Cheapest Term Insurance

When it comes to financial planning and securing the future of your loved ones, term insurance is often considered a crucial component. Term insurance provides a cost-effective way to protect your family's financial well-being in the event of an unfortunate event. This article aims to delve into the world of term insurance, focusing on finding the cheapest options without compromising on essential coverage.

Understanding Term Insurance: The Basics

Term insurance is a type of life insurance policy that offers coverage for a specific period, known as the term. It is designed to provide financial protection to your dependents during this designated time frame. Unlike whole life or permanent insurance, term insurance does not accumulate cash value over time. Instead, it focuses on offering pure protection at an affordable price.

The primary benefit of term insurance is its cost-effectiveness. By opting for a term policy, you can secure a substantial death benefit for a relatively low premium. This makes it an attractive choice for individuals and families looking to safeguard their financial future without incurring significant costs.

Key Features of Term Insurance

- Coverage Period: Term insurance policies typically offer coverage for a fixed term, ranging from 10 to 30 years. You can choose a term that aligns with your financial goals and the duration you wish to protect your loved ones.

- Death Benefit: In the event of the policyholder’s death during the term, the insurance company pays out a lump sum amount to the beneficiaries. This death benefit can be used to cover various expenses, including funeral costs, outstanding debts, and daily living expenses.

- Renewal and Conversion Options: Most term insurance policies provide the option to renew or convert the policy at the end of the term. Renewal allows you to extend the coverage period, while conversion enables you to switch to a permanent insurance policy without undergoing a new medical examination.

Now that we have a basic understanding of term insurance, let's explore how to identify and secure the cheapest term insurance policies available.

Factors Affecting Term Insurance Premiums

The cost of term insurance premiums can vary significantly based on several factors. Understanding these factors can help you make informed decisions when comparing policies and identifying the cheapest options.

Age and Health

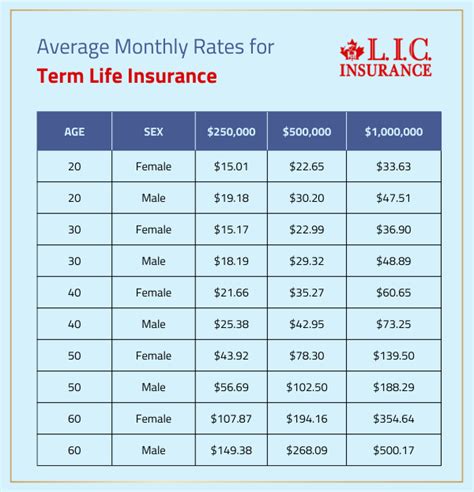

One of the most significant factors influencing term insurance premiums is the age and health of the policyholder. Insurance companies assess the risk associated with insuring an individual based on their age and overall health. Younger individuals tend to have lower premiums as they are less likely to make a claim during the policy term.

Additionally, individuals with a healthy lifestyle and no pre-existing medical conditions may qualify for preferred rates. Insurance companies often offer discounts or reduced premiums to policyholders who maintain a healthy weight, do not smoke, and have a clean medical history. Regular health check-ups and maintaining a healthy lifestyle can positively impact your term insurance premiums.

Policy Term and Coverage Amount

The length of the policy term and the coverage amount you choose can also affect the cost of your term insurance premiums. Longer policy terms generally result in higher premiums, as the insurance company bears the risk for a more extended period. Similarly, a higher coverage amount will require a higher premium to ensure sufficient financial protection for your beneficiaries.

It's essential to strike a balance between the term length and coverage amount that aligns with your financial needs. Opting for a shorter term may reduce premiums but may not provide adequate coverage if your financial responsibilities extend beyond the policy term. Similarly, while a higher coverage amount offers greater protection, it may also increase your premiums significantly.

Tobacco Usage

Insurance companies consider tobacco usage, including smoking and chewing tobacco, as a risk factor when determining premiums. Individuals who use tobacco products may face higher premiums compared to non-users. This is because tobacco usage increases the likelihood of health issues and reduces life expectancy, leading to a higher risk for the insurance company.

