Comparing Dental Insurance Plans

Choosing the right dental insurance plan can be a complex decision, as it involves considering various factors and understanding the intricacies of different coverage options. With numerous plans available, it's essential to delve into the specifics to make an informed choice that aligns with your oral health needs and financial considerations.

Understanding Dental Insurance Plans

Dental insurance plans provide coverage for a range of dental services, from routine check-ups and cleanings to more extensive procedures like root canals and implants. These plans typically operate on a reimbursement or direct payment basis, where the insurance company pays a portion of the dental costs directly to the dentist or reimburses the insured individual for the expenses incurred.

The key components of a dental insurance plan include:

- Premiums: The amount you pay monthly or annually to maintain your dental coverage.

- Deductibles: The out-of-pocket expenses you must pay before your insurance coverage kicks in.

- Copayments: A fixed amount you pay for covered services, often expressed as a percentage of the total cost.

- Coverage Limits: The maximum amount your insurance will pay for a specific procedure or within a given period.

- Network Dentists: The plan may have a network of preferred dentists who offer discounted rates to insured individuals.

Additionally, dental insurance plans often categorize procedures into different levels of coverage, typically known as:

- Preventive Care: Includes routine check-ups, cleanings, and X-rays, which are often fully covered.

- Basic Procedures: Encompasses fillings, extractions, and root planing, usually covered at a higher percentage than major procedures.

- Major Procedures: Includes crowns, bridges, and dentures, which often have a lower coverage percentage compared to basic procedures.

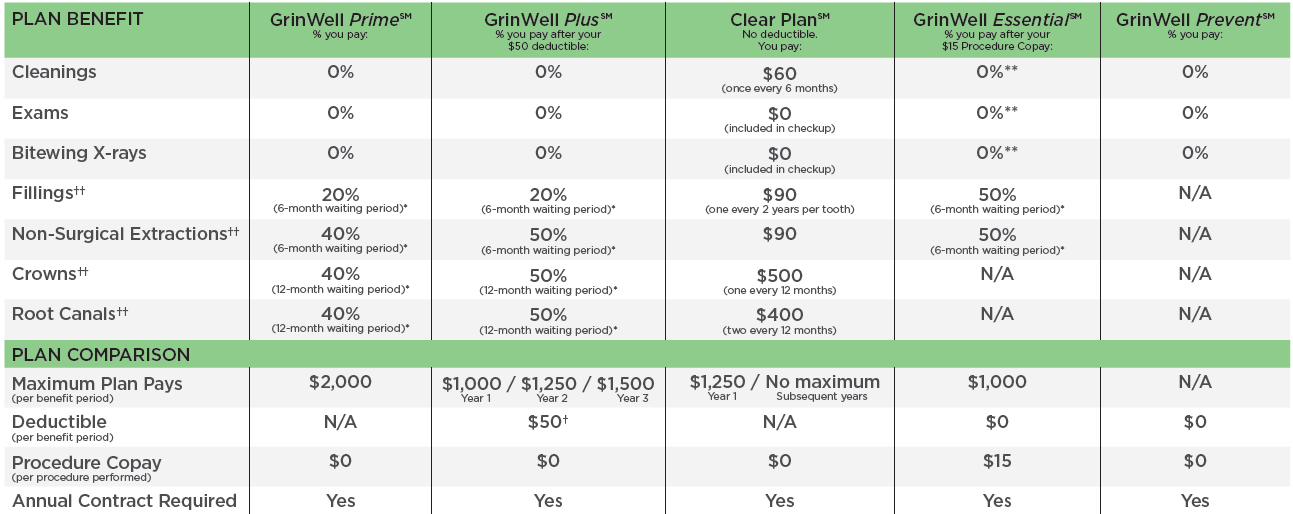

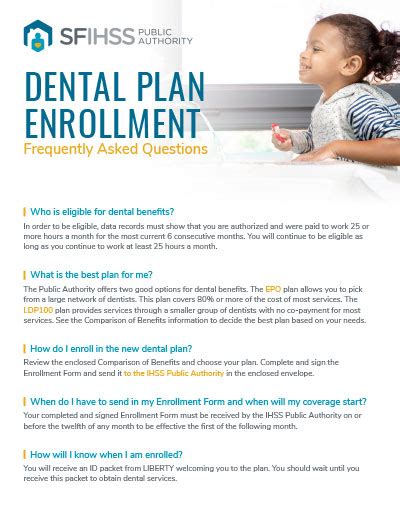

Factors to Consider When Choosing a Dental Insurance Plan

When comparing dental insurance plans, several factors come into play. These considerations can significantly impact your overall satisfaction with the chosen plan and your oral health journey.

