Car Insurance What Is Full Coverage

Car insurance is a vital aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. One commonly used term in the world of car insurance is full coverage, but what exactly does this term entail? Understanding full coverage car insurance is crucial for vehicle owners to ensure they have the right protection tailored to their needs.

In this comprehensive guide, we will delve into the world of full coverage car insurance, exploring its components, benefits, and considerations. By the end of this article, you'll have a clear understanding of what full coverage entails and how it can provide comprehensive protection for your vehicle.

Understanding Full Coverage Car Insurance

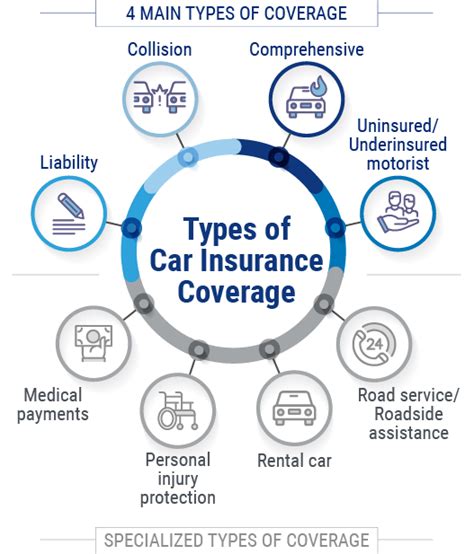

Full coverage car insurance is a term used to describe a comprehensive insurance policy that offers a wide range of coverage options to protect your vehicle. It goes beyond the basic liability coverage, which only covers damages caused to others in an accident, and provides additional protection for your own vehicle and assets.

Full coverage typically includes two main components: collision coverage and comprehensive coverage. These coverages, combined with liability insurance, form the basis of a full coverage policy.

Collision Coverage

Collision coverage is a crucial aspect of full coverage car insurance. It provides protection for your vehicle in the event of a collision with another vehicle or object. This coverage helps cover the costs of repairing or replacing your vehicle, regardless of who is at fault in the accident.

Collision coverage typically includes repairs for damages such as:

- Bumper damage

- Bodywork repairs

- Glass repairs or replacements

- Mechanical repairs resulting from the collision

However, it's important to note that collision coverage comes with a deductible, which is the amount you'll need to pay out of pocket before your insurance kicks in. The deductible amount can vary depending on your insurance policy and the chosen coverage limits.

Additionally, collision coverage may have certain exclusions. For instance, it may not cover damages resulting from acts of nature like floods or earthquakes, or damages caused by non-collision events such as vandalism or theft. These scenarios are typically covered by comprehensive coverage, which we'll explore next.

Comprehensive Coverage

Comprehensive coverage is an essential component of full coverage car insurance, providing protection for a wide range of non-collision events. It covers damages caused by factors beyond your control, such as:

- Natural disasters like floods, hurricanes, or wildfires

- Theft or vandalism

- Hail, wind, or other weather-related incidents

- Animal collisions (e.g., hitting a deer)

- Falling objects (e.g., tree branches)

- Fire, explosion, or civil unrest

Comprehensive coverage also includes protection against certain perils that are often excluded from collision coverage. For example, it covers damages caused by rocks or debris on the road, or even instances where your vehicle is damaged while parked.

Similar to collision coverage, comprehensive coverage also has a deductible. The amount of the deductible will depend on your chosen coverage limits and insurance policy.

It's worth noting that comprehensive coverage may have certain limitations or exclusions. For instance, it may not cover mechanical breakdowns or wear and tear, as these are typically considered the responsibility of the vehicle owner. Additionally, comprehensive coverage may have restrictions on certain high-risk activities, such as off-roading or racing.

Benefits of Full Coverage Car Insurance

Opting for full coverage car insurance offers several advantages and provides a comprehensive safety net for vehicle owners. Here are some key benefits of full coverage:

Financial Protection

Full coverage car insurance provides financial protection in a wide range of situations. Whether it's a collision, theft, natural disaster, or other unforeseen event, full coverage ensures that the costs of repairing or replacing your vehicle are covered, up to the limits of your policy.

This financial protection can be particularly valuable for vehicle owners who rely on their cars for daily transportation, work, or other essential purposes. By having full coverage, you can avoid the financial burden of costly repairs or replacements, ensuring your vehicle remains in good condition.

Peace of Mind

Knowing that your vehicle is protected by full coverage car insurance can provide a sense of peace of mind. With collision and comprehensive coverage, you can drive with confidence, knowing that you're covered in a variety of scenarios, both common and rare.

Full coverage takes away the worry of unexpected expenses and provides reassurance that your vehicle's value and functionality are safeguarded. This peace of mind can be especially beneficial for those who have invested in high-value vehicles or rely on their cars for specific purposes.

