Car Insurance Quote Ny

Securing a car insurance quote in New York is an essential step for any vehicle owner in the state. With its diverse population and unique road conditions, understanding the intricacies of car insurance in New York is crucial. This article aims to provide an in-depth guide to obtaining accurate and competitive car insurance quotes tailored to the specific needs of New Yorkers.

Navigating Car Insurance in New York

New York is renowned for its bustling cities, intricate road networks, and diverse driving environments. This complexity extends to the car insurance landscape, where policies must be tailored to meet the specific requirements and risks associated with driving in the state.

Understanding New York's Insurance Requirements

New York State mandates that all registered vehicles have liability insurance coverage. This coverage is designed to protect the policyholder against claims arising from bodily injury or property damage caused in an accident. The minimum liability limits in New York are as follows:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury per Person | $25,000 |

| Bodily Injury per Accident | $50,000 |

| Property Damage | $10,000 |

While these are the minimum requirements, many drivers opt for higher limits to ensure comprehensive coverage in the event of an accident. It's important to note that New York also requires additional coverage, such as uninsured/underinsured motorist coverage, to protect against losses caused by drivers who lack sufficient insurance.

Factors Influencing Car Insurance Quotes in New York

Several factors play a significant role in determining car insurance quotes in New York. These include:

- Vehicle Type and Usage: The make, model, and year of your vehicle, as well as its primary use (e.g., commuting, pleasure driving, business), can impact your quote.

- Driver Profile: Your age, driving history, and credit score are key considerations. Younger drivers and those with a history of accidents or violations may face higher premiums.

- Location: The city or county you reside in, as well as the specific neighborhood, can influence your quote. Urban areas often have higher premiums due to increased traffic and accident risks.

- Coverage Options: The level of coverage you choose, including liability, collision, comprehensive, and additional coverages like rental car reimbursement, will impact your quote.

- Deductibles: Selecting higher deductibles can lower your premium, but it's essential to choose a deductible that aligns with your financial capacity.

Obtaining Competitive Car Insurance Quotes

Securing competitive car insurance quotes in New York requires a strategic approach. Here are some steps to guide you through the process:

Research and Compare Insurers

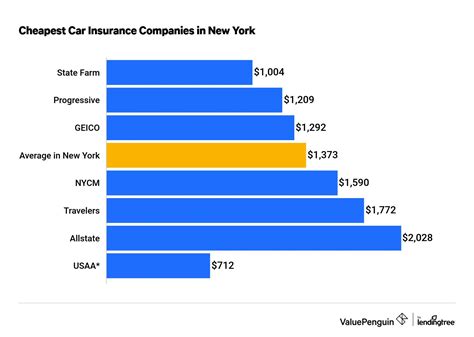

New York has a diverse insurance market, with numerous carriers offering policies. Research and compare different insurers to understand their coverage options, pricing, and customer satisfaction ratings. Consider both traditional insurance companies and digital-first insurers to explore a range of options.

Understand Your Coverage Needs

Assess your specific coverage needs. Consider factors like the value of your vehicle, your financial situation, and the risks you face on the road. For instance, if you drive an older vehicle, you might opt for liability-only coverage rather than comprehensive coverage.

Utilize Online Quote Tools

Many insurance companies offer online quote tools that allow you to input your information and receive personalized quotes. These tools can provide a quick and convenient way to compare rates and coverage options from multiple insurers.

Work with an Insurance Agent

Engaging with a licensed insurance agent can be beneficial, especially if you have complex insurance needs or require guidance on coverage options. Agents can provide personalized advice and help you navigate the insurance landscape to find the best policy for your situation.

Review Your Quote and Ask Questions

Once you've received a quote, carefully review it to ensure you understand the coverage limits, deductibles, and any exclusions. If you have questions or need clarification, don't hesitate to reach out to the insurer or your agent. It's important to fully understand your policy before committing.

Shop Around and Negotiate

Don't settle for the first quote you receive. Shopping around and negotiating with different insurers can often lead to better rates and coverage options. Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially save on premiums.

Tailoring Your Car Insurance Policy

Beyond the basic liability coverage, there are several additional coverages you can add to your car insurance policy in New York to enhance your protection.

Collision and Comprehensive Coverage

Collision coverage pays for damages to your vehicle when you're in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers damages from non-accident-related events, such as theft, vandalism, natural disasters, or collisions with animals.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, provides benefits for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you're involved in an accident with a driver who has little or no insurance. It can cover medical expenses, property damage, and other costs.

Additional Coverages

Depending on your needs and budget, you may also consider adding rental car reimbursement, roadside assistance, or gap insurance to your policy.

Frequently Asked Questions

What is the average cost of car insurance in New York?

+The average cost of car insurance in New York can vary widely based on numerous factors. According to recent data, the average annual premium in the state is approximately $1,500. However, this can range significantly, with some drivers paying as little as $800 while others pay upwards of $3,000.

Are there any discounts available for car insurance in New York?

+Yes, there are various discounts that New York drivers can take advantage of to reduce their insurance premiums. These may include discounts for safe driving records, multi-policy bundles, loyalty programs, good student status, and even specific vehicle safety features.

Can I get car insurance without a driver's license in New York?

+Obtaining car insurance without a valid driver's license in New York can be challenging. Most insurance companies require proof of a valid license to issue a policy. However, there may be limited circumstances, such as non-owner policies or specialized coverage for specific situations, where insurance can be obtained without a license.

Securing a car insurance quote in New York is a critical step towards protecting yourself and your vehicle on the state’s roads. By understanding the unique requirements and factors influencing quotes in New York, you can navigate the insurance landscape with confidence and find a policy that meets your needs at a competitive price.