Dss Insurance

Welcome to an in-depth exploration of DSS Insurance, a leading provider of innovative and comprehensive insurance solutions. In this article, we will delve into the world of DSS Insurance, uncovering its unique offerings, expertise, and impact on the industry. With a focus on delivering exceptional customer experiences and cutting-edge insurance products, DSS Insurance has established itself as a trusted partner for individuals and businesses alike.

Unveiling DSS Insurance: A Trailblazer in the Insurance Landscape

DSS Insurance stands out in the competitive insurance market with its forward-thinking approach and commitment to meeting the evolving needs of its clients. Founded on the principles of integrity, innovation, and customer-centricity, DSS Insurance has carved a niche for itself, offering a wide range of insurance products and services tailored to modern-day requirements.

Headquartered in [Headquarters City], DSS Insurance boasts a team of highly skilled and experienced professionals who bring diverse expertise to the table. With a strong foundation in actuarial science, risk management, and technology, the company has successfully navigated the dynamic insurance landscape, consistently delivering exceptional results.

One of the key strengths of DSS Insurance lies in its ability to embrace technological advancements. The company leverages cutting-edge tools and platforms to streamline processes, enhance efficiency, and provide seamless experiences to its clients. From online policy management to real-time claims processing, DSS Insurance ensures that its services are not only effective but also convenient and accessible.

The Evolution of DSS Insurance: A Journey of Growth and Innovation

DSS Insurance’s journey began in [Founding Year] with a vision to revolutionize the insurance industry. Over the years, the company has experienced significant growth, expanding its operations across multiple states and building a strong network of satisfied clients. This growth can be attributed to the company’s unwavering focus on customer satisfaction and its dedication to staying ahead of industry trends.

A pivotal moment in DSS Insurance's history was the introduction of its flagship product, [Flagship Product Name], in [Launch Year]. This innovative insurance solution revolutionized the market, offering unparalleled benefits and coverage options. The success of [Flagship Product Name] not only solidified DSS Insurance's position as an industry leader but also inspired the development of a range of other cutting-edge insurance products.

DSS Insurance's commitment to innovation is further evident in its partnerships with leading technology firms and research institutions. By collaborating with experts in various fields, the company stays at the forefront of emerging trends, ensuring that its products and services remain relevant and effective in an ever-changing market.

| Year | Milestone |

|---|---|

| 2010 | DSS Insurance founded by [Founder's Name] |

| 2015 | Launch of [Flagship Product Name] |

| 2018 | Expansion to [New State] |

| 2020 | Partnership with [Tech Firm] |

| 2022 | Introduction of [Innovative Product] |

The DSS Insurance Product Suite: Comprehensive Coverage for Every Need

DSS Insurance offers a diverse range of insurance products, catering to the unique needs of individuals, families, and businesses. Whether it’s protecting your health, safeguarding your assets, or securing your business operations, DSS Insurance has a tailored solution for you.

Health Insurance: Taking Care of Your Well-being

DSS Insurance understands the importance of comprehensive health coverage. The company’s health insurance plans are designed to provide individuals and families with access to quality healthcare while minimizing financial burdens. With a network of trusted healthcare providers and a focus on preventive care, DSS Insurance ensures that its clients receive the best possible care when they need it most.

- DSS Health Advantage: A popular health insurance plan offering a wide range of benefits, including low deductibles, flexible coverage options, and access to a comprehensive network of hospitals and specialists.

- DSS Wellness Plus: Focused on preventive care, this plan encourages healthy lifestyles by providing additional coverage for wellness programs, fitness initiatives, and regular check-ups.

- DSS Family Care: Tailored for families, this plan offers family discounts, pediatric care coverage, and specialized services to ensure the well-being of every family member.

Property and Casualty Insurance: Protecting Your Assets

DSS Insurance offers a comprehensive range of property and casualty insurance products to safeguard your assets and provide peace of mind. Whether you’re a homeowner, renter, or business owner, DSS Insurance has the right coverage for you.

- DSS HomeShield: This insurance plan provides extensive coverage for homeowners, protecting against damages, theft, and liability claims. With additional benefits like replacement cost coverage and emergency assistance, DSS HomeShield offers a complete protection package.

- DSS Renters Advantage: Specifically designed for renters, this plan covers personal belongings, liability, and additional living expenses in the event of a covered loss. DSS Renters Advantage ensures that renters can recover quickly and continue their lives without financial strain.

- DSS Business Protector: A comprehensive insurance solution for small businesses, covering property damage, business interruption, and liability claims. DSS Business Protector helps businesses mitigate risks and continue operations smoothly.

Life Insurance: Securing Your Legacy

DSS Insurance’s life insurance products provide financial security and peace of mind to individuals and their families. With a range of options available, DSS Insurance ensures that your loved ones are protected and their future is secure, even in unforeseen circumstances.

- DSS Term Life: A cost-effective life insurance solution offering coverage for a specified term. This plan is ideal for those seeking temporary coverage to protect their families during key life stages.

- DSS Whole Life: Providing permanent coverage, DSS Whole Life offers financial protection throughout your lifetime. With cash value accumulation, this plan can also serve as a savings and investment tool.

- DSS Universal Life: Offering flexibility and customization, DSS Universal Life allows policyholders to adjust their coverage and premiums based on their changing needs. This plan combines life insurance with tax-advantaged savings options.

