Free Quotes On Auto Insurance

Are you looking to find the best auto insurance coverage for your vehicle but don't know where to start? Getting multiple quotes from different insurance providers is essential to ensure you're getting the most competitive rates and the coverage that suits your needs. In this comprehensive guide, we'll delve into the world of auto insurance, exploring how to get free quotes, comparing different policies, and ultimately helping you make an informed decision to protect your vehicle and yourself.

Understanding Auto Insurance

Auto insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unexpected situations. It’s a legal requirement in most countries and states, ensuring that drivers are accountable for any damages they cause. Understanding the basics of auto insurance is the first step toward making informed choices.

Key Components of Auto Insurance

Auto insurance policies typically consist of several components, each designed to cover specific risks. These include:

- Liability Coverage: This covers the costs of damages or injuries you cause to others in an accident. It’s typically divided into bodily injury liability and property damage liability.

- Collision Coverage: Pays for repairs to your vehicle after an accident, regardless of fault. It’s an optional coverage but is often recommended for newer or more valuable vehicles.

- Comprehensive Coverage: Provides protection against non-accident-related incidents, such as theft, vandalism, natural disasters, or collisions with animals. Like collision coverage, it’s optional but highly beneficial.

- Medical Payments or Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of who’s at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re involved in an accident with a driver who doesn’t have enough insurance to cover the damages.

Each of these components can be tailored to your needs, with different coverage limits and deductibles. Understanding these components is crucial when comparing quotes and choosing the right policy.

The Process of Getting Free Quotes

Obtaining free quotes for auto insurance is a straightforward process, thanks to the numerous online resources and insurance providers’ willingness to offer estimates without obligation. Here’s a step-by-step guide to help you navigate this process:

Step 1: Research and Comparison

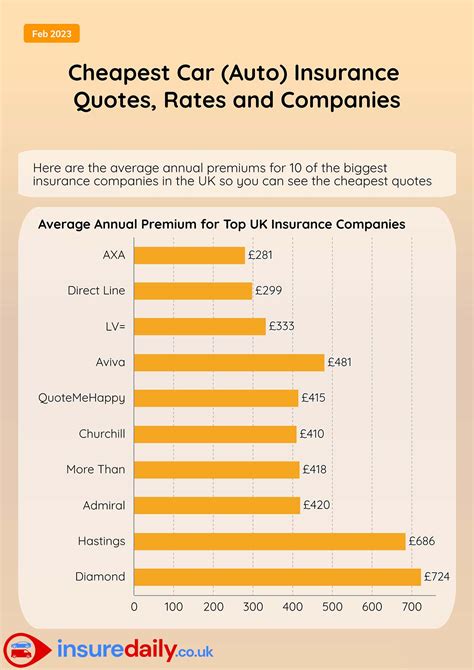

Start by researching the major auto insurance providers in your area. Look for reputable companies with a solid financial rating and positive customer reviews. Online resources, consumer reports, and recommendations from trusted sources can be invaluable in this initial stage.

Step 2: Gather Information

To get an accurate quote, you’ll need to provide specific details about your vehicle, driving history, and personal information. Here’s a list of information you should have ready:

- Vehicle Make, Model, and Year

- Vehicle Identification Number (VIN)

- Annual Mileage

- Driving Record (Accidents, Tickets, etc.)

- Current or Previous Insurance Information

- Personal Details (Name, Address, Date of Birth)

Ensure that you have all the necessary documents and information organized before starting the quote process.

Step 3: Use Online Quote Tools

Many insurance providers offer online quote tools on their websites. These tools allow you to input your information and receive an instant estimate. They’re convenient and provide a quick way to get a rough idea of the cost of coverage.

When using these tools, be as accurate as possible with your details to ensure the quote is as precise as it can be.

Step 4: Contact Insurance Agents

While online quotes are convenient, speaking directly with an insurance agent can provide more personalized advice and guidance. Reach out to local insurance agents or brokers who represent multiple companies. They can offer quotes from various providers and help you understand the nuances of each policy.

Step 5: Compare and Analyze

Once you’ve gathered a few quotes, it’s time to compare them. Look at the coverage limits, deductibles, and any additional benefits or discounts offered. Ensure that you’re comparing apples to apples by considering policies with similar coverage levels.

Use a spreadsheet or a comparison tool to organize the quotes, making it easier to see the differences and similarities between the policies.

Step 6: Consider Additional Factors

Beyond the cost and coverage, there are other factors to consider. These include the financial stability of the insurance company, their customer service reputation, and the ease of filing claims. Check online reviews and ratings to get a sense of the provider’s overall performance.

Tips for Saving on Auto Insurance

Getting multiple quotes is a great start, but there are additional strategies to ensure you’re getting the best value for your auto insurance.

Increase Your Deductible

Opting for a higher deductible can significantly reduce your premium. However, ensure that you choose a deductible amount that you’re comfortable paying out of pocket if needed.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, or renters’ insurance, consider bundling them with the same provider. Many companies offer discounts for customers who have multiple policies with them.

Explore Discounts

Insurance providers often offer a range of discounts, including those for safe driving records, loyalty, good student status, senior discounts, and more. Ask about these discounts when getting your quotes.

Maintain a Good Driving Record

A clean driving record can lead to significant savings on your auto insurance. Avoid accidents and traffic violations to keep your rates as low as possible.

Consider Usage-Based Insurance

Some providers offer usage-based insurance, where your premium is determined by your actual driving habits. This can be a great option for safe, low-mileage drivers.

Making the Right Choice

Choosing the right auto insurance policy involves a balance between cost and coverage. While it’s tempting to go for the lowest premium, ensure that the policy provides adequate protection for your vehicle and your personal liability.

Consider your unique needs and circumstances. If you have a long commute or frequently drive in high-risk areas, you may need more comprehensive coverage. On the other hand, if you rarely drive and have an excellent driving record, you might opt for a policy with higher deductibles and lower premiums.

Remember, auto insurance is a long-term investment, and finding the right policy can provide peace of mind and financial protection when you need it most.

Conclusion

Getting free quotes on auto insurance is an essential step in ensuring you’re adequately covered and getting the best value for your money. By understanding the components of auto insurance, following the quote process, and implementing strategies to save, you can make an informed decision that protects your vehicle and your finances.

Key Takeaways

- Research and compare reputable insurance providers.

- Gather all necessary information before seeking quotes.

- Use online tools and contact agents for personalized advice.

- Analyze quotes based on coverage and additional benefits.

- Consider cost-saving strategies like higher deductibles and policy bundling.

FAQs

Can I get auto insurance without a quote?

+While it’s possible to purchase insurance without getting quotes first, it’s generally not recommended. Quotes provide an essential overview of the coverage and cost, allowing you to make an informed decision.

How often should I review my auto insurance policy?

+It’s a good practice to review your policy annually, especially when your circumstances change, such as a move to a new area, a new vehicle purchase, or a significant life event. These changes can impact your insurance needs and premiums.

What happens if I don’t have auto insurance?

+Driving without auto insurance is illegal in most places and can result in significant fines, the suspension of your driver’s license, and even jail time. It’s also important to note that you’ll be financially responsible for any damages or injuries you cause in an accident.