Compare Auto And Home Insurance Quotes

Finding the right auto and home insurance coverage is crucial for protecting your assets and ensuring peace of mind. However, navigating the insurance landscape can be daunting, with numerous options and varying quotes. In this comprehensive guide, we will delve into the world of auto and home insurance quotes, offering expert insights and strategies to help you make informed decisions.

Understanding Auto Insurance Quotes

Auto insurance is a necessity for every vehicle owner. It provides financial protection in case of accidents, theft, or other unexpected events. When comparing auto insurance quotes, several key factors come into play.

Coverage Options

Auto insurance policies offer a range of coverage options, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. Each coverage type serves a specific purpose, and understanding your needs is essential. For instance, liability coverage protects you against claims for bodily injury or property damage caused by you to others, while collision coverage pays for repairs if your vehicle is damaged in an accident.

Consider your personal circumstances and the value of your vehicle when selecting coverage. For older vehicles, comprehensive and collision coverage might be less cost-effective, while newer or high-value cars may require more extensive protection.

| Coverage Type | Description |

|---|---|

| Liability | Covers claims for bodily injury and property damage caused to others. |

| Collision | Pays for repairs if your vehicle is damaged in an accident. |

| Comprehensive | Covers non-collision incidents like theft, vandalism, or natural disasters. |

| Medical Payments | Covers medical expenses for you and your passengers after an accident. |

| Uninsured/Underinsured Motorist | Provides coverage if an at-fault driver lacks sufficient insurance. |

Factors Affecting Quotes

Auto insurance quotes are influenced by various factors, including your driving history, age, gender, location, and the make and model of your vehicle. Insurance providers use these factors to assess the level of risk associated with insuring you. Here are some key considerations:

- Driving Record: A clean driving record with no accidents or violations can lead to lower quotes. Conversely, multiple accidents or traffic violations may result in higher premiums.

- Age and Gender: Younger drivers, especially males, often face higher premiums due to statistical risk factors. However, as you gain experience and reach a certain age, premiums may decrease.

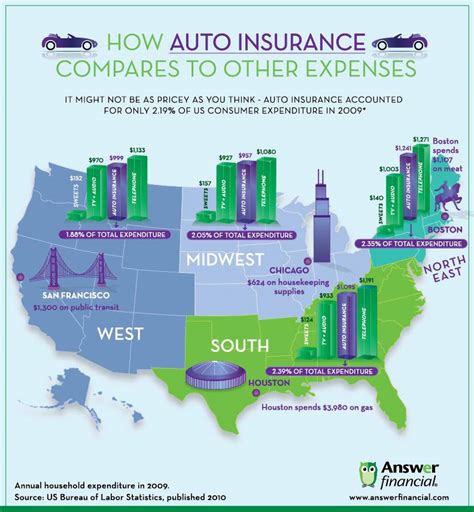

- Location: The area where you live and drive plays a significant role. High-crime or high-accident areas may result in higher quotes.

- Vehicle Type: The make, model, and year of your vehicle affect quotes. Sports cars and luxury vehicles often have higher premiums due to their increased risk of theft or accidents.

Home Insurance: Protecting Your Sanctuary

Home insurance is an essential safeguard for your home and its contents. It provides financial protection against various risks, including damage to your home, theft, and liability claims. When shopping for home insurance quotes, several key aspects should be considered.

Coverage Types for Homeowners

Home insurance policies typically offer a range of coverage options, such as dwelling coverage, personal property coverage, liability coverage, and additional living expenses. Dwelling coverage protects the structure of your home, while personal property coverage safeguards your belongings. Liability coverage is crucial to protect you against lawsuits resulting from injuries or accidents on your property.

When selecting coverage, consider the replacement cost of your home and its contents. Additionally, assess your liability risks, especially if you have frequent visitors or host events.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home. |

| Personal Property Coverage | Covers the contents of your home, including furniture, electronics, and personal items. |

| Liability Coverage | Protects you against claims for bodily injury or property damage caused to others on your property. |

| Additional Living Expenses | Provides coverage for temporary living expenses if your home becomes uninhabitable due to a covered loss. |

Factors Influencing Home Insurance Quotes

Similar to auto insurance, home insurance quotes are influenced by a variety of factors, including the location of your home, its age and construction, the value of your possessions, and your claims history. Here are some key considerations:

- Location: The area where your home is located plays a significant role. Areas prone to natural disasters, high crime rates, or high fire risks may result in higher premiums.

