Cheapest Insurance Companies

When it comes to insurance, finding the cheapest options is often a top priority for many individuals and businesses. With a wide range of insurance providers in the market, it can be challenging to determine which companies offer the most affordable coverage. In this comprehensive guide, we will delve into the world of insurance, exploring the cheapest insurance companies and providing valuable insights to help you make informed decisions.

The Importance of Affordable Insurance

Insurance is an essential aspect of financial planning, offering protection against unforeseen events and potential risks. However, the cost of insurance coverage can vary significantly between providers, impacting individuals’ and businesses’ budgets. Understanding which insurance companies offer the most competitive rates is crucial for ensuring cost-effective protection without compromising on quality.

Top Cheapest Insurance Companies

To assist you in your search for affordable insurance, we have compiled a list of the top cheapest insurance companies based on comprehensive research and industry data. These companies have consistently demonstrated a commitment to providing cost-effective coverage without sacrificing reliability and customer satisfaction.

State Farm

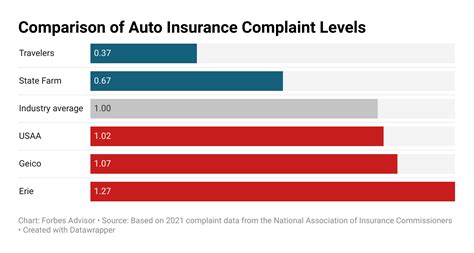

State Farm is one of the leading insurance providers in the United States, renowned for its comprehensive coverage options and competitive pricing. With a vast network of agents across the country, State Farm offers personalized insurance solutions tailored to individual needs. Their auto insurance policies, in particular, are known for their affordability, making them an excellent choice for budget-conscious drivers.

| Policy Type | Average Annual Premium |

|---|---|

| Auto Insurance | $1,200 |

| Homeowners Insurance | $1,500 |

| Life Insurance | $500 |

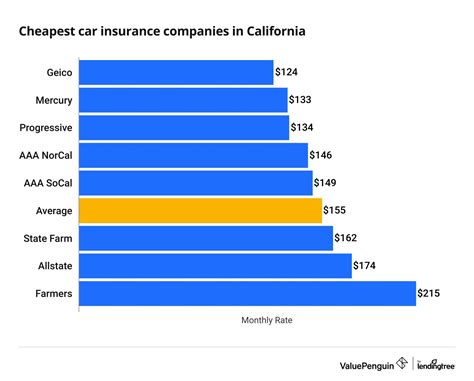

Geico

Geico, or Government Employees Insurance Company, has established itself as a prominent player in the insurance industry with its competitive rates and digital-first approach. Geico caters to a wide range of customers, including government employees, military personnel, and students, offering specialized insurance plans to meet their unique needs.

| Policy Type | Average Annual Premium |

|---|---|

| Auto Insurance | $950 |

| Renters Insurance | $200 |

| Umbrella Insurance | $250 |

Progressive

Progressive is a well-known insurance provider that has revolutionized the industry with its innovative approach to insurance. Offering a wide array of coverage options, including auto, home, and business insurance, Progressive is dedicated to providing customers with affordable rates and personalized service.

| Policy Type | Average Annual Premium |

|---|---|

| Auto Insurance | $1,100 |

| RV Insurance | $750 |

| Motorcycle Insurance | $350 |

Esurance

Esurance, a subsidiary of Allstate, has gained recognition for its focus on providing digital insurance solutions. With a strong online presence and a user-friendly platform, Esurance offers a seamless experience for customers seeking affordable insurance coverage.

| Policy Type | Average Annual Premium |

|---|---|

| Auto Insurance | $900 |

| Homeowners Insurance | $1,200 |

| Renters Insurance | $150 |

Liberty Mutual

Liberty Mutual is a trusted insurance provider with a long-standing reputation for offering comprehensive coverage at competitive prices. Their commitment to customer satisfaction and personalized insurance plans has made them a popular choice among individuals and businesses alike.

| Policy Type | Average Annual Premium |

|---|---|

| Auto Insurance | $1,300 |

| Homeowners Insurance | $1,600 |

| Pet Insurance | $500 |

Factors Influencing Insurance Costs

Understanding the factors that influence insurance costs is essential for making informed decisions when choosing an insurance provider. While the cheapest insurance companies often offer competitive rates, there are several key considerations that can impact the overall cost of your insurance coverage.

