Cheap Full Cover Insurance

Securing comprehensive insurance coverage at an affordable price is a priority for many individuals and businesses alike. Full cover insurance, also known as comprehensive insurance, offers a wide range of benefits to protect against various risks. In this article, we will delve into the world of cheap full cover insurance, exploring the factors that influence its affordability, the coverage options available, and the steps you can take to find the best deals without compromising on essential protections.

Understanding Full Cover Insurance

Full cover insurance, or comprehensive coverage, is a type of insurance policy that provides a broad range of protections against a variety of potential risks. Unlike basic liability insurance, which primarily covers damages caused to others, full cover insurance extends its reach to protect the insured individual or entity from a multitude of unforeseen circumstances.

This type of insurance is particularly valuable for individuals and businesses that wish to safeguard their assets, property, and financial stability in the face of unexpected events. Full cover insurance policies typically include coverage for damages to the insured's property, medical expenses, legal liabilities, and even personal injuries sustained by the insured or others involved in an incident.

The comprehensive nature of full cover insurance makes it an attractive option for those seeking peace of mind and financial security. By understanding the scope and benefits of full cover insurance, individuals can make informed decisions about their insurance needs and find affordable policies that provide the necessary protections.

The Benefits of Full Cover Insurance

Full cover insurance offers a comprehensive set of benefits that can provide significant peace of mind and financial security. Here are some key advantages of opting for this type of insurance coverage:

- Comprehensive Protection: Full cover insurance extends its reach to cover a wide range of potential risks, including property damage, medical expenses, legal liabilities, and personal injuries. This broad coverage ensures that individuals and businesses are protected against a variety of unforeseen circumstances.

- Peace of Mind: Knowing that you have comprehensive insurance coverage can provide a sense of security and confidence. With full cover insurance, you can rest assured that you are prepared for unexpected events, reducing anxiety and stress related to potential financial losses.

- Financial Security: In the event of an accident or other covered incident, full cover insurance can help mitigate the financial impact. By covering medical bills, property repairs, and legal costs, this type of insurance ensures that individuals and businesses can focus on recovery without the added burden of substantial financial obligations.

- Customizable Options: Full cover insurance policies often offer a range of customizable options, allowing individuals to tailor their coverage to their specific needs and budget. This flexibility ensures that policyholders can select the level of protection that best suits their circumstances, providing added value and peace of mind.

Factors Affecting the Cost of Full Cover Insurance

The cost of full cover insurance can vary significantly depending on several key factors. Understanding these influences is essential when seeking affordable coverage options. Here are some of the primary factors that impact the cost of full cover insurance:

Risk Assessment

Insurance providers assess the level of risk associated with insuring an individual or entity. Factors such as age, occupation, location, and driving record (for auto insurance) play a significant role in determining the perceived risk. Higher-risk individuals or businesses may face higher insurance premiums to compensate for the increased likelihood of claims.

Coverage Options

The extent of coverage chosen can greatly impact the cost of full cover insurance. Policyholders have the flexibility to select the level of protection they require, including coverage limits, deductibles, and additional endorsements. Opting for higher coverage limits or adding optional endorsements can increase the overall cost of the policy.

Policyholder’s Profile

The personal characteristics and history of the policyholder are crucial in determining insurance premiums. Factors such as age, gender, marital status, and credit score can influence the perceived risk and, consequently, the cost of insurance. Younger individuals, for instance, may face higher premiums due to their lack of experience, while those with a strong credit history may enjoy more favorable rates.

Claims History

Insurance providers carefully consider an individual’s or business’s claims history when setting insurance rates. A history of frequent claims may indicate a higher risk profile, leading to increased premiums. On the other hand, a clean claims record can result in more affordable insurance rates, as it demonstrates a lower likelihood of future claims.

Location and Surroundings

The geographical location and surrounding environment can significantly impact insurance costs. Areas with higher crime rates, natural disaster risks, or dense traffic may result in higher premiums. Additionally, the proximity to emergency services and the availability of specialized medical care can also influence insurance rates.

