Cheap Rent Insurance

Renters often overlook the importance of insurance, assuming that their landlord's insurance covers any potential damages or losses. However, this is a common misconception. Renters need their own insurance to protect their possessions and liability, especially in today's world where unexpected events and accidents can occur anytime, anywhere.

While it is crucial to have renters insurance, many individuals are deterred by the perceived high costs. Fortunately, there are affordable options available that provide comprehensive coverage without breaking the bank. In this article, we will delve into the world of cheap rent insurance, exploring the factors that affect its cost, the benefits it offers, and how to find the best policy for your needs.

Understanding the Cost of Rent Insurance

The cost of rent insurance, or renters insurance as it is commonly known, can vary significantly depending on several factors. Understanding these factors can help you make informed decisions when choosing a policy and potentially reduce the overall cost.

Location and Risk Factors

One of the primary determinants of rent insurance cost is the location of the rental property. Insurance providers assess the risk associated with a particular area, taking into account factors such as crime rates, natural disasters, and even the proximity to fire stations. For instance, a rental property in an area prone to hurricanes or earthquakes will likely have higher insurance premiums due to the increased risk of damage.

| Location | Average Annual Premium |

|---|---|

| High-Risk Area (e.g., Coastal Region) | $350 |

| Moderate-Risk Area (e.g., Suburban Neighborhood) | $280 |

| Low-Risk Area (e.g., Rural Setting) | $220 |

Additionally, the type of building can also influence the cost. Apartments in a secure, well-maintained complex may have lower premiums compared to standalone rental homes, which could be more susceptible to break-ins or weather-related damages.

Coverage Amount and Deductibles

The amount of coverage you choose for your personal property and liability will directly impact the cost of your insurance. Generally, the more coverage you opt for, the higher the premium. However, it is essential to strike a balance between adequate coverage and affordability.

Deductibles, the amount you pay out-of-pocket before the insurance coverage kicks in, can also affect the cost. Higher deductibles typically result in lower premiums, but it's important to consider your financial situation and ability to cover a larger deductible in the event of a claim.

Discounts and Bundling

Insurance providers often offer discounts to encourage renters to purchase policies. These discounts can significantly reduce the overall cost of insurance. Some common discounts include:

- Multi-Policy Discounts: If you already have other insurance policies, such as auto insurance, with the same provider, you may be eligible for a discount on your rent insurance.

- Loyalty Discounts: Insurance companies sometimes reward long-term customers with lower premiums.

- Safety Features Discounts: Renters who have installed security systems, smoke detectors, or fire extinguishers in their rental units may qualify for reduced premiums.

Furthermore, bundling your insurance policies can lead to substantial savings. By combining rent insurance with other policies, like auto or home insurance, you can often negotiate better rates.

Benefits of Rent Insurance

Cheap rent insurance might seem like a good deal, but it's important to ensure that you're not sacrificing coverage for cost. Here are some key benefits that a good rent insurance policy should offer:

Personal Property Coverage

Rent insurance provides coverage for your personal belongings, including furniture, electronics, clothing, and more. In the event of a covered loss, such as a fire, theft, or vandalism, your insurance policy will reimburse you for the cost of replacing these items.

Liability Protection

Rent insurance also offers liability protection, which is crucial for renters. If someone is injured in your rental unit or if your actions result in property damage to others, your insurance will cover the legal costs and any damages awarded up to your policy limits.

Additional Living Expenses

In the unfortunate event that your rental unit becomes uninhabitable due to a covered loss, your insurance policy may provide additional living expenses coverage. This coverage helps pay for temporary housing and other necessary expenses until you can return to your home.

Optional Coverages

Many rent insurance policies offer optional coverages that can be added to your policy for an additional cost. These coverages can provide protection for specific items or situations, such as:

- Personal Property Floater: This coverage provides extra protection for valuable items like jewelry, fine art, or collectibles that may exceed the standard coverage limits.

- Water Backup Coverage: If your rental unit is susceptible to water damage due to backup from sewers or drains, this coverage can provide peace of mind.

- Identity Theft Coverage: With the rise of identity theft, this coverage can help reimburse you for expenses incurred as a result of identity theft and provide assistance in restoring your identity.

Finding the Best Cheap Rent Insurance

Now that we've explored the cost factors and benefits of rent insurance, it's time to dive into the process of finding the best policy for your needs at an affordable price.

Research and Compare Providers

Start by researching and comparing different insurance providers. Look for reputable companies that offer a range of coverage options and have a good track record of claims handling. Online reviews and customer feedback can provide valuable insights into the quality of service and overall customer satisfaction.

Compare the features and costs of various policies, including the coverage limits, deductibles, and any additional benefits or discounts offered. Consider using online insurance comparison tools to streamline the process and quickly get an overview of the market.

Assess Your Coverage Needs

Before selecting a policy, take the time to assess your specific coverage needs. Consider the value of your personal belongings and the potential liability risks associated with your rental unit. It's essential to find a balance between adequate coverage and affordability.

If you have valuable items, such as expensive electronics or jewelry, you may want to consider adding a personal property floater to your policy to ensure they are fully covered. Additionally, assess the likelihood of liability risks and choose a policy with appropriate liability limits to protect yourself financially.