If you are a tobacco user, it's advisable to consider quitting or, at the very least, disclosing your tobacco usage honestly when applying for term insurance. Hiding tobacco usage can lead to policy cancellation or denied claims in the future.

Other Factors

Apart from age, health, policy term, coverage amount, and tobacco usage, other factors can influence term insurance premiums. These include your occupation, hobbies, and participation in high-risk activities. For instance, individuals working in high-risk occupations or engaging in extreme sports may face higher premiums due to the increased risk of accidents or health issues.

Additionally, your credit score and financial history can impact your insurance premiums. A good credit score may result in lower premiums, as it indicates a lower risk of defaulting on insurance payments. Conversely, a poor credit score may lead to higher premiums or even difficulty in securing insurance coverage.

Comparing Term Insurance Policies: A Step-by-Step Guide

Now that we have explored the factors affecting term insurance premiums, let’s delve into a step-by-step guide to help you compare and identify the cheapest term insurance policies.

Step 1: Define Your Needs

Before comparing term insurance policies, it’s crucial to define your specific needs and financial goals. Consider the following questions to determine the coverage amount and term length that align with your requirements:

- What financial obligations do you wish to cover with the term insurance policy (e.g., mortgage, education expenses, daily living costs)?

- How long do you need the coverage to last? Consider your current age, financial responsibilities, and the duration you wish to protect your dependents.

- Do you have any specific requirements, such as coverage for critical illnesses or accidental death benefits?

Step 2: Research and Gather Quotes

Once you have defined your needs, it’s time to research and gather quotes from various insurance providers. You can start by visiting the websites of reputable insurance companies or using online comparison tools that allow you to compare multiple policies simultaneously.

When gathering quotes, ensure you provide accurate and honest information about your age, health status, tobacco usage, and other relevant factors. This will ensure that the quotes you receive are tailored to your specific circumstances and provide an accurate comparison.

Step 3: Analyze the Policies

After collecting quotes, carefully analyze the policies to identify the cheapest options without compromising on essential coverage. Here are some key aspects to consider during your analysis:

- Premiums: Compare the premiums for the coverage amount and term length you require. Look for policies that offer the lowest premiums for your specific needs.

- Coverage Options: Ensure that the policies you are considering provide the coverage you desire. Compare the death benefit amounts, additional riders (e.g., critical illness coverage), and any other benefits that align with your financial goals.

- Renewal and Conversion Options: Understand the renewal and conversion terms of each policy. Some policies may offer automatic renewal, while others may require medical examinations or additional fees. Choose a policy that provides flexibility and aligns with your long-term financial planning.

- Reputation and Financial Stability: Research the reputation and financial stability of the insurance companies offering the policies. Opt for well-established companies with a strong financial standing to ensure the longevity and reliability of your term insurance coverage.

Step 4: Review Policy Terms and Conditions

Once you have identified a few affordable term insurance policies, take the time to review the policy terms and conditions carefully. Pay attention to the following aspects:

- Exclusion Clauses: Understand the exclusions and limitations of the policy. Certain events or circumstances may not be covered, so ensure you are aware of any restrictions before finalizing your decision.

- Grace Period: Look for policies that offer a grace period for premium payments. This grace period allows you to make late payments without facing immediate cancellation of your policy.

- Policy Riders: Evaluate the additional riders or benefits offered by the policies. Consider whether these riders align with your needs and add value to your coverage.

- Policy Amendments: Check if the policies allow for amendments or changes to the coverage amount or term length during the policy term. This flexibility can be beneficial if your financial circumstances change over time.

Tips for Securing the Cheapest Term Insurance

Apart from comparing policies and analyzing their features, here are some additional tips to help you secure the cheapest term insurance:

Shop Around and Compare

Don’t settle for the first insurance company or policy you come across. Take the time to shop around and compare multiple providers. Insurance rates can vary significantly between companies, so exploring different options can help you find the best deal.

