Dental Insurance For Veterans

Dental health is an often-overlooked aspect of overall well-being, yet it plays a pivotal role in maintaining physical health and quality of life. For veterans, who have served their countries with dedication and sacrifice, access to quality dental care is not just a necessity but a crucial component of their healthcare rights.

This comprehensive guide aims to delve into the world of dental insurance for veterans, exploring the benefits, eligibility criteria, and the process of securing dental coverage. We will also provide insights into the value of dental insurance and the impact it can have on veterans' lives.

Understanding Dental Insurance for Veterans

Veterans, like any other individual, require regular dental check-ups and treatments to maintain optimal oral health. Dental insurance provides coverage for a range of dental services, from routine cleanings and examinations to more complex procedures such as root canals, extractions, and restorative treatments.

For veterans, dental insurance can bridge the gap between their service-related healthcare needs and the comprehensive care required to maintain their oral health. It ensures that veterans have access to the necessary dental services, promoting not only their oral health but also their overall physical and mental well-being.

The Importance of Dental Health for Veterans

Oral health is an integral part of overall health and can significantly impact an individual’s quality of life. For veterans, who often face unique challenges and experiences, maintaining good dental health can be even more critical.

Veterans may encounter various dental issues, such as tooth decay, gum disease, or trauma-related dental injuries. These issues, if left untreated, can lead to severe complications, including infections, pain, and even systemic health problems. Dental insurance provides a vital safety net, ensuring that veterans can access the care they need without financial barriers.

Furthermore, good oral health can positively impact veterans' mental well-being. Dental issues can cause discomfort, pain, and self-esteem issues, affecting their overall mood and daily functioning. By addressing these issues promptly, dental insurance can help veterans maintain their confidence and improve their quality of life.

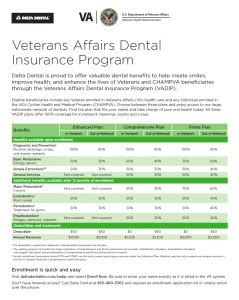

Veterans Affairs (VA) Dental Benefits

The Department of Veterans Affairs (VA) offers a range of dental benefits for eligible veterans. These benefits aim to provide access to dental care for those who may not otherwise have insurance coverage.

The VA dental program offers various services, including preventive care, diagnostic services, restorative treatments, and emergency dental care. However, it's important to note that not all veterans are eligible for these benefits, and the coverage provided may not be as comprehensive as traditional dental insurance plans.

| VA Dental Service | Description |

|---|---|

| Preventive Care | Regular dental check-ups, cleanings, and fluoride treatments to maintain oral health. |

| Diagnostic Services | X-rays, oral cancer screenings, and other diagnostic procedures to detect dental issues. |

| Restorative Treatments | Fillings, crowns, bridges, and other procedures to repair or replace damaged teeth. |

| Emergency Dental Care | Immediate treatment for severe dental pain, swelling, or trauma-related injuries. |

Eligibility for Dental Insurance

The eligibility criteria for dental insurance can vary depending on the specific plan and provider. However, there are some general guidelines that apply to veterans seeking dental coverage.

Veterans Affairs (VA) Eligibility

To be eligible for VA dental benefits, veterans must meet certain criteria set by the Department of Veterans Affairs. These criteria typically include:

- Service-Connected Disability: Veterans with service-connected disabilities rated at 100% or 100% P&T (Permanent and Total) are generally eligible for comprehensive dental care.

- Former Prisoners of War (POWs): Veterans who were prisoners of war for at least 90 days during military service are eligible for dental care.

- Purple Heart Recipients: Veterans who have received the Purple Heart medal for their service are eligible for dental care.

- Veterans with Specific Conditions: Veterans with certain conditions, such as dental trauma or certain medical conditions, may be eligible for dental care.

- Veterans with Low Income: Some veterans with low incomes may qualify for VA dental care through the Means Test.

It's important to note that eligibility criteria can vary, and veterans should consult the VA website or speak with a VA representative to determine their specific eligibility.

