Get Auto Insurance Quote Online

Obtaining an auto insurance quote online has become an increasingly popular and convenient way for individuals to assess their insurance options. With just a few clicks, drivers can access multiple quotes, compare coverage and prices, and make informed decisions about their insurance needs. This article aims to provide an in-depth guide to the process of getting an auto insurance quote online, offering valuable insights and practical tips to help you navigate the often complex world of insurance.

Understanding the Basics of Auto Insurance Quotes

Auto insurance is a legal requirement for all vehicle owners in most regions, serving as a financial safety net in the event of accidents, theft, or other vehicular incidents. When you seek an insurance quote, you are essentially requesting an estimate of the cost of insuring your vehicle and yourself. This quote is calculated based on a range of factors, including your personal information, driving history, the make and model of your vehicle, and the level of coverage you require.

Factors Influencing Auto Insurance Quotes

A multitude of factors come into play when insurers calculate quotes. These include your age, gender, marital status, and location. Your driving record, whether it showcases a clean history or includes accidents and traffic violations, is also a significant factor. The type of vehicle you drive, its age, make, model, and safety features can impact the quote as well. Additionally, the level of coverage you desire, such as liability-only, comprehensive, or collision coverage, will affect the final quote.

| Factor | Description |

|---|---|

| Demographic Factors | Age, gender, marital status, location |

| Driving Record | Clean history or past accidents/violations |

| Vehicle Details | Make, model, age, safety features |

| Coverage Level | Liability, comprehensive, collision, etc. |

It's important to note that while these factors are standard across most insurance providers, the weight given to each factor can vary. This means that two individuals with similar profiles may receive different quotes from different insurers.

The Online Quoting Process

Getting an auto insurance quote online is a straightforward process, but it’s essential to understand the steps involved to ensure you get the most accurate and beneficial quotes.

Step 1: Gather Your Information

Before you begin the quoting process, ensure you have all the necessary information readily available. This includes your personal details (name, date of birth, address), your vehicle’s make, model, year, and VIN (Vehicle Identification Number), and your driving history (including any accidents or violations). If you’re unsure about any of these details, it’s a good idea to have your driver’s license and vehicle registration handy.

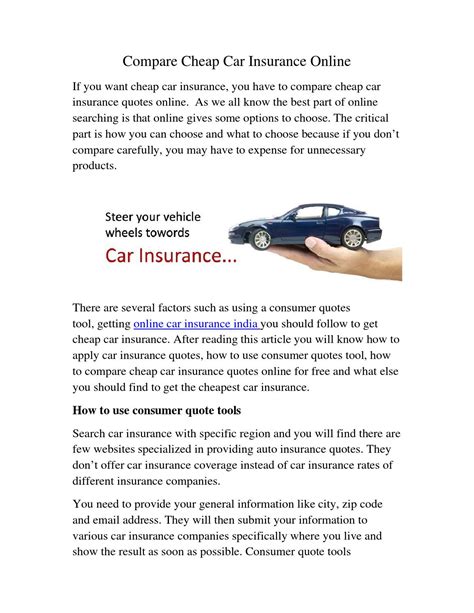

Step 2: Choose Your Insurers

There are numerous insurance providers in the market, each offering different coverage options and price points. It’s recommended to get quotes from at least three to five insurers to ensure you’re getting a competitive rate. You can find a list of reputable insurers online, or you can use comparison websites that aggregate quotes from multiple insurers.

Step 3: Fill Out the Quote Form

Once you’ve chosen your insurers, you’ll need to fill out a quote form. This form will ask for the information you gathered in Step 1, as well as details about your desired coverage level and any additional services you might want, such as roadside assistance or rental car coverage.

It's crucial to provide accurate information on these forms. Any discrepancies between the information you provide and your actual situation could lead to issues with your insurance coverage down the line.

Step 4: Compare Quotes and Choose Your Coverage

After submitting your quote forms, you’ll receive quotes from each insurer. Take the time to carefully compare these quotes, considering not just the price, but also the coverage offered. Some insurers may offer lower prices but have higher deductibles or less comprehensive coverage.

It's also a good idea to read reviews of the insurers you're considering. This can give you an idea of their customer service, claim handling process, and overall reputation.

| Insurers | Quote | Coverage Details |

|---|---|---|

| Company A | $1200 annually | Liability, collision, comprehensive |

| Company B | $1150 annually | Liability, collision, rental car coverage |

| Company C | $1300 annually | Liability, comprehensive, roadside assistance |

In this example, while Company B offers the lowest quote, it lacks comprehensive coverage. Company A and Company C provide more comprehensive coverage, but at a higher cost. The choice ultimately depends on your personal needs and budget.

Tips for Getting the Best Auto Insurance Quote

Getting an auto insurance quote is just the first step. To ensure you’re getting the best deal, there are several additional strategies you can employ.

Shop Around Regularly

Insurance rates can change over time, and different insurers may offer different rates at different periods. It’s a good idea to shop around for quotes annually, or even more frequently if your circumstances change significantly (e.g., you move to a new area, get married, or purchase a new vehicle).

Consider Bundling Your Policies

If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling your policies with one insurer. Many insurers offer discounts for customers who bundle their policies, which can lead to significant savings.

Explore Discounts

Insurance providers offer a variety of discounts to their customers. These can include safe driver discounts, multi-car discounts, good student discounts, and loyalty discounts. Be sure to ask about any applicable discounts when getting your quote.

Understand Your Coverage

Auto insurance policies can be complex, with a variety of coverage options and add-ons. Take the time to understand what each component of your policy covers and what it doesn’t. This will help you make an informed decision about your coverage and ensure you’re not paying for coverage you don’t need.

The Future of Auto Insurance Quotes

The landscape of auto insurance is continually evolving, with new technologies and data analytics playing an increasingly significant role. Insurers are now using telematics and data-driven models to offer more personalized and dynamic insurance products.

Telematics and Usage-Based Insurance

Telematics involves the use of technology to monitor and record vehicle usage and driving behavior. This data is then used to offer more accurate and personalized insurance quotes. With telematics, insurers can reward safe drivers with lower premiums, while also encouraging safer driving practices.

Data-Driven Insurance Models

Advanced data analytics and machine learning algorithms are being used by insurers to develop more sophisticated risk assessment models. These models can consider a broader range of factors, such as weather conditions, traffic patterns, and even social media data, to provide more accurate quotes.

The Rise of Insurtech

Insurtech, or insurance technology, refers to the use of technology and innovative business models to improve the insurance industry. Insurtech startups are disrupting the traditional insurance market by offering more transparent, efficient, and customer-centric insurance products. These companies often leverage technology to provide faster quotes, simpler claim processes, and more personalized coverage.

Conclusion

Getting an auto insurance quote online is a convenient and efficient way to explore your insurance options. By understanding the factors that influence quotes, following a structured quoting process, and employing strategic tips, you can ensure you’re getting the best possible coverage at the most competitive price. As the insurance industry continues to evolve, staying informed and proactive about your insurance needs will help you make the most of the opportunities available.

How often should I get a new auto insurance quote?

+It’s recommended to get a new quote at least annually, or whenever your circumstances change significantly. This ensures you’re always aware of the best deals and most suitable coverage options for your current situation.

Can I get an auto insurance quote without providing my personal information?

+While some insurers may offer basic quotes without personal information, a detailed and accurate quote will typically require details such as your age, location, and driving history.

What if I’m not satisfied with the quotes I receive?

+If you’re not happy with the quotes you receive, you can always try shopping around with different insurers or exploring alternative coverage options. It’s also worth reviewing your current coverage to ensure you’re not paying for unnecessary features.