Do I Have Health Insurance

Health insurance is a vital aspect of modern life, offering financial protection and peace of mind when it comes to medical care. It can be a complex topic, with numerous types of plans, providers, and coverage options available. Understanding your health insurance coverage is essential to ensure you're prepared for any medical emergencies or routine healthcare needs. This comprehensive guide will walk you through the steps to determine whether you have health insurance and, if so, what type of coverage you possess.

Understanding Your Health Insurance Status

Determining your health insurance status involves a series of steps that can provide clarity on your coverage and help you make informed decisions about your healthcare. Here’s a systematic approach to finding out whether you have health insurance:

Check Your Payroll Deductions

If you’re employed, start by examining your payroll deductions. Many employers offer health insurance as part of their benefits package, and the cost is typically deducted from your paycheck. Look for entries like “Medical Insurance” or “Health Plan” on your payslip. The amount deducted each pay period indicates your contribution towards your health insurance plan.

Review Your Employment Contract or Benefits Summary

Your employment contract or benefits summary should outline the healthcare coverage offered by your employer. This document will detail the type of plan, such as HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization), and provide information about deductibles, copayments, and other important features of your health insurance plan.

Contact Your Employer’s HR Department

If you’re unsure about the specifics of your health insurance coverage, reach out to your employer’s human resources (HR) department. They can provide you with detailed information about your plan, including the insurance provider, plan type, and any unique features or benefits it offers. HR representatives can also guide you through the process of enrolling in or changing your health insurance plan if needed.

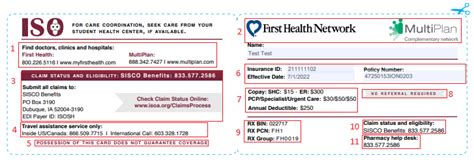

Examine Your Insurance Card

If you have an insurance card, it can provide valuable insights into your health insurance coverage. The card will typically display the name of your insurance provider, your policy number, and your unique identification details. It may also include information about your plan type and any specific benefits or limitations associated with your coverage.

Check with Your Insurance Provider Directly

In some cases, you may not have an insurance card or the necessary information from your employer. In such situations, you can contact your insurance provider directly. Most insurance companies have online portals or customer service hotlines where you can verify your coverage, access your policy details, and obtain any necessary documentation.

Review Your Recent Medical Bills

If you’ve recently received medical treatment, reviewing your medical bills can offer clues about your health insurance coverage. Look for any mentions of your insurance provider or plan on the bills. If your insurance has covered any part of the treatment, it should be reflected in the billing statements. However, keep in mind that this method may not provide a comprehensive understanding of your coverage, as some bills might not have been processed yet.

Types of Health Insurance Plans

Health insurance plans come in various forms, each with its own set of advantages and limitations. Understanding the type of plan you have is crucial for managing your healthcare expenses effectively. Here’s a breakdown of some common types of health insurance plans:

Health Maintenance Organization (HMO)

- Network of Providers: HMOs operate within a network of healthcare providers, including doctors, specialists, and hospitals. You must choose a primary care physician (PCP) within this network, who will coordinate your care and provide referrals to specialists if needed.

- Lower Costs: HMOs generally offer lower out-of-pocket costs compared to other plans, as they negotiate discounted rates with their network providers.

- Limited Choice: The trade-off for lower costs is a more restricted choice of providers. If you require specialized care or prefer a specific doctor outside the HMO network, you may incur additional expenses.

Preferred Provider Organization (PPO)

- Broader Network: PPOs offer a larger network of healthcare providers, providing you with more flexibility in choosing doctors and specialists.

- Out-of-Network Coverage: Unlike HMOs, PPOs typically cover out-of-network care, although at a higher cost. This feature can be beneficial if you require specialized treatment from a specific provider.

- Higher Costs: PPOs often come with higher premiums and out-of-pocket expenses compared to HMOs.

Exclusive Provider Organization (EPO)

- Limited Out-of-Network Coverage: EPOs function similarly to HMOs but offer more flexibility. While you must choose a primary care physician within the network, you can visit specialists without a referral. However, EPOs provide limited or no coverage for out-of-network care.

Point-of-Service (POS) Plan

- Combination of HMO and PPO Features: POS plans combine elements of both HMOs and PPOs. You choose a primary care physician within the network, but you can also access out-of-network care with higher out-of-pocket costs.

High-Deductible Health Plan (HDHP)

- Lower Premiums, Higher Deductibles: HDHPs offer lower monthly premiums but require you to pay a higher deductible before your insurance coverage kicks in. These plans are often paired with Health Savings Accounts (HSAs) to help you save for medical expenses.

Short-Term Health Insurance

- Temporary Coverage: Short-term health insurance plans provide coverage for a limited period, typically ranging from a few months to a year. They are designed for individuals who need temporary coverage between jobs or while waiting for long-term insurance options.

Comparing Health Insurance Plans

When comparing health insurance plans, several factors come into play. It’s essential to evaluate these aspects to find the plan that best suits your healthcare needs and financial situation.

Premium Costs

Premiums are the monthly payments you make to maintain your health insurance coverage. Compare the premiums of different plans to determine which one fits within your budget. Keep in mind that lower premiums may indicate higher out-of-pocket expenses or limited coverage.

