Geico Insurance Quote

Geico, short for Government Employees Insurance Company, is a well-known name in the world of insurance, offering a wide range of policies to cater to various needs. Whether you're looking for car insurance, homeowners' insurance, or even insurance for your pets, Geico provides comprehensive coverage and a user-friendly experience. In this comprehensive article, we'll delve into the world of Geico insurance quotes, exploring how you can obtain accurate and personalized quotes, the factors that influence these quotes, and the benefits of choosing Geico as your insurance provider.

Understanding Geico Insurance Quotes

Obtaining an insurance quote from Geico is a straightforward process designed to provide you with a clear understanding of your insurance needs and the associated costs. Geico offers online quote tools that allow you to receive an instant quote by answering a series of questions about your circumstances. These quotes are tailored to your specific requirements, ensuring you receive an accurate representation of the coverage and premiums you can expect.

The Online Quote Process

To obtain a Geico insurance quote online, you’ll typically need to provide information such as your name, address, date of birth, and details about the property or vehicle you wish to insure. For car insurance quotes, Geico may ask for your vehicle’s make, model, and year, as well as information about your driving history and any accidents or claims you’ve had in the past.

Geico's online quote process is designed to be user-friendly and efficient. You can expect a step-by-step guide that walks you through the necessary information, ensuring you have all the details ready. Once you've provided the required information, Geico's system will generate a quote based on your inputs, giving you an instant estimate of your insurance costs.

Factors Influencing Geico Insurance Quotes

Like most insurance providers, Geico considers a variety of factors when calculating insurance quotes. These factors help Geico assess the level of risk associated with insuring you and your property, which ultimately impacts the premium you’ll pay. Here are some key factors that can influence your Geico insurance quote:

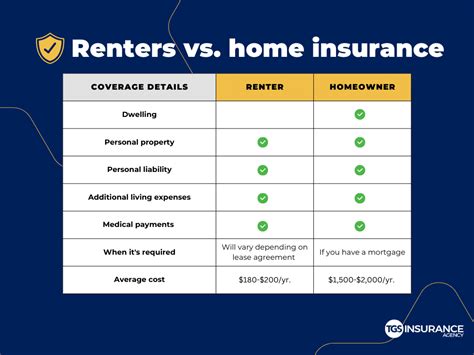

- Type of Insurance: Different types of insurance, such as car insurance, homeowners' insurance, or renters' insurance, have varying levels of risk and coverage, which can impact your quote.

- Location: Your geographical location plays a significant role in determining your insurance quote. Factors like crime rates, weather conditions, and the cost of living in your area can affect the premium.

- Age and Gender: In some cases, Geico may consider your age and gender when calculating quotes, especially for car insurance. Younger drivers, for instance, are often considered higher-risk and may face higher premiums.

- Driving History: For car insurance quotes, Geico will review your driving record. A clean driving history with no accidents or violations can lead to lower premiums, while a history of accidents or traffic violations may result in higher quotes.

- Credit Score: In many states, Geico may consider your credit score when determining car insurance quotes. A higher credit score can often result in more favorable rates.

- Coverage and Deductibles: The level of coverage you choose and the associated deductibles can impact your premium. Higher coverage limits and lower deductibles typically result in higher premiums.

- Discounts: Geico offers a variety of discounts that can lower your insurance costs. These may include multi-policy discounts (for bundling multiple insurance types with Geico), good student discounts, military discounts, and more.

It's important to note that while these factors can influence your Geico insurance quote, the exact weighting and consideration of each factor may vary based on your state's regulations and Geico's underwriting guidelines.

Benefits of Choosing Geico for Your Insurance Needs

Geico has established itself as a trusted insurance provider, offering a range of benefits and advantages to its customers. Here are some key reasons why choosing Geico for your insurance needs can be a wise decision:

Comprehensive Coverage Options

Geico provides a wide array of insurance products to meet various needs. Whether you’re looking for auto insurance, homeowners’ insurance, renters’ insurance, life insurance, or even insurance for your pets, Geico offers comprehensive coverage tailored to your specific requirements.

| Insurance Type | Coverage Highlights |

|---|---|

| Auto Insurance | Covers a range of vehicles, including cars, motorcycles, and RVs. Offers collision, comprehensive, liability, and personal injury protection (PIP) coverage. |

| Homeowners' Insurance | Provides protection for your home and its contents, including coverage for damage, theft, and liability. Offers additional coverage for high-value items and flood insurance. |

| Renters' Insurance | Covers your personal belongings and provides liability protection, even if you're renting. Can also include additional living expenses coverage. |

| Life Insurance | Offers term life insurance and whole life insurance policies, providing financial protection for your loved ones in the event of your passing. |

| Pet Insurance | Covers veterinary costs for unexpected illnesses or injuries, helping you provide the best care for your furry friends. |

