specific situation. Here are some factors to consider when tailoring your coverage:

Assess Your Valuables

Evaluate the value of your personal belongings and determine if you need additional coverage. Standard homeowners insurance policies often provide basic coverage for personal property, but high-value items like jewelry, art, or electronics may require separate endorsements or riders.

Consider Special Circumstances

If you have unique circumstances, such as owning a home-based business or having valuable collections, you may need specialized coverage. Discuss your specific needs with your insurance agent to ensure you have adequate protection.

Review Your Coverage Regularly

Life circumstances and the value of your home and belongings can change over time. Regularly review your homeowners insurance policy to ensure it aligns with your current needs. This includes updating your coverage limits and considering any necessary adjustments to your policy.

Common Misconceptions and Pitfalls to Avoid

When obtaining homeowners insurance quotes, it's important to be aware of common misconceptions and pitfalls to avoid making costly mistakes.

Avoid Underinsurance

Choosing a policy with insufficient coverage, known as underinsurance, can leave you vulnerable in the event of a claim. Ensure your coverage limits are adequate to cover the cost of rebuilding your home and replacing your belongings.

Understand Policy Exclusions

Every insurance policy has exclusions, which are situations or events not covered by the policy. Familiarize yourself with the exclusions in your policy to avoid any unpleasant surprises when filing a claim.

Don't Neglect Maintenance

Proper maintenance of your home can impact your insurance rates and coverage. Neglecting maintenance issues may result in higher premiums or even policy cancellations. Regularly inspect and maintain your home to avoid potential problems.

Be Aware of Deductible Implications

While opting for a higher deductible can lower your premiums, it's important to consider the financial implications. In the event of a claim, you will need to pay the deductible amount out of pocket. Ensure you have the financial means to cover the deductible before choosing a higher deductible option.

The Claims Process and Policy Adjustments

Understanding the claims process and knowing when to adjust your policy is crucial for effective homeowners insurance coverage.

Filing a Claim

If you experience a covered loss, promptly file a claim with your insurance provider. Provide accurate and detailed information about the incident and any damages incurred. The claims process typically involves an inspection by an insurance adjuster to assess the extent of the damage.

Policy Adjustments

After filing a claim, review your policy to ensure it still meets your needs. If your circumstances have changed or if you've made significant improvements to your home, consider updating your coverage limits or adding additional endorsements.

Understanding Deductible Options

Different insurance policies offer various deductible options. While a higher deductible may result in lower premiums, it's important to understand the trade-offs. Consider your financial situation and the likelihood of filing claims when choosing a deductible.

The Future of Homeowners Insurance

The homeowners insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here are some insights into the future of homeowners insurance:

Technology Integration

Insurance companies are increasingly leveraging technology to enhance the customer experience. From online quote comparisons to digital claims processing, technology is streamlining the insurance process.

Personalized Coverage

As data analytics and artificial intelligence advance, insurance providers can offer more personalized coverage options. This includes customized policies based on individual risk profiles and preferences.

Focus on Prevention

The industry is shifting its focus from solely reacting to claims to actively preventing losses. Insurance companies are encouraging homeowners to take proactive measures to mitigate risks, such as installing smart home devices or adopting fire safety practices.

Collaborative Partnerships

Insurance providers are forming partnerships with home improvement and maintenance companies to offer bundled services. This collaboration aims to provide homeowners with comprehensive protection and assistance, from insurance coverage to home maintenance.

Frequently Asked Questions

How often should I review my homeowners insurance policy?

+It’s recommended to review your policy annually or whenever your circumstances change significantly. Regular reviews ensure your coverage remains adequate and aligned with your needs.

Can I negotiate homeowners insurance quotes?

+Yes, you can negotiate insurance quotes by comparing multiple providers and highlighting any discounts you may be eligible for. Insurance agents are often open to discussing rates and coverage options.

What happens if I need to file a claim but my policy has exclusions for certain events?

+If your policy excludes coverage for a specific event or situation, you will not receive compensation for damages caused by that event. It’s crucial to understand your policy’s exclusions to avoid any surprises.

How can I reduce my homeowners insurance premiums?

+To lower your premiums, consider increasing your deductible, maintaining a good credit score, and exploring discount opportunities. Additionally, regular home maintenance can help prevent costly repairs and reduce insurance costs.