Finding Affordable Full Cover Insurance

While full cover insurance offers extensive protection, it is possible to find affordable policies that meet your specific needs. Here are some strategies to help you secure cheap full cover insurance without compromising on essential coverage:

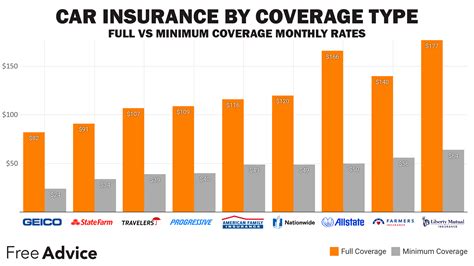

Compare Quotes from Multiple Providers

One of the most effective ways to find affordable full cover insurance is to compare quotes from multiple insurance providers. Each insurer has its own unique underwriting guidelines and pricing structures, so obtaining quotes from a variety of sources can help you identify the most competitive rates. Online comparison tools and insurance brokers can streamline this process, making it easier to compare options and find the best deal.

Utilize Online Comparison Tools

Online insurance comparison platforms have revolutionized the way individuals shop for insurance. These tools allow you to input your specific needs and preferences, and they generate personalized quotes from a wide range of insurance providers. By using online comparison tools, you can quickly assess different policy options, compare prices, and identify the most cost-effective full cover insurance plans available in your area.

Shop Around and Negotiate

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare prices from different insurers. Contact insurance providers directly and negotiate the terms of your policy. Many insurers are willing to offer discounts or customized plans to attract new customers, so don’t be afraid to ask for better rates or additional coverage options.

Consider Bundling Policies

Bundling multiple insurance policies, such as auto, home, and life insurance, with the same provider can often result in significant savings. Insurance companies often offer multi-policy discounts to encourage customers to purchase multiple types of coverage from them. By consolidating your insurance needs with a single provider, you can potentially reduce your overall insurance costs and simplify your policy management.

Review Coverage Limits and Deductibles

Reviewing your coverage limits and deductibles is an effective way to adjust your insurance costs. Increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lower your premium. However, it’s important to strike a balance between affordability and adequate protection. Consult with an insurance professional to determine the appropriate coverage limits and deductibles for your specific needs.

Maintain a Good Credit Score

Your credit score plays a significant role in determining your insurance rates. Insurance providers often use credit-based insurance scores to assess the risk associated with insuring an individual or business. Maintaining a good credit score can improve your chances of obtaining more favorable insurance rates. Consider reviewing your credit report regularly and taking steps to improve your creditworthiness if necessary.

Explore Discounts and Incentives

Insurance providers frequently offer discounts and incentives to attract and retain customers. These discounts can be based on various factors, such as safe driving records, loyalty to the insurer, or membership in certain organizations. Research the discounts available and ask your insurance provider about any potential savings you may qualify for. By taking advantage of these incentives, you can further reduce the cost of your full cover insurance policy.

Understand Policy Exclusions

It’s crucial to carefully review the exclusions outlined in your full cover insurance policy. Exclusions are specific circumstances or events that are not covered by the policy. By understanding these exclusions, you can ensure that you have the necessary coverage for your unique needs. If there are gaps in your coverage, consider adding optional endorsements or seeking out a policy that provides the desired level of protection.

Seek Professional Advice

If you’re unsure about the best insurance options for your needs, consider seeking advice from an insurance professional or broker. These experts can provide valuable insights and guidance based on your specific circumstances. They can help you navigate the complex world of insurance, assess your risk profile, and recommend the most suitable and affordable full cover insurance policy to meet your requirements.

Analyzing Performance and Future Implications

Understanding the performance and future implications of full cover insurance is crucial for both policyholders and insurance providers. By analyzing key metrics and trends, stakeholders can make informed decisions and adapt their strategies accordingly.

Key Performance Indicators (KPIs)

Insurance providers closely monitor various KPIs to assess the performance of their full cover insurance policies. These indicators help evaluate the effectiveness of coverage, identify areas for improvement, and make data-driven decisions. Some common KPIs include:

- Claims Frequency: This metric measures the number of claims filed per policyholder or per policy. A higher claims frequency may indicate a higher risk profile or inadequate coverage, prompting insurance providers to review their underwriting practices and adjust premiums accordingly.

- Claims Severity: Claims severity refers to the average cost of claims paid out by the insurance provider. Higher claim severity can impact profitability and may lead to adjustments in coverage limits or premium rates.