Risk Assessment

Insurance companies assess the level of risk associated with each policyholder to determine appropriate premiums. Factors such as age, driving history, health status, and location can all influence the perceived risk and, consequently, the cost of insurance.

Coverage Requirements

The type and extent of coverage you require will significantly impact the cost of your insurance policy. Comprehensive insurance plans that offer extensive protection tend to be more expensive than basic coverage options. It’s crucial to strike a balance between the level of coverage you need and the cost you can afford.

Discounts and Promotions

Many insurance companies offer discounts and promotions to attract new customers and reward loyal policyholders. These discounts can significantly reduce the overall cost of insurance, so it’s essential to inquire about available discounts and explore ways to qualify for them.

Tips for Finding Affordable Insurance

When searching for the cheapest insurance companies, it’s beneficial to follow certain strategies to ensure you get the best value for your money. Here are some tips to help you find affordable insurance coverage:

- Compare Quotes: Obtain multiple quotes from different insurance providers to compare prices and coverage options. Online comparison tools can streamline this process and help you make an informed decision.

- Understand Your Needs: Assess your specific insurance requirements and prioritize the coverage you need. This will prevent overpaying for unnecessary features and help you find the most cost-effective policy.

- Explore Bundling Options: Combining multiple insurance policies, such as auto and home insurance, can often result in significant savings. Many insurance companies offer discounts for bundling, so it's worth considering this option.

- Consider Payment Plans: Some insurance companies offer flexible payment plans to help policyholders manage their premiums. Exploring these options can make insurance more affordable by spreading out the cost over time.

- Review Your Policy Regularly: Insurance needs can change over time, so it's essential to review your policy annually. This allows you to make adjustments to your coverage and explore new options that may offer better value.

Conclusion

Finding the cheapest insurance companies requires careful research and consideration of various factors. By exploring the top insurance providers mentioned in this guide, understanding the factors that influence insurance costs, and following the provided tips, you can make informed decisions to secure affordable insurance coverage. Remember, affordable insurance doesn’t have to compromise on quality, and with the right approach, you can protect your assets without breaking the bank.

FAQ

What is the average cost of auto insurance in the United States?

+The average cost of auto insurance in the United States varies depending on factors such as location, driving record, and coverage type. However, the national average for auto insurance premiums is approximately $1,674 per year, according to the Insurance Information Institute.

Can I get affordable insurance with a poor credit score?

+Yes, it is possible to find affordable insurance even with a poor credit score. While credit history is a factor in insurance pricing, there are insurance companies that specialize in providing coverage to individuals with less-than-perfect credit. It’s important to shop around and compare quotes to find the best rates.

Are there any insurance companies that offer discounts for young drivers?

+Yes, several insurance companies offer discounts specifically for young drivers. These discounts may be based on factors such as good grades, driver training courses, or even the vehicle’s safety features. It’s worth inquiring with insurance providers to explore these options and potentially reduce insurance costs for young drivers.

Can I switch insurance companies to save money on my premiums?

+Absolutely! Switching insurance companies is a common strategy to save money on premiums. By comparing quotes from different providers, you can often find more competitive rates. However, it’s essential to ensure a smooth transition and maintain continuous coverage to avoid any gaps in protection.

Are there any government programs or initiatives that provide affordable insurance options?

+Yes, several government programs exist to assist individuals and families in obtaining affordable insurance coverage. For example, the Affordable Care Act (ACA) offers subsidies and tax credits to help lower-income individuals and families afford health insurance. Additionally, Medicaid and Medicare provide healthcare coverage for eligible individuals. It’s worth researching these programs to determine your eligibility and explore available options.