Hmo Or Ppo Insurance

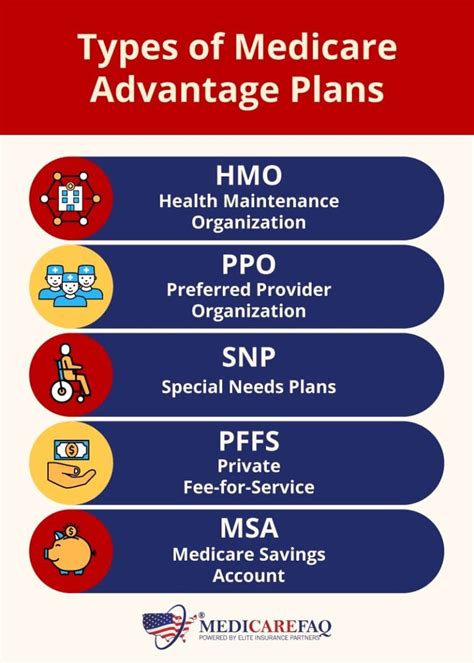

In the world of healthcare, navigating the complex landscape of insurance options can be a daunting task. Among the myriad of choices, two prominent types of health insurance plans often capture the attention of individuals seeking coverage: Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). These plans, with their distinct characteristics and coverage models, offer different paths to accessing healthcare services. Understanding the nuances of HMOs and PPOs is crucial for making an informed decision that aligns with one's specific healthcare needs and preferences.

Understanding Health Maintenance Organizations (HMOs)

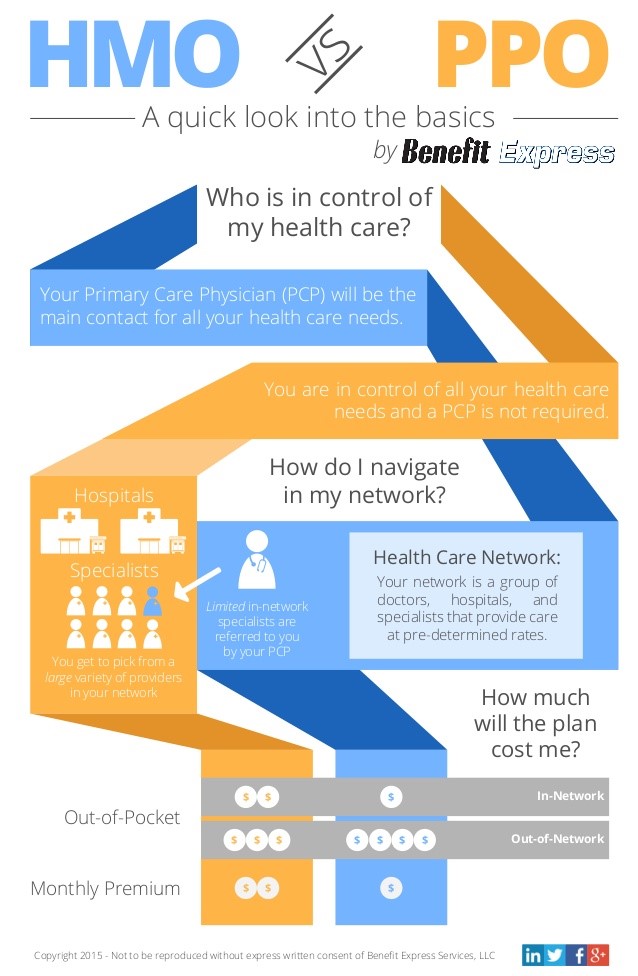

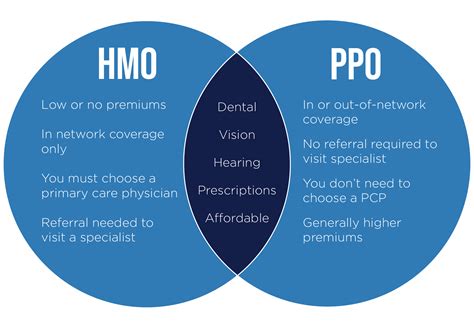

Health Maintenance Organizations, or HMOs, represent a structured approach to healthcare coverage. At the core of an HMO plan is the concept of a designated primary care physician (PCP) who acts as the central figure in an individual’s healthcare journey. This PCP serves as the initial point of contact for all non-emergency medical needs and is responsible for coordinating the patient’s care, including referrals to specialists within the HMO network.

