Child's Health Insurance

Securing Your Child's Health: A Comprehensive Guide to Children's Health Insurance

Ensuring the well-being of our children is a top priority for every parent, and a vital aspect of this responsibility is providing them with comprehensive health insurance coverage. Children's health insurance plans are designed to offer specialized care and benefits tailored to meet the unique needs of growing bodies and minds. In this in-depth guide, we will explore the ins and outs of children's health insurance, providing you with the knowledge and insights to make informed decisions for your family's healthcare.

With a myriad of options available, from public programs to private policies, understanding the landscape of children's health insurance can be daunting. However, with the right information and a strategic approach, you can navigate this complex terrain and secure the best possible coverage for your child's healthcare needs. Let's delve into the world of children's health insurance and uncover the key considerations, benefits, and resources available to you.

Understanding Children's Health Insurance

Children's health insurance is a specialized type of medical coverage designed to address the unique healthcare needs of infants, children, and adolescents. These plans offer a range of benefits tailored to support the growing and developing bodies of young individuals. From well-child checkups and immunizations to specialized care for chronic conditions, children's health insurance provides a comprehensive safety net for your child's health.

One of the primary advantages of children's health insurance is the emphasis on preventive care. Regular checkups, screenings, and immunizations are crucial for identifying and addressing potential health issues early on. These preventive measures not only promote overall well-being but also help prevent more serious health problems down the line. Additionally, children's health insurance often covers a range of essential services, including dental and vision care, mental health support, and access to specialized pediatric services.

Publicly funded programs, such as Medicaid and the Children's Health Insurance Program (CHIP), play a significant role in providing healthcare coverage for millions of children across the United States. These programs offer low-cost or no-cost insurance to eligible families, ensuring that children have access to the healthcare services they need. Private insurance companies also offer a range of children's health insurance plans, providing families with additional options and flexibility to choose a plan that best suits their needs and preferences.

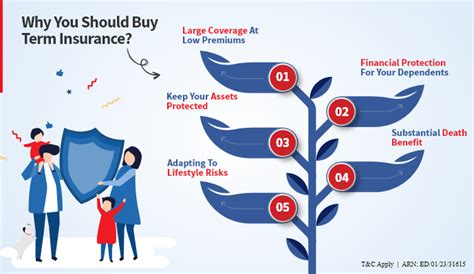

Key Benefits of Children's Health Insurance

- Comprehensive Medical Coverage: Children's health insurance plans typically offer a wide range of medical services, including physician visits, hospital stays, prescription medications, and emergency care. This ensures that your child has access to the necessary healthcare services when they need them.

- Preventive Care Emphasis: A key focus of children's health insurance is on preventive care, which includes regular checkups, immunizations, and screenings. This proactive approach helps identify and address potential health issues early on, promoting overall health and well-being.

- Specialized Pediatric Care: These plans often provide access to specialized pediatric services, ensuring that your child receives age-appropriate and expert care. This includes pediatricians, pediatric specialists, and pediatric hospitals or clinics.

- Dental and Vision Coverage: Many children's health insurance plans include dental and vision benefits, covering routine checkups, cleanings, and necessary treatments. This comprehensive approach ensures that your child's oral and visual health are also prioritized.

- Mental Health Support: Recognizing the importance of mental health, children's health insurance plans often include coverage for mental health services, such as counseling and therapy. This support is crucial for addressing common childhood mental health concerns and promoting emotional well-being.

Navigating Children's Health Insurance Options

With a range of children's health insurance options available, it's essential to carefully evaluate and compare the various plans to find the best fit for your family. Publicly funded programs, such as Medicaid and CHIP, offer valuable coverage for eligible families, providing access to a network of healthcare providers and services. These programs often have income-based eligibility criteria, making them a viable option for many families.

Private insurance companies also offer a diverse range of children's health insurance plans. These plans may be purchased through the Health Insurance Marketplace, employer-sponsored coverage, or directly from insurance providers. When exploring private insurance options, consider factors such as the network of healthcare providers, the range of covered services, and the plan's cost-sharing structure, including deductibles, copayments, and coinsurance.

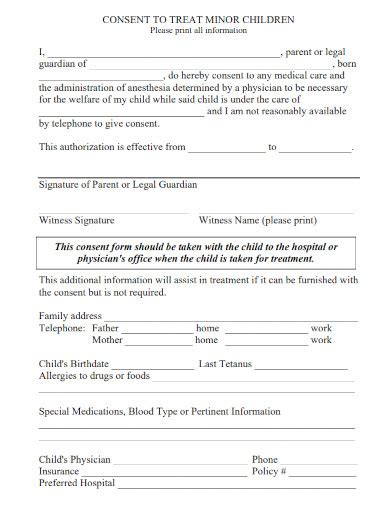

Publicly Funded Programs: Medicaid and CHIP

Medicaid and the Children's Health Insurance Program (CHIP) are two publicly funded programs that provide healthcare coverage for millions of children across the United States. These programs offer low-cost or no-cost insurance to eligible families, ensuring that children have access to the healthcare services they need. Medicaid is a federal and state-funded program that provides coverage for low-income individuals and families, including children.

| Program | Eligibility | Key Benefits |

|---|---|---|

| Medicaid | Low-income families, pregnant women, children, and individuals with disabilities. | Comprehensive coverage, including doctor visits, hospital stays, prescriptions, and specialized services. |

| CHIP | Children in families with incomes too high for Medicaid but still financially challenged. | Low-cost coverage, often with no premiums, and access to a wide range of healthcare services. |

CHIP, on the other hand, is specifically designed to provide coverage for children in families with incomes too high to qualify for Medicaid but still facing financial challenges. CHIP offers low-cost coverage, often with no premiums, and provides access to a wide range of healthcare services. Both Medicaid and CHIP aim to ensure that children receive the necessary medical care and support for their healthy development.

