Conceal And Carry Insurance

In today's world, personal safety and protection have become increasingly important topics of discussion. With the rise in concerns about self-defense and the growing number of individuals choosing to exercise their right to carry firearms, the need for comprehensive insurance coverage has emerged as a critical aspect to consider.

Conceal and Carry Insurance, often referred to as CACI, is a specialized insurance policy designed to provide coverage for individuals who legally carry concealed firearms. This type of insurance offers a unique set of benefits and protections tailored to the specific needs of gun carriers, addressing potential liabilities and providing peace of mind.

Understanding Conceal and Carry Insurance

CACI policies are designed to protect individuals who possess a valid Concealed Carry Permit (CCP) or a License to Carry (LTC). These permits allow individuals to carry concealed firearms for self-defense purposes, adhering to the legal requirements and regulations of their respective jurisdictions.

While possessing a CCP or LTC is a significant step towards personal protection, it is essential to recognize that it does not cover all potential liabilities that may arise from carrying a firearm. This is where Conceal and Carry Insurance steps in, offering a comprehensive solution to address these concerns.

Key Coverage Elements

CACI policies typically include a range of coverage options, each addressing different aspects of liability and providing financial protection. Here are some of the key coverage elements commonly found in Conceal and Carry Insurance policies:

- Liability Coverage: This provides protection in the event that an insured individual accidentally discharges their firearm, causing injury or property damage to others. Liability coverage helps cover legal fees and potential settlements or judgments.

- Legal Defense Coverage: If an insured individual is involved in a self-defense incident and faces legal charges, this coverage provides financial support for their legal defense, including attorney fees and court costs.

- Replacement or Repair Coverage: In the unfortunate event of firearm theft, loss, or damage, this coverage assists with the cost of replacing or repairing the insured's firearm, ensuring they can quickly regain their means of self-defense.

- Medical Payment Coverage: This coverage extends to situations where the insured individual accidentally injures themselves or others while handling their firearm. It provides financial assistance for medical expenses, regardless of fault.

- Travel Assistance: Many CACI policies include travel assistance benefits, offering support for emergencies that may occur while traveling, such as lost or stolen firearms, medical emergencies, or legal assistance in unfamiliar jurisdictions.

It is important to note that the specific coverage elements and limits may vary depending on the insurance provider and the policy chosen. It is crucial to carefully review the policy terms and conditions to ensure that the coverage aligns with the individual's unique needs and circumstances.

Benefits of Conceal and Carry Insurance

Conceal and Carry Insurance offers a range of benefits that can provide significant peace of mind for individuals who choose to carry firearms for self-defense.

Legal Protection

One of the primary benefits of CACI is the legal protection it provides. In the event of a self-defense incident, the insured individual may face legal challenges, including criminal charges or civil lawsuits. CACI policies typically offer coverage for legal defense costs, ensuring that the insured has access to qualified legal representation to navigate these complex situations.

Legal defense coverage is particularly crucial as it can be financially burdensome to defend oneself in court. With CACI, individuals can focus on their legal strategy and peace of mind rather than worrying about the financial implications of legal proceedings.

Financial Security

CACI policies provide financial security by covering a range of potential expenses that may arise from carrying a concealed firearm. These expenses can include liability claims, legal fees, medical costs, and even the replacement or repair of the firearm itself. By having this comprehensive coverage, individuals can avoid significant financial setbacks and maintain their ability to protect themselves and their loved ones.

Travel Assistance

For individuals who frequently travel, CACI policies often include travel assistance benefits. This can be especially valuable when traveling to different states or countries, where firearm laws and regulations may vary. Travel assistance coverage can provide support for a range of emergencies, such as lost or stolen firearms, medical emergencies, or even legal assistance in unfamiliar jurisdictions.

By having travel assistance coverage, individuals can feel more confident and secure when carrying their firearms during their travels, knowing that they have access to the necessary support and resources if any unforeseen incidents occur.

