Cheapest Renters Insurance

Renters insurance is a crucial yet often overlooked aspect of financial planning, especially for those living in rented accommodations. This type of insurance provides coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances like theft, fire, or natural disasters. While the primary goal is to safeguard your possessions, it also offers peace of mind, knowing that you're financially protected in the face of uncertainty. However, finding the right policy that offers adequate coverage at an affordable price can be a daunting task. This article aims to guide you through the process, highlighting the key factors to consider and presenting the cheapest renters insurance options currently available on the market.

Understanding Renters Insurance

Renters insurance is a form of property insurance that specifically caters to individuals who rent their place of residence. Unlike homeowners insurance, which covers the structure of the home and its contents, renters insurance primarily focuses on protecting the tenant’s personal belongings and providing liability coverage. This insurance is particularly important as it safeguards your possessions against a range of perils, including theft, fire, water damage, and natural disasters like hurricanes or tornadoes.

Additionally, renters insurance often includes liability coverage, which can protect you from financial loss if someone is injured on your rental property and decides to sue you. It also provides coverage for additional living expenses, such as temporary accommodation and food costs, if your rental becomes uninhabitable due to a covered event.

Factors to Consider When Choosing Renters Insurance

When shopping for renters insurance, there are several key factors that you should consider to ensure you’re getting the best coverage at the most competitive price. These factors include the amount of coverage you need, the specific perils covered by the policy, any available discounts, and the financial strength and reputation of the insurance provider.

Coverage Amount

The first step in choosing renters insurance is to determine the amount of coverage you need. This will depend on the value of your personal belongings and any additional living expenses you may incur in the event of a covered loss. It’s important to accurately assess the value of your possessions, as underestimating can leave you underinsured, while overestimating can result in unnecessary expense.

To determine the appropriate coverage amount, consider the replacement cost of your belongings. This is the cost to replace your items with new ones of similar quality, rather than the original purchase price. You can use an online calculator or a home inventory app to help you estimate the value of your possessions.

Perils Covered

Different renters insurance policies cover different perils, so it’s essential to understand what risks are included in your policy. Common perils covered include fire, lightning, windstorms, hail, explosions, smoke, vandalism, and theft. Some policies may also cover additional perils, such as water damage from plumbing issues or weight of ice and snow.

It's crucial to review the policy's coverage details to ensure that the perils most likely to affect your area are included. For example, if you live in a region prone to earthquakes or floods, you'll want to make sure these perils are covered, as standard renters insurance policies often exclude them.

Discounts and Savings

Many insurance companies offer discounts and savings opportunities to make their policies more affordable. These can include multi-policy discounts (if you bundle your renters insurance with other policies, like auto insurance), loyalty discounts (for long-term customers), and discounts for specific safety features in your home, such as smoke detectors or security systems.

Additionally, some insurers offer discounts for certain professions or affiliations, such as military service members or members of specific professional organizations. It's worth inquiring about these discounts when obtaining quotes to ensure you're getting the most competitive price.

Financial Strength and Reputation

When choosing an insurance provider, it’s important to consider their financial strength and reputation. A financially stable company is more likely to be able to pay out claims, even in the event of a large-scale disaster affecting many policyholders. You can research an insurer’s financial strength by checking their ratings with independent agencies like AM Best, Moody’s, or Standard & Poor’s.

Additionally, consider the insurer's reputation for customer service and claim handling. Reading reviews from current and past customers can give you an idea of the company's responsiveness and fairness when it comes to paying out claims. A company with a good reputation for customer service is more likely to provide a positive experience if you ever need to file a claim.

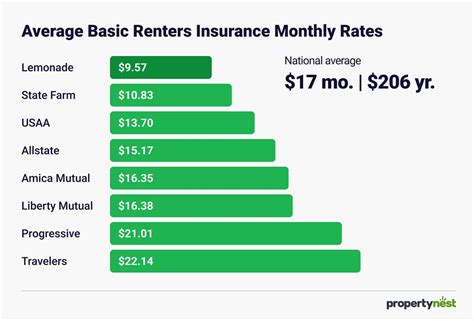

The Cheapest Renters Insurance Options

Now that we’ve covered the key factors to consider when choosing renters insurance, let’s delve into some of the most affordable options currently available on the market.

State Farm

State Farm is one of the largest insurance providers in the United States and offers competitive renters insurance rates. Their standard renters insurance policy provides coverage for personal property, liability, and additional living expenses. State Farm also offers several discounts, including a multi-line discount for bundling your renters insurance with other policies, such as auto insurance.

State Farm's renters insurance policies start at around $12 per month for basic coverage, making it one of the most affordable options available. However, the exact cost will depend on various factors, including the amount of coverage you choose, your location, and any applicable discounts.

Lemonade

Lemonade is a unique insurance provider that operates entirely online and uses artificial intelligence to streamline the insurance process. They offer renters insurance policies that provide coverage for personal property, liability, and additional living expenses, with the option to customize your coverage to suit your specific needs.

