Gap Insurance For Cars

When it comes to purchasing a new or used vehicle, one crucial aspect that often gets overlooked is gap insurance. This type of insurance provides valuable protection for car owners, ensuring they are financially covered in specific situations. In this comprehensive article, we will delve into the world of gap insurance, exploring its significance, how it works, and why it is an essential consideration for any vehicle owner.

Understanding Gap Insurance

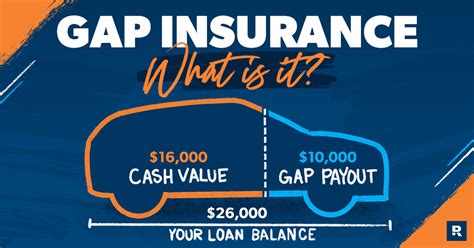

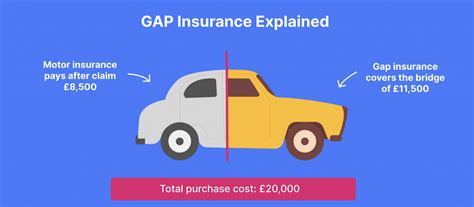

Gap insurance, also known as guaranteed asset protection insurance, is a specialized form of coverage designed to bridge the gap between the actual value of your vehicle and the amount owed on your auto loan or lease. It steps in to cover the difference, known as the “gap,” when the outstanding balance on your loan exceeds the vehicle’s market value.

This scenario often arises in the early years of a car loan or lease, when depreciation can significantly reduce the vehicle's worth. In such cases, if your car is totaled or stolen, the gap insurance policy will ensure you receive sufficient compensation to pay off the entire loan or lease balance, providing financial relief and peace of mind.

The Need for Gap Insurance

Consider the following real-life scenario: You’ve just purchased a new car, and within the first year of ownership, an unfortunate accident occurs, resulting in a total loss. At this point, your vehicle’s value has already depreciated significantly, and the insurance payout based on its current market value might not be enough to cover the remaining loan balance.

Without gap insurance, you would be left with the financial burden of paying off the difference, potentially thousands of dollars, out of your own pocket. This is where gap insurance steps in as a safety net, ensuring you are not left with a substantial financial loss and protecting your budget from unexpected expenses.

How Gap Insurance Works

Gap insurance operates by providing additional coverage on top of your standard auto insurance policy. It fills the gap between the vehicle’s current value and the amount owed on your loan or lease. Here’s a simplified breakdown of how it works:

- Depreciation: Vehicles tend to lose value rapidly in their first few years of ownership due to depreciation. This means that the initial loan or lease amount is often higher than the vehicle's actual worth.

- Total Loss or Theft: If your vehicle is declared a total loss due to an accident, fire, or theft, your standard insurance policy will typically provide compensation based on the current market value of the car.

- Gap Coverage: Gap insurance steps in to cover the difference between the insurance payout and the remaining loan or lease balance. It ensures you receive sufficient funds to settle the entire debt, eliminating the need to pay out of pocket.

It's important to note that gap insurance is often offered as an optional add-on to your auto insurance policy. It can be purchased directly from your insurance provider or sometimes even from the dealership at the time of purchasing your vehicle.

Who Should Consider Gap Insurance

Gap insurance is particularly beneficial for individuals who find themselves in the following circumstances:

Leasing a Vehicle

When leasing a car, you typically do not own the vehicle, and at the end of the lease term, you must return it to the dealership. However, if the car is damaged or stolen during the lease period, you may still be responsible for paying off the remaining lease balance. Gap insurance can protect you from this financial liability, ensuring you are not left paying for a vehicle you no longer possess.

Financing a New or Used Car

If you’ve financed a new or used vehicle, especially with a low down payment or for a longer loan term, gap insurance becomes even more crucial. During the initial years of ownership, the rapid depreciation of your car can leave you with a significant gap between the loan balance and the vehicle’s value. Gap insurance provides a safety net, ensuring you are not burdened with unexpected expenses.

High-Value Vehicles

Owners of high-value vehicles, such as luxury cars or specialty vehicles, may find gap insurance particularly beneficial. These vehicles tend to depreciate more rapidly, and their higher initial purchase price can result in a larger gap between the loan balance and market value. Gap insurance protects against the financial loss associated with owning a high-value vehicle.

Factors to Consider Before Purchasing Gap Insurance

While gap insurance offers valuable protection, it’s essential to assess your specific circumstances and needs before purchasing. Here are some key factors to consider:

- Vehicle Depreciation: Research the expected depreciation rate of your vehicle model. Some cars depreciate more rapidly than others, making gap insurance a wiser investment.