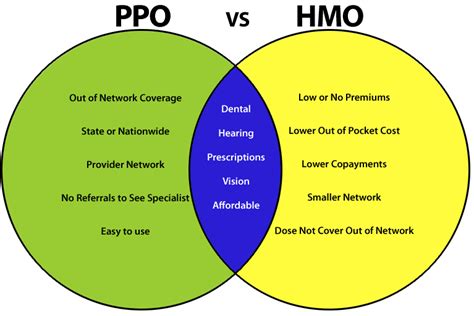

One of the key advantages of HMOs is their emphasis on preventive care. HMO plans often provide comprehensive coverage for preventative services such as annual check-ups, immunizations, and screenings, aiming to catch potential health issues early on. This proactive approach to healthcare not only promotes better overall health but also helps manage costs by preventing more serious, and often more expensive, health conditions from developing.

However, HMOs come with certain restrictions. Out-of-network services are typically not covered, which means that seeking medical attention from a provider outside the HMO's designated network would likely result in higher out-of-pocket expenses. Additionally, while referrals to specialists are a common part of HMO plans, these referrals must be obtained from the PCP, adding an extra step in the process.

Key Features of HMOs

- Primary Care Physician (PCP): Acts as the gatekeeper to the healthcare system, coordinating all non-emergency care and providing referrals to specialists.

- Preventive Care Emphasis: Comprehensive coverage for preventive services like check-ups and screenings, promoting early detection and better health outcomes.

- Cost-Effectiveness: Often more affordable due to the structured network and emphasis on preventive care.

- Network Restrictions: Services from out-of-network providers are typically not covered, requiring patients to stay within the HMO network.

- Referral Process: Requires a referral from the PCP for specialist care, adding an extra step in the healthcare process.

When to Choose an HMO

HMOs are an excellent choice for individuals who prioritize affordability and the continuity of care provided by a primary care physician. They are particularly beneficial for those who value preventive care and are comfortable with the structured nature of HMOs, including the need for referrals and the restriction to in-network providers.

Exploring Preferred Provider Organizations (PPOs)

Preferred Provider Organizations, or PPOs, offer a more flexible approach to healthcare coverage compared to HMOs. At the heart of a PPO plan is the concept of a broad network of healthcare providers, including physicians, specialists, and hospitals, with whom the insurance company has negotiated discounted rates for services.

One of the key advantages of PPOs is the freedom they provide to their members. Unlike HMOs, PPOs do not require members to select a primary care physician or obtain referrals for specialist care. This means that individuals can directly access a wide range of healthcare services without the need for prior authorization or coordination through a PCP. Additionally, PPOs typically cover out-of-network services, although at a higher cost compared to in-network providers.

Key Features of PPOs

- Broad Network: Offers a large network of healthcare providers with whom the insurance company has negotiated discounted rates.

- Flexibility: Allows members to directly access a wide range of healthcare services without the need for referrals or coordination through a primary care physician.

- Out-of-Network Coverage: Typically covers out-of-network services, although at a higher cost compared to in-network providers.

- Cost-Sharing: Often requires higher deductibles and out-of-pocket costs, but these costs can be offset by the flexibility and broader coverage options.

- Preventive Care: Provides coverage for preventive services, but may not be as comprehensive as HMOs.

When to Choose a PPO

PPOs are an ideal choice for individuals who value flexibility and the ability to choose their healthcare providers without restrictions. They are particularly beneficial for those who travel frequently or live in areas with limited HMO network options. Additionally, PPOs can be a good fit for individuals who require frequent specialist care or have complex healthcare needs that may require coordination among various providers.

Comparative Analysis: HMOs vs. PPOs

When comparing HMOs and PPOs, several key factors come into play. Cost is often a significant consideration, and in this regard, HMOs tend to be more affordable due to their structured network and emphasis on preventive care. On the other hand, PPOs may require higher deductibles and out-of-pocket costs, but they offer the flexibility to choose from a broader range of providers, both in and out of network.

The level of coverage is another critical aspect. HMOs typically provide comprehensive coverage for preventive services, while PPOs may offer less extensive coverage in this area. However, PPOs make up for this with their broader network of providers and the freedom to access specialist care without referrals.

