Full Cover Insurance Quotes

Full cover insurance quotes are a crucial aspect of financial planning and risk management for individuals and businesses alike. These quotes provide an estimate of the cost of comprehensive insurance coverage, offering peace of mind and protection against a wide range of potential risks and liabilities. In today's complex and ever-changing risk landscape, understanding the intricacies of full cover insurance and how to obtain accurate quotes is essential.

Whether you're seeking insurance for your home, vehicle, business, or personal assets, the process of obtaining a full cover insurance quote involves careful consideration of various factors. From assessing your specific needs and risks to comparing policies and providers, this article will guide you through the essential steps to ensure you receive accurate and competitive quotes. By the end, you'll have a comprehensive understanding of the full cover insurance quote process and the knowledge to make informed decisions about your insurance coverage.

Understanding Full Cover Insurance

Full cover insurance, also known as comprehensive insurance, is a type of coverage that offers protection against a wide range of risks and potential losses. Unlike basic insurance policies that provide limited coverage, full cover insurance aims to provide financial security and peace of mind by covering a broad spectrum of potential incidents.

Here are some key aspects to understand about full cover insurance:

- Comprehensive Coverage: Full cover insurance policies are designed to offer protection for a variety of scenarios. This can include natural disasters, accidents, theft, vandalism, and even liability claims. By opting for full cover insurance, you ensure that you're prepared for a wide range of unforeseen events.

- Risk Assessment: Obtaining full cover insurance requires a thorough assessment of your unique risks. Insurance providers will consider factors such as your location, the value of your assets, your lifestyle, and your specific needs. This personalized risk assessment is crucial for determining the level of coverage you require.

- Policy Customization: Full cover insurance policies are often highly customizable. You can choose specific add-ons or endorsements to tailor your policy to your exact needs. For example, if you have valuable jewelry or artwork, you can add a rider to your policy to ensure these items are adequately covered.

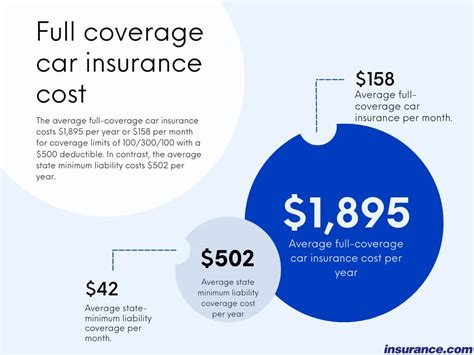

- Cost and Value: While full cover insurance may come with a higher premium compared to basic policies, it offers significantly more value. By having comprehensive coverage, you can avoid the financial burden of unexpected losses and ensure that your assets and livelihood are protected.

Understanding the benefits and intricacies of full cover insurance is the first step towards making informed decisions about your insurance needs. By assessing your risks and choosing the right policy, you can have the confidence that comes with being fully covered.

The Process of Obtaining a Full Cover Insurance Quote

Obtaining a full cover insurance quote involves a series of steps designed to ensure accuracy and provide you with a comprehensive understanding of your coverage options. Here's a detailed breakdown of the process:

Assessing Your Insurance Needs

The first step in obtaining a full cover insurance quote is to assess your specific insurance needs. Consider the following factors:

- Assets to Insure: Make a comprehensive list of all the assets you wish to insure. This could include your home, vehicles, valuable possessions, business property, or any other assets of significance.

- Risk Profile: Evaluate your personal or business risk profile. Consider factors such as your location, the likelihood of natural disasters, crime rates, and any other potential hazards that could impact your assets.

- Coverage Requirements: Determine the level of coverage you require for each asset. For instance, do you need basic coverage, or do you have specific needs like flood insurance or high-value item coverage?

Gathering Relevant Information

To obtain an accurate full cover insurance quote, you'll need to gather specific information. This includes:

- Asset Details: Provide detailed information about the assets you wish to insure. For real estate, this includes the property's value, size, age, and any recent improvements. For vehicles, provide make, model, year, and any modifications.

- Risk Factors: Share any relevant risk factors with your insurance provider. This could include information about your neighborhood's crime rate, the history of natural disasters in your area, or any personal circumstances that might impact your risk profile.

- Existing Policies: If you already have insurance policies in place, provide details about your current coverage. This helps the insurance provider understand your existing level of protection and offer tailored advice.

Comparing Insurance Providers

Once you've gathered the necessary information, it's time to compare insurance providers. Consider the following when choosing an insurance company:

- Reputation and Financial Stability: Opt for reputable insurance companies with a solid financial standing. This ensures they'll be able to pay out claims in the event of a loss.

- Policy Customization: Look for providers that offer customizable policies. This allows you to tailor your coverage to your specific needs, ensuring you're not paying for unnecessary add-ons.

- Customer Service: Assess the quality of customer service offered by each provider. You want an insurance company that's responsive, helpful, and transparent throughout the entire process.

Requesting Quotes

With your research complete, you can now request full cover insurance quotes from your chosen providers. When requesting quotes, ensure you provide all the relevant information to receive accurate estimates. Many providers offer online quote tools, making the process quick and convenient.

