Geico Car Insurance Florida

In the vibrant state of Florida, where the sun shines bright and the lifestyle is often fast-paced, having reliable car insurance is not just a legal requirement but a necessity. Geico, a well-known name in the insurance industry, offers comprehensive coverage tailored to the unique needs of Florida residents. This article delves into the specifics of Geico car insurance in Florida, providing an in-depth analysis of its offerings, benefits, and how it can cater to the diverse requirements of Floridians.

Geico’s Comprehensive Coverage in Florida

Geico’s car insurance policies in Florida are designed to provide extensive protection, ensuring that policyholders can navigate the state’s roads with peace of mind. The coverage options include liability insurance, which is mandatory in Florida, as well as optional coverages such as collision, comprehensive, and personal injury protection (PIP) to meet the specific needs of Florida drivers.

Liability Coverage

Liability insurance is the cornerstone of any car insurance policy. In Florida, it is a legal requirement to carry a minimum amount of liability coverage to protect against damages or injuries caused to others in an accident. Geico’s liability coverage offers protection for bodily injury and property damage, with limits that can be customized to meet individual preferences and requirements.

| Liability Coverage | Limits |

|---|---|

| Bodily Injury Liability | Up to $100,000 per person / $300,000 per accident |

| Property Damage Liability | Up to $50,000 per accident |

Geico also provides the option to increase these limits to provide higher levels of protection, especially for those who own high-value assets or have a higher risk profile.

Collision and Comprehensive Coverage

For Florida drivers who want added protection, Geico offers collision and comprehensive coverage. Collision insurance covers damage to the insured vehicle in the event of an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against damages caused by non-collision events such as theft, vandalism, natural disasters, or damage caused by animals.

| Collision and Comprehensive Coverage | Features |

|---|---|

| Collision | Repairs or replaces the insured vehicle after an accident |

| Comprehensive | Covers damages from non-collision incidents |

Both collision and comprehensive coverage come with optional deductibles, allowing policyholders to customize their coverage and premiums based on their preferences and financial situation.

Personal Injury Protection (PIP)

Florida is a no-fault state, which means that regardless of who caused the accident, each driver’s own insurance policy pays for their injuries. Geico’s Personal Injury Protection coverage in Florida provides medical benefits to the insured and their passengers for injuries sustained in an accident. This coverage is crucial in ensuring that medical expenses are covered promptly, regardless of fault.

| Personal Injury Protection (PIP) | Benefits |

|---|---|

| Medical Expenses | Covers 80% of all reasonable and necessary medical expenses up to policy limits |

| Lost Wages | Reimburses 60% of lost income up to $10,000 |

| Death Benefits | Provides up to $5,000 in death benefits |

Discounts and Savings Opportunities

Geico is known for its commitment to providing affordable insurance solutions. In Florida, they offer a range of discounts to help policyholders save on their car insurance premiums. These discounts include:

- Multi-Policy Discount: Policyholders can save by bundling their car insurance with other Geico policies, such as homeowners or renters insurance.

- Military Discount: Active duty military personnel, veterans, and their families can benefit from significant discounts on their car insurance premiums.

- Good Student Discount: Young drivers who maintain good grades in school can receive a discount on their insurance premiums, encouraging academic excellence.

- Safe Driver Discount: Drivers with a clean record and no at-fault accidents or moving violations can qualify for this discount, rewarding safe driving behavior.

- Emergency Deployment Discount: Geico offers a special discount for policyholders who are deployed for military service, ensuring that their insurance coverage remains affordable during their absence.

By taking advantage of these discounts, Florida residents can significantly reduce their car insurance premiums, making Geico an even more attractive option for their insurance needs.

Geico’s Claims Process and Customer Service

In the unfortunate event of an accident or incident, Geico’s claims process is designed to be efficient and hassle-free. Policyholders can file claims online, over the phone, or through the Geico mobile app, ensuring convenience and accessibility. Geico’s claims adjusters are experienced and knowledgeable, providing timely and fair assessments to ensure policyholders receive the coverage they need.

