Cheap Auto Insurance In New Jersey

Are you looking for affordable auto insurance in the Garden State? New Jersey is known for its high insurance rates, making it challenging for many drivers to find budget-friendly options. However, with a bit of research and an understanding of the factors that impact insurance costs, it's possible to secure a cheap auto insurance policy that suits your needs and budget.

Understanding the Landscape of Auto Insurance in New Jersey

New Jersey is a unique state when it comes to auto insurance. With its dense population and high traffic volume, the state experiences a higher rate of accidents and claims, which contributes to the elevated insurance costs. Additionally, the state’s no-fault insurance system, known as Personal Injury Protection (PIP), adds to the complexity of insurance pricing.

Despite these challenges, there are strategies to navigate the New Jersey insurance market and find affordable coverage. Here's a comprehensive guide to help you secure cheap auto insurance in the Garden State.

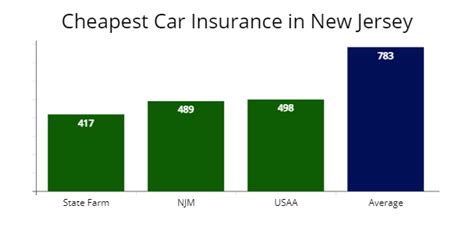

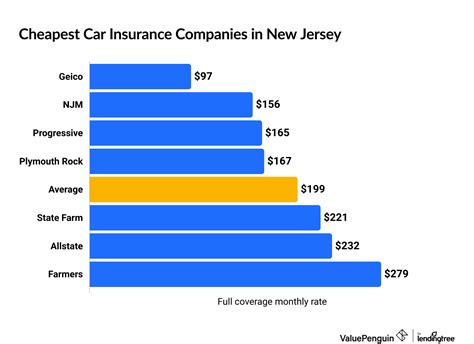

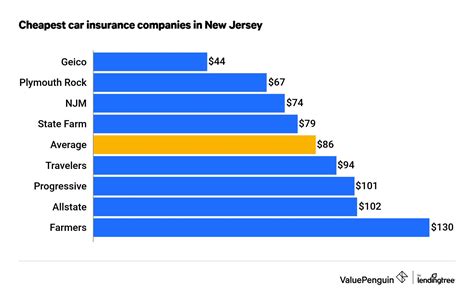

Researching and Comparing Insurance Providers

The first step to finding cheap auto insurance is to conduct thorough research and compare quotes from multiple providers. New Jersey is home to a variety of insurance companies, including national brands and local carriers. By exploring different options, you can identify the insurers that offer the best combination of coverage and pricing for your specific circumstances.

When researching insurance providers, consider the following factors:

- Reputation and Financial Stability: Opt for reputable insurers with a solid financial standing. Check reviews and ratings to ensure the company has a positive track record and is likely to be around for the long haul.

- Coverage Options: Evaluate the coverage options offered by each insurer. Ensure they provide the specific coverage you require, such as liability, collision, comprehensive, and additional add-ons like rental car coverage or roadside assistance.

- Discounts: Look for insurers that offer a wide range of discounts. Common discounts include multi-policy discounts (bundling auto and home insurance), good student discounts, safe driver discounts, and loyalty discounts for long-term customers.

- Customer Service and Claims Handling: Consider the insurer's reputation for customer service and claims handling. Efficient and responsive claims processing can make a significant difference in the event of an accident.

To compare quotes effectively, use online quote comparison tools or directly request quotes from the insurers' websites or through independent agents. Provide accurate and detailed information about your driving history, vehicle make and model, and any other relevant factors to ensure you receive precise quotes.

Online Quote Comparison Tools

Online quote comparison tools are a convenient way to quickly gather quotes from multiple insurers. These tools allow you to input your information once and receive multiple quotes side by side. However, keep in mind that these tools may not always provide the most accurate quotes, as they may not consider all the unique factors that impact your insurance costs.

Independent Insurance Agents

Working with an independent insurance agent can be beneficial, as they represent multiple insurance companies and can shop around for the best rates on your behalf. They can provide personalized advice and assist you in understanding the coverage options that best fit your needs.