Analyzing and Comparing Quotes

Upon receiving your quotes, it's essential to analyze and compare them thoroughly. Consider the following when evaluating your options:

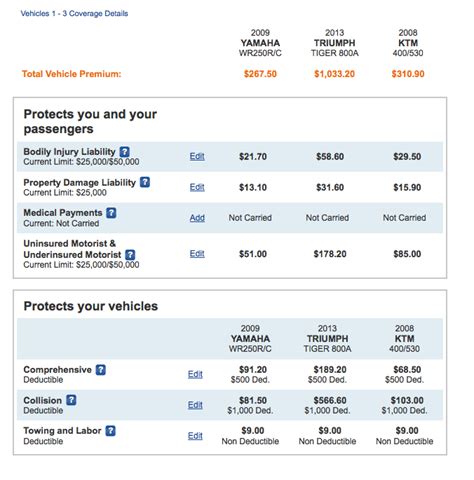

- Coverage: Ensure that the policies provide the level of coverage you require. Compare the scope of each policy to ensure you're not missing out on any essential protection.

- Premiums: Evaluate the cost of each policy. While price is an important factor, it shouldn't be the sole determining factor. Balance the cost with the level of coverage offered.

- Deductibles and Limits: Understand the deductibles (the amount you pay out of pocket before insurance coverage kicks in) and policy limits (the maximum amount the insurer will pay for a covered loss). These can vary significantly between policies.

- Additional Benefits: Some insurance providers offer extra benefits or perks, such as discounts for multiple policies or loyalty programs. Consider these when making your decision.

Choosing the Right Policy

Based on your analysis and comparison, select the full cover insurance policy that best meets your needs and budget. Remember, the right policy provides adequate coverage without unnecessary expenses. Don't hesitate to seek clarification or additional information from your insurance provider if needed.

Benefits of Full Cover Insurance

Opting for full cover insurance brings a range of benefits that can provide significant peace of mind and financial security. Here's a closer look at some of these advantages:

Comprehensive Protection

Full cover insurance policies are designed to offer a comprehensive level of protection. Unlike basic insurance plans that provide limited coverage, full cover policies aim to safeguard your assets against a wide range of potential risks. This includes natural disasters, theft, accidents, and even liability claims. By choosing full cover insurance, you can rest assured that you're prepared for almost any eventuality.

Customizable Coverage

One of the significant advantages of full cover insurance is the ability to customize your policy to meet your specific needs. Whether you have high-value items, unique assets, or specific concerns, full cover insurance allows you to tailor your coverage accordingly. This level of customization ensures that you're not paying for unnecessary coverage while still enjoying the peace of mind that comes with having adequate protection.

Peace of Mind

Full cover insurance provides the invaluable benefit of peace of mind. When you have comprehensive coverage, you can go about your daily life knowing that you're protected against financial losses and liabilities. This sense of security can significantly reduce stress and anxiety, allowing you to focus on what matters most.

Financial Security

In the event of a covered loss, full cover insurance can provide significant financial security. Whether you've experienced a natural disaster, theft, or an accident, your insurance policy will help cover the costs of repairs, replacements, or legal fees. This financial support can be crucial in ensuring your financial stability and preventing major setbacks.

Risk Management

Full cover insurance is an essential tool for effective risk management. By assessing your risks and choosing the right policy, you can proactively mitigate potential losses. This not only protects your assets but also helps you plan for the future with confidence. Effective risk management through full cover insurance can be a critical component of your overall financial strategy.

FAQs

What is the difference between full cover insurance and basic insurance policies?

+Full cover insurance, also known as comprehensive insurance, offers a broader range of coverage compared to basic insurance policies. While basic policies typically provide limited protection for specific risks, full cover insurance aims to safeguard your assets against a wide array of potential losses, including natural disasters, accidents, theft, and liability claims. It provides peace of mind and financial security by covering a comprehensive set of risks, ensuring you're prepared for various unforeseen events.

<div class="faq-item">

<div class="faq-question">

<h3>How do I determine the level of full cover insurance I need?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Assessing your specific insurance needs is crucial for determining the level of full cover insurance required. Consider the value of your assets, your risk profile (including location and potential hazards), and your coverage requirements. It's beneficial to consult with insurance professionals who can guide you in choosing the right level of coverage based on your unique circumstances.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are full cover insurance quotes more expensive than basic insurance quotes?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, full cover insurance quotes typically come with a higher premium compared to basic insurance policies. This is because full cover insurance provides a more comprehensive level of protection, covering a wider range of potential risks and losses. However, the additional cost is often justified by the peace of mind and financial security it offers. It's essential to balance the cost with the level of coverage needed to make an informed decision.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I customize my full cover insurance policy to meet my specific needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! One of the significant advantages of full cover insurance is its flexibility and customization options. You can tailor your policy to your specific needs, adding or removing coverage elements as required. This allows you to ensure that your insurance policy aligns perfectly with your unique assets, risks, and concerns. By customizing your policy, you can achieve the right balance of coverage and cost.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How do I choose the right insurance provider for my full cover insurance needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>When selecting an insurance provider for your full cover insurance needs, consider factors such as their reputation, financial stability, policy customization options, and customer service. Opt for a reputable company with a solid financial standing to ensure they can pay out claims effectively. Look for providers that offer policies tailored to your specific needs and provide excellent customer support throughout the process.</p>

</div>

</div>