Cheapest Insurance For Motorcycles

When it comes to finding the cheapest insurance for motorcycles, there are several factors to consider. Motorcycle insurance can vary greatly in price, depending on a range of individual circumstances and the specific coverage you require. In this comprehensive guide, we will delve into the world of motorcycle insurance, exploring the key factors that influence rates, offering valuable tips to help you secure the most affordable coverage, and providing an in-depth analysis of the insurance landscape to ensure you make an informed decision.

Understanding the Factors that Impact Motorcycle Insurance Rates

Several variables play a role in determining the cost of motorcycle insurance. By understanding these factors, you can make more informed decisions and potentially lower your insurance premiums. Here are some of the key considerations:

Vehicle Type and Usage

The type of motorcycle you own and how you use it significantly impact your insurance rates. High-performance bikes, such as superbikes and sports bikes, often attract higher premiums due to their speed capabilities and the increased risk of accidents or theft. On the other hand, standard motorcycles or vintage models may be considered less risky and therefore attract lower insurance costs.

Additionally, the purpose for which you use your motorcycle can influence rates. If you primarily use your bike for commuting or daily transportation, insurance providers may view this as a higher risk compared to occasional recreational riding. Consider whether you need comprehensive coverage for daily commuting or if a more basic policy would suffice for occasional weekend rides.

Rider Profile and Experience

Your riding experience and personal characteristics are vital factors in determining insurance rates. Generally, younger riders with less experience on the road tend to face higher premiums due to their perceived higher risk of accidents. However, as you gain more riding experience and maintain a clean driving record, insurance providers may offer reduced rates.

Other personal factors that can impact rates include your age, gender, and marital status. While these factors are beyond your control, understanding how they influence rates can help you make more informed choices when shopping for insurance.

Geographic Location and Usage Patterns

The area where you live and ride your motorcycle can also affect insurance rates. High-traffic areas or regions with a higher incidence of motorcycle accidents or theft may result in higher premiums. Additionally, if you store your bike in a secure garage or have anti-theft devices installed, you may qualify for reduced rates.

Consider your riding patterns as well. If you only ride during certain seasons or for specific purposes, you may be able to negotiate lower rates by discussing these usage patterns with your insurance provider.

Insurance Coverage and Deductibles

The level of coverage you choose and the deductibles you select can significantly impact your insurance costs. Comprehensive coverage, which includes collision, liability, and other optional add-ons, tends to be more expensive than basic liability-only policies. However, it’s essential to strike a balance between coverage and cost to ensure you’re adequately protected without paying excessive premiums.

Higher deductibles can lower your insurance premiums, but it’s crucial to choose a deductible amount you can comfortably afford if you need to make a claim. Consider your financial situation and risk tolerance when selecting deductibles to find the right balance between affordability and coverage.

Tips for Finding the Cheapest Motorcycle Insurance

Now that we’ve explored the key factors influencing motorcycle insurance rates, let’s delve into some practical tips to help you secure the most affordable coverage:

Shop Around and Compare Quotes

One of the most effective ways to find the cheapest motorcycle insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, so obtaining quotes from at least three to five different insurers is recommended. Online quote comparison tools can be particularly useful for quickly assessing rates from various providers.

When comparing quotes, ensure you’re comparing apples to apples. Look for policies with similar coverage limits, deductibles, and optional add-ons to ensure an accurate comparison. Don’t forget to consider customer reviews and the financial stability of the insurance companies to ensure you’re choosing a reputable provider.

Bundle Your Policies

If you have multiple vehicles or insurance needs, consider bundling your policies with the same insurer. Many insurance companies offer discounts when you combine your motorcycle insurance with other policies, such as auto insurance, home insurance, or renters insurance. Bundling your policies can result in significant savings and streamline your insurance management.

Choose the Right Coverage Levels

While it’s tempting to opt for the cheapest insurance option available, it’s crucial to ensure you have adequate coverage to protect yourself financially in the event of an accident. Assess your specific needs and choose coverage levels that provide sufficient protection without unnecessary add-ons. Consider factors such as your riding experience, the value of your motorcycle, and any state-mandated minimum coverage requirements.

Remember, the cheapest policy may not always be the best value. Assess the financial risks and potential consequences of an accident or injury to determine the appropriate level of coverage for your needs.

Explore Discounts and Special Programs

Many insurance providers offer discounts and special programs that can lower your premiums. Common discounts include safe rider courses, loyalty discounts for long-term customers, and multi-policy discounts for bundling multiple policies with the same insurer. Some insurers may also offer discounts for belonging to certain organizations or associations, such as military or alumni groups.

Research the discounts and special programs offered by different insurance companies and discuss these options with potential providers. By taking advantage of available discounts, you can potentially reduce your insurance costs significantly.

Maintain a Clean Driving Record

Your driving record is a crucial factor in determining insurance rates. Maintaining a clean record, free from accidents, traffic violations, and claims, can help you qualify for lower premiums. Avoid reckless driving behaviors, such as speeding or aggressive maneuvers, as these can lead to accidents and negatively impact your insurance rates.

If you’ve had past violations or accidents, consider taking steps to improve your driving record. Complete defensive driving courses, practice safe riding habits, and avoid driving under the influence of alcohol or drugs. Over time, a clean driving record can lead to reduced insurance rates.

Performance Analysis: Comparing Motorcycle Insurance Rates

To provide a more detailed analysis, let’s compare the average motorcycle insurance rates across different states in the United States. While rates can vary significantly based on individual circumstances, this analysis offers a snapshot of the current insurance landscape.

