Car Insurance Average

Car insurance is a fundamental aspect of vehicle ownership, providing financial protection and peace of mind to drivers worldwide. With the diverse range of policies and factors influencing premiums, understanding the average cost of car insurance is essential for informed decision-making. In this comprehensive guide, we delve into the intricacies of car insurance averages, shedding light on key factors, regional variations, and strategies to secure the best coverage at an affordable price.

Understanding Car Insurance Premiums

Car insurance premiums, or the amount you pay for coverage, are influenced by a myriad of factors, resulting in significant variations across regions and individual circumstances. The average premium serves as a benchmark, offering insights into the typical costs associated with insuring a vehicle.

Factors Influencing Car Insurance Averages

Several critical factors contribute to the determination of car insurance averages. These include:

- Location: Geographical variations play a substantial role, with urban areas often experiencing higher premiums due to increased traffic congestion and accident risks.

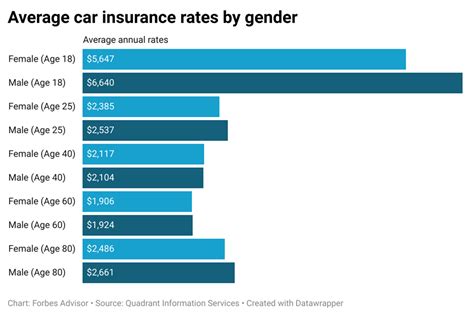

- Age and Gender: Younger drivers, particularly males, tend to face higher premiums due to their perceived higher risk profile.

- Vehicle Type and Usage: The make, model, and primary purpose of your vehicle (e.g., personal or commercial) impact insurance costs. High-performance vehicles and those used for business purposes generally attract higher premiums.

- Driving History: Your driving record, including past accidents and traffic violations, significantly influences insurance rates. A clean driving history typically leads to more affordable premiums.

- Coverage Level: The extent of coverage you choose, such as comprehensive, collision, or liability-only, directly affects your premium. More extensive coverage comes at a higher cost.

- Deductibles: Opting for higher deductibles can lower your premium, as you agree to pay more out-of-pocket before the insurance coverage kicks in.

Regional Variations in Car Insurance Averages

Car insurance averages exhibit significant regional disparities, with urban areas generally experiencing higher premiums due to elevated accident risks and denser traffic. In contrast, rural areas often enjoy more affordable rates, owing to lower accident probabilities and reduced traffic congestion.

| Region | Average Annual Premium |

|---|---|

| Urban Areas | $1,500 - $2,500 |

| Suburban Areas | $1,200 - $1,800 |

| Rural Areas | $800 - $1,500 |

These averages provide a general indication, but it's essential to consider individual circumstances and local market dynamics when seeking accurate insurance quotes.

Strategies to Lower Your Car Insurance Premium

While car insurance averages offer a valuable benchmark, it’s crucial to remember that these rates can be influenced by your choices and actions. By adopting certain strategies, you can potentially lower your insurance premium and secure more affordable coverage.

Improving Your Driving Record

Maintaining a clean driving record is one of the most effective ways to reduce your insurance premium. Avoid traffic violations and prioritize safe driving practices. Over time, a clean record can lead to significant premium reductions.

Increasing Deductibles

Opting for higher deductibles can lower your insurance premium. By agreeing to pay a higher out-of-pocket amount in the event of a claim, you reduce the financial burden on your insurer, resulting in a more affordable premium.

Bundling Insurance Policies

If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with the same provider. Many insurers offer discounts for customers who bundle multiple policies, making it a cost-effective strategy.

Taking Advantage of Discounts

Insurance companies often provide various discounts to policyholders. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and multi-car discounts. Be sure to inquire about available discounts when obtaining quotes to maximize your savings.

Comparing Quotes from Multiple Insurers

One of the most effective ways to secure the best car insurance deal is to compare quotes from multiple insurers. Rates can vary significantly between providers, so obtaining quotes from at least three to five insurers can help you identify the most competitive premium for your specific circumstances.

