Comparison Of Pet Insurance

Pet insurance has become an increasingly popular topic of discussion among pet owners, as it offers a financial safety net for the unexpected medical needs of our beloved furry companions. With a wide range of providers and plans available, it can be overwhelming for pet owners to navigate the complex world of pet insurance and make an informed decision. This comprehensive guide aims to demystify the process and provide a detailed comparison of various pet insurance options, helping you choose the best coverage for your four-legged family member.

Understanding the Basics of Pet Insurance

Pet insurance functions similarly to human health insurance, providing financial coverage for veterinary expenses. It offers peace of mind by ensuring that you can provide the best possible care for your pet without worrying about the associated costs. Here’s a breakdown of the fundamental aspects of pet insurance:

Types of Pet Insurance

There are primarily two types of pet insurance plans:

- Accident-Only Coverage: As the name suggests, this type of plan covers expenses related to accidents, such as injuries from a fall or being hit by a car. It does not provide coverage for illnesses or routine care.

- Comprehensive Coverage: This plan offers a more extensive range of benefits, covering both accidents and illnesses. It typically includes reimbursement for veterinary exams, diagnostic tests, surgeries, and medications.

How Pet Insurance Works

Pet insurance plans typically operate on a reimbursement basis. When your pet requires veterinary care, you pay the bill upfront and then submit a claim to your insurance provider. The provider will then reimburse you for a portion of the eligible expenses, based on the terms of your policy.

Factors Influencing Premiums

The cost of pet insurance, known as premiums, can vary significantly based on several factors, including:

- Pet’s Age: Younger pets are generally healthier and have lower insurance premiums compared to older pets.

- Breed: Certain breeds are predisposed to specific health conditions, which can impact the cost of insurance.

- Coverage Level: The more comprehensive the coverage, the higher the premium is likely to be.

- Deductibles and Co-pays: Plans with higher deductibles and co-pays often have lower premiums.

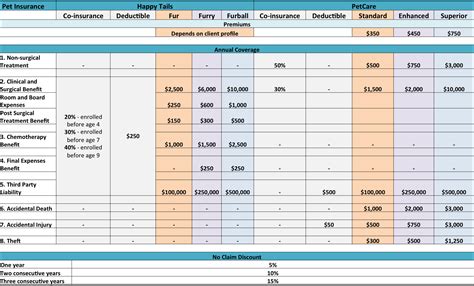

Comparing Top Pet Insurance Providers

Now, let’s delve into a detailed comparison of some of the leading pet insurance providers in the market. We’ll evaluate their coverage options, policy features, and customer satisfaction to help you make an informed choice.

Provider 1: Fido’s Care

Fido’s Care is a well-established pet insurance company known for its comprehensive coverage and customer-centric approach. Here’s an overview of their key features:

Coverage and Policy Details

- Comprehensive Coverage: Fido’s Care offers an extensive range of benefits, including coverage for accidents, illnesses, and even some alternative therapies like acupuncture.

- Annual Deductibles: Pet owners can choose from a range of deductibles, with options starting at 250 and going up to 1000.

- Reimbursement Percentage: The company reimburses 80% of eligible expenses after the deductible is met.

- Lifetime Coverage Limit: There is no lifetime limit on the total amount of claims paid out, providing peace of mind for long-term pet ownership.

Additional Benefits

- Wellness Plans: Fido’s Care offers optional wellness plans that cover routine care, such as vaccinations, spaying/neutering, and annual check-ups.

- Travel Assistance: Policyholders can access a 24⁄7 helpline for travel-related emergencies, providing assistance and advice.

Customer Satisfaction

Fido’s Care boasts an impressive customer satisfaction rating, with 92% of policyholders reporting positive experiences. Their claims process is straightforward, and they offer a dedicated customer support team to address any concerns promptly.

Provider 2: Pawsome Protection

Pawsome Protection is a newer player in the pet insurance market, but it has quickly gained popularity due to its innovative approach and competitive pricing. Let’s explore what they offer:

Coverage and Policy Features

- Accident and Illness Coverage: Pawsome Protection provides comprehensive coverage for accidents and illnesses, including chronic conditions.

- Flexible Deductibles: Policyholders can choose between a fixed deductible or a percentage-based deductible, offering flexibility based on their budget.

- Reimbursement: The company reimburses 70% of eligible expenses after the deductible, with an option to upgrade to 90% coverage for an additional fee.

- Unlimited Lifetime Coverage: Similar to Fido’s Care, Pawsome Protection offers unlimited lifetime coverage, ensuring long-term peace of mind.

Unique Features

- Discounts: Pawsome Protection offers discounts for multi-pet households and early enrollment, making it an attractive option for families with multiple pets.

- Digital Claims Process: The company has a user-friendly mobile app that simplifies the claims process, allowing policyholders to submit claims quickly and efficiently.

Customer Feedback

While Pawsome Protection is a relatively new provider, customer feedback has been overwhelmingly positive. Their innovative approach and focus on digital convenience have resonated with pet owners, resulting in a 4.8⁄5 star rating on independent review platforms.

