Car Auto Insurance Quote

Car auto insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. With numerous options available in the market, obtaining an accurate and competitive quote for auto insurance is crucial. In this comprehensive guide, we will delve into the world of car auto insurance quotes, exploring the factors that influence rates, the process of obtaining quotes, and the key considerations to make when choosing the right coverage.

Understanding the Auto Insurance Quote Landscape

Auto insurance quotes serve as a snapshot of the potential cost of coverage, offering insights into the various factors that impact rates. These quotes are based on an assessment of individual circumstances and the specific requirements of the policyholder. By understanding the quote landscape, drivers can make informed decisions about their insurance needs.

Factors Influencing Auto Insurance Quotes

A multitude of elements contribute to the calculation of auto insurance quotes. These factors are analyzed by insurance providers to assess the level of risk associated with each driver. Here are some key considerations that impact insurance quotes:

- Driver’s Profile: Personal characteristics such as age, gender, driving history, and credit score play a significant role. Younger drivers, for instance, often face higher premiums due to their perceived risk level.

- Vehicle Details: The make, model, year, and value of the vehicle being insured are crucial factors. Certain vehicles may be more expensive to insure due to their repair costs or susceptibility to theft.

- Location: The geographical area where the vehicle is primarily driven and garaged can affect insurance rates. Urban areas with higher crime rates or a greater frequency of accidents may result in higher premiums.

- Coverage Type and Limits: The level of coverage chosen, including liability, collision, comprehensive, and additional options, directly impacts the quote. Higher coverage limits generally lead to increased premiums.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as safe driving records, multiple vehicles insured, or policy bundling. These discounts can significantly reduce overall costs.

The Quote Process: A Step-by-Step Guide

Obtaining an auto insurance quote involves a straightforward process that allows drivers to compare options and make informed choices. Here’s a step-by-step breakdown:

- Gather Information: Before requesting quotes, compile relevant details about yourself, your driving history, and your vehicle. This includes personal information, license details, vehicle make and model, and any additional coverage requirements.

- Choose Insurance Providers: Select a reputable list of insurance companies to request quotes from. Consider a mix of well-known providers and local or regional insurers to ensure a comprehensive comparison.

- Submit Quote Requests: Contact each insurance provider, either online or through their customer service channels, to request a quote. Provide accurate and complete information to ensure an accurate assessment of your insurance needs.

- Review and Compare: Once you receive quotes from multiple providers, take the time to review and compare them. Analyze the coverage limits, deductibles, and any additional features or discounts offered. Consider both the price and the value of the coverage provided.

- Ask Questions: If you have any doubts or require clarification, don’t hesitate to reach out to the insurance providers. Their customer service representatives can provide further insights and address any concerns you may have.

- Select the Right Coverage: Based on your research and comparison, choose the insurance provider that best meets your needs and budget. Ensure you understand the terms and conditions of the policy before finalizing your decision.

Key Considerations for Choosing the Right Coverage

Selecting the appropriate auto insurance coverage involves balancing your needs and budget. Here are some essential considerations to keep in mind:

- Coverage Levels: Assess your risk tolerance and financial capabilities to determine the appropriate level of coverage. While higher coverage limits provide greater protection, they also come with higher premiums. Strike a balance that aligns with your comfort level.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can reduce your premium, but it also means you’ll bear more financial responsibility in the event of a claim.

- Additional Coverages: Evaluate the need for optional coverages such as rental car reimbursement, roadside assistance, or gap insurance. These add-ons can provide valuable protection but may increase your overall premium.

- Discounts and Bundling: Explore the discounts and bundling options offered by insurance providers. By bundling multiple policies (e.g., auto and home insurance) or maintaining a clean driving record, you can often secure significant savings on your insurance premiums.

- Customer Service and Claims Handling: While price is important, don’t underestimate the value of excellent customer service and efficient claims handling. Research and read reviews to ensure the insurance provider has a solid reputation for prompt and fair claims settlement.

