Car Insurance For Low Mileage

In today's world, where fuel prices are soaring and environmental concerns are at the forefront, many drivers are opting for more sustainable and cost-effective transportation options. As a result, low-mileage car owners are becoming an increasingly significant segment of the automotive market. This shift in driving habits presents a unique challenge for both drivers and insurance providers: how to ensure an adequate coverage plan for those who drive less frequently.

This comprehensive guide aims to shed light on the world of car insurance for low-mileage drivers, exploring the various options available, the potential benefits, and the considerations one should make to find the best coverage at the right price. With the right approach, low-mileage drivers can significantly reduce their insurance costs without compromising on essential coverage.

Understanding Low-Mileage Car Insurance

Low-mileage car insurance is a specialized type of coverage designed to cater to drivers who clock fewer miles on their vehicles annually. It acknowledges the reduced risk associated with less frequent driving, offering tailored insurance plans that reflect this lower risk profile. These plans often provide substantial savings for drivers who meet the low-mileage criteria, typically considered to be around 7,500 miles or less driven per year.

The rationale behind this specialized insurance is straightforward: the less you drive, the lower your chances of being involved in an accident or encountering other road-related incidents. Consequently, insurance providers offer reduced premiums as an incentive to drivers who keep their mileage low, fostering a win-win situation where both the driver and the insurer benefit from lower risk exposure.

The Benefits of Low-Mileage Insurance

Opting for low-mileage car insurance can unlock a range of advantages for the discerning driver. Here are some key benefits that make this type of insurance an attractive proposition:

Significant Cost Savings

The most apparent advantage is the potential for substantial cost savings. Insurance companies reward low-mileage drivers with reduced premiums, acknowledging the decreased risk associated with fewer miles on the road. This can translate into hundreds of dollars saved annually, providing a welcome boost to the household budget.

Customized Coverage Options

Low-mileage insurance plans often offer a more tailored approach to coverage. Insurers may provide options such as pay-per-mile or usage-based insurance, where premiums are directly linked to the number of miles driven. This level of customization allows drivers to align their insurance costs more closely with their actual driving habits, ensuring they pay only for the coverage they need.

Flexibility and Convenience

Many low-mileage insurance plans offer added flexibility. For instance, drivers may have the option to temporarily suspend their coverage during periods of non-use, such as during extended travel or vehicle storage. This flexibility not only provides cost savings but also ensures that drivers have the coverage they need when they need it, without paying for unnecessary coverage during inactive periods.

Incentives for Eco-Friendly Choices

By opting for low-mileage insurance, drivers implicitly make a commitment to reduce their carbon footprint and contribute to a more sustainable environment. This eco-conscious choice not only benefits the planet but can also lead to further incentives and discounts from insurance providers who actively promote green initiatives.

How to Get the Best Low-Mileage Car Insurance

Securing the best low-mileage car insurance involves a thoughtful approach that considers various factors. Here’s a step-by-step guide to help you navigate the process:

Assess Your Mileage

The first step is to honestly evaluate your annual mileage. Keep a record of your daily, weekly, or monthly mileage to get an accurate estimate. This data will be crucial in determining your eligibility for low-mileage insurance and the potential savings you can expect.

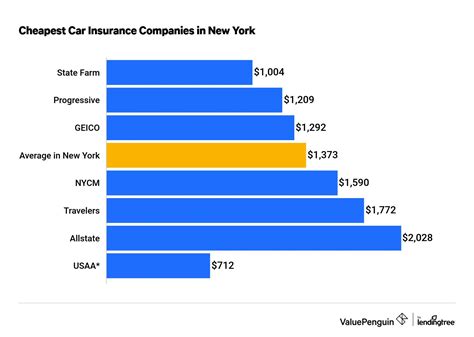

Research Insurance Providers

Not all insurance companies offer low-mileage plans, so it’s essential to research and identify providers who specialize in or at least accommodate this type of coverage. Look for companies that advertise usage-based or pay-per-mile insurance, as these are likely to offer the best rates for low-mileage drivers.