Shop Around for Quotes

Don't settle for the first quote you receive. Shop around and request quotes from multiple insurance providers. This will give you a better understanding of the range of prices available and allow you to negotiate better rates.

When requesting quotes, provide accurate and detailed information about your rental unit, including the location, the value of your personal belongings, and any safety features or discounts you may be eligible for. Being transparent and providing accurate information will ensure you receive quotes that reflect your actual needs and potential risks.

Consider Bundling Options

As mentioned earlier, bundling your insurance policies can lead to significant savings. If you already have other insurance policies, such as auto or homeowners insurance, consider bundling them with your rent insurance. Many insurance providers offer discounts for customers who bundle multiple policies, making it a cost-effective option.

Read the Fine Print

Before finalizing your insurance policy, take the time to carefully read the fine print. Understand the coverage limits, exclusions, and any conditions that may apply. Make sure you are comfortable with the terms and conditions of the policy and that it aligns with your expectations and needs.

If you have any questions or concerns about the policy, don't hesitate to reach out to the insurance provider's customer service team. They should be able to clarify any uncertainties and provide additional information to help you make an informed decision.

Future of Rent Insurance

As the rental market continues to evolve, so does the world of rent insurance. Here are some trends and potential future developments to consider:

Increased Focus on Digitalization

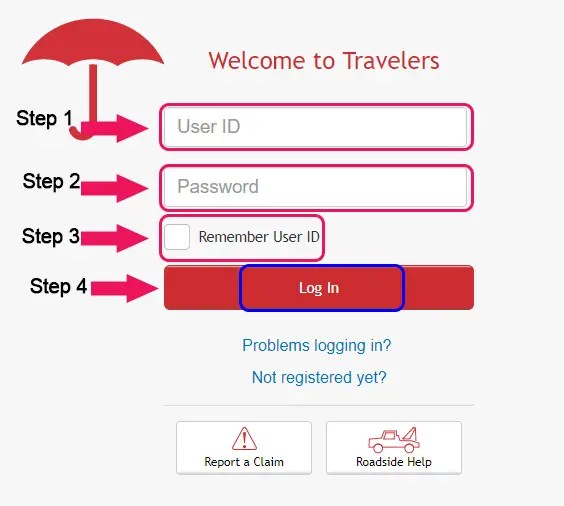

The insurance industry is embracing digitalization, and rent insurance is no exception. Insurance providers are investing in technology to streamline the policy acquisition process, making it more convenient and efficient for renters. Online applications, digital signatures, and instant coverage confirmation are becoming the norm, enhancing the overall customer experience.

Personalized Coverage Options

Insurance providers are recognizing the diverse needs of renters and are working towards offering more personalized coverage options. This includes customizable policies that allow renters to choose specific coverages based on their individual circumstances and preferences. By tailoring the policy to their needs, renters can achieve better value and peace of mind.

Expanded Use of Telematics

Telematics, the use of technology to monitor and analyze data, is expected to play a more significant role in rent insurance. For instance, insurance providers may use smart home devices or sensors to monitor and assess risks in real-time. This technology can help identify potential hazards, such as water leaks or fire risks, and provide renters with valuable insights to mitigate these risks.

Focus on Customer Experience

Insurance providers are increasingly prioritizing customer experience, aiming to provide renters with a seamless and hassle-free insurance journey. This includes improved claims handling processes, efficient customer service, and the implementation of self-service options. By focusing on customer satisfaction, insurance providers can build trust and loyalty among renters.

Integration of Sustainability Practices

With the growing emphasis on sustainability and environmental consciousness, insurance providers are exploring ways to integrate eco-friendly practices into rent insurance. This could include incentives for renters who adopt sustainable habits, such as energy-efficient appliances or water conservation measures. By promoting sustainable living, insurance providers can contribute to a greener future while also offering cost-effective solutions to renters.

FAQ

What is the average cost of rent insurance per month?

+The average cost of rent insurance can vary depending on factors such as location, coverage limits, and deductibles. On average, renters can expect to pay between 15 to 30 per month for basic coverage. However, it’s important to note that these costs can be significantly higher or lower depending on individual circumstances.

Do I need rent insurance if my landlord has insurance?

+While your landlord’s insurance may cover the structure of the building, it typically does not cover your personal belongings or liability. Rent insurance provides coverage specifically for renters, protecting their possessions and liability in the event of a covered loss. It is important to have your own insurance to ensure you are fully protected.

Can I get rent insurance if I have a low credit score?

+Yes, having a low credit score does not necessarily prevent you from obtaining rent insurance. Insurance providers typically consider a range of factors, including your rental history, claims history, and the value of your belongings, when determining your eligibility and premiums. It’s always worth shopping around and comparing quotes to find the best policy for your situation.

What should I do if I need to file a claim with my rent insurance?

+If you need to file a claim with your rent insurance, the first step is to contact your insurance provider as soon as possible. They will guide you through the claims process, which typically involves providing documentation and evidence of the loss. It’s important to cooperate fully with your insurance provider and provide accurate and honest information to ensure a smooth claims process.