The Impact of Vehicle Type on Insurance Averages

The type of vehicle you drive plays a pivotal role in determining your car insurance premium. High-performance sports cars and luxury vehicles generally attract higher insurance costs due to their elevated repair and replacement expenses. In contrast, economical sedans and compact cars often enjoy more affordable insurance rates.

| Vehicle Type | Average Annual Premium |

|---|---|

| Sports Cars | $2,000 - $3,500 |

| Luxury Vehicles | $1,800 - $3,000 |

| Economical Sedans | $1,200 - $1,800 |

| Compact Cars | $1,000 - $1,500 |

The Role of Technology in Car Insurance Averages

Advancements in technology have significantly influenced the car insurance industry, impacting both premiums and the overall customer experience. Telematics devices and usage-based insurance programs, for instance, allow insurers to monitor driving behavior and offer more tailored and accurate premiums.

Telematics Devices

Telematics devices, often referred to as “black boxes,” are installed in vehicles to track driving behavior, including speed, acceleration, and braking patterns. Insurers use this data to assess individual risk profiles, offering more precise premiums tailored to a driver’s habits.

Usage-Based Insurance

Usage-based insurance programs reward safe driving behavior by offering discounts to policyholders who exhibit low-risk driving patterns. These programs often involve the installation of a telematics device or the use of a smartphone app to track driving behavior.

The Future of Car Insurance Averages

The car insurance landscape is continuously evolving, influenced by technological advancements, changing consumer preferences, and regulatory developments. As autonomous vehicles become more prevalent, insurance premiums are expected to undergo significant transformations. The reduced accident risks associated with self-driving cars could lead to more affordable insurance rates in the future.

Additionally, the growing popularity of electric vehicles (EVs) is likely to impact insurance averages. While EVs generally enjoy lower maintenance costs, their higher upfront costs and specialized repair needs could potentially influence insurance premiums. However, as EV technology advances and becomes more widespread, insurance rates for these vehicles may become more competitive.

The Rise of Autonomous Vehicles

Autonomous vehicles have the potential to revolutionize the insurance industry. With their advanced safety features and reduced accident risks, these vehicles could lead to a significant decrease in insurance premiums over time. However, the transition to a fully autonomous fleet is expected to be gradual, and the insurance industry will need to adapt to this evolving landscape.

Electric Vehicles and Insurance

The increasing adoption of electric vehicles is likely to impact insurance rates. While the reduced maintenance costs of EVs could lead to lower premiums, the higher initial purchase price and specialized repair needs may counterbalance these savings. As the EV market matures and becomes more mainstream, insurance rates for these vehicles are expected to become more competitive.

How do car insurance averages vary by state in the US?

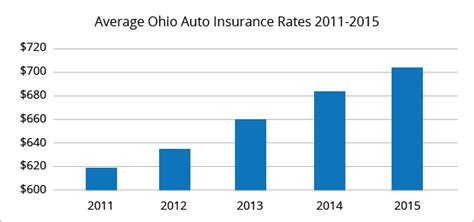

+Car insurance averages vary significantly across states in the US due to differences in traffic conditions, accident rates, and state-specific regulations. For instance, states with high population densities and urban centers often experience higher insurance premiums due to increased accident risks and traffic congestion. Conversely, states with lower population densities and more rural areas tend to have lower average insurance rates.

Are there any ways to lower my car insurance premium without compromising coverage?

+Yes, there are several strategies to reduce your car insurance premium without sacrificing coverage. These include improving your driving record by avoiding traffic violations and practicing safe driving habits, increasing your deductibles to lower your premium, and bundling your insurance policies with the same provider to take advantage of multi-policy discounts. Additionally, exploring usage-based insurance programs that reward safe driving behavior can also lead to lower premiums.

How do insurance companies determine car insurance averages?

+Insurance companies use a complex algorithm to determine car insurance averages. This algorithm takes into account various factors, including the driver’s age, gender, location, driving history, vehicle type, and coverage level. By analyzing historical data and statistical models, insurers can estimate the average premium for a specific driver profile. However, it’s important to note that individual circumstances can significantly impact the actual premium you pay.