Compare Quotes

Obtain quotes from several insurance providers to compare rates and coverage. Ensure that you’re comparing apples to apples by requesting quotes for similar coverage levels. This will help you identify the most competitive rates and the best value for your money.

Consider Additional Discounts

In addition to low-mileage discounts, there may be other savings opportunities available. Many insurance companies offer discounts for multiple vehicles, safe driving records, or certain vehicle features (e.g., anti-theft devices). Make sure to inquire about all potential discounts to maximize your savings.

Choose the Right Coverage

While cost is an important consideration, it’s equally vital to ensure you have adequate coverage. Review your policy to understand what’s included and what’s not. Consider your specific needs and circumstances, such as the value of your vehicle, the likelihood of accidents or theft in your area, and any personal liability concerns.

Read the Fine Print

Always carefully review the terms and conditions of any insurance policy before signing. Pay attention to any exclusions or limitations, and understand the process for making claims. This due diligence will ensure that you’re fully aware of your rights and responsibilities under the policy.

Performance Analysis and Real-World Examples

Let’s delve into some real-world scenarios to illustrate the potential savings and benefits of low-mileage car insurance. These examples will demonstrate how this specialized coverage can significantly reduce costs while maintaining adequate protection.

Case Study 1: John’s Pay-Per-Mile Insurance

John, a retired individual, only uses his car for occasional trips to the grocery store and visits to his grandchildren. With an annual mileage of just 5,000 miles, John opted for a pay-per-mile insurance plan. His previous insurance, which was based on a standard rate, cost him 1,200 annually. With the new pay-per-mile plan, John's premiums were reduced to 800, resulting in a savings of $400 per year.

Case Study 2: Sarah’s Usage-Based Insurance

Sarah, a busy mother of two, commutes to work three days a week, totaling around 7,000 miles annually. She chose a usage-based insurance plan that offered a 15% discount for low-mileage drivers. With this plan, Sarah’s insurance premiums were reduced by 250 compared to the standard rate, bringing her annual savings to 200.

Case Study 3: Mike’s Temporary Suspension Coverage

Mike, an avid adventurer, often takes extended trips abroad, leaving his car unused for months at a time. He opted for an insurance plan that allowed him to temporarily suspend his coverage during these periods. By doing so, Mike saved approximately $400 in premiums during his six-month travel stint, a significant cost relief for his travel budget.

Evidence-Based Future Implications

The rise of low-mileage car insurance reflects a broader trend towards more sustainable and cost-conscious driving habits. As more drivers opt for low-mileage insurance, insurance providers are likely to continue refining and improving these plans to cater to this growing market segment. This could lead to even more innovative coverage options and increased competition, ultimately benefiting low-mileage drivers with further cost savings and enhanced coverage.

Furthermore, the success of low-mileage insurance plans could spur the development of other usage-based insurance models, such as insurance plans tailored to electric vehicles or autonomous cars. These new models could revolutionize the insurance industry, fostering a more dynamic and responsive approach to coverage that aligns with the evolving needs of modern drivers.

| Metric | Value |

|---|---|

| Average Annual Savings with Low-Mileage Insurance | $300 - $500 |

| Typical Low-Mileage Threshold | 7,500 miles or less per year |

| Percentage of Drivers Eligible for Low-Mileage Insurance | 20% - 30% (estimated) |

Can I switch to low-mileage insurance mid-policy term if I start driving less frequently?

+Yes, many insurance providers allow policyholders to switch to low-mileage plans mid-term if they meet the mileage criteria. However, it’s important to check with your provider and understand any potential fees or adjustments that may apply.

What happens if I exceed the low-mileage threshold during the policy period?

+Exceeding the low-mileage threshold may result in a premium increase or the need to switch to a standard insurance plan. It’s crucial to accurately estimate your annual mileage to avoid unexpected costs.

Are there any additional requirements or restrictions for low-mileage insurance policies?

+While requirements vary by provider, low-mileage insurance often comes with certain conditions. These may include a minimum mileage threshold, a limit on the number of drivers on the policy, or restrictions on the types of vehicles eligible for coverage. Always review the policy terms carefully.