Comparable Car Insurance

In the world of automotive finance, car insurance is an essential yet often complex topic. With numerous providers and policies available, finding the right coverage at the right price can be a daunting task. This comprehensive guide aims to shed light on the concept of comparable car insurance, offering an in-depth analysis to assist drivers in making informed decisions.

Understanding Comparable Car Insurance

Comparable car insurance is an umbrella term for insurance policies that offer similar levels of coverage and benefits. It is a concept that allows drivers to make fair and accurate comparisons between different insurance providers, ensuring they receive the best value for their money.

When we talk about comparability in car insurance, we refer to policies that align in key aspects such as coverage limits, deductibles, and the scope of services provided. This ensures that drivers are not comparing apples to oranges when evaluating insurance options.

Key Factors for Comparison

Several critical factors define the comparability of car insurance policies. These include:

- Coverage Limits: The maximum amount the insurance company will pay out for a claim. Higher coverage limits typically mean better protection but can also result in higher premiums.

- Deductibles: The amount the policyholder must pay out-of-pocket before the insurance coverage kicks in. Lower deductibles are more appealing but can lead to higher premiums.

- Policy Exclusions: Certain situations or events that are not covered by the insurance policy. Understanding these exclusions is crucial to avoid unexpected gaps in coverage.

- Additional Services: Some insurance providers offer extra benefits such as roadside assistance, rental car coverage, or accident forgiveness. These services can significantly enhance the overall value of the policy.

- Discounts and Incentives: Many insurance companies offer discounts for various reasons, such as good driving records, vehicle safety features, or loyalty. These discounts can greatly impact the overall cost of the policy.

By understanding and comparing these factors, drivers can make informed decisions and choose a policy that best fits their needs and budget.

The Process of Comparison

Comparing car insurance policies involves a systematic approach to ensure accuracy and fairness. Here are the steps to effectively compare car insurance:

Step 1: Define Your Needs

Before comparing policies, it’s essential to understand your specific needs and priorities. Consider factors such as the value of your vehicle, your driving habits, and the level of coverage you require. For instance, if you drive an older vehicle, you might prioritize lower premiums over extensive coverage.

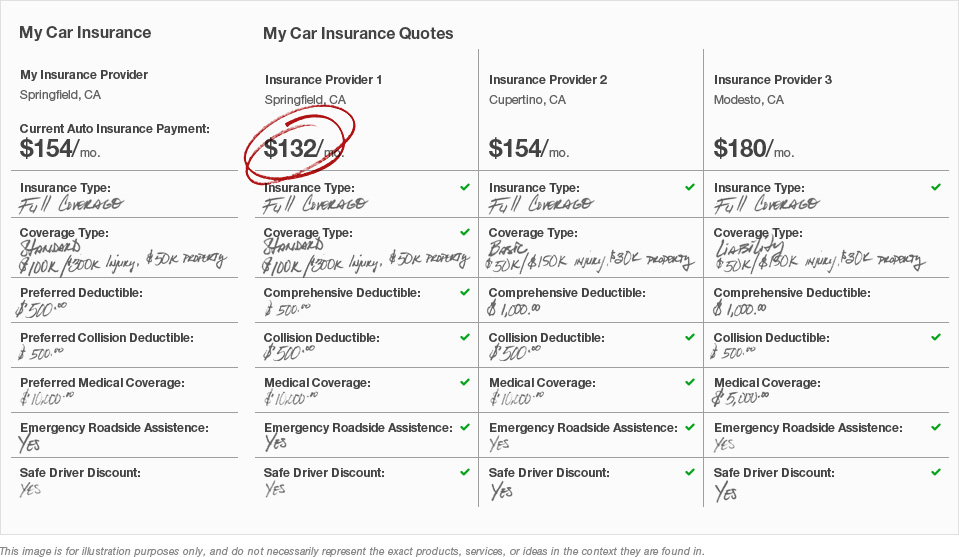

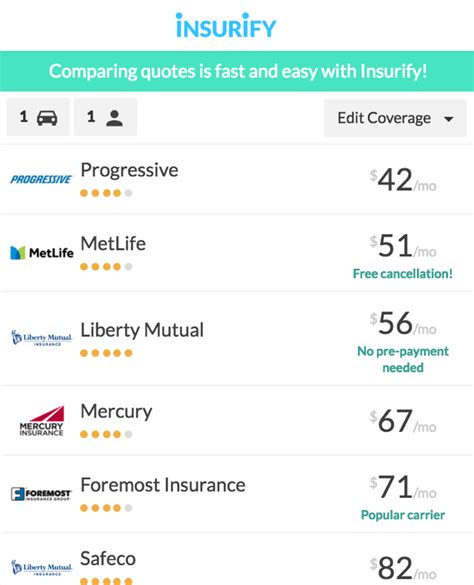

Step 2: Gather Quotes

Obtain quotes from multiple insurance providers. This can be done online, over the phone, or through insurance brokers. Ensure that you request quotes for similar coverage levels and deductibles to ensure an accurate comparison.