Private Insurance Options

Private insurance companies offer a diverse range of children's health insurance plans, providing families with additional options and flexibility. These plans can be purchased through the Health Insurance Marketplace, employer-sponsored coverage, or directly from insurance providers. When considering private insurance options, it's important to evaluate the following factors:

- Network of Healthcare Providers: Ensure that the plan's network includes your preferred healthcare providers, such as pediatricians, specialists, and hospitals.

- Range of Covered Services: Review the plan's benefits and coverage to ensure it aligns with your child's healthcare needs, including preventive care, prescription medications, and any specialized services they may require.

- Cost-Sharing Structure: Consider the plan's cost-sharing arrangements, including deductibles, copayments, and coinsurance. Assess how these costs align with your family's budget and healthcare needs.

- Additional Benefits: Look for plans that offer additional benefits, such as dental and vision coverage, mental health services, or wellness programs, to provide comprehensive support for your child's overall health and well-being.

Maximizing Your Child's Health Insurance Benefits

Once you've selected a children's health insurance plan, it's important to understand how to maximize the benefits and ensure your child receives the care they need. Here are some key strategies to optimize your child's health insurance coverage:

- Familiarize Yourself with the Plan's Benefits: Review the plan's summary of benefits and coverage details. Understand what services are covered, any exclusions or limitations, and the cost-sharing requirements. This knowledge will help you navigate the healthcare system effectively.

- Choose In-Network Providers: Utilize the plan's network of healthcare providers to maximize your coverage and minimize out-of-pocket costs. Check with your insurance company or visit their website to find a list of in-network providers in your area.

- Schedule Regular Checkups and Preventive Care: Take advantage of the preventive care benefits offered by your child's health insurance plan. Regular checkups, immunizations, and screenings are crucial for maintaining your child's health and identifying any potential issues early on.

- Understand Your Cost-Sharing Responsibilities: Be aware of your plan's cost-sharing structure, including deductibles, copayments, and coinsurance. Plan your healthcare expenses accordingly and consider setting aside funds to cover these costs when needed.

- Explore Additional Benefits and Resources: Many children's health insurance plans offer additional benefits and resources, such as wellness programs, health education materials, or support groups. Take advantage of these offerings to enhance your child's overall health and well-being.

Future Implications and Trends in Children's Health Insurance

The landscape of children's health insurance is continually evolving, driven by advancements in healthcare, changing policy landscapes, and emerging healthcare needs. Staying informed about these developments is crucial for ensuring that your child's healthcare coverage remains up-to-date and effective.

Emerging Trends in Children's Health Insurance

- Focus on Value-Based Care: There is a growing trend towards value-based healthcare models, which emphasize quality and outcomes over quantity of services. This approach aims to improve the overall healthcare experience and outcomes for children, while also controlling costs.

- Integration of Technology: Digital health technologies, such as telemedicine and remote monitoring, are increasingly being incorporated into children's health insurance plans. These technologies enhance access to care, particularly for rural or underserved communities, and improve overall efficiency.

- Emphasis on Mental Health and Well-being: Recognizing the importance of mental health, many children's health insurance plans are expanding their coverage to include mental health services and wellness programs. This trend aims to address the rising prevalence of mental health concerns among children and adolescents.

- Innovative Care Models: Alternative care models, such as patient-centered medical homes and accountable care organizations, are gaining traction in children's health insurance. These models focus on coordinated, patient-centric care, ensuring that children receive comprehensive and efficient healthcare services.

💡 Expert Insight: Staying Informed

In the dynamic field of children's health insurance, staying informed is essential. Regularly review your child's health insurance plan to ensure it continues to meet their evolving healthcare needs. Keep an eye on policy changes, emerging trends, and new benefits that may become available. Engage with your insurance provider and healthcare professionals to understand any updates or enhancements to your plan.

Additionally, consider participating in relevant healthcare advocacy efforts or joining support groups focused on children's health insurance. These communities can provide valuable insights, resources, and support, helping you navigate the complex world of healthcare coverage for your child.

What is the difference between Medicaid and CHIP?

+

Medicaid and CHIP are both publicly funded programs providing healthcare coverage for children, but they have different eligibility criteria and target populations. Medicaid is a federal and state-funded program with broader eligibility criteria, covering low-income individuals and families, including children. CHIP, on the other hand, is specifically designed for children in families with incomes too high for Medicaid but still facing financial challenges. CHIP offers low-cost coverage, often with no premiums, and provides access to a wide range of healthcare services.

How can I find out if my child is eligible for Medicaid or CHIP?

+

To determine your child’s eligibility for Medicaid or CHIP, you can visit your state’s Medicaid or CHIP website, where you’ll find detailed information about the eligibility criteria and application process. You can also contact your state’s Medicaid or CHIP office for assistance. It’s important to note that eligibility criteria may vary by state, so it’s beneficial to review the specific guidelines for your state.

What if I can’t afford private insurance for my child?

+

If you are unable to afford private insurance for your child, you may be eligible for publicly funded programs such as Medicaid or CHIP. These programs offer low-cost or no-cost insurance to eligible families, ensuring that children have access to the healthcare services they need. You can check your eligibility and apply for these programs through your state’s Medicaid or CHIP website or by contacting their office.

Can I switch my child’s health insurance plan if I’m not satisfied with the current one?

+

Yes, you have the option to switch your child’s health insurance plan if you are not satisfied with the current one. However, it’s important to understand the timing and process for switching plans. Open enrollment periods, which typically occur annually, are the designated times when you can make changes to your insurance coverage. During these periods, you can review your options and select a new plan that better suits your child’s healthcare needs. It’s beneficial to research and compare different plans during open enrollment to ensure a smooth transition.