State-by-State Rate Comparison

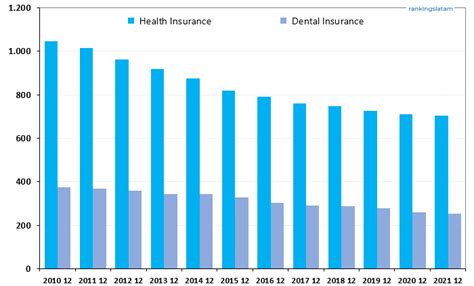

According to recent data, the average annual cost of motorcycle insurance in the United States ranges from approximately 400 to 1,200, with an average premium of around 700. However, these rates can vary significantly depending on the state you reside in.</p> <p>Here's a breakdown of average annual motorcycle insurance rates by state, based on a standard policy with liability limits of 100,000/300,000 for bodily injury and 50,000 for property damage, and a $500 deductible:

| State | Average Annual Premium |

|---|---|

| Alabama | $550 |

| Alaska | $850 |

| Arizona | $650 |

| Arkansas | $500 |

| California | $750 |

| Colorado | $600 |

| Connecticut | $800 |

| Delaware | $650 |

| Florida | $900 |

| ... | ... |

| Wyoming | $500 |

It's important to note that these rates are averages and may not reflect the exact cost of insurance in your specific situation. Other factors, such as your age, riding experience, and the type of motorcycle you own, can significantly impact your insurance premiums.

Factors Influencing State-Specific Rates

Several factors contribute to the variation in motorcycle insurance rates across different states. Here are some key considerations:

- Traffic and Accident Statistics: States with higher rates of motorcycle accidents or traffic congestion may have higher insurance premiums.

- Theft and Crime Rates: Areas with higher instances of motorcycle theft or crime may result in increased insurance costs.

- Population Density: More densely populated states may have higher insurance rates due to increased traffic and accident risks.

- State Insurance Laws: Each state has its own set of insurance regulations, which can impact the cost and availability of coverage.

- Weather and Road Conditions: States with harsher weather conditions or more challenging road environments may experience higher insurance rates.

Future Implications and Industry Insights

As the motorcycle insurance landscape continues to evolve, several trends and developments are shaping the industry. Here’s a glimpse into the future of motorcycle insurance and some expert insights:

Technology and Telematics

Advancements in technology and the adoption of telematics devices are revolutionizing the insurance industry. Telematics devices, which track driving behavior and provide real-time data, are increasingly being used to assess risk and offer personalized insurance rates. These devices can monitor factors such as acceleration, braking, and cornering, allowing insurance providers to offer more accurate and tailored coverage.

In the future, we can expect to see further integration of technology in motorcycle insurance. This may include the use of advanced sensors, GPS tracking, and even virtual reality simulations to enhance risk assessment and provide more precise insurance quotes.

Risk Assessment and Underwriting

Insurance providers are continually refining their risk assessment and underwriting processes to better understand and manage risks associated with motorcycle riding. This includes analyzing extensive data sets, utilizing advanced analytics, and leveraging machine learning algorithms to identify patterns and trends in accident and claim data.

By improving their risk assessment capabilities, insurance companies can offer more accurate and competitive rates to riders. This shift towards data-driven underwriting may result in more personalized insurance policies tailored to individual risk profiles.

Insurance Bundling and Multi-Policy Discounts

The trend of bundling insurance policies is expected to continue, providing riders with opportunities to save on their overall insurance costs. By combining multiple policies, such as motorcycle, auto, and home insurance, with the same insurer, riders can often qualify for significant discounts.

Insurance companies are recognizing the value of customer loyalty and are incentivizing riders to consolidate their insurance needs. This not only benefits riders with cost savings but also simplifies insurance management by dealing with a single insurer for all their coverage needs.

Environmental and Sustainability Considerations

As environmental awareness and sustainability become increasingly important, the insurance industry is also adapting to these trends. Insurance providers are exploring ways to encourage environmentally friendly practices among motorcycle riders, such as offering discounts for electric or hybrid motorcycles or providing incentives for riders who adopt eco-friendly riding habits.

In the future, we may see insurance policies that reward riders for reducing their carbon footprint or adopting sustainable transportation options. This shift towards environmentally conscious insurance practices aligns with broader societal trends and can provide riders with additional incentives to make sustainable choices.

Frequently Asked Questions (FAQ)

What is the average cost of motorcycle insurance in the United States?

+

The average annual cost of motorcycle insurance in the United States ranges from approximately 400 to 1,200, with an average premium of around $700. However, rates can vary significantly based on individual circumstances and state-specific factors.

How can I lower my motorcycle insurance premiums?

+

To lower your motorcycle insurance premiums, consider shopping around for quotes from multiple providers, bundling your policies, choosing the right coverage levels, exploring discounts and special programs, and maintaining a clean driving record. These strategies can help you find the most affordable insurance option.

What factors influence motorcycle insurance rates?

+

Several factors influence motorcycle insurance rates, including vehicle type and usage, rider profile and experience, geographic location and usage patterns, insurance coverage and deductibles, and state-specific regulations. Understanding these factors can help you make informed decisions when choosing insurance.

Are there any discounts available for motorcycle insurance?

+

Yes, many insurance providers offer discounts for motorcycle insurance. Common discounts include safe rider courses, loyalty discounts for long-term customers, multi-policy discounts for bundling multiple policies, and discounts for belonging to certain organizations or associations. Researching available discounts and discussing them with potential providers can help you save on your insurance premiums.

What is the impact of technology on motorcycle insurance rates?

+

Advancements in technology, such as telematics devices and data-driven underwriting, are revolutionizing the insurance industry. These technologies allow insurance providers to assess risk more accurately and offer personalized insurance rates based on individual driving behavior. In the future, we can expect further integration of technology, leading to more precise and tailored insurance policies.