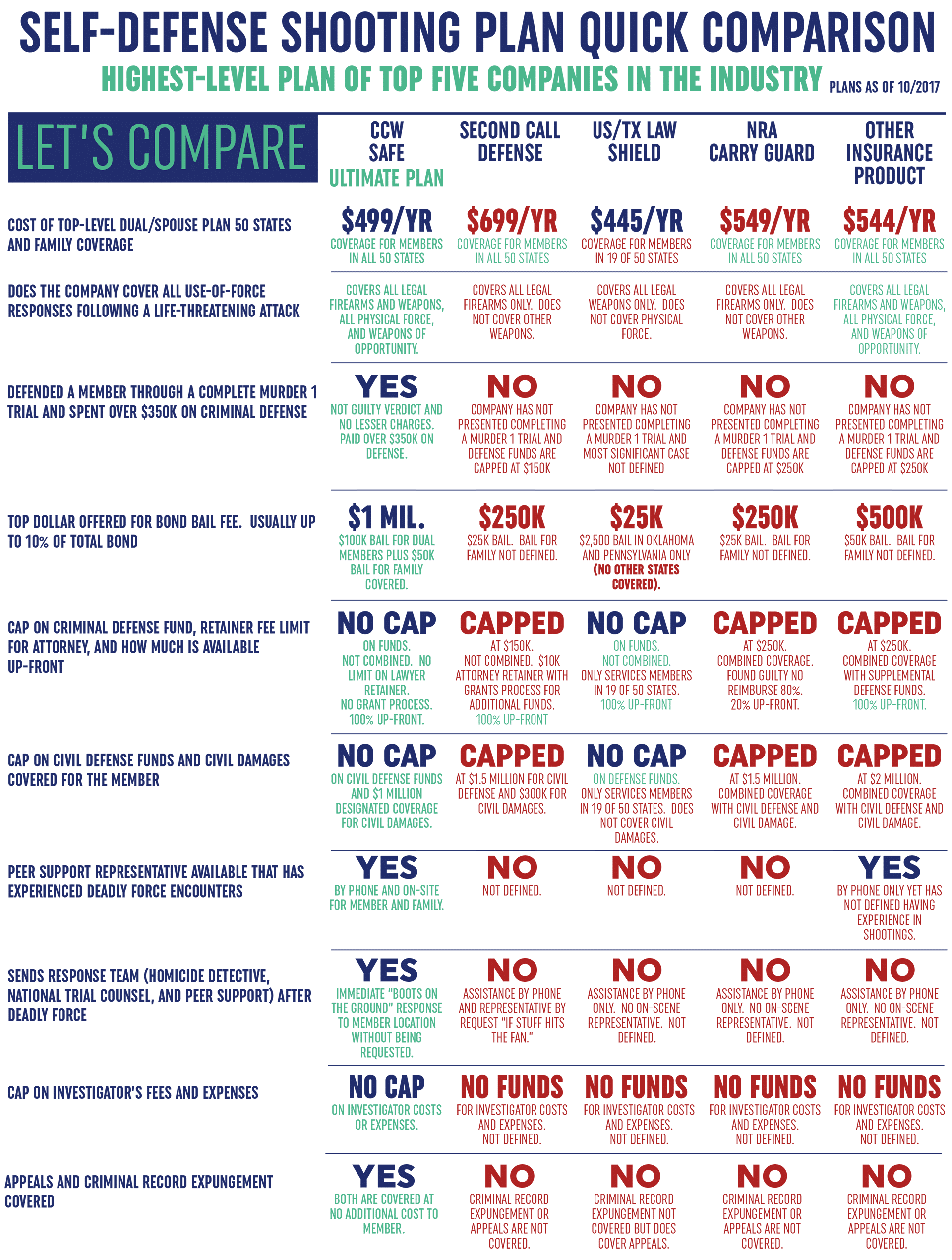

Selecting the Right Conceal and Carry Insurance

When it comes to choosing the right Conceal and Carry Insurance policy, there are several factors to consider to ensure that the coverage meets your specific needs.

Coverage Limits and Deductibles

Review the policy’s coverage limits and deductibles to understand the extent of protection it offers. Consider your personal circumstances and the potential risks you may face. Higher coverage limits may provide more comprehensive protection but may also result in higher premiums. Choose a policy with coverage limits that align with your comfort level and potential liabilities.

Policy Exclusions

Carefully read the policy’s exclusions to understand what situations or incidents are not covered. Exclusions can vary between insurance providers and policies, so it is essential to be aware of any limitations to avoid unexpected gaps in coverage. If you have specific concerns or scenarios you want to ensure are covered, discuss them with your insurance provider to clarify any potential exclusions.