24⁄7 Customer Support

Geico understands that insurance needs can arise at any time, which is why they offer 24⁄7 customer support. Whether it’s a simple inquiry or a complex issue, Geico’s customer service team is always available to provide assistance. Policyholders can reach out via phone, email, or live chat, ensuring that their questions and concerns are addressed promptly.

Online Tools and Resources

Geico provides a range of online tools and resources to enhance the insurance experience. Policyholders can manage their policies, make payments, and view their coverage details through the Geico website or mobile app. Additionally, Geico offers educational resources and articles to help Floridians better understand their insurance options and make informed decisions.

Tailored Coverage for Florida’s Unique Needs

Florida presents unique challenges and considerations when it comes to car insurance. From the state’s strict no-fault laws to the potential risks posed by hurricanes and other natural disasters, Geico’s car insurance policies are designed to address these specific needs.

No-Fault Coverage

As mentioned earlier, Florida is a no-fault state. Geico’s PIP coverage ensures that policyholders are compliant with this law, providing the necessary medical and wage loss benefits in the event of an accident. This coverage is particularly crucial in Florida, where the no-fault system is designed to streamline the claims process and reduce litigation.

Hurricane and Storm Coverage

Florida is no stranger to hurricanes and tropical storms. Geico’s comprehensive coverage includes protection against damages caused by these natural disasters. Policyholders can rest assured that their vehicles are protected, even in the face of severe weather events.

Rental Car Coverage

For those who frequently travel or rent cars, Geico offers rental car coverage. This optional coverage provides reimbursement for the cost of renting a vehicle while the insured car is being repaired or replaced due to a covered loss. It ensures that policyholders can maintain their mobility even when their own vehicle is out of commission.

Geico’s Commitment to Florida Communities

Beyond providing insurance coverage, Geico is actively involved in supporting Florida communities. They partner with local organizations and initiatives to promote road safety, education, and community development. This commitment to giving back reinforces Geico’s role as a trusted partner for Floridians.