Consider Online Insurance Providers

Online insurance providers often offer more competitive rates due to lower overhead costs. These providers may provide convenient online applications, policy management, and claims processes, making it easier and more cost-effective to secure term insurance coverage.

Bundle Your Insurance Policies

If you already have other insurance policies, such as auto or home insurance, consider bundling your term insurance with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially reducing your term insurance premiums.

Maintain a Healthy Lifestyle

As mentioned earlier, your health and lifestyle can impact your term insurance premiums. Maintaining a healthy lifestyle, including regular exercise, a balanced diet, and avoiding tobacco products, can not only improve your overall well-being but also lead to lower insurance premiums.

Consider Group Insurance Plans

If you are employed, check if your employer offers group insurance plans. Group insurance plans often provide term insurance coverage at a discounted rate, as the insurance company spreads the risk across a larger pool of individuals.

Future Implications and Considerations

While securing the cheapest term insurance is essential, it’s crucial to consider the long-term implications and potential changes in your financial situation. Here are some factors to keep in mind:

Inflation and Cost of Living

Inflation and the rising cost of living can impact the adequacy of your term insurance coverage over time. As your financial responsibilities and expenses increase, you may need to review and potentially increase your coverage amount to ensure sufficient protection for your loved ones.

Changing Family Dynamics

Your family’s financial needs and responsibilities may change over time. Events such as marriage, the birth of children, or the death of a spouse can significantly impact your financial planning. Regularly review your term insurance coverage to ensure it aligns with your family’s evolving needs.

Long-Term Financial Goals

Consider your long-term financial goals and how term insurance fits into your overall financial plan. While term insurance provides temporary protection, it may not be sufficient for your entire lifetime. Explore other financial instruments, such as retirement savings and investment plans, to ensure a secure financial future for yourself and your family.

Regular Policy Reviews

It’s essential to review your term insurance policy periodically to ensure it remains adequate and aligned with your financial goals. Regular policy reviews can help you identify any changes in your circumstances or the insurance market that may impact your coverage and premiums.

Conclusion

Finding the cheapest term insurance policy involves a careful balance between cost and coverage. By understanding the factors that influence premiums, comparing policies, and following the tips outlined in this article, you can secure affordable term insurance coverage that provides the financial protection your loved ones deserve.

Remember, term insurance is a crucial component of your financial planning, and choosing the right policy can give you peace of mind knowing that your family's future is secure. Take the time to assess your needs, research, and make an informed decision to ensure a bright and financially stable future for your loved ones.

How do I know if I qualify for the cheapest term insurance rates?

+Qualifying for the cheapest term insurance rates depends on various factors, including your age, health status, tobacco usage, and credit score. Generally, younger individuals with a healthy lifestyle and no pre-existing medical conditions are more likely to qualify for preferred rates. It’s advisable to consult with insurance providers or brokers to understand your eligibility and the specific requirements for the cheapest term insurance rates.

Can I switch to a different term insurance policy if I find a better deal later on?

+Yes, you can switch to a different term insurance policy if you find a better deal or if your circumstances change. However, it’s essential to carefully review the terms and conditions of your current policy, as some policies may have surrender charges or penalties for early cancellation. Additionally, you may need to undergo a new medical examination when switching to a new policy, depending on the provider’s requirements.

Are there any hidden costs or fees associated with term insurance policies?

+While term insurance policies are generally straightforward, it’s crucial to review the policy documents carefully to understand any potential hidden costs or fees. Some policies may have administrative fees, surrender charges, or additional charges for certain riders or benefits. Ensure you are aware of these costs to make an informed decision about your term insurance coverage.

Can I increase the coverage amount of my term insurance policy if my financial needs change?

+Yes, many term insurance policies allow policyholders to increase the coverage amount during the policy term. This flexibility is particularly beneficial if your financial responsibilities or family circumstances change, such as the birth of a child or the purchase of a new home. However, increasing the coverage amount may result in higher premiums, so it’s essential to carefully assess your needs and budget before making any changes.