Farmers Insurance Policy Lookup

Welcome to the ultimate guide to understanding and utilizing Farmers Insurance policies! In today's complex insurance landscape, it's essential to have a comprehensive grasp of your policy details. This guide will take you on a journey, demystifying the process of looking up your Farmers Insurance policy information and empowering you to make informed decisions about your coverage.

Unraveling the Farmers Insurance Policy Lookup Process

Navigating the world of insurance policies can be a daunting task, but with Farmers Insurance, the process is designed to be straightforward and user-friendly. Let’s delve into the key steps to efficiently locate and understand your policy details.

Step 1: Access Your Online Account

The first step towards accessing your Farmers Insurance policy information is to log in to your online account. Farmers Insurance provides a secure online platform where policyholders can manage their policies, make payments, and access important documents. Here’s a quick guide to accessing your account:

- Visit the official Farmers Insurance website.

- Look for the "Log In" or "My Account" button, usually found in the top right corner of the homepage.

- Enter your username and password. If you're a new user, you'll need to create an account by providing some basic information.

- Once logged in, you'll have access to your policy dashboard, where you can view and manage your policies.

If you encounter any issues during the login process, Farmers Insurance offers a dedicated customer support team that can assist you. You can find their contact information on the website or by reaching out through their social media channels.

Step 2: Locate Your Policy Details

Once you’ve successfully accessed your online account, the next step is to locate your specific policy details. Farmers Insurance provides a user-friendly interface that makes it easy to find the information you need. Here’s how to navigate this process:

- From your policy dashboard, look for the "Policy Details" or "Policy Information" section.

- Click on the specific policy you want to view. This will open a detailed overview of your coverage.

- You'll find important information such as your policy number, effective dates, coverage limits, and any additional endorsements or riders.

- Take note of the policy document, which provides a comprehensive breakdown of your coverage and any exclusions.

It's crucial to review your policy details regularly to ensure that your coverage aligns with your current needs. Farmers Insurance encourages policyholders to stay informed and make adjustments as necessary.

Step 3: Understanding Your Policy Coverage

Understanding your policy coverage is essential to make informed decisions about your insurance needs. Farmers Insurance offers a range of coverage options to cater to various lifestyles and circumstances. Here’s a breakdown of some key coverage types:

| Coverage Type | Description |

|---|---|

| Homeowners Insurance | Protects your home and its contents against damage or loss. Covers structures, personal belongings, and provides liability protection. |

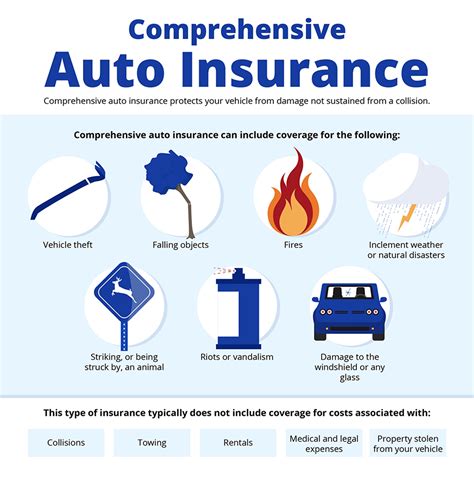

| Auto Insurance | Covers your vehicle against accidents, theft, and damage. Includes liability, collision, and comprehensive coverage options. |

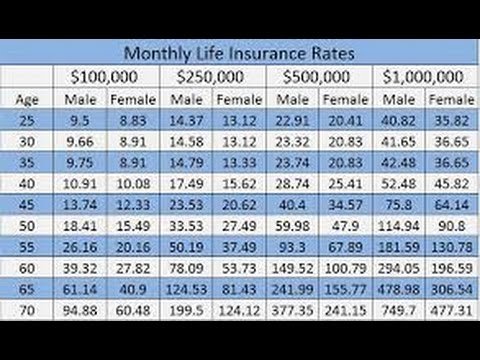

| Life Insurance | Provides financial protection to your loved ones in the event of your passing. Offers various types such as term life, whole life, and universal life insurance. |

| Umbrella Insurance | Offers additional liability protection beyond your standard policies, providing an extra layer of financial security. |

Each coverage type comes with its own set of benefits and limitations. Farmers Insurance agents are available to guide you through the process of selecting the right coverage for your unique situation.

Step 4: Reviewing and Updating Your Policy

Regularly reviewing and updating your Farmers Insurance policy is crucial to ensure that your coverage remains adequate and up-to-date. Life circumstances can change, and so can your insurance needs. Here’s how to stay on top of your policy:

- Schedule periodic policy reviews with your Farmers Insurance agent. They can assess your current coverage and make recommendations based on any changes in your life.

- Consider updating your policy when significant life events occur, such as marriage, buying a new home, starting a family, or changing jobs.

- Review your policy limits and deductibles to ensure they align with your financial goals and risk tolerance.

- Stay informed about any changes in insurance laws or regulations that may impact your coverage.

By staying proactive and regularly reviewing your policy, you can make informed decisions to protect your assets and secure your financial future.