Competitive Pricing and Discounts

Geico is known for its competitive pricing and a range of discounts that can help you save on your insurance premiums. Here are some key discounts Geico offers:

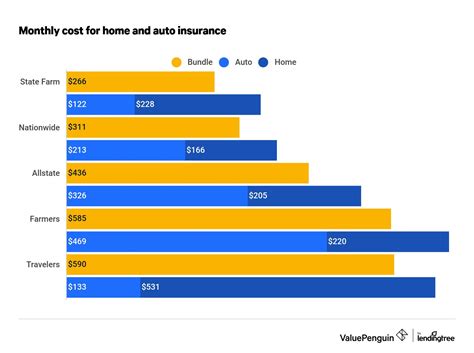

- Multi-Policy Discount: Save by bundling multiple insurance policies with Geico. This can include combining auto insurance with homeowners' insurance or renters' insurance.

- Good Student Discount: If you're a student with a good academic record, you may be eligible for a discount on your auto insurance premium.

- Military Discount: Geico offers special discounts to active-duty military personnel, veterans, and their families as a token of appreciation for their service.

- Safe Driver Discount

- Paperless Discount: Opting for paperless billing and policy documents can save you a few dollars on your premium.

Reward your safe driving habits with a discount on your auto insurance. Geico considers factors like a clean driving record and accident-free years when determining eligibility.

Excellent Customer Service

Geico prides itself on providing exceptional customer service. Their team of knowledgeable and friendly representatives is available 24⁄7 to assist with any insurance-related queries or concerns. Whether you need to file a claim, make policy changes, or simply have questions, Geico’s customer service team is readily accessible via phone, email, or online chat.

Digital Convenience and Tools

Geico offers a range of digital tools and resources to enhance your insurance experience. Their mobile app allows you to manage your policies, file claims, and access your insurance cards conveniently from your smartphone. Additionally, their online platform provides a user-friendly interface for policy management, billing, and quote comparisons.

Claims Handling and Satisfaction

Geico has a proven track record of efficient claims handling. Their claims process is designed to be straightforward and customer-centric, ensuring a smooth experience when you need it most. Geico’s claims adjusters work diligently to assess and settle claims promptly, often utilizing advanced technology to streamline the process.

Geico Insurance Quote: A Step Towards Peace of Mind

Obtaining a Geico insurance quote is the first step towards securing comprehensive coverage and peace of mind. With Geico’s user-friendly quote tools and competitive pricing, you can easily explore your insurance options and find a policy that fits your needs and budget. Whether you’re a homeowner, a renter, a driver, or a pet owner, Geico offers a range of insurance products to protect what matters most to you.

Remember, insurance is an essential aspect of financial planning, and choosing the right provider can make a significant difference in your overall experience. With Geico's extensive coverage options, competitive pricing, and excellent customer service, you can have confidence in your insurance choices.

Can I get a Geico insurance quote without providing my personal information?

+No, Geico requires certain personal information to provide an accurate insurance quote. This information helps Geico assess your specific needs and risks, allowing them to generate a tailored quote. While some basic quotes may be available without all the details, a comprehensive and accurate quote will require personal information such as your name, address, and details about the property or vehicle you wish to insure.

How long does it take to get a Geico insurance quote online?

+Obtaining a Geico insurance quote online is a quick and efficient process. Typically, you can expect to receive an instant quote by answering a series of questions about your circumstances. The time it takes to complete the quote process will depend on the complexity of your insurance needs and the type of insurance you’re seeking. For simple quotes like auto insurance, it may take just a few minutes to complete the online form and receive your quote.

Can I customize my Geico insurance quote to include specific coverage options?

+Yes, Geico’s online quote tools allow you to customize your quote based on your specific coverage needs. During the quote process, you’ll have the opportunity to select the coverage options and limits that best fit your requirements. Whether you’re looking for comprehensive auto insurance, additional coverage for your home, or specific pet insurance benefits, Geico’s quote tools provide flexibility to tailor your quote to your preferences.

Are Geico’s insurance quotes binding, or can they change after I receive them?

+Geico’s insurance quotes are not binding and may be subject to change based on additional information or verification. While the quotes provide an accurate estimate based on the information you’ve provided, Geico may need to review and verify certain details before finalizing your policy and premium. It’s important to carefully review your quote and understand any conditions or exclusions that may apply.

Can I compare Geico insurance quotes with quotes from other providers to find the best deal?

+Absolutely! It’s a good practice to compare insurance quotes from multiple providers to ensure you’re getting the best value for your money. Geico’s online quote tools make it easy to obtain and compare quotes, allowing you to see how Geico’s offerings stack up against other insurance companies. By comparing quotes, you can make an informed decision and choose the insurance provider that best meets your needs and budget.