- Loss Ratio: The loss ratio is calculated by dividing the total incurred losses by the total earned premiums. A loss ratio above 100% indicates that the insurer is paying out more in claims than it is collecting in premiums, which may prompt adjustments in pricing or coverage terms.

- Customer Satisfaction: Measuring customer satisfaction is crucial for insurance providers to gauge the effectiveness of their policies and services. Positive customer feedback and high satisfaction ratings can drive retention and attract new customers, while negative feedback may prompt improvements in coverage offerings and customer support.

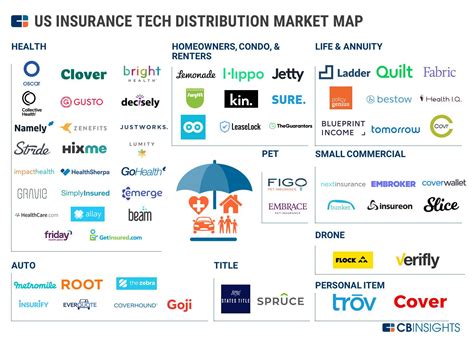

Future Trends and Innovations

The insurance industry is constantly evolving, driven by technological advancements, changing consumer expectations, and regulatory developments. Here are some key trends and innovations that are shaping the future of full cover insurance:

- Telematics and Usage-Based Insurance: Telematics technology, which collects data on driving behavior, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer personalized premiums based on actual driving habits. This innovative approach allows insurers to more accurately assess risk and offer tailored coverage, leading to potentially lower premiums for safe drivers.

- Digital Transformation: The digital revolution has transformed the insurance landscape, with online platforms, mobile apps, and digital tools becoming integral to the customer experience. Insurance providers are investing in technology to streamline processes, enhance customer engagement, and provide convenient self-service options. Digital transformation also enables insurers to gather and analyze vast amounts of data, improving risk assessment and personalization of coverage.

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are revolutionizing the insurance industry, from underwriting and risk assessment to claims processing and fraud detection. These technologies enable insurers to automate tasks, make data-driven decisions, and personalize coverage offerings. By leveraging AI, insurance providers can enhance efficiency, accuracy, and customer satisfaction while mitigating risks more effectively.

- Parametric Insurance: Parametric insurance is an innovative approach that provides coverage based on predefined parameters rather than traditional indemnity-based policies. This type of insurance triggers payments based on specific events or parameters, such as weather conditions or natural disasters. Parametric insurance offers faster claim settlements, reduced administrative burdens, and increased transparency, making it an attractive option for certain high-risk industries and emerging markets.

Conclusion

Cheap full cover insurance is an achievable goal for individuals and businesses seeking comprehensive protection at an affordable price. By understanding the factors that influence insurance costs, comparing quotes, and exploring various coverage options, you can find the right balance between affordability and essential protections. Additionally, staying informed about industry trends and innovations can help you make well-informed decisions and stay ahead of the curve in the ever-evolving world of insurance.

FAQ

What is the difference between full cover insurance and basic liability insurance?

+

Full cover insurance, also known as comprehensive insurance, provides a wide range of protections, including coverage for damages to the insured’s property, medical expenses, legal liabilities, and personal injuries. On the other hand, basic liability insurance primarily covers damages caused to others, offering limited protection compared to full cover insurance.

How can I lower my full cover insurance premiums?

+

There are several strategies to lower your full cover insurance premiums. These include comparing quotes from multiple providers, utilizing online comparison tools, shopping around and negotiating, considering policy bundling, reviewing coverage limits and deductibles, maintaining a good credit score, exploring discounts and incentives, and seeking professional advice.

What are some common exclusions in full cover insurance policies?

+

Common exclusions in full cover insurance policies may include intentional acts, war or terrorism, nuclear incidents, normal wear and tear, and pre-existing conditions. It’s crucial to carefully review the exclusions outlined in your policy to ensure you have the necessary coverage for your specific needs.

Can I customize my full cover insurance policy to meet my specific needs?

+

Yes, full cover insurance policies often offer a range of customizable options. Policyholders can choose coverage limits, deductibles, and optional endorsements to tailor their policy to their specific needs and budget. This flexibility ensures that individuals can select the level of protection that best suits their circumstances.