Road Safety Initiatives

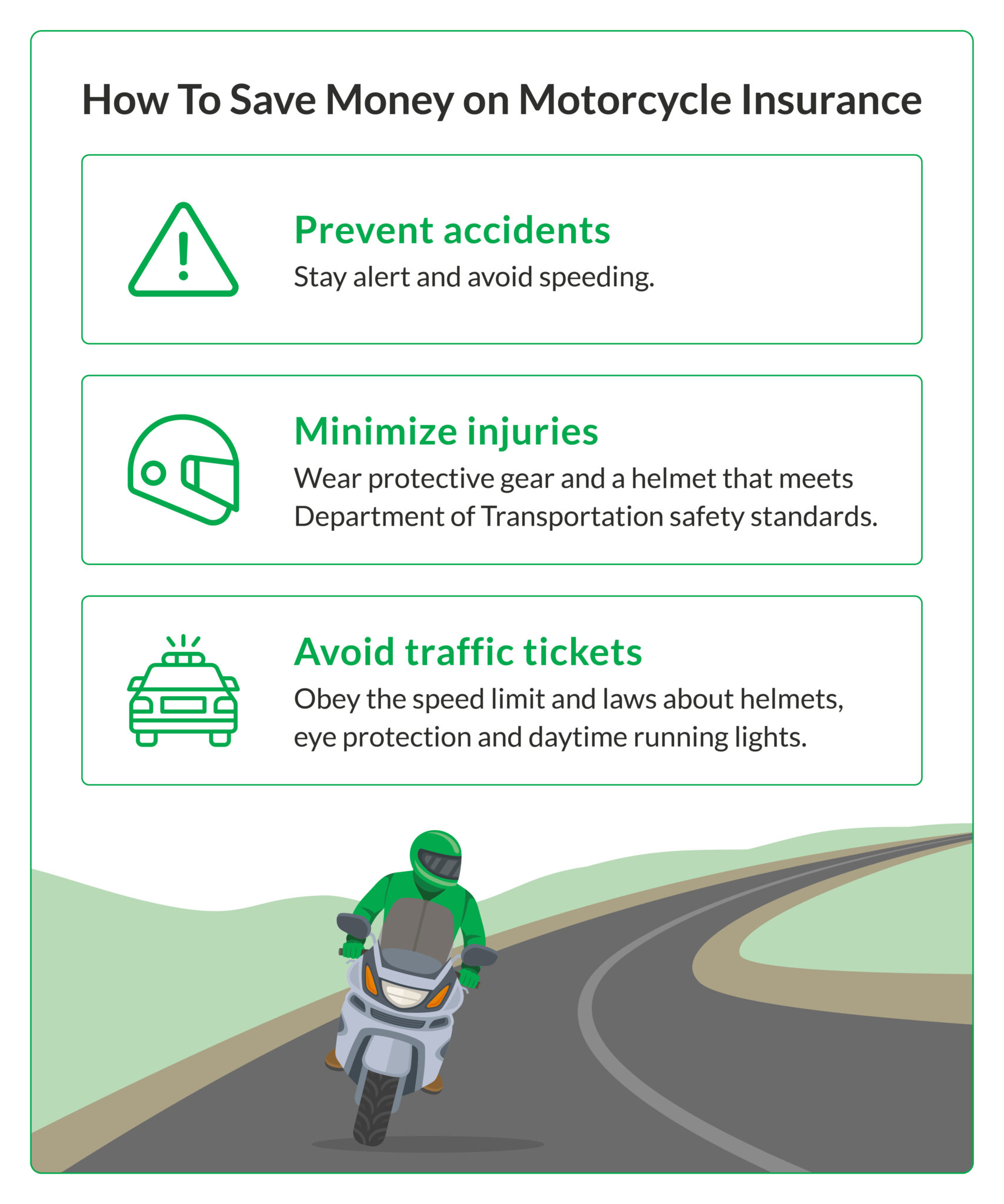

Geico believes in promoting safe driving practices. They sponsor and support various road safety campaigns and initiatives, working to reduce accidents and injuries on Florida’s roads. These efforts include educational programs for young drivers, as well as campaigns to raise awareness about distracted driving and other road safety issues.

Community Partnerships

Geico’s community involvement extends beyond road safety. They actively participate in local events, sponsor youth sports teams, and support educational institutions. By investing in Florida’s communities, Geico demonstrates its commitment to the state and its residents, building trust and goodwill.

Conclusion: Geico - A Reliable Choice for Florida Car Insurance

Geico’s car insurance offerings in Florida are comprehensive, tailored, and affordable. With a range of coverage options, discounts, and a commitment to customer service, Geico provides peace of mind to Florida drivers. Whether it’s navigating the state’s unique insurance landscape or providing protection against natural disasters, Geico is well-equipped to meet the needs of Floridians.

By choosing Geico, Florida residents can trust that they are protected on the roads and supported in their communities. With Geico's extensive coverage, efficient claims process, and community involvement, policyholders can drive with confidence, knowing they have a reliable partner by their side.

How does Geico’s liability coverage compare to the state minimum requirements in Florida?

+Geico’s liability coverage offers higher limits than the state minimum requirements in Florida. While the state minimum for bodily injury liability is 10,000 per person and 20,000 per accident, Geico’s standard policy provides up to 100,000 per person and 300,000 per accident. This additional coverage ensures that policyholders are better protected in the event of an accident.

What are the benefits of Geico’s collision and comprehensive coverage in Florida?

+Collision and comprehensive coverage provide added protection for Florida drivers. Collision coverage ensures that repairs or replacements for the insured vehicle are covered after an accident, regardless of fault. Comprehensive coverage protects against damages caused by non-collision events, such as theft, vandalism, or natural disasters. These coverages provide peace of mind and financial security for policyholders.

How does Geico’s Personal Injury Protection (PIP) coverage work in Florida’s no-fault system?

+In Florida’s no-fault system, Geico’s PIP coverage provides medical benefits to the insured and their passengers for injuries sustained in an accident. It covers 80% of all reasonable and necessary medical expenses up to policy limits. Additionally, it offers lost wage reimbursement and death benefits, ensuring that policyholders are protected in the event of an accident. PIP coverage is a crucial component of Geico’s car insurance policies in Florida.