Private Dental Insurance Eligibility

Private dental insurance plans offer coverage to a wider range of individuals, including veterans. These plans are typically available through employers, individual purchases, or as part of a family plan. Eligibility for private dental insurance often depends on factors such as:

- Employer-Provided Plans: Veterans who are employed may have access to dental insurance through their employer's benefits package.

- Individual Plans: Veterans can purchase private dental insurance on their own, either directly from an insurance company or through a health insurance marketplace.

- Family Plans: Veterans with families may be eligible for family dental insurance plans, providing coverage for themselves and their dependents.

- Medicaid and Medicare: Some veterans may qualify for Medicaid or Medicare, which can provide dental coverage. However, the level of coverage may vary.

When considering private dental insurance, veterans should carefully review the plan's benefits, coverage limits, and any exclusions to ensure it meets their specific dental needs.

Securing Dental Insurance for Veterans

Securing dental insurance as a veteran involves understanding the available options and taking the necessary steps to enroll in a suitable plan. Here’s a step-by-step guide to help veterans navigate the process.

Step 1: Understanding VA Dental Benefits

The first step is to understand the dental benefits offered by the Department of Veterans Affairs. Veterans should visit the VA website, https://www.va.gov/health-care/get-care/dental-care, to explore the eligibility criteria and the services covered by the VA dental program.

Veterans should also consider speaking with a VA representative or healthcare provider to clarify any doubts and determine their specific eligibility.

Step 2: Exploring Private Dental Insurance Options

For veterans who are not eligible for VA dental benefits or require additional coverage, exploring private dental insurance options is essential. Here are some steps to consider:

- Research Plans: Research different private dental insurance plans available in your area. Compare the benefits, coverage limits, and costs to find a plan that aligns with your dental needs and budget.

- Employer Benefits: If you're employed, check with your employer to see if they offer dental insurance as part of their benefits package. Many employers provide dental coverage, which can be a cost-effective option.

- Health Insurance Marketplace: Visit the Health Insurance Marketplace, https://www.healthcare.gov, to explore dental insurance plans available in your state. You can compare plans and apply for coverage during the open enrollment period.

- Individual or Family Plans: Consider purchasing an individual dental insurance plan or enrolling in a family plan if you have dependents. Ensure the plan covers the necessary dental services and consider any additional benefits or discounts offered.

- Medicaid and Medicare: If you qualify for Medicaid or Medicare, check the dental coverage provided by these programs. While the coverage may be limited, it can still provide some financial assistance for dental care.

Step 3: Enrollment and Coverage

Once you’ve identified the dental insurance plan that best suits your needs, it’s time to enroll. Here’s what you need to do:

- Review Plan Details: Carefully review the plan's summary of benefits and coverage to ensure it meets your dental requirements. Pay attention to any exclusions or limitations.

- Complete Enrollment Forms: Obtain and complete the necessary enrollment forms provided by the insurance company or the Health Insurance Marketplace. Ensure you provide accurate and complete information.

- Submit Supporting Documents: Depending on the plan, you may need to submit supporting documents, such as proof of eligibility or identification. Ensure you have all the required documents ready.

- Pay Premiums: Most dental insurance plans require the payment of premiums, either monthly or annually. Set up a payment method and ensure timely payments to maintain your coverage.

- Understand Waiting Periods: Some dental insurance plans have waiting periods before certain benefits become effective. Be aware of these waiting periods and plan your dental treatments accordingly.

Maximizing Dental Insurance Benefits

Once you have secured dental insurance, it’s essential to understand how to maximize your benefits and make the most of your coverage. Here are some tips to help you get the most value from your dental insurance plan.

Understanding Your Plan’s Coverage

Each dental insurance plan has its own set of benefits and coverage limits. It’s crucial to understand what your plan covers, including the types of dental procedures, the percentage of costs covered, and any annual or lifetime maximums.

Review your plan's summary of benefits, which outlines the specific services covered, the percentage of costs reimbursed, and any exclusions. This information will help you make informed decisions about your dental care and financial planning.

Utilizing Preventive Care

Preventive dental care is an essential aspect of maintaining good oral health. Most dental insurance plans cover preventive services, such as routine cleanings, examinations, and X-rays. These services help detect dental issues early on, allowing for timely treatment and potentially preventing more complex and costly procedures.

