Geico Insurance Motorcycle

Geico Motorcycle Insurance: Comprehensive Protection for Riders

Riding a motorcycle offers a unique sense of freedom and adventure. However, with the thrill of the open road comes the responsibility of ensuring your safety and the safety of others. That's where Geico's motorcycle insurance steps in, providing riders with the comprehensive coverage they need to navigate the roads with peace of mind.

In this in-depth article, we will explore the various aspects of Geico's motorcycle insurance, from the coverage options and benefits to the claims process and customer experience. Whether you're a seasoned rider or new to the world of motorcycles, understanding the ins and outs of insurance is crucial. So, buckle up (or should we say, strap on your helmet) as we take a comprehensive journey through Geico's motorcycle insurance offerings.

Understanding Geico's Motorcycle Insurance Coverage

Geico, known for its catchy slogans and affordable insurance rates, has become a trusted name in the world of auto insurance. But how does their motorcycle insurance measure up? Let's dive into the details.

Geico offers a range of coverage options tailored to the specific needs of motorcycle enthusiasts. From liability coverage to comprehensive and collision protection, they aim to provide riders with the right balance of protection and value.

Liability Coverage: Protecting Others on the Road

Liability insurance is a fundamental component of any motorcycle insurance policy. It safeguards riders against financial losses resulting from accidents they cause. Geico's liability coverage includes bodily injury liability and property damage liability, ensuring that riders are covered for medical expenses and property repairs incurred by others involved in an accident.

The specific liability limits offered by Geico can be customized to fit individual needs. While state minimums vary, it's recommended to opt for higher limits to provide adequate protection in case of severe accidents. Geico's agents can guide riders through the process of selecting appropriate liability coverage limits.

| Liability Coverage | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for injured parties. |

| Property Damage Liability | Pays for repairs or replacements of damaged property, including vehicles. |

Collision and Comprehensive Coverage: Protecting Your Ride

Collision and comprehensive coverage are essential for motorcycle owners who want to protect their investment. Collision coverage steps in when an accident occurs, providing reimbursement for repairs or the replacement cost of the motorcycle, minus the deductible.

Comprehensive coverage, on the other hand, offers protection against non-collision-related incidents such as theft, vandalism, fire, and natural disasters. It ensures that riders are not left financially burdened in the event of unforeseen circumstances.

Geico's comprehensive and collision coverage options are highly customizable, allowing riders to choose deductibles and coverage limits that align with their preferences and budget. Additionally, they offer optional add-ons such as accessory coverage, which provides protection for custom parts and accessories installed on the motorcycle.

| Coverage Type | Description |

|---|---|

| Collision Coverage | Pays for repairs or replacement if your motorcycle is in an accident. |

| Comprehensive Coverage | Covers damages caused by theft, vandalism, natural disasters, and more. |

| Accessory Coverage | Provides additional protection for custom parts and accessories. |

The Benefits of Geico Motorcycle Insurance

Geico's motorcycle insurance goes beyond basic coverage, offering a range of benefits that enhance the overall experience for riders. Let's explore some of the key advantages:

Discounts and Savings: Keeping Costs Low

One of the standout features of Geico's motorcycle insurance is their commitment to offering discounts. Riders can take advantage of various savings opportunities, including:

- Multi-Policy Discount: Combine your motorcycle insurance with other Geico policies, such as auto or homeowners insurance, to save on premiums.

- Safe Rider Discount: Demonstrate your commitment to safe riding practices and receive a discount on your insurance.

- Military Discount: Active-duty military personnel and veterans can benefit from reduced rates as a token of appreciation for their service.

- New Bike Discount: If you've recently purchased a new motorcycle, Geico offers a discount to celebrate your new ride.

By taking advantage of these discounts, riders can significantly reduce their insurance costs, making Geico's motorcycle insurance an even more attractive option.

Rental Coverage: Enjoying Peace of Mind on the Go

For riders who love to explore new destinations on their motorcycles, Geico's rental coverage is a valuable addition. This optional coverage provides reimbursement for rental vehicle expenses when your motorcycle is undergoing repairs due to a covered incident.

With rental coverage, riders can continue their adventures without worrying about the inconvenience and additional costs associated with renting a vehicle. It ensures that your journey remains uninterrupted, allowing you to focus on the open road ahead.

Roadside Assistance: Help When You Need It

Geico understands that unexpected situations can arise while riding. That's why they offer 24/7 roadside assistance as part of their motorcycle insurance package. This invaluable service provides peace of mind, knowing that help is just a call away.

Whether you encounter a flat tire, run out of fuel, or need a jump-start, Geico's roadside assistance team is ready to assist. They can dispatch a tow truck to your location, provide fuel delivery, or offer other necessary services to get you back on the road quickly and safely.

The Claims Process: Seamless and Efficient

In the unfortunate event of an accident or incident, the claims process can be a crucial factor in determining a rider's satisfaction with their insurance provider. Geico prides itself on offering a seamless and efficient claims experience.