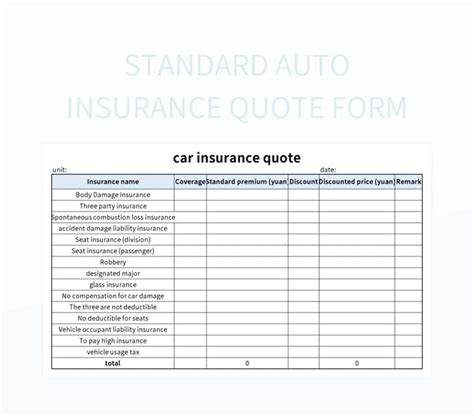

Case Study: Analyzing Auto Insurance Quotes

To illustrate the practical application of auto insurance quotes, let’s consider a hypothetical case study. Meet John, a 30-year-old driver residing in a suburban area with a clean driving record. John is looking to insure his recently purchased 2022 Toyota Camry.

| Insurance Provider | Coverage Limits | Annual Premium | Discounts |

|---|---|---|---|

| Provider A | 100,000 Bodily Injury Liability / 50,000 Property Damage Liability / Comprehensive and Collision Coverage | 850</td> <td>5% Safe Driver Discount</td> </tr> <tr> <td>Provider B</td> <td>150,000 Bodily Injury Liability / 100,000 Property Damage Liability / Comprehensive and Collision Coverage</td> <td>1,100 | 10% Multi-Policy Discount |

| Provider C | 200,000 Bodily Injury Liability / 150,000 Property Damage Liability / Comprehensive and Collision Coverage | $1,350 | 3% Good Student Discount |

In this case study, John can see the impact of different coverage limits and discounts on the annual premiums. Provider A offers a lower premium due to the lower coverage limits and a safe driver discount. Provider B provides a multi-policy discount, making it a more attractive option for those with multiple insurance needs. Provider C, with the highest coverage limits, offers a good student discount, which may be beneficial for younger drivers or those with students in the household.

Future Implications and Industry Trends

The auto insurance industry is evolving, driven by technological advancements and changing consumer preferences. Here are some key trends and future implications to consider:

- Telematics and Usage-Based Insurance: With the rise of telematics devices and usage-based insurance programs, drivers can now have their premiums determined based on their actual driving behavior. This trend encourages safer driving habits and provides personalized insurance rates.

- Digitalization and Online Platforms: The insurance industry is embracing digitalization, offering convenient online quote comparisons and policy management. This shift allows drivers to obtain quotes and manage their insurance needs more efficiently and seamlessly.

- Autonomous Vehicles and New Technologies: The advent of autonomous vehicles and advanced driver-assistance systems is expected to revolutionize the auto insurance landscape. As these technologies become more prevalent, insurance providers will need to adapt their policies and risk assessment methodologies.

- Personalized Insurance: Insurers are increasingly focusing on personalized insurance offerings, taking into account individual driving patterns, vehicle usage, and even lifestyle factors. This trend allows for more tailored coverage options and potentially lower premiums for lower-risk drivers.

FAQ

What factors influence my auto insurance premium the most?

+The factors that impact your auto insurance premium the most include your driving record, the type of vehicle you drive, your age and gender, and the coverage limits you choose. Additionally, your location and any discounts you qualify for can also significantly affect your premium.

How can I lower my auto insurance costs?

+To lower your auto insurance costs, you can consider increasing your deductible, maintaining a clean driving record, exploring multi-policy discounts, and shopping around for quotes from different providers. Additionally, comparing quotes online can help you find competitive rates.

What is comprehensive coverage, and is it necessary?

+Comprehensive coverage protects your vehicle against non-collision incidents such as theft, vandalism, natural disasters, and animal collisions. While it is not legally required, comprehensive coverage is highly recommended to protect your vehicle from unexpected damages and provide peace of mind.

In conclusion, obtaining accurate and competitive auto insurance quotes is a crucial step in securing the right coverage for your vehicle. By understanding the factors that influence quotes, following a systematic process, and making informed choices, you can navigate the insurance landscape with confidence. Stay informed about industry trends and embrace the opportunities for personalized and innovative insurance solutions.