Factors That Impact Insurance Costs

To secure cheap auto insurance, it’s essential to understand the factors that insurance companies consider when calculating premiums. By being aware of these factors, you can take steps to improve your insurance profile and potentially reduce your costs.

Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to lower premiums. On the other hand, a history of accidents, traffic violations, or DUIs can result in higher insurance costs.

If you have a less-than-perfect driving record, consider taking defensive driving courses or completing a driver improvement program. These courses can help improve your driving skills and may even lead to a discount on your insurance policy.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance costs. Generally, newer, more expensive vehicles with higher repair costs tend to have higher insurance premiums. Additionally, vehicles with advanced safety features may be eligible for discounts.

Consider the following when choosing a vehicle:

- Vehicle Make and Model: Research the insurance costs associated with different makes and models. Some vehicles are more expensive to insure due to their repair costs or theft rates.

- Usage: Inform your insurance provider about how you use your vehicle. If you primarily drive for pleasure or short commutes, you may be eligible for a lower rate compared to someone who commutes long distances or uses their vehicle for business purposes.

Credit Score

In many states, including New Jersey, insurance companies use your credit score as a factor in determining your insurance rates. Generally, individuals with higher credit scores are considered lower risk and may be eligible for lower premiums. Improving your credit score can potentially lead to savings on your insurance policy.

Age and Gender

Insurance rates can also be influenced by your age and gender. Younger drivers, especially those under 25, tend to have higher insurance costs due to their lack of driving experience. Additionally, insurance companies may consider gender as a factor, although this practice is becoming less common.

Maximizing Discounts and Savings

In addition to comparing quotes and understanding the factors that impact insurance costs, there are several strategies you can employ to maximize discounts and savings on your auto insurance policy.

Bundle Your Insurance Policies

If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same insurer. Many insurance companies offer multi-policy discounts, which can lead to significant savings. By bundling your policies, you not only save money but also simplify your insurance management.

Choose Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially accepting more financial responsibility in the event of a claim. However, ensure that you select a deductible amount that you can comfortably afford in the event of an accident.

Safe Driver Discounts

Many insurance companies offer safe driver discounts to reward drivers with clean driving records. These discounts can significantly reduce your insurance costs. To qualify for these discounts, maintain a clean driving record, avoid accidents and violations, and consider completing defensive driving courses to demonstrate your commitment to safe driving.

Loyalty Discounts

Loyalty pays off in the insurance world. Many insurers offer loyalty discounts to customers who have been with the company for an extended period. These discounts can increase over time, providing even greater savings as you maintain your policy.

Additional Discounts

Insurance companies often provide a variety of additional discounts. Some common discounts include:

- Good Student Discount: If you're a student with good grades, you may be eligible for a discount. Many insurers offer discounts to students who maintain a certain GPA or honor roll status.

- Anti-Theft Devices: Installing approved anti-theft devices in your vehicle can lead to savings. These devices can deter thieves and reduce the risk of theft, making your vehicle a less attractive target.

- Paperless Billing and Automatic Payments: Opting for paperless billing and setting up automatic payments can result in small discounts. These options streamline the billing process and reduce administrative costs for the insurer.

Understanding New Jersey’s Insurance Laws

To navigate the auto insurance landscape in New Jersey effectively, it’s crucial to understand the state’s insurance laws and regulations. New Jersey has a unique insurance system, and being aware of these laws can help you make informed decisions about your coverage.

Personal Injury Protection (PIP) Coverage

New Jersey is a no-fault state, which means that in the event of an accident, your own insurance policy will cover your medical expenses and lost wages, regardless of who is at fault. This coverage is known as Personal Injury Protection (PIP) and is mandatory for all drivers in the state.

PIP coverage provides benefits such as:

- Medical expenses coverage for you and your passengers, including hospital stays, doctor visits, and rehabilitation.

- Lost income coverage for a portion of your lost wages if you're unable to work due to injuries sustained in the accident.

- Essential services coverage, such as childcare or housework assistance, if you're unable to perform these tasks due to your injuries.

