Cost For Renters Insurance Per Month Average

Renter's insurance is a crucial aspect of financial protection for individuals who live in rented accommodations. It provides coverage for personal belongings, liability, and additional living expenses in the event of various unforeseen circumstances. While the cost of renter's insurance can vary based on numerous factors, understanding the average monthly expenses can offer valuable insights for prospective policyholders.

Factors Influencing the Cost of Renter’s Insurance

The cost of renter’s insurance is determined by a combination of personal factors and the specific policy selected. Here are some key considerations that can impact the average monthly premium:

- Location: The geographic location of the rental property plays a significant role. Areas with higher crime rates or a history of natural disasters may incur higher insurance costs.

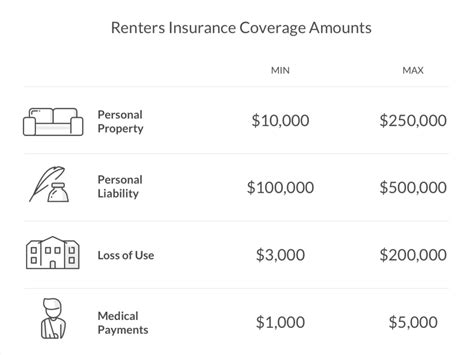

- Coverage Amount: The amount of coverage an individual chooses directly affects the premium. Higher coverage limits will result in a higher monthly cost.

- Deductibles: Similar to other insurance policies, renters can opt for higher deductibles to reduce their monthly premiums. However, this means they will pay more out-of-pocket in the event of a claim.

- Personal Property Value: The value of personal belongings also influences the cost of insurance. Renters with valuable items or expensive electronics may require additional coverage, increasing their monthly premiums.

- Additional Coverage: Renters may choose to add optional coverage for specific items or situations. For instance, coverage for high-value items like jewelry or artwork, or additional liability protection, can increase the monthly cost.

Average Monthly Cost of Renter’s Insurance

According to industry data and surveys, the average monthly cost of renter’s insurance in the United States ranges from 15 to 30, depending on the state and the provider. However, it’s important to note that this is just an average, and actual costs can vary significantly based on individual circumstances.

For instance, a recent study by InsuranceQuotes revealed that the average annual cost of renter's insurance in the U.S. is $187, which translates to an average monthly premium of approximately $15.60. However, this average cost can vary widely across different states. For example, renter's insurance in Florida averages around $23 per month, while in California, it's closer to $12 per month.

| State | Average Monthly Cost |

|---|---|

| Florida | $23 |

| California | $12 |

| Texas | $17 |

| New York | $14 |

| Illinois | $16 |

These variations are influenced by factors such as the state's average property values, crime rates, and the frequency of natural disasters. For instance, Florida's higher average cost can be attributed to its susceptibility to hurricanes and other natural calamities.

Tips to Reduce Monthly Renter’s Insurance Costs

While the average monthly cost of renter’s insurance is relatively affordable, there are strategies renters can employ to further reduce their insurance expenses:

- Bundle Policies: Many insurance providers offer discounts when customers bundle multiple policies, such as renter's insurance with auto insurance. This can lead to significant savings.

- Increase Deductibles: Opting for a higher deductible can lower monthly premiums. However, renters should ensure they can afford the deductible amount if they need to file a claim.

- Compare Providers: Shopping around and comparing quotes from different insurance companies can help renters identify the most cost-effective option for their needs.

- Maintain a Good Credit Score: Insurance providers often use credit scores as a factor in determining premiums. A higher credit score can lead to lower insurance costs.

- Review Coverage Regularly: Renters should periodically review their insurance policies to ensure they have the right amount of coverage and aren't overpaying for unnecessary features.

The Benefits of Renter’s Insurance

While the focus has been on the cost of renter’s insurance, it’s important to emphasize the benefits and peace of mind it provides. Renter’s insurance offers protection against various risks, including:

- Theft: If personal belongings are stolen from the rental property, renter's insurance can provide coverage for their replacement.

- Fire or Water Damage: In the event of a fire, flood, or other water-related incidents, renter's insurance can help cover the cost of repairing or replacing damaged items.

- Liability Protection: This coverage protects renters if they are held legally responsible for an accident or injury that occurs on the rental property.

- Additional Living Expenses: If a rental property becomes uninhabitable due to a covered event, renter's insurance can help cover the cost of temporary housing and other living expenses.

Additionally, renter's insurance often includes personal liability coverage, which can provide financial protection if a guest is injured on the rental property or if the renter accidentally causes damage to someone else's property.

Conclusion

Understanding the average monthly cost of renter’s insurance is a crucial step in making informed financial decisions. While the average premium ranges from 15 to 30 per month, the actual cost can vary based on individual circumstances and location. By considering the factors that influence insurance costs and implementing strategies to reduce premiums, renters can ensure they have adequate coverage without breaking the bank.

How does renter’s insurance work, and what does it cover?

+Renter’s insurance is a contract between the policyholder and the insurance company, where the insurer agrees to cover the policyholder’s personal property and provide liability protection. It typically covers personal belongings against theft, fire, and water damage, as well as offering liability protection if the renter is sued for bodily injury or property damage caused to others. Additionally, it may provide coverage for additional living expenses if the rental property becomes uninhabitable due to a covered loss.

Is renter’s insurance required by law, or is it optional?

+Renter’s insurance is not typically required by law, but it is strongly recommended. While the landlord’s insurance may cover the building itself, it does not cover the tenant’s personal belongings or provide liability protection for the tenant. Renter’s insurance offers these crucial protections, ensuring that tenants are financially protected in the event of a loss or liability claim.

What are some common misconceptions about renter’s insurance?

+One common misconception is that renter’s insurance is unnecessary because the landlord’s insurance will cover any losses. However, as mentioned, landlord’s insurance typically only covers the building, not the tenant’s belongings. Another misconception is that renter’s insurance is too expensive. While costs can vary, the average monthly premium is relatively affordable, and there are strategies to reduce these costs further.