Step 5: Utilizing Farmers Insurance Resources

Farmers Insurance understands the importance of providing valuable resources to their policyholders. They offer a range of tools and information to enhance your insurance experience. Here’s an overview of some key resources:

- Online Tools: Farmers Insurance provides online calculators and assessment tools to help you estimate coverage needs and premiums. These tools can be accessed through your online account or the Farmers Insurance website.

- Educational Resources: The Farmers Insurance website features a wealth of educational content, including articles, videos, and infographics, covering various insurance topics. These resources can help you better understand your coverage and make informed choices.

- Claim Resources: In the event of a claim, Farmers Insurance offers a seamless claim process. You can report claims online, by phone, or through the Farmers Insurance mobile app. They provide detailed guidance and support throughout the claims process.

By utilizing these resources, you can maximize the benefits of your Farmers Insurance policy and navigate the insurance landscape with confidence.

Expert Insights: Maximizing Your Farmers Insurance Policy

Now that we’ve covered the fundamentals of looking up your Farmers Insurance policy, let’s explore some expert insights to help you get the most out of your coverage.

Tailoring Your Coverage to Your Needs

Farmers Insurance understands that every policyholder has unique circumstances and requirements. That’s why they offer customizable coverage options to ensure you receive the protection that’s right for you. Here are some tips to tailor your coverage:

- Homeowners Insurance: Consider adding endorsements to your policy to cover specific risks, such as water backup, identity theft, or personal property replacement.

- Auto Insurance: Evaluate your coverage limits and deductibles to find the right balance between affordability and protection. Farmers Insurance offers options like accident forgiveness and rental car coverage.

- Life Insurance: Discuss your financial goals and family needs with a Farmers Insurance agent to determine the appropriate amount and type of life insurance coverage.

- Umbrella Insurance: This coverage provides an extra layer of protection for high-risk individuals or those with significant assets. It can be a valuable addition to your existing policies.

By tailoring your coverage to your specific needs, you can ensure that you're adequately protected without paying for unnecessary coverage.

Utilizing Discounts and Savings Opportunities

Farmers Insurance offers a range of discounts and savings opportunities to help policyholders reduce their insurance costs. Here are some ways to take advantage of these benefits:

- Multi-Policy Discounts: Bundle your insurance policies with Farmers Insurance to receive significant discounts. Combining your homeowners, auto, and life insurance policies can lead to substantial savings.

- Safe Driver Discounts: If you have a clean driving record, Farmers Insurance offers discounts for safe drivers. This can lower your auto insurance premiums and reward your responsible driving habits.

- Home Safety Discounts: Install home safety features like smoke detectors, security systems, or fire extinguishers to qualify for discounts on your homeowners insurance. These measures not only protect your home but also reduce your insurance costs.

- Loyalty Rewards: Farmers Insurance rewards loyal customers with discounts and incentives. The longer you maintain your policies with them, the more savings you can accumulate.

By exploring these discount opportunities, you can make your Farmers Insurance policy more affordable while still enjoying comprehensive coverage.

Staying Informed and Engaged

Staying informed and engaged with your Farmers Insurance policy is essential to make the most of your coverage. Here are some tips to stay connected and proactive:

- Regular Policy Reviews: Schedule annual or bi-annual policy reviews with your Farmers Insurance agent to assess your coverage and make any necessary adjustments. This ensures that your policy remains aligned with your changing needs.

- Newsletter Subscriptions: Subscribe to Farmers Insurance newsletters or follow their social media channels to stay updated on insurance news, industry trends, and relevant information. This can help you make informed decisions about your coverage.

- Attend Educational Events: Farmers Insurance often hosts educational webinars or workshops to provide valuable insights and tips on insurance-related topics. Attending these events can enhance your understanding of insurance and empower you to make better choices.

- Engage with Customer Support: Don't hesitate to reach out to Farmers Insurance's customer support team if you have any questions or concerns. They are dedicated to providing exceptional service and can offer personalized guidance based on your specific situation.

By staying engaged and informed, you can navigate the world of insurance with confidence and ensure that your Farmers Insurance policy serves your best interests.

Conclusion: Empowering Your Insurance Journey

Looking up your Farmers Insurance policy is a crucial step towards taking control of your insurance needs. By following the steps outlined in this guide and leveraging the resources provided by Farmers Insurance, you can make informed decisions, tailor your coverage, and maximize the benefits of your policy.

Remember, insurance is a dynamic field, and staying proactive is key to protecting your assets and securing your financial future. With Farmers Insurance by your side, you can navigate the complexities of insurance with confidence and peace of mind.

FAQ

How often should I review my Farmers Insurance policy?

+

It’s recommended to review your policy at least once a year, or whenever significant life changes occur. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I make changes to my policy online?

+

Yes, Farmers Insurance provides an online platform where you can make certain policy changes, such as updating your contact information or adjusting coverage limits. However, for more complex changes, it’s best to consult with your insurance agent.

What should I do if I need to file a claim?

+

If you need to file a claim, you can do so through the Farmers Insurance website, mobile app, or by contacting their customer support team. They will guide you through the process and provide the necessary assistance.