Understanding the extent of your PIP coverage is crucial, as it ensures you have adequate protection in the event of an accident. It's important to review your policy and ensure that your PIP coverage limits align with your specific needs.

Other Insurance Requirements

In addition to PIP coverage, New Jersey requires all drivers to carry liability insurance. Liability insurance covers damages you cause to others in an accident, including property damage and bodily injury. The minimum liability limits in New Jersey are:

- Bodily Injury Liability: $15,000 per person and $30,000 per accident

- Property Damage Liability: $5,000 per accident

While these are the minimum requirements, it's generally recommended to carry higher liability limits to provide adequate protection in the event of a serious accident. Consider your assets and financial situation when determining the appropriate liability limits for your policy.

Tips for Maintaining Affordable Insurance

Once you’ve secured a cheap auto insurance policy, it’s essential to maintain those low rates over time. Here are some tips to help you keep your insurance costs affordable:

Review Your Policy Regularly

Insurance rates and coverage needs can change over time. Review your policy annually or whenever your circumstances change. This ensures that your coverage remains up-to-date and that you’re not paying for unnecessary coverage.

Keep a Clean Driving Record

Maintain a clean driving record to avoid surcharges and higher insurance rates. Avoid accidents, traffic violations, and DUIs. Even a single incident can significantly impact your insurance costs for several years.

Consider Telematics or Usage-Based Insurance

Telematics or usage-based insurance programs use data from your driving behavior to determine your insurance rates. These programs can be a great option for safe drivers, as they reward good driving habits with lower premiums. If you’re a safe and cautious driver, consider enrolling in a telematics program to potentially save on your insurance costs.

Shop Around Periodically

Even if you’ve found a great deal on your auto insurance, it’s always a good idea to shop around periodically. Insurance rates can fluctuate, and new discounts or promotions may become available. By comparing quotes every few years, you can ensure you’re still getting the best rate for your specific circumstances.

Conclusion

Finding cheap auto insurance in New Jersey is possible with a combination of research, comparison, and understanding of the factors that impact insurance costs. By comparing quotes from multiple insurers, maximizing discounts, and staying informed about New Jersey’s insurance laws, you can secure an affordable policy that provides the coverage you need. Remember to maintain a clean driving record, review your policy regularly, and stay vigilant about shopping around to ensure you’re always getting the best value for your insurance dollar.

Frequently Asked Questions

What is the average cost of auto insurance in New Jersey?

+

The average cost of auto insurance in New Jersey can vary widely depending on factors such as your driving record, vehicle type, and coverage limits. According to recent data, the average annual premium in New Jersey is around 2,100, but it can range from 1,500 to $3,000 or more. It’s important to shop around and compare quotes to find the best rate for your specific circumstances.

Can I find cheap auto insurance if I have a less-than-perfect driving record?

+

Yes, it is possible to find affordable auto insurance even with a less-than-perfect driving record. While a clean driving record is ideal, there are insurers who specialize in providing coverage for high-risk drivers. Additionally, taking steps to improve your driving record, such as completing defensive driving courses, can lead to lower premiums over time.

Are there any specific discounts available for New Jersey residents?

+

Yes, New Jersey residents can take advantage of various discounts offered by insurance companies. These may include multi-policy discounts, good student discounts, safe driver discounts, and discounts for completing defensive driving courses. It’s important to inquire about these discounts when comparing quotes to ensure you’re maximizing your savings.

How can I improve my credit score to lower my insurance costs?

+

Improving your credit score can potentially lead to lower insurance costs. Focus on paying your bills on time, reducing your credit card balances, and maintaining a low credit utilization ratio. Consider reviewing your credit report for any errors and disputing them if necessary. Building a positive credit history over time will help improve your credit score.

What should I do if I’m involved in an accident in New Jersey?

+

If you’re involved in an accident in New Jersey, it’s important to remain calm and follow these steps: exchange contact and insurance information with the other parties involved, take photos of the accident scene and any damages, and notify your insurance company as soon as possible. Cooperate with the claims process and provide accurate information to ensure a smooth resolution.