Step 3: Analyze the Policies

Scrutinize the quotes you receive. Pay attention to the fine print, including policy exclusions and additional services. Compare the coverage limits and deductibles to ensure they align with your defined needs.

Step 4: Consider Additional Factors

Apart from the core coverage, consider other factors that can impact your insurance experience. These include the insurance provider’s financial stability, their customer service reputation, and their claims process. You might also want to consider the provider’s environmental or social initiatives if these are important to you.

Step 5: Make an Informed Decision

Based on your analysis, choose the policy that best meets your needs. Remember that the cheapest policy might not always be the best option if it lacks essential coverage or has hidden costs.

Real-World Examples

Let’s illustrate the concept of comparable car insurance with a few real-world scenarios.

Scenario 1: Young Driver with a New Car

John, a 22-year-old, has just purchased a new sports car. He’s looking for comprehensive insurance coverage. After comparing quotes from three providers, he finds that Provider A offers the best coverage limits and includes additional benefits like rental car coverage during repairs. Provider B has slightly lower premiums but lacks the extra benefits, and Provider C has the lowest premiums but has higher deductibles.

In this case, John might opt for Provider A, as the additional benefits and comprehensive coverage outweigh the slightly higher premiums.

| Provider | Coverage Limits | Additional Benefits | Premium |

|---|---|---|---|

| A | $1,000,000 | Rental Car Coverage | $1,500/year |

| B | $800,000 | None | $1,300/year |

| C | $700,000 | None | $1,200/year |

Scenario 2: Experienced Driver with an Older Vehicle

Sarah, a 45-year-old with a clean driving record, owns an older sedan. She’s looking for affordable insurance without compromising on basic coverage. After comparing quotes, she finds that Provider X offers the lowest premiums, but has higher deductibles and excludes coverage for older vehicles. Provider Y has slightly higher premiums but provides comprehensive coverage for older vehicles, and Provider Z has the highest premiums but includes additional benefits like roadside assistance.

Given her needs, Sarah might choose Provider Y, as it offers the necessary coverage without breaking the bank.

| Provider | Premium | Deductible | Coverage for Older Vehicles |

|---|---|---|---|

| X | $750/year | $1,000 | Excluded |

| Y | $850/year | $500 | Included |

| Z | $1,000/year | $300 | Included |

Future Implications and Industry Trends

The concept of comparable car insurance is evolving with advancements in technology and changing consumer preferences. Here are some key trends and implications to consider:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance (UBI) are gaining popularity. These technologies allow insurance providers to track driving behavior and offer policies based on individual driving habits. While this can lead to more personalized and potentially cheaper insurance, it also raises privacy concerns.

Digital Transformation

The insurance industry is increasingly moving towards digital platforms and automation. This shift can make the process of obtaining quotes and comparing policies more efficient and accessible. However, it also requires consumers to be tech-savvy and aware of potential online scams.

Environmental and Social Initiatives

With growing environmental and social consciousness, insurance providers are beginning to offer policies that align with these values. This includes incentives for electric vehicles or discounts for community involvement. Such initiatives can attract consumers who prioritize these aspects.

Regulatory Changes

Changes in insurance regulations can impact the comparability of policies. For instance, mandatory coverage requirements or changes in tax laws can affect the structure and cost of insurance policies. Staying informed about such changes is crucial for consumers.

Competition and Innovation

The car insurance market is highly competitive, and this competition drives innovation. Insurance providers are constantly developing new products and services to differentiate themselves and attract customers. This dynamic market environment benefits consumers, offering a wider range of choices and potentially better deals.

Conclusion

In conclusion, comparable car insurance is a vital concept for drivers seeking the best value and protection. By understanding the key factors for comparison and following a systematic approach, drivers can navigate the complex world of car insurance with confidence. With the right knowledge and tools, finding the perfect insurance policy is within everyone’s reach.

How often should I review and compare my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever your life circumstances change significantly. This could include buying a new car, moving to a different location, getting married, or having a change in your driving habits. Regular reviews ensure that your coverage remains adequate and that you’re not overpaying.

What are some common mistakes to avoid when comparing car insurance policies?

+Some common mistakes include solely focusing on premiums without considering coverage limits and exclusions, failing to read the fine print, and not taking into account additional benefits or discounts. It’s crucial to compare policies comprehensively to make an informed decision.

Can I negotiate car insurance rates with providers?

+While car insurance rates are largely based on standardized risk assessments, you can negotiate with providers by highlighting your unique circumstances or negotiating bundle deals if you have multiple policies with the same provider. Some providers may also offer loyalty discounts for long-term customers.