Lemonade's renters insurance policies are incredibly affordable, with premiums starting at just $5 per month. This low cost is made possible by Lemonade's innovative business model, which includes a flat fee for administrative costs and an optional "Giveback" program, where any unused premium is donated to a charity of your choice.

Allstate

Allstate is another well-known insurance provider that offers comprehensive renters insurance policies. Their standard policy covers personal property, liability, and additional living expenses, with the option to add additional coverage for specific items, such as jewelry or musical instruments.

Allstate's renters insurance policies are generally affordable, with premiums starting at around $15 per month for basic coverage. However, the exact cost will depend on various factors, including the amount of coverage you choose, your location, and any applicable discounts.

Progressive

Progressive is a leading insurance provider that offers a wide range of insurance products, including renters insurance. Their renters insurance policies provide coverage for personal property, liability, and additional living expenses, with the option to customize your coverage to meet your specific needs.

Progressive's renters insurance policies are known for their affordability, with premiums starting at around $10 per month for basic coverage. The exact cost will depend on various factors, including the amount of coverage you choose, your location, and any applicable discounts.

USAA

USAA is an insurance provider that specifically caters to military service members, veterans, and their families. They offer a range of insurance products, including renters insurance, which provides coverage for personal property, liability, and additional living expenses.

USAA's renters insurance policies are designed to be affordable, with premiums starting at around $10 per month for basic coverage. However, it's important to note that USAA's policies are only available to those who meet their eligibility criteria, which includes being an active-duty military service member, veteran, or a direct family member of someone who serves or has served in the military.

Performance Analysis

When it comes to performance, the key metric to consider is the number of claims paid out by the insurance provider relative to the total number of claims filed. A higher claims-paid ratio indicates that the insurer is more responsive and likely to honor their policy obligations. Additionally, the speed at which claims are processed and paid out is another important factor, as it directly impacts your financial recovery after a loss.

Among the cheapest renters insurance options, State Farm stands out for its strong financial performance and claims-paying ability. They consistently rank highly in terms of claims satisfaction, with a proven track record of paying out claims promptly and fairly. Lemonade also performs well in this regard, with a unique business model that prioritizes efficient claims processing and customer satisfaction.

Allstate and Progressive also have solid reputations for claims handling, with a good track record of paying out claims in a timely manner. However, it's important to note that the specific performance of any insurance provider can vary based on the location and type of claim, so it's always a good idea to research the company's performance in your specific area before making a decision.

Evidence-Based Future Implications

The renters insurance market is evolving, with a growing focus on digital innovation and customer-centric business models. Insurers like Lemonade are leading the way with their use of artificial intelligence and online platforms to streamline the insurance process, making it more efficient and cost-effective for both the insurer and the policyholder.

This trend towards digital transformation is likely to continue, with more insurers adopting online platforms and leveraging technology to improve the customer experience. This shift is expected to drive down costs and increase competition, ultimately benefiting consumers by making insurance more affordable and accessible.

Additionally, there is a growing trend towards personalized insurance, where policies can be customized to meet the specific needs and circumstances of the policyholder. This shift towards more tailored coverage is expected to continue, allowing renters to choose the coverage that best suits their individual needs and budgets.

Conclusion

Renters insurance is an essential financial tool for anyone living in a rented accommodation, providing peace of mind and financial protection in the face of unexpected events. While finding affordable renters insurance can be a challenge, there are several excellent options available on the market, including State Farm, Lemonade, Allstate, Progressive, and USAA.

When choosing renters insurance, it's important to consider factors such as coverage amount, perils covered, available discounts, and the financial strength and reputation of the insurance provider. By carefully evaluating these factors and comparing different policies, you can find the cheapest renters insurance option that provides the coverage you need at a price you can afford.

What is the average cost of renters insurance per month?

+The average cost of renters insurance per month varies depending on several factors, including the amount of coverage you need, your location, and any applicable discounts. However, as a general guide, you can expect to pay anywhere from 10 to 30 per month for basic renters insurance coverage.

How much renters insurance do I need?

+The amount of renters insurance you need will depend on the value of your personal belongings and any additional living expenses you may incur in the event of a covered loss. It’s important to accurately assess the value of your possessions and choose a coverage amount that will adequately protect your financial interests.

What perils are typically covered by renters insurance?

+Renters insurance typically covers a range of perils, including fire, lightning, windstorms, hail, explosions, smoke, vandalism, and theft. Some policies may also cover additional perils, such as water damage from plumbing issues or weight of ice and snow. It’s important to review the policy’s coverage details to ensure that the perils most likely to affect your area are included.

Are there any discounts available for renters insurance?

+Yes, many insurance companies offer discounts to make renters insurance more affordable. These can include multi-policy discounts (for bundling renters insurance with other policies), loyalty discounts (for long-term customers), and discounts for specific safety features in your home. It’s worth inquiring about these discounts when obtaining quotes to ensure you’re getting the most competitive price.