- Home Age and Construction: Older homes may require more extensive coverage, especially if they have outdated electrical or plumbing systems. Newer homes, built with modern materials and construction techniques, may be eligible for discounts.

- Personal Property Value

- Claims History: A history of frequent claims can impact your premiums. Insurance providers consider this when assessing the risk of insuring you.

Strategies for Securing the Best Quotes

To obtain the most favorable auto and home insurance quotes, consider implementing these strategies:

Shop Around

Don’t settle for the first quote you receive. Take the time to compare quotes from multiple insurance providers. Online comparison tools can be valuable resources, allowing you to quickly gather quotes from various companies.

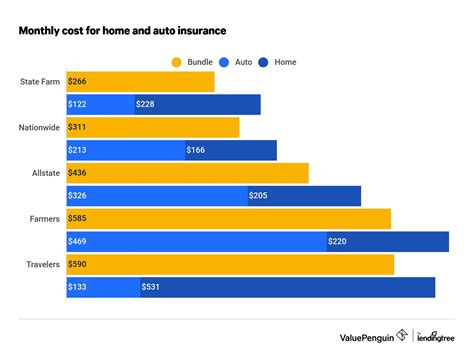

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies, such as auto and home insurance. By combining your policies, you may be eligible for significant savings.

Increase Deductibles

Opting for higher deductibles can lead to lower premiums. However, it’s essential to ensure you can afford the deductible in case of a claim. Higher deductibles mean you’ll pay more out of pocket before insurance coverage kicks in.

Improve Your Credit Score

Believe it or not, your credit score can impact your insurance premiums. Insurance providers often consider credit scores as an indicator of financial responsibility. Improving your credit score may result in lower insurance rates.

Review Coverage Regularly

Life circumstances and insurance needs can change over time. Regularly review your coverage to ensure it aligns with your current situation. This includes considering any recent home improvements, changes in personal property value, or updates to your driving record.

Future Implications and Innovations

The insurance industry is continuously evolving, and several trends and innovations are shaping the future of auto and home insurance.

Telematics and Usage-Based Insurance

Telematics technology allows insurance providers to track driving behavior in real time. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, uses telematics to offer personalized premiums based on actual driving habits. This technology is gaining popularity and may lead to more accurate and fair pricing for drivers.

Digital Transformation

The insurance industry is embracing digital transformation, with many providers offering online quoting and policy management tools. This shift towards digital services enhances convenience and efficiency for customers, allowing for faster and more accurate quotes.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing the insurance industry. These technologies enable insurance providers to analyze vast amounts of data, identify patterns, and make more accurate predictions. This can lead to improved risk assessment and more precise pricing models.

Smart Home Technology

The integration of smart home technology is becoming increasingly common. Insurance providers are recognizing the potential of smart devices to reduce the risk of claims. For instance, smart water leak detectors can prevent water damage, while smart smoke detectors can minimize the risk of fire-related losses.

How often should I review my insurance policies?

+It's recommended to review your insurance policies annually or whenever there are significant changes in your life, such as buying a new car, moving to a new home, or getting married. Regular reviews ensure your coverage remains adequate and up-to-date.

Can I negotiate my insurance rates?

+While insurance rates are largely based on risk assessment, there may be room for negotiation. Some providers offer discounts for loyal customers or for bundling multiple policies. It's worth inquiring about potential discounts and negotiating with your insurer to find the best deal.

What factors can lead to an increase in insurance rates?

+Several factors can cause an increase in insurance rates, including a poor driving record (e.g., accidents, violations), moving to a high-risk area, adding a teenage driver to your auto policy, or filing multiple claims. It's important to maintain a clean record and be mindful of these factors to avoid premium hikes.

Are there any discounts available for auto insurance?

+Yes, many auto insurance providers offer discounts for safe driving, good grades (for young drivers), bundling with other policies, having certain safety features in your vehicle, and more. It's worth exploring these discounts to reduce your premiums.

How can I lower my home insurance premiums without sacrificing coverage?

+To lower your home insurance premiums, consider increasing your deductible, reviewing your coverage limits to ensure they're not excessive, and installing security systems or fire prevention devices. These measures can help reduce your premiums without compromising your protection.

By understanding the factors that influence auto and home insurance quotes and implementing strategic approaches, you can secure the best coverage at competitive rates. Stay informed, compare options, and leverage the latest innovations to make well-informed decisions about your insurance needs.