Dog Insurances

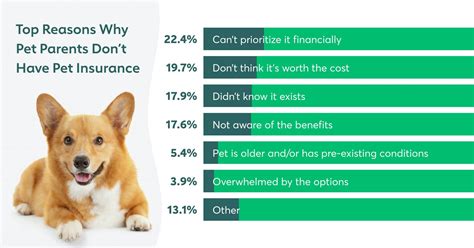

The pet insurance market has witnessed a remarkable surge in recent years, with dog insurance leading the way. As pet ownership continues to rise, especially during the pandemic, responsible pet parents are increasingly recognizing the benefits of securing their furry friends' health and well-being through comprehensive insurance plans. This article delves into the intricacies of dog insurance, exploring its coverage, costs, and the peace of mind it offers to dog owners.

Understanding Dog Insurance: Coverage and Benefits

Dog insurance, much like health insurance for humans, provides financial protection for unexpected veterinary expenses. These policies typically cover a range of medical conditions and treatments, ensuring that dog owners can access quality care for their pets without incurring substantial financial burdens.

Core Coverage Features

The coverage offered by dog insurance plans can vary, but most policies include the following key elements:

- Accident and Illness Coverage: This is the foundation of most dog insurance policies. It covers unexpected accidents, such as fractures or poisoning, as well as illnesses like diabetes or cancer. Some plans may offer separate limits for accident and illness claims.

- Wellness or Routine Care: Many modern dog insurance policies extend beyond emergency care to include routine check-ups, vaccinations, and even preventative treatments like flea and tick medication.

- Surgical Procedures: Major surgical operations, including those related to accidents or illnesses, are often covered. This can be a significant financial relief for owners, as these procedures can be costly.

- Specialist Referrals: Insurance may also cover visits to veterinary specialists, ensuring your dog receives expert care when needed.

- Prescription Medication: The cost of prescription drugs can quickly add up, so having this covered is a welcome benefit.

It's important to note that not all policies are created equal, and the level of coverage can vary significantly. Some plans may offer comprehensive coverage, while others may have more basic or limited features.

Customizing Your Dog’s Insurance Plan

Insurance providers understand that every dog is unique, and as such, they often allow policyholders to customize their plans. This might involve choosing between different levels of coverage, such as basic, enhanced, or premium plans, each with its own set of features and price points.

| Plan Type | Coverage Highlights | Average Monthly Cost |

|---|---|---|

| Basic | Essential accident and illness coverage, limited wellness benefits | $25 - $40 |

| Enhanced | Comprehensive accident and illness, expanded wellness coverage | $45 - $65 |

| Premium | All-inclusive coverage, including specialist referrals and advanced treatments | $70 - $100 |

Additionally, some insurers offer optional add-ons, such as coverage for pre-existing conditions (usually at an additional cost) or travel insurance for dogs accompanying their owners on vacations.

The Cost of Dog Insurance: A Worthwhile Investment

The financial aspect of dog insurance is often a primary concern for prospective buyers. While the cost of insurance can vary based on several factors, it’s important to consider it as an investment in your dog’s health and your own peace of mind.

Factors Influencing Cost

- Age and Breed: Generally, younger dogs are less expensive to insure, as they are less likely to develop age-related health issues. However, certain breeds, especially those predisposed to genetic conditions, may command higher premiums.

- Location: The cost of living and veterinary care in your area can impact insurance premiums. Urban areas with higher veterinary costs may see correspondingly higher insurance rates.

- Coverage Level: As mentioned, the level of coverage you choose will directly affect the cost. Comprehensive plans with high limits will be more expensive than basic policies.

- Deductibles and Co-Pays: Some policies operate on a reimbursement basis, where you pay the vet directly and then submit claims to the insurer. In these cases, you may have to choose between a higher monthly premium with lower deductibles or a lower premium with higher out-of-pocket costs.

It's worth noting that while dog insurance can seem expensive upfront, the potential savings over the long term can be substantial, especially if your dog develops a serious health condition.

Comparing Quotes and Finding the Right Fit

With numerous insurance providers in the market, it’s essential to shop around and compare quotes to find the best policy for your dog’s needs and your budget. Online comparison tools can be invaluable in this process, allowing you to see multiple quotes side by side and make an informed decision.

When comparing quotes, pay attention to the fine print. Look for policies that offer coverage for the specific conditions or treatments your dog may require. Also, consider the insurer's reputation and financial stability to ensure they will be able to honor claims in the future.

The Peace of Mind that Comes with Dog Insurance

Beyond the financial protection it offers, dog insurance provides a unique sense of security and peace of mind for dog owners. Knowing that your beloved pet is covered for unexpected illnesses or accidents can alleviate a significant source of stress.

Focus on Quality Care, Not Finances

With insurance in place, you can make decisions about your dog’s healthcare based solely on what’s best for their well-being, without the added pressure of worrying about the cost. This can lead to earlier detection and treatment of health issues, potentially improving your dog’s prognosis and quality of life.

A Safety Net for Emergencies

Dog insurance can be a literal lifesaver in emergency situations. Whether it’s a sudden illness or an accident, having insurance means you can act quickly without the immediate concern of financial strain. This swift action can be crucial in critical situations, potentially saving your dog’s life.

Long-Term Financial Planning

Over the long term, dog insurance can help you budget for your pet’s healthcare needs more effectively. By spreading the cost of veterinary care over monthly premiums, you can avoid large, unexpected expenses that might otherwise strain your finances.

Conclusion: Navigating the World of Dog Insurance

Dog insurance is an essential aspect of responsible pet ownership, offering a comprehensive safety net for your canine companion’s health and well-being. With a range of coverage options and customizable plans, insurance providers cater to a variety of needs and budgets. The peace of mind that comes with knowing your dog is protected is invaluable, allowing you to focus on the joy and love they bring to your life.

What is the average cost of dog insurance per month?

+The average cost of dog insurance can vary widely based on factors like age, breed, location, and coverage level. Basic plans might start around 25 per month, while premium plans can exceed 100. It’s important to compare quotes to find the best value for your dog’s needs.

Do all dog insurance plans cover pre-existing conditions?

+No, most dog insurance plans do not cover pre-existing conditions. However, some insurers offer optional add-ons or specific plans that provide coverage for these conditions at an additional cost.

Can I get dog insurance for an older dog?

+Yes, you can insure older dogs, but the cost may be higher due to the increased likelihood of age-related health issues. It’s best to inquire with specific insurers about their policies regarding older pets.