In terms of convenience, PPOs take the lead with their flexible nature and direct access to healthcare services. HMOs, on the other hand, require members to coordinate their care through a primary care physician, which can be seen as either a benefit for those who prefer a more guided healthcare approach or a drawback for those who value autonomy.

| Category | HMOs | PPOs |

|---|---|---|

| Cost | Typically more affordable due to structured network and preventive care emphasis | May require higher deductibles and out-of-pocket costs, but offers broader coverage options |

| Coverage | Comprehensive coverage for preventive services | Less extensive preventive care coverage, but broader network of providers |

| Convenience | Requires coordination through a primary care physician | Flexible and direct access to healthcare services without referrals |

Making the Right Choice

The decision between an HMO and a PPO ultimately depends on an individual’s unique healthcare needs and preferences. For those who prioritize affordability, preventive care, and the guidance of a primary care physician, an HMO plan may be the best fit. On the other hand, individuals who value flexibility, the ability to choose their healthcare providers, and direct access to specialist care may find a PPO plan more suitable.

Future Implications and Trends

As the healthcare industry continues to evolve, the landscape of insurance options is also transforming. The rise of consumer-directed healthcare plans, such as Health Savings Accounts (HSAs) and High Deductible Health Plans (HDHPs), offers individuals greater control over their healthcare decisions and expenses. These plans often pair well with PPOs, providing a flexible and cost-effective approach to healthcare coverage.

Additionally, the integration of technology into healthcare is leading to innovative solutions that could further impact insurance choices. Telehealth services, for instance, are becoming increasingly popular, offering convenient access to healthcare professionals from the comfort of one's home. This trend may influence the way individuals interact with their healthcare providers and could potentially impact the appeal of HMO and PPO plans in the future.

Industry Insights

According to a recent report by Healthcare Finance News, the healthcare insurance market is experiencing a shift towards value-based care models. This shift is driven by the recognition that traditional fee-for-service models may not always align with patient outcomes and cost-effectiveness. As a result, insurance companies are increasingly focusing on providing incentives for preventive care and managing chronic conditions, which could further enhance the appeal of HMOs with their emphasis on preventive services.

Furthermore, the ongoing COVID-19 pandemic has accelerated the adoption of digital health solutions, including telemedicine and remote patient monitoring. These technologies are expected to play a significant role in shaping the future of healthcare delivery and insurance coverage, potentially influencing the features and appeal of both HMO and PPO plans.

Conclusion

In navigating the complex world of healthcare insurance, understanding the distinctions between HMOs and PPOs is a critical step towards making an informed choice. HMOs offer a structured, cost-effective approach with an emphasis on preventive care, while PPOs provide flexibility and direct access to a broad network of providers. The right choice depends on an individual’s unique healthcare needs, financial situation, and personal preferences.

As the healthcare industry continues to evolve, staying informed about the latest trends and developments is essential. Whether it's the rise of consumer-directed healthcare plans, the integration of technology, or the shift towards value-based care models, these factors will shape the future of insurance options and influence the way individuals access and manage their healthcare.

What is the main difference between an HMO and a PPO plan?

+

The primary difference lies in the level of flexibility and the way healthcare services are coordinated. HMOs require members to select a primary care physician (PCP) and obtain referrals for specialist care, offering a more structured approach. PPOs, on the other hand, provide greater flexibility by allowing members to directly access a wide range of healthcare services without the need for referrals.

Are HMOs always more affordable than PPOs?

+

In general, HMOs are often more affordable due to their structured network and emphasis on preventive care. However, the affordability of a plan can also depend on an individual’s specific healthcare needs and the coverage provided by the plan.

Do PPOs cover out-of-network services?

+

Yes, PPOs typically cover out-of-network services, although at a higher cost compared to in-network providers. This flexibility can be beneficial for individuals who travel frequently or live in areas with limited HMO network options.

What is the role of a primary care physician (PCP) in an HMO plan?

+

In an HMO plan, the PCP serves as the central figure in an individual’s healthcare journey. They act as the initial point of contact for non-emergency medical needs and are responsible for coordinating the patient’s care, including referrals to specialists within the HMO network.

How do I choose between an HMO and a PPO plan?

+

The choice between an HMO and a PPO depends on your unique healthcare needs, financial situation, and personal preferences. Consider factors such as cost, coverage, convenience, and the level of flexibility you desire in choosing your healthcare providers.