Make sure to schedule regular dental check-ups and take advantage of the preventive care benefits offered by your insurance plan. Early detection and treatment can save you from experiencing severe dental problems and reduce your overall dental expenses.

Exploring Additional Benefits

Some dental insurance plans offer additional benefits beyond basic coverage. These may include discounts on certain procedures, coverage for orthodontic treatment, or access to a network of preferred providers.

Explore the additional benefits provided by your plan and consider how they can enhance your dental care experience. For example, if you have a specific dental issue or require specialized treatment, knowing about these benefits can help you make informed decisions about your care.

Understanding Out-of-Pocket Costs

Dental insurance typically requires you to pay a portion of the costs for certain procedures, known as out-of-pocket expenses. These can include deductibles, co-pays, and co-insurance. Understanding these costs is crucial for financial planning and managing your dental expenses effectively.

Review your plan's out-of-pocket cost information, including any deductibles you must meet before your insurance coverage kicks in. Additionally, be aware of any co-pays or co-insurance percentages you may be responsible for paying during each dental visit.

By understanding these costs, you can budget accordingly and plan your dental treatments strategically, especially if you have a high deductible or co-insurance percentage.

The Impact of Dental Insurance on Veterans’ Lives

Dental insurance can have a significant impact on veterans’ lives, improving their overall health and well-being. Here’s how dental insurance can make a difference:

Improved Oral Health

With dental insurance, veterans have access to regular dental check-ups, cleanings, and preventive care. This helps maintain their oral health, preventing issues such as tooth decay, gum disease, and oral infections. Early detection and treatment of dental problems can lead to better overall health outcomes and a reduced risk of complications.

Financial Relief

Dental treatments can be costly, especially for complex procedures. Dental insurance provides financial relief by covering a portion or, in some cases, the full cost of dental services. This can alleviate the financial burden on veterans, allowing them to access necessary dental care without worrying about the associated costs.

Enhanced Quality of Life

Good oral health is closely linked to overall well-being. Dental insurance ensures that veterans can address dental issues promptly, reducing pain, discomfort, and potential complications. This can improve their quality of life, allowing them to eat, speak, and socialize without embarrassment or pain.

Peace of Mind

Knowing that they have dental insurance provides veterans with peace of mind. They can rest assured that they have access to the necessary dental care, regardless of their financial situation. This sense of security can reduce stress and anxiety related to dental health and overall well-being.

FAQs

Can veterans get free dental care through the VA?

+Yes, veterans who meet certain eligibility criteria, such as having a service-connected disability rated at 100% or 100% P&T, are eligible for comprehensive dental care through the VA. Other veterans may be eligible for limited dental care based on specific conditions or circumstances.

What if I don’t qualify for VA dental benefits?

+If you don’t qualify for VA dental benefits, you can explore private dental insurance options. These plans are typically available through employers, individual purchases, or as part of a family plan. It’s important to research and compare different plans to find one that suits your needs and budget.

How do I apply for VA dental benefits?

+To apply for VA dental benefits, you can visit the VA website and follow the instructions provided. You’ll need to complete an application form and provide supporting documentation, such as proof of eligibility or military service records. It’s recommended to consult with a VA representative or healthcare provider for guidance.

Are there any discounts or programs for veterans who need dental insurance?

+Yes, some dental insurance companies offer discounts or programs specifically for veterans. These programs may provide reduced premiums or additional benefits tailored to veterans’ needs. It’s worth exploring these options when researching private dental insurance plans.

Can I use my VA dental benefits at any dentist?

+VA dental benefits typically require you to use dentists within the VA healthcare system. However, in some cases, the VA may authorize treatment with a non-VA dentist if it’s not available within the VA network. It’s important to check with the VA or your local VA facility for specific guidelines and authorization requirements.

Dental insurance for veterans is a vital aspect of their overall healthcare. It provides access to essential dental care, improves oral health, and offers financial relief. By understanding the eligibility criteria, exploring available options, and maximizing their benefits, veterans can ensure they receive the necessary dental care they deserve.