Consumer Reports Best Medicare Supplemental Insurance

Medicare Supplemental Insurance, often referred to as Medigap, plays a crucial role in ensuring that Medicare beneficiaries have access to comprehensive healthcare coverage. With a vast array of insurance options available, choosing the best Medigap plan can be a daunting task. Consumer Reports, a trusted source for unbiased product and service evaluations, has conducted extensive research to provide valuable insights into the best Medicare Supplemental Insurance plans. In this comprehensive guide, we will delve into the world of Medigap, explore the Consumer Reports findings, and help you make an informed decision about your healthcare coverage.

Understanding Medicare Supplemental Insurance (Medigap)

Medigap, or Medicare Supplemental Insurance, is a set of standardized insurance plans designed to fill the gaps in Original Medicare coverage. These plans, offered by private insurance companies, cover various out-of-pocket expenses that Medicare Parts A and B do not typically cover. By understanding the benefits and limitations of Medigap, individuals can make informed choices to tailor their healthcare coverage to their specific needs.

The Importance of Medigap

Original Medicare, consisting of Part A (hospital insurance) and Part B (medical insurance), provides essential coverage for many healthcare services. However, it leaves certain gaps, such as deductibles, coinsurance, and copayments, which can result in significant out-of-pocket expenses. Medigap plans step in to cover these gaps, offering additional financial protection and peace of mind for Medicare beneficiaries.

Standardized Medigap Plans

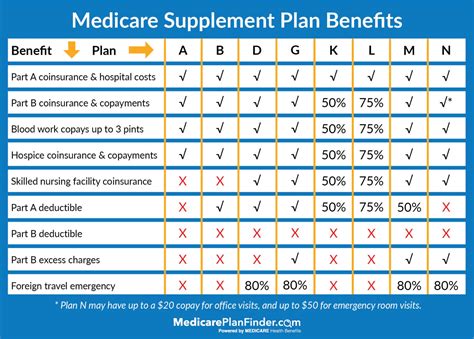

One of the unique aspects of Medigap is the standardization of plans. Each Medigap plan is labeled with a letter (A, B, C, D, F, G, K, L, M, N, or S) and offers a predetermined set of benefits. This standardization ensures that individuals can easily compare plans across different insurance companies, making it simpler to choose the most suitable option.

| Medigap Plan | Benefits Covered |

|---|---|

| Plan A | Basic coverage including deductibles, coinsurance, and hospice care. |

| Plan B | Includes all Plan A benefits plus blood deductibles and foreign travel emergency care. |

| Plan C | Offers more comprehensive coverage, including skilled nursing facility care coinsurance and Part B excess charges. |

| ... | ... |

| Plan N | Provides coverage for coinsurance, copayments, and some additional benefits. |

Consumer Reports: Evaluating the Best Medicare Supplemental Insurance

Consumer Reports, known for its rigorous evaluation methods, has conducted an in-depth analysis of Medicare Supplemental Insurance plans to help consumers make informed choices. Their comprehensive approach considers various factors, including plan benefits, cost, and insurer reputation, to determine the best Medigap options available.

The Methodology Behind Consumer Reports’ Ratings

Consumer Reports employs a meticulous methodology to assess Medigap plans. They evaluate each plan based on its coverage, ensuring that it aligns with the needs of Medicare beneficiaries. Additionally, they analyze the financial stability and customer satisfaction ratings of the insurance companies offering these plans. By considering these factors, Consumer Reports provides a well-rounded perspective on the quality and reliability of Medigap options.

Top-Rated Medigap Plans According to Consumer Reports

Based on their extensive research, Consumer Reports has identified several Medigap plans that consistently rank highly in terms of coverage, cost, and insurer reputation. These plans offer a balance of comprehensive benefits and competitive pricing, making them attractive options for Medicare beneficiaries.

- Plan F: One of the most popular Medigap plans, Plan F covers a wide range of out-of-pocket expenses, including Part A deductible, Part B deductible, and excess charges. It provides extensive coverage, making it a preferred choice for many individuals.

- Plan G: Similar to Plan F, Plan G offers comprehensive coverage but differs in that it does not cover the Part B deductible. However, it provides coverage for all other gaps in Original Medicare, making it a cost-effective option.

- Plan N: Plan N is known for its affordability, covering many out-of-pocket expenses while maintaining a lower premium. It covers coinsurance, copayments, and some additional benefits, making it an attractive choice for budget-conscious individuals.

Factors to Consider When Choosing a Medigap Plan

When selecting a Medicare Supplemental Insurance plan, it’s crucial to consider several factors to ensure you choose the right option for your healthcare journey. Here are some key aspects to keep in mind:

Your Healthcare Needs

Understanding your healthcare needs is essential. Consider your medical history, any pre-existing conditions, and the types of medical services you may require. Some Medigap plans offer more specialized coverage for specific conditions, so tailoring your plan to your needs is vital.

Cost and Budget

Medigap plans come with varying premium costs. It’s important to assess your budget and choose a plan that aligns with your financial capabilities. Consumer Reports’ ratings can help you identify cost-effective options without compromising on coverage.

Insurance Company Reputation

The financial stability and reputation of the insurance company offering the Medigap plan are crucial factors. Researching the insurer’s track record, customer satisfaction ratings, and claim settlement processes ensures that you choose a reliable and trustworthy provider.

Plan Benefits and Coverage

Carefully review the benefits and coverage provided by each Medigap plan. Compare the plans based on the specific gaps they cover, such as deductibles, coinsurance, and copayments. Ensure that the plan aligns with your anticipated healthcare expenses.