Reporting a Claim: Quick and Convenient

Geico has made the process of reporting a claim straightforward and accessible. Riders can choose from multiple convenient options:

- Online Claims Reporting: Visit Geico's website or use their mobile app to file a claim quickly and easily.

- Phone Claims Reporting: Speak directly with a Geico representative by calling their toll-free number, available 24/7.

- In-Person Claims Reporting: Visit a local Geico office to discuss your claim face-to-face with an agent.

Regardless of the method chosen, Geico aims to provide prompt assistance and guide riders through the claims process with clarity and efficiency.

Claim Handling: Expertise and Support

Once a claim is reported, Geico's dedicated claims team takes over. They are trained to handle a wide range of motorcycle-related incidents, ensuring that riders receive the support and expertise they need.

Geico's claims adjusters work diligently to assess the damage, determine liability, and provide fair and timely compensation. They collaborate with riders to ensure that all necessary information is gathered and that the repair or replacement process is seamless.

In addition, Geico offers a network of preferred repair shops, ensuring that riders have access to high-quality, reliable repair services. These shops are carefully selected based on their expertise in motorcycle repairs, ensuring that your bike receives the best possible care.

Customer Experience: A Journey Beyond Insurance

Geico's commitment to customer satisfaction extends beyond the coverage they provide. They aim to create a positive and engaging experience for riders throughout their insurance journey.

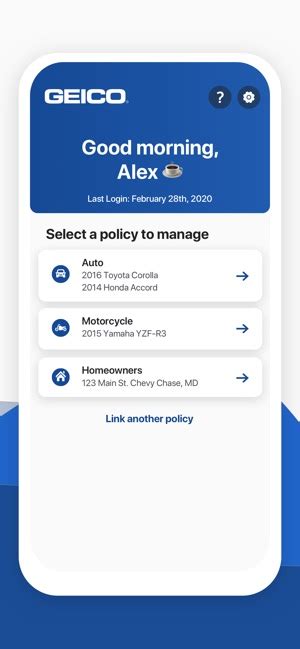

Digital Convenience: Accessing Your Policy Anytime

In today's digital age, convenience is key. Geico understands this and has developed a robust online platform and mobile app to enhance the customer experience.

Riders can access their policy information, make payments, and manage their account with just a few clicks. The Geico mobile app, available for both iOS and Android devices, offers added convenience, allowing riders to file claims, view policy details, and receive important updates on the go.

Educational Resources: Empowering Riders with Knowledge

Geico recognizes the importance of rider education in promoting safety and responsible riding practices. They provide a wealth of educational resources on their website, covering various topics such as motorcycle maintenance, riding tips, and safety guidelines.

By empowering riders with knowledge, Geico aims to create a community of informed and skilled motorcyclists. These resources not only enhance the riding experience but also contribute to a safer road environment for all.

Community Engagement: Connecting with Fellow Riders

Geico believes in fostering a sense of community among riders. They actively engage with the motorcycle community through various initiatives and partnerships.

From sponsoring motorcycle events and rallies to partnering with riding organizations, Geico strives to create opportunities for riders to connect, share experiences, and celebrate their passion for motorcycles. These community-focused efforts reinforce Geico's commitment to supporting the riding lifestyle beyond insurance coverage.

FAQ

How much does Geico motorcycle insurance cost?

+The cost of Geico motorcycle insurance can vary based on factors such as your location, riding experience, and the type of motorcycle you own. Geico offers personalized quotes, so it's best to obtain a quote specific to your circumstances. Additionally, the coverage options and deductibles you choose will impact the overall cost.

Can I customize my Geico motorcycle insurance policy?

+Yes, Geico allows riders to customize their motorcycle insurance policies. You can choose the coverage limits, deductibles, and optional add-ons that best fit your needs and budget. This flexibility ensures that you have the right level of protection without paying for unnecessary coverage.

What discounts are available for Geico motorcycle insurance?

+Geico offers a range of discounts to help riders save on their motorcycle insurance premiums. These include multi-policy discounts, safe rider discounts, military discounts, and discounts for new motorcycles. By taking advantage of these discounts, you can significantly reduce your insurance costs.

How do I file a claim with Geico for my motorcycle insurance?

+Filing a claim with Geico is straightforward. You can report a claim online through their website or mobile app, or by calling their toll-free number. Geico's claims team is available 24/7 to assist you and guide you through the process. They will work with you to gather the necessary information and ensure a smooth and efficient claims experience.

Does Geico offer rental coverage for motorcycles?

+Yes, Geico offers rental coverage as an optional add-on to their motorcycle insurance policies. This coverage provides reimbursement for rental vehicle expenses when your motorcycle is undergoing repairs due to a covered incident. It ensures that your travel plans are not disrupted and you can continue your journey without added stress.

Geico’s motorcycle insurance offers riders a comprehensive and personalized experience, combining essential coverage with valuable benefits and discounts. From liability protection to roadside assistance and community engagement, Geico strives to provide a well-rounded insurance solution tailored to the needs of motorcycle enthusiasts. With their focus on customer satisfaction and a seamless claims process, Geico continues to be a trusted choice for riders seeking peace of mind on the open road.