Deductibles and Out-of-Pocket Limits

Deductibles are the amount you must pay out of pocket before your insurance coverage begins. Out-of-pocket limits, on the other hand, represent the maximum amount you’ll pay in a year for covered services. Plans with lower deductibles and out-of-pocket limits may be more expensive but provide greater financial protection.

Network of Providers

The network of providers is a crucial consideration, especially if you have a preferred doctor or specialist. Ensure that your chosen plan includes your preferred healthcare professionals in its network to avoid unexpected costs.

Coverage for Pre-Existing Conditions

If you have any pre-existing medical conditions, it’s essential to verify that your health insurance plan covers them. Some plans may have specific requirements or exclusions for pre-existing conditions, so thorough research is necessary.

Prescription Drug Coverage

Prescription medications can be costly, so it’s crucial to understand how your health insurance plan covers them. Compare the plans’ prescription drug formularies and copayment structures to ensure you can afford the medications you may need.

Maternity and Pediatric Care

If you’re planning a family or have children, consider the coverage for maternity and pediatric care. Ensure that the plan includes prenatal care, childbirth, and pediatric services to avoid unexpected expenses.

Navigating Health Insurance Coverage

Once you’ve determined that you have health insurance and understood the type of plan you’re enrolled in, it’s essential to familiarize yourself with the various aspects of your coverage. This knowledge will empower you to make informed decisions about your healthcare and effectively utilize your insurance benefits.

Understanding Your Policy

Take the time to carefully read and understand your health insurance policy. This document outlines the specifics of your coverage, including what’s included and excluded, as well as any limitations or restrictions. Familiarize yourself with the plan’s terms and conditions to avoid any surprises when seeking medical care.

Knowing Your Benefits

Health insurance plans offer a range of benefits, from preventive care to specialized treatments. Understand the scope of your coverage, including wellness checkups, screenings, mental health services, and any specific benefits tailored to your plan. Knowing your benefits ensures you can take full advantage of the services provided.

Choosing In-Network Providers

If you have an HMO or EPO plan, selecting an in-network provider is crucial for cost-effective care. Your insurance company’s website or customer service can help you locate nearby doctors and specialists within your network. This step ensures that your medical expenses are covered by your insurance plan.

Understanding Cost-Sharing

Health insurance plans typically involve cost-sharing, which means you share the cost of your healthcare with your insurance provider. This includes deductibles, copayments, and coinsurance. Understanding these cost-sharing arrangements helps you budget for your healthcare expenses and avoid unexpected financial burdens.

Maximizing Preventive Care

Many health insurance plans cover preventive care services, such as annual physicals, immunizations, and screenings, at little to no cost. Taking advantage of these services can help you stay healthy and detect potential health issues early on. Preventive care not only benefits your well-being but can also save you money in the long run by preventing more costly treatments.

Utilizing Customer Service and Online Portals

Your health insurance provider’s customer service team is a valuable resource for any questions or concerns you may have about your coverage. Additionally, many insurance companies offer online portals where you can access your policy details, view claims, and find a list of in-network providers. These digital tools can simplify the process of managing your health insurance.

Conclusion

Understanding your health insurance coverage is a critical step towards taking control of your healthcare. By following the steps outlined in this guide, you can confidently determine whether you have health insurance, identify the type of plan you’re enrolled in, and make informed decisions about your healthcare needs. Remember that health insurance is a complex topic, and it’s essential to stay informed and seek assistance when needed. With the right knowledge and resources, you can navigate the healthcare system effectively and protect your well-being.

How do I know if my health insurance covers a specific medical procedure or treatment?

+To determine if your health insurance covers a specific medical procedure or treatment, you can follow these steps: First, check your insurance policy or summary of benefits, which should outline the covered services and any exclusions. If you’re still unsure, contact your insurance provider’s customer service hotline. They can provide detailed information about your coverage and guide you through the pre-authorization process if necessary.

What should I do if I have a pre-existing condition and want to enroll in a new health insurance plan?

+If you have a pre-existing condition and are looking to enroll in a new health insurance plan, it’s crucial to carefully review the plan’s policy. Some plans may have specific requirements or exclusions for pre-existing conditions. During the enrollment process, you’ll typically be asked to disclose any pre-existing conditions. Be transparent and provide accurate information to ensure you’re not denied coverage for failing to disclose a pre-existing condition.

Can I switch health insurance plans during the year, or am I locked into my current plan until the next open enrollment period?

+Switching health insurance plans during the year is possible under certain circumstances. If you experience a qualifying life event, such as getting married, having a baby, or losing your job, you may be eligible for a Special Enrollment Period (SEP). During an SEP, you can enroll in a new health insurance plan outside of the typical open enrollment period. Check with your insurance provider or the healthcare marketplace to understand your options and the necessary steps to switch plans.

What happens if I have an emergency and need medical care while traveling abroad? Will my health insurance cover it?

+If you have an emergency and require medical care while traveling abroad, it’s essential to understand your health insurance coverage. Some health insurance plans include international coverage, while others may offer limited or no coverage outside your home country. Before traveling, check with your insurance provider to understand your specific coverage and any necessary steps to access care, such as contacting a designated assistance company.