Enhanced Resale Value

Full coverage car insurance can also positively impact the resale value of your vehicle. Potential buyers often prefer vehicles with a comprehensive insurance history, as it indicates that the vehicle has been well-maintained and protected against various damages.

Having a full coverage insurance policy can give buyers confidence in the vehicle's condition and reliability, making it more appealing and potentially increasing its resale value. This is particularly beneficial for those who plan to sell their vehicles in the future or trade them in for a new one.

Considerations and Limitations

While full coverage car insurance offers extensive protection, it's important to be aware of certain considerations and limitations.

Cost and Deductibles

Full coverage car insurance typically comes with a higher premium compared to basic liability coverage. This is because it provides a broader range of protection and covers a wider variety of scenarios. As a result, the cost of full coverage may be a factor to consider, especially for those on a tight budget.

Additionally, as mentioned earlier, full coverage policies often include deductibles for both collision and comprehensive coverage. The deductible is the amount you'll need to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but it also means you'll have to pay more out of pocket in the event of a claim.

Exclusions and Limitations

While full coverage car insurance offers comprehensive protection, it's essential to review the policy's exclusions and limitations. These can vary depending on the insurance provider and the specific policy.

Some common exclusions may include:

- Normal wear and tear

- Mechanical breakdowns

- Intentional damage or vandalism (if not specifically covered)

- Certain high-risk activities (e.g., off-roading, racing)

- Damage resulting from a driver's intentional acts

It's crucial to carefully read and understand the policy's exclusions to ensure you have the coverage you need for your specific circumstances.

Personalized Coverage Options

Full coverage car insurance policies can be tailored to meet your specific needs and circumstances. Insurance providers often offer various add-on coverages or endorsements that can enhance your policy's protection.

Some common add-ons or endorsements include:

- Rental car coverage: Provides reimbursement for rental car expenses while your vehicle is being repaired.

- Gap coverage: Covers the difference between your vehicle's actual cash value and the amount owed on your loan or lease in the event of a total loss.

- Roadside assistance: Offers emergency services such as towing, battery jump-starts, or flat tire changes.

- Personal injury protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

Discuss your options with your insurance provider to determine the best coverage for your needs and budget.

Choosing the Right Coverage for You

Selecting the appropriate car insurance coverage depends on various factors, including your vehicle's value, your financial situation, and your personal preferences. Here are some considerations to help you choose the right coverage:

Vehicle's Value and Age

The value and age of your vehicle play a significant role in determining the type of coverage you may need. If you own a newer or high-value vehicle, full coverage car insurance may be a wise choice to protect your investment. On the other hand, if you have an older vehicle with a lower resale value, you might consider more basic coverage options.

Financial Situation

Your financial situation is an important factor to consider when choosing car insurance coverage. Full coverage policies can be more expensive, so it's essential to assess your budget and determine how much you can comfortably afford for premiums and potential deductibles.

Driving Habits and Risks

Your driving habits and the risks associated with your daily routine can also influence your coverage choices. If you frequently drive in areas prone to natural disasters or live in a high-crime neighborhood, comprehensive coverage may be a priority. Similarly, if you often drive long distances or commute during rush hour, collision coverage can provide valuable protection.

State Requirements

Each state has its own minimum car insurance requirements. While basic liability coverage is often the minimum legal requirement, it's important to understand your state's specific regulations to ensure you meet the necessary coverage limits.

Personal Preferences

Ultimately, your personal preferences and peace of mind are crucial factors in choosing car insurance coverage. Consider your comfort level with potential risks and the financial impact of unexpected events. If you prefer comprehensive protection and peace of mind, full coverage car insurance may be the right choice for you.

FAQ

What is the difference between full coverage and liability-only car insurance?

+Full coverage car insurance provides a comprehensive range of protection, including collision and comprehensive coverage, along with liability insurance. Liability-only car insurance, on the other hand, only covers damages caused to others in an accident, offering no protection for your own vehicle.

Is full coverage car insurance mandatory?

+Full coverage car insurance is not mandatory in all states, but it is often recommended to ensure comprehensive protection for your vehicle. Some states may require additional coverage, such as personal injury protection (PIP) or uninsured motorist coverage.

Can I customize my full coverage car insurance policy?

+Yes, full coverage car insurance policies can be customized to meet your specific needs. You can choose different coverage limits, deductibles, and add-on endorsements to tailor the policy to your vehicle's value, driving habits, and budget.

Understanding full coverage car insurance is crucial for making informed decisions about your vehicle’s protection. By considering your vehicle’s value, financial situation, and personal preferences, you can choose the right coverage to provide the peace of mind and financial security you need on the road.