Additional Coverage Options

Some insurance providers offer additional coverage options that can be added to the base CACI policy. These may include enhanced liability coverage, identity theft protection, or even coverage for ammunition. Consider your unique needs and circumstances to determine if any of these additional coverages would provide valuable protection.

Provider Reputation and Financial Stability

Research the reputation and financial stability of the insurance provider offering the CACI policy. Choose a reputable provider with a solid track record of paying claims promptly and fairly. A financially stable provider ensures that they will be able to provide the promised coverage and support when needed.

Performance Analysis and Real-World Examples

To illustrate the value and effectiveness of Conceal and Carry Insurance, let’s examine a real-world scenario and analyze how CACI could provide critical support.

Imagine a licensed concealed carry holder, John, who is involved in a self-defense incident where he accidentally discharges his firearm, causing property damage to a nearby vehicle. In this scenario, John's CACI policy would come into play, offering the following benefits:

- Liability Coverage: John's CACI policy would cover the cost of repairing the damaged vehicle, providing financial protection against the liability claim.

- Legal Defense Coverage: If John faces legal charges or is sued by the vehicle owner, his CACI policy would provide coverage for his legal defense costs, ensuring he has access to skilled legal representation.

- Medical Payment Coverage: In the event that John or the vehicle owner sustains any injuries during the incident, the medical payment coverage would assist with the medical expenses, regardless of who is at fault.

This real-world example highlights how Conceal and Carry Insurance can provide comprehensive protection and financial support in a range of scenarios, offering peace of mind to individuals who choose to carry firearms for self-defense.

Future Implications and Industry Insights

The demand for Conceal and Carry Insurance is expected to continue growing as more individuals recognize the importance of comprehensive coverage when carrying firearms. As the industry evolves, insurance providers are likely to enhance their CACI policies to better meet the needs of this specific market.

Some potential future developments and industry insights include:

- Increased Coverage Limits: Insurance providers may offer higher coverage limits to address the growing number of high-profile self-defense incidents and the associated legal and financial implications.

- Enhanced Legal Defense Benefits: CACI policies may include more comprehensive legal defense coverage, providing support for a wider range of legal proceedings, including civil lawsuits and criminal charges.

- Integration of Technology: Insurance providers may leverage technology to streamline the claims process, offering digital platforms for policyholders to file claims and track their progress.

- Education and Training: Insurance providers may collaborate with firearms training organizations to offer educational resources and discounts on training programs, promoting responsible firearm ownership and handling.

- Partnerships with Firearms Manufacturers: Insurance providers may form partnerships with reputable firearms manufacturers, offering exclusive benefits or discounts to policyholders who purchase their firearms from these manufacturers.

As the Conceal and Carry Insurance industry continues to evolve, policyholders can expect more tailored and comprehensive coverage options, ensuring their personal safety and financial well-being.

| Coverage Element | Description |

|---|---|

| Liability Coverage | Protects against financial liabilities arising from accidental discharge of firearm. |

| Legal Defense Coverage | Provides financial support for legal defense in self-defense incidents. |

| Replacement/Repair Coverage | Assists with costs of replacing or repairing stolen, lost, or damaged firearms. |

| Medical Payment Coverage | Covers medical expenses for insured and others injured during firearm handling. |

| Travel Assistance | Offers support for emergencies while traveling, including firearm-related incidents. |

Can I customize my Conceal and Carry Insurance policy to suit my specific needs?

+Absolutely! Many insurance providers offer customizable CACI policies, allowing you to choose the coverage elements and limits that best fit your circumstances. You can tailor the policy to address your specific concerns, such as higher liability limits or additional coverage for travel assistance.

Is Conceal and Carry Insurance only for individuals who carry firearms for self-defense?

+While CACI policies are primarily designed for individuals who carry firearms for self-defense, they can also provide coverage for a range of firearm-related activities. This includes competitive shooting, hunting, or even carrying firearms for personal protection while traveling. The specific coverage and exclusions may vary, so it’s important to review the policy terms carefully.

What happens if I’m involved in a self-defense incident and need to use my CACI policy?

+In the event of a self-defense incident, it’s important to follow the instructions provided by your insurance company. Typically, you would need to notify them promptly and provide a detailed account of the incident. They will guide you through the claims process and assist with any legal or financial support covered by your policy.