Enrollment Periods and Eligibility

Understanding the enrollment periods and eligibility requirements for Medigap plans is essential. The Medicare Open Enrollment Period is a crucial time to enroll in a Medigap plan, as it offers special protections and guarantees acceptance. Being aware of these periods ensures you don’t miss out on valuable opportunities.

Medigap vs. Medicare Advantage: Making the Right Choice

When exploring Medicare Supplemental Insurance options, it’s important to distinguish between Medigap and Medicare Advantage plans. While Medigap plans work alongside Original Medicare, Medicare Advantage plans (also known as Part C) are an alternative to Original Medicare.

Understanding Medicare Advantage Plans

Medicare Advantage plans are offered by private insurance companies and provide an all-in-one solution, covering Parts A, B, and often Part D (prescription drug coverage). These plans typically include additional benefits such as vision, dental, and hearing coverage. However, it’s important to note that Medicare Advantage plans may have a limited network of providers and require prior authorization for certain services.

Comparing Medigap and Medicare Advantage

The choice between Medigap and Medicare Advantage depends on individual preferences and healthcare needs. Medigap plans offer flexibility and the ability to choose your own healthcare providers, while Medicare Advantage plans provide a more comprehensive and often more affordable option with additional benefits. Consumer Reports provides valuable insights into both types of plans, helping you make an informed decision.

Real-Life Success Stories: Consumer Reports’ Impact

Consumer Reports’ evaluations of Medicare Supplemental Insurance plans have had a significant impact on the lives of many Medicare beneficiaries. By providing unbiased and comprehensive information, Consumer Reports has empowered individuals to make informed choices about their healthcare coverage. Here are a few real-life success stories:

-

Mr. Johnson's Journey to Peace of Mind

Mr. Johnson, a retired teacher, was overwhelmed by the multitude of Medigap plan options. After consulting Consumer Reports' ratings, he found Plan G to be the perfect fit. With its comprehensive coverage and competitive pricing, Mr. Johnson gained peace of mind, knowing he was protected from unexpected healthcare expenses.

-

Ms. Williams' Affordable Coverage

Ms. Williams, a senior on a fixed income, needed an affordable Medigap plan. Consumer Reports' evaluation led her to Plan N, which offered excellent coverage at a lower premium. She was able to save money while still receiving the necessary healthcare services without worrying about financial strain.

-

The Smith Family's Customized Plan

The Smith family, with a history of heart conditions, sought a Medigap plan that catered to their specific needs. Consumer Reports' analysis helped them identify Plan C, which provided specialized coverage for cardiovascular care. With this plan, the family felt secure knowing they had access to the specialized medical services they required.

The Future of Medicare Supplemental Insurance

The landscape of Medicare Supplemental Insurance is constantly evolving, with new plans, regulations, and innovations emerging. As healthcare needs and technologies advance, Medigap plans are adapting to meet the changing demands of Medicare beneficiaries.

Emerging Trends in Medigap

One notable trend in Medigap is the increasing focus on value-based care. Insurance companies are developing plans that incentivize preventative care and wellness, aiming to improve overall health outcomes. Additionally, there is a growing emphasis on digital health solutions, with Medigap plans incorporating telemedicine and remote monitoring services.

Government Initiatives and Regulatory Changes

The U.S. government plays a crucial role in shaping the Medigap market. Ongoing initiatives, such as the Medicare Access and CHIP Reauthorization Act (MACRA), aim to improve healthcare quality and value. Regulatory changes, including the implementation of the Medicare Advantage Open Enrollment Period, provide beneficiaries with additional opportunities to enroll in Medicare Advantage plans.

The Impact of Technological Advancements

Technological advancements are revolutionizing the healthcare industry, and Medigap plans are no exception. Telehealth services, digital health platforms, and wearable technology are transforming the way healthcare is delivered and monitored. These innovations enhance patient engagement, improve access to care, and offer new opportunities for insurers to provide tailored coverage.

Conclusion

Choosing the best Medicare Supplemental Insurance plan is a crucial decision that can significantly impact your healthcare journey. Consumer Reports’ unbiased evaluations and comprehensive research provide a valuable resource for individuals navigating the complex world of Medigap. By understanding the factors that influence your choice, assessing your healthcare needs, and considering the latest trends and innovations, you can make an informed decision to ensure you have the coverage you deserve.

What is the difference between Medigap and Medicare Advantage plans?

+Medigap plans supplement Original Medicare (Parts A and B) and fill coverage gaps, while Medicare Advantage plans (Part C) are an alternative to Original Medicare, offering all-in-one coverage with additional benefits. Medigap provides flexibility in choosing providers, while Medicare Advantage may have a limited network.

How do I choose the right Medigap plan for my needs?

+Consider your healthcare needs, budget, and the reputation of the insurance company. Assess the plan’s coverage, compare benefits, and evaluate your anticipated healthcare expenses. Consumer Reports’ ratings can guide you in finding the most suitable plan.

Are there any special enrollment periods for Medigap plans?

+Yes, the Medicare Open Enrollment Period is a crucial time to enroll in a Medigap plan. During this period, you are guaranteed acceptance, regardless of pre-existing conditions, and may not face higher premiums due to your health status.

Can I switch Medigap plans after enrolling?

+Yes, you have the option to switch Medigap plans during specific enrollment periods, such as the Medicare Open Enrollment Period or when certain life events occur. However, it’s important to understand the implications and potential costs associated with switching plans.

How can I find more information about Medigap plans in my area?

+You can visit the official Medicare website or contact your local Medicare office for detailed information about Medigap plans available in your area. Additionally, you can consult insurance agents or brokers who specialize in Medicare plans.