Cost and Coverage

The cost of dental insurance plans can vary widely based on the level of coverage provided. It’s essential to assess your dental needs and budget to find a plan that offers the right balance.

| Plan Type | Premium | Deductible | Coverage Limits |

|---|---|---|---|

| Basic Plan | $30/month | $50 | $1,500/year |

| Standard Plan | $45/month | $100 | $2,000/year |

| Comprehensive Plan | $60/month | $200 | $3,000/year |

The table above provides a simplified comparison of different plan types, highlighting their premiums, deductibles, and coverage limits. Note that these values are for illustrative purposes only and may vary significantly based on your location, age, and specific insurance provider.

Network Dentists

Many dental insurance plans have a network of preferred dentists. It’s crucial to check if your preferred dentist is within the network. If not, you may incur higher out-of-pocket expenses or have limited coverage for out-of-network providers.

Coverage for Specific Procedures

Different plans offer varying levels of coverage for specific procedures. For instance, some plans may provide extensive coverage for braces or orthodontic treatments, while others might have limited or no coverage for these procedures. Understanding your dental needs and considering future procedures can help you choose a plan that aligns with your requirements.

Waiting Periods

Some dental insurance plans have waiting periods before certain procedures are covered. For example, a plan might have a 6-month waiting period for major restorative work. It’s essential to consider these waiting periods, especially if you anticipate needing specific procedures soon after enrolling in the plan.

Additional Benefits

Beyond the standard coverage, some dental insurance plans offer additional benefits. These can include discounts on vision care, hearing aids, or even fitness memberships. While these perks may not be essential for oral health, they can provide added value and make a plan more attractive.

Analyzing Popular Dental Insurance Plans

Let’s take a closer look at some of the leading dental insurance providers and their plan offerings.

Delta Dental

Delta Dental is one of the most well-known dental insurance providers in the United States. They offer a range of plans, including individual, family, and employer-sponsored options. Delta Dental’s plans often have extensive networks, ensuring easy access to preferred dentists.

Key features of Delta Dental plans include:

- No waiting periods for preventive care.

- Competitive premiums and coverage limits.

- Optional vision and hearing aid coverage.

- A user-friendly online platform for managing claims and finding in-network dentists.

Cigna Dental

Cigna Dental provides a comprehensive suite of dental insurance plans, catering to various needs. Their plans are designed to be flexible and customizable, allowing individuals and families to choose the coverage that suits them best.

Notable aspects of Cigna Dental plans:

- Extensive network of dentists, including specialists.

- Discounts on certain procedures, even for out-of-network providers.

- Option to add orthodontic coverage for an additional premium.

- A mobile app for convenient claim submission and tracking.

MetLife Dental

MetLife Dental is known for its robust network of providers and comprehensive coverage options. They offer a variety of plans, making it suitable for individuals, families, and businesses.

Key advantages of MetLife Dental plans:

- Flexible coverage options, allowing customization based on specific needs.

- No waiting periods for most preventive and basic procedures.

- Discounts on orthodontic treatments and specialty care.

- A dedicated customer support team for assistance with claims and plan inquiries.

Tips for Choosing the Right Dental Insurance Plan

Selecting the right dental insurance plan requires careful consideration. Here are some tips to guide your decision-making process:

- Assess Your Dental Needs: Evaluate your current and potential future dental requirements. Consider any ongoing treatments, regular check-ups, and potential procedures you may need in the coming years.

- Compare Premiums and Coverage: Analyze the premiums and coverage limits of different plans. Ensure that the plan offers adequate coverage for your needs without being overly expensive.

- Check Network Dentists: Verify if your preferred dentist is in the plan's network. If not, assess the out-of-network coverage and potential costs.

- Read the Fine Print: Pay close attention to the plan's details, including waiting periods, coverage exclusions, and any limitations on specific procedures.

- Consider Additional Benefits: Look beyond basic coverage and explore plans that offer added perks like vision or hearing aid discounts.

- Read Customer Reviews: Check online reviews and testimonials from existing plan holders to gain insights into the plan's reliability and customer service.

Conclusion

Choosing the right dental insurance plan is a crucial decision that impacts your oral health and financial well-being. By understanding the factors involved, comparing popular plans, and following the provided tips, you can make an informed choice that best suits your needs. Remember, dental insurance is an investment in your smile and overall health, so choose wisely!

How do I know if a dental insurance plan covers a specific procedure?

+To determine if a specific procedure is covered by a dental insurance plan, you should review the plan’s coverage details. These details are typically available on the insurance provider’s website or can be requested from the plan administrator. Additionally, contacting the insurance company directly can provide clarity on coverage for specific procedures.

Can I switch dental insurance plans if I’m unhappy with my current one?

+Yes, you have the option to switch dental insurance plans if you’re dissatisfied with your current coverage. However, it’s important to note that switching plans may involve waiting periods or changes in premiums and coverage limits. Research and compare alternative plans before making a switch to ensure a smoother transition.

Are there any government-sponsored dental insurance plans available?

+Yes, government-sponsored dental insurance plans are available through programs like Medicaid and the Children’s Health Insurance Program (CHIP). These plans offer dental coverage to eligible individuals and families, providing access to essential dental care services.