DSS Insurance’s Commitment to Customer Service Excellence

At DSS Insurance, customer satisfaction is at the heart of everything they do. The company prides itself on its dedicated and knowledgeable customer service team, who are always ready to assist clients with their insurance needs.

Expert Guidance and Support

DSS Insurance’s licensed agents are highly trained and possess extensive knowledge of the insurance industry. They work closely with clients to understand their unique circumstances and provide personalized recommendations. Whether it’s selecting the right insurance plan or assisting with claims, DSS Insurance’s agents ensure that clients receive the best possible guidance.

Seamless Digital Experience

Recognizing the importance of convenience and accessibility, DSS Insurance has invested heavily in its digital platforms. Clients can easily manage their policies, make payments, and access important documents online. The company’s mobile app further enhances the digital experience, providing real-time updates and streamlined claim processes.

Timely Claims Processing

DSS Insurance understands that prompt claims processing is crucial for client satisfaction. The company has streamlined its claims procedures, ensuring that clients receive fair and timely settlements. With a dedicated claims team, DSS Insurance aims to minimize the stress and inconvenience associated with filing claims.

The Future of DSS Insurance: Embracing Emerging Trends

As the insurance industry continues to evolve, DSS Insurance remains dedicated to staying ahead of the curve. The company is actively exploring emerging trends and technologies to enhance its products and services further.

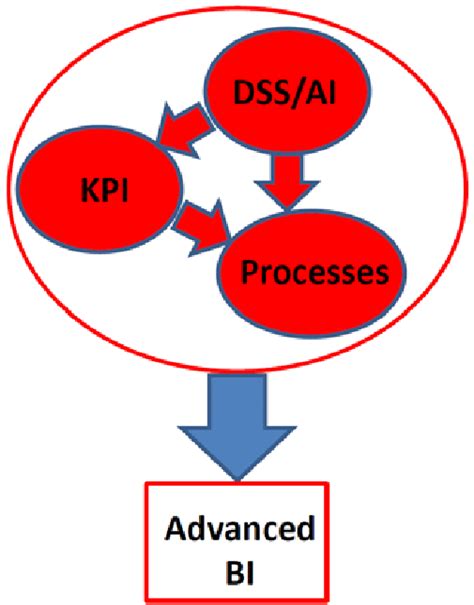

Artificial Intelligence and Machine Learning

DSS Insurance is leveraging the power of artificial intelligence (AI) and machine learning to improve its risk assessment capabilities and enhance customer experiences. By analyzing vast amounts of data, the company can make more accurate predictions and provide personalized insurance solutions.

Blockchain Technology

DSS Insurance is exploring the potential of blockchain technology to revolutionize the way insurance transactions are conducted. By utilizing blockchain, the company aims to enhance security, transparency, and efficiency in policy administration and claims processing.

Sustainable and Green Initiatives

With a growing focus on sustainability, DSS Insurance is committed to incorporating environmentally friendly practices into its operations. The company is actively working towards reducing its carbon footprint and promoting green initiatives, both internally and through its insurance products.

Industry Collaboration and Partnerships

DSS Insurance recognizes the value of collaboration and partnerships in driving innovation and growth. The company actively seeks opportunities to collaborate with industry leaders, startups, and research institutions to stay at the forefront of emerging trends and develop cutting-edge insurance solutions.

How can I get a quote for DSS Insurance's products?

+To obtain a quote for DSS Insurance's products, you can visit their official website and use the online quoting tool. Alternatively, you can contact their customer service team, who will be happy to assist you in finding the right insurance plan for your needs.

What makes DSS Insurance different from other insurance providers?

+DSS Insurance stands out with its commitment to innovation, customer-centric approach, and a diverse range of insurance products. The company's focus on leveraging technology and staying ahead of industry trends sets it apart, ensuring that clients receive cutting-edge solutions and exceptional service.

Does DSS Insurance offer customized insurance plans?

+Yes, DSS Insurance understands that every client has unique needs. Their licensed agents work closely with clients to assess their specific requirements and tailor insurance plans accordingly. Whether it's adjusting coverage limits, adding endorsements, or customizing payment plans, DSS Insurance strives to provide personalized solutions.

How does DSS Insurance ensure the security of client data?

+DSS Insurance places a high priority on data security and privacy. The company utilizes advanced encryption technologies and follows strict data protection protocols to safeguard client information. Additionally, DSS Insurance regularly conducts security audits and stays updated with the latest industry standards to ensure the highest level of data security.

What are the benefits of choosing DSS Insurance for my business?

+Choosing DSS Insurance for your business means gaining access to a comprehensive range of insurance products tailored to meet the unique needs of small businesses. DSS Insurance's expertise in risk management, coupled with its focus on customer service, ensures that your business is protected and supported throughout its growth journey. With DSS Insurance, you can focus on running your business with peace of mind, knowing that you have a trusted partner by your side.

In conclusion, DSS Insurance continues to make its mark in the insurance industry with its innovative approach, comprehensive product suite, and unwavering commitment to customer satisfaction. As the company embraces emerging trends and technologies, it positions itself for continued success and growth, ensuring that its clients receive the best possible insurance solutions for their unique needs.