- Loan or Lease Terms: Evaluate the length of your loan or lease agreement. Longer terms or loans with a high loan-to-value ratio may benefit more from gap insurance, as they are more susceptible to depreciation.

- State Laws: Certain states have regulations regarding gap insurance. Some states require dealerships to offer gap insurance, while others may have specific guidelines for when it can be waived. Familiarize yourself with your state's laws to make an informed decision.

- Vehicle Usage: Consider how you use your vehicle. If you frequently drive long distances or in high-risk areas, the chances of an accident or theft may be higher, making gap insurance a prudent choice.

Performance Analysis: Gap Insurance Benefits

The benefits of gap insurance extend beyond financial protection. Here’s a detailed analysis of how gap insurance performs and the advantages it offers:

Financial Security

Gap insurance provides a vital layer of financial security by covering the gap between your vehicle’s value and the loan or lease balance. In the event of a total loss or theft, you won’t be left with a substantial financial burden, ensuring you can move forward without the stress of unexpected expenses.

Peace of Mind

Knowing that you have gap insurance in place offers peace of mind. It allows you to drive your vehicle with confidence, knowing that you are protected against potential financial losses. This peace of mind can enhance your overall driving experience and reduce anxiety related to vehicle ownership.

Budget-Friendly Protection

Gap insurance is typically an affordable add-on to your auto insurance policy. The cost varies depending on factors such as your vehicle’s make and model, loan terms, and insurance provider. However, when compared to the potential financial loss without gap insurance, it represents a small investment for significant protection.

Flexibility and Customization

Gap insurance policies can be tailored to meet your specific needs. You can choose the coverage duration, whether it aligns with your loan term or lease agreement, ensuring you have protection for the period you require. Additionally, some policies offer customizable options, allowing you to select the level of coverage that suits your budget and preferences.

Enhanced Resale Value

Having gap insurance can indirectly enhance the resale value of your vehicle. When potential buyers see that your car is protected by gap insurance, they may perceive it as a well-maintained and responsibly owned vehicle. This can increase its appeal and potentially command a higher resale price.

Evidence-Based Future Implications

As the automotive industry continues to evolve, the role of gap insurance is likely to remain crucial. Here are some future implications based on current trends and industry insights:

Increasing Vehicle Depreciation

With advancements in technology and the rapid introduction of new vehicle models, depreciation rates are expected to rise. This means that the gap between a vehicle’s initial value and its worth a few years later will widen. Gap insurance will become even more essential to protect against this accelerated depreciation.

Longer Loan Terms

As the cost of vehicles continues to rise, longer loan terms may become more common. This trend will make gap insurance increasingly relevant, as longer loan periods are more susceptible to depreciation and potential financial gaps.

Electrification and Alternative Fuels

The transition to electric and alternative fuel vehicles is gaining momentum. However, these vehicles may face unique challenges when it comes to resale and depreciation. Gap insurance will play a vital role in protecting owners of these emerging technologies from unexpected financial losses.

Advanced Safety Features

Modern vehicles are equipped with an array of advanced safety features, from lane departure warnings to automatic emergency braking. While these features enhance safety, they can also increase the cost of repairs in the event of an accident. Gap insurance will become even more crucial in such scenarios, ensuring owners are not left with substantial repair bills.

Changing Ownership Models

The traditional model of vehicle ownership is evolving, with subscription-based services and shared mobility gaining popularity. Gap insurance will adapt to these changing ownership models, providing protection for those who choose alternative ways to access and utilize vehicles.

FAQ

Can I purchase gap insurance at any time during my loan or lease term?

+Gap insurance is typically most effective when purchased at the beginning of your loan or lease term. However, some providers may offer it as an add-on throughout the duration of your agreement. It’s best to inquire with your insurance provider or dealership about the availability and timing of gap insurance purchases.

Does gap insurance cover all types of vehicles, including motorcycles and RVs?

+Gap insurance is primarily designed for automobiles, including cars, trucks, and SUVs. However, some providers may offer gap insurance for other vehicles, such as motorcycles, recreational vehicles (RVs), and even boats. It’s important to check with your specific insurance provider to understand the coverage options available for your unique vehicle type.

Are there any exclusions or limitations to gap insurance coverage?

+Gap insurance policies may have certain exclusions and limitations. For example, some policies may not cover vehicles that have been significantly modified or customized. Additionally, gap insurance typically does not cover situations where you voluntarily terminate your loan or lease. It’s crucial to carefully review the policy terms and conditions to understand any exclusions or limitations specific to your coverage.