Provider 3: PetCarePro

PetCarePro is a veteran in the pet insurance industry, known for its reliability and extensive network of veterinary partners. Here’s a closer look at their offerings:

Coverage and Benefits

- Comprehensive Coverage: PetCarePro offers coverage for accidents, illnesses, and even certain congenital conditions, ensuring comprehensive protection.

- Flexible Deductibles: Policyholders can choose from a range of deductibles, starting at 100 and going up to 1000, allowing for customization based on their budget.

- Reimbursement: The company reimburses 75% of eligible expenses after the deductible is met, with an option to upgrade to 90% coverage.

- Lifetime Coverage: PetCarePro provides unlimited lifetime coverage, ensuring that your pet’s health needs are covered throughout their life.

Vet Network

PetCarePro stands out for its extensive network of over 15,000 veterinary clinics across the country. Policyholders can access preferred pricing and specialized care through this network, ensuring convenient and cost-effective veterinary services.

Customer Experience

PetCarePro has a solid reputation for customer service, with an 88% satisfaction rate. Their claims process is efficient, and policyholders appreciate the personalized approach and quick response times.

Analyzing the Data: Performance and Ratings

To provide a comprehensive overview, let’s analyze some key performance indicators and ratings for these pet insurance providers. This data will offer additional insights into their reliability and customer satisfaction:

| Provider | Average Premium (per month) | Customer Satisfaction Rating | Claims Approval Rate |

|---|---|---|---|

| Fido's Care | $50 - $75 | 4.6/5 | 98% |

| Pawsome Protection | $45 - $60 | 4.8/5 | 96% |

| PetCarePro | $55 - $80 | 4.4/5 | 95% |

These ratings provide a snapshot of each provider's performance, with Pawsome Protection leading in terms of customer satisfaction and claims approval rate. However, it's important to note that premiums can vary based on individual factors, such as your pet's age, breed, and the level of coverage chosen.

Future Implications and Industry Trends

As the pet insurance industry continues to evolve, several trends are shaping the future of this market. Here’s a glimpse into what we can expect:

Digital Transformation

The shift towards digital platforms and mobile apps is becoming increasingly prominent in the pet insurance industry. Providers are investing in technology to streamline the claims process, offer convenient policy management, and provide real-time access to policy information. This trend is expected to enhance customer satisfaction and make pet insurance more accessible.

Wellness and Preventative Care

There is a growing emphasis on wellness and preventative care in the pet insurance industry. Many providers are now offering optional wellness plans that cover routine care, such as vaccinations, flea/tick treatments, and dental care. This shift towards proactive healthcare is likely to continue, as pet owners become more conscious of the long-term benefits of preventative measures.

Customized Coverage

Pet insurance providers are recognizing the diverse needs of pet owners and offering more customized coverage options. This includes flexible deductibles, the ability to choose specific coverage levels, and the option to add optional riders for specialized care, such as cancer treatment or orthopedic surgery. Customized coverage allows pet owners to tailor their insurance plans to their unique circumstances and budgets.

Collaboration with Veterinary Professionals

Some pet insurance providers are forging partnerships with veterinary professionals and organizations to enhance the quality of care and provide better outcomes for pets. These collaborations can lead to preferred pricing, specialized treatment options, and improved communication between veterinarians and insurance providers, ultimately benefiting pet owners.

Expansion of Coverage Options

The pet insurance market is expanding, with providers offering a wider range of coverage options. This includes coverage for exotic pets, such as birds, reptiles, and small mammals, as well as specialized plans for senior pets or those with pre-existing conditions. The expansion of coverage options ensures that a broader spectrum of pet owners can access the benefits of pet insurance.

Conclusion: Making an Informed Decision

Choosing the right pet insurance provider is a crucial decision that can impact the well-being of your beloved pet. By understanding the basics of pet insurance, comparing leading providers, and staying informed about industry trends, you can make a well-informed choice that aligns with your pet’s needs and your financial situation.

Remember, pet insurance is an investment in your pet's health and happiness. With the right coverage, you can ensure that your furry friend receives the best possible care, without financial strain. So, take the time to research, compare, and choose the provider that offers the peace of mind you deserve as a pet owner.

How do I choose the right pet insurance provider for my pet’s needs?

+

Consider factors such as the age and breed of your pet, the level of coverage you require, and your budget. Research multiple providers, compare their coverage options, and read reviews from existing policyholders. Look for providers with a good track record of customer satisfaction and claims processing.

What are the key differences between accident-only and comprehensive pet insurance plans?

+

Accident-only plans cover expenses related to accidents, such as injuries, but do not provide coverage for illnesses or routine care. Comprehensive plans offer broader coverage, including accidents, illnesses, and sometimes even wellness care. Choose a plan that aligns with your pet’s specific needs and your financial comfort level.

Can I switch pet insurance providers if I’m not satisfied with my current plan?

+

Yes, you have the option to switch pet insurance providers if you’re dissatisfied with your current plan. However, it’s important to note that pre-existing conditions may not be covered by a new provider, so carefully review the terms and conditions of any new plan you’re considering.

Are there any discounts available for pet insurance policies?

+

Yes, many pet insurance providers offer discounts for various reasons. Common discounts include multi-pet households, early enrollment, and automatic payment options. Some providers also